Private equity firm Five Point Capital funds midstream MLP EVX

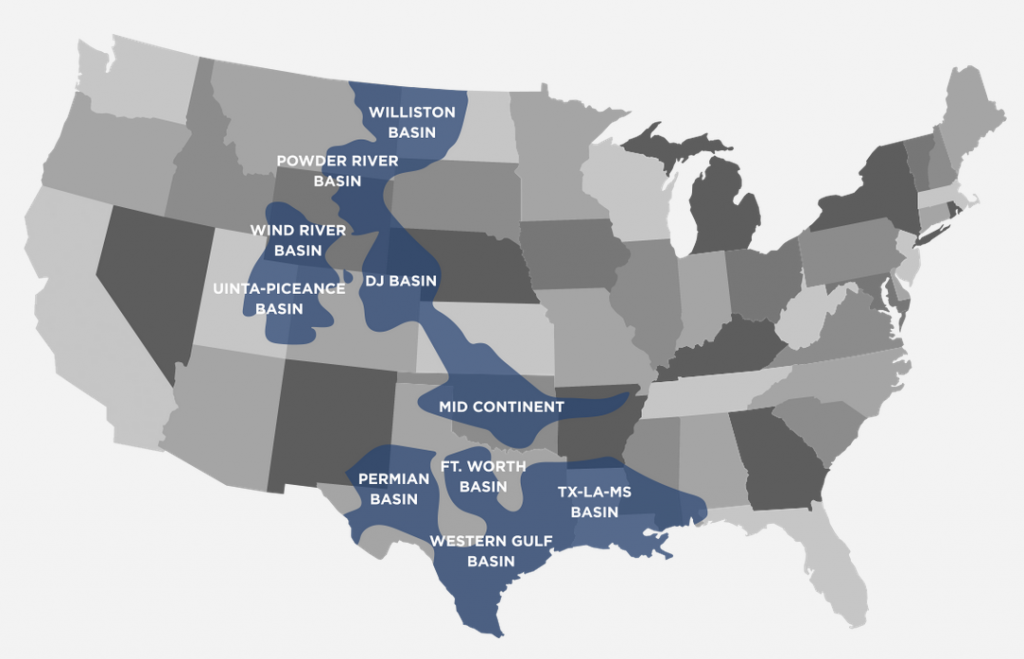

EVX Midstream Partners announced its formation last Friday with a $75 million equity commitment from Five Point Capital Partners. EVX is a private midstream MLP that will focus on the development of crude oil, natural gas and produced water gathering, processing, treating and transportation assets in the Permian Basin, Eagle Ford and Mid-Continent, according to a company press release.

EVX’s three founders are Herb Chambers IV, president and CEO; Charlie Flynn, COO; and Brian Kellar, CFO. The three have over 50 years of collective experience originating transactions and projects, structuring and developing midstream assets and operating assets post-acquisition or project completion.

David Capobianco, CEO and managing partner of Five Point, said: “Future demand for infrastructure remains irrefutable, and Five Point is well-positioned to capitalize on producers’ needs in the midstream energy space. Despite current crude pricing, the addressable market for Five Point is expanding as upstream operators focus their limited capex on drilling and development rather than building midstream assets.”

Five Point continues expanding midstream portfolio

Texas based Five Point manages more than $450 million of capital commitments with a focus on midstream energy infrastructure and energy sector investments in North America. The private equity firm’s portfolio also includes Twin Eagle Resource Management and Redwood Midstream, both based in Houston, Texas.

Redwood received a $75 million commitment from Five Point in February 2014 after being founded in 2013. Redwood is focused on acquiring, developing, operating and optimizing crude oil, natural gas liquids and natural gas infrastructure in North America.

Five Point and affiliates of GSO Capital Partners purchased a 50% interest in Twin Eagle from Chesapeake Energy (ticker: CHK) and LS Power Group in March of last year. In addition to acquiring a 50% stake in the company, Five Point and GSO committed to invest up to an additional $200 million to fund the company’s growth. Twin Eagle’s midstream business is focused on crude oil gathering, marketing, pipeline transportation, rail transportation and storage, as well as frac sand transloading, storage and logistics management.