Who’s searching? An exclusive conversation with David Preng

David Preng isn’t worried about the timing of an oil price recovery, as he knows it is coming.

“We have to drive cars; we have to use trucks and trains to get goods to market; we still fly planes—we need motor fuels. In April natural gas overtook coal for generating electrical power. We are going to be a hydrocarbon society for a while.”

Like most people who have been associated with the oil and gas industry for a career, David Preng has seen several commodities price swings that pushed and pulled the level of drilling, investment and hiring in the industry. He’s seen it first-hand since 1980, when he established Houston-based Preng & Associates, which grew into one of the energy industry’s premier executive search firms.

“Our firm is celebrating its 35th birthday,” the Preng & Associates founder and president told Oil & Gas 360®. “We started in a 10’ by 10’ executive suite with just me.”

Today Preng & Associates has six partners and 24 global employees. The firm has served more than 700 clients and conducted more than 3,200 engagements since its founding. Today Preng specializes in recruiting top talent for the industry’s top leadership positions: Board of Directors, C-suite and other senior executives.

So how is the industry today, compared to other cycles since Preng & Associates was founded?

“The difference between 1986-‘87 and today, there was no private equity back then,” Preng said. “Today there is $80+ billion in unlevered cash sitting in private equity’s coffers looking to be invested. Right now, we’re working for three different PE groups who’ve asked us to find leadership teams.”

“The difference between 1986-‘87 and today, there was no private equity back then,” Preng said. “Today there is $80+ billion in unlevered cash sitting in private equity’s coffers looking to be invested. Right now, we’re working for three different PE groups who’ve asked us to find leadership teams.”

The oil and gas industry is highly consolidated compared to 30 years ago, Preng pointed out. “Gulf, Texaco, Amoco, Arco—they all went away. The number of people in the market was so much greater then, compared to today.

“I had a talk with one of the large independents in town. The CEO said, ‘we’re not hiring, but I’m always on the look out to high-grade my talent. So if you see anyone who has this or that, let me know. I’d be interested in talking’.”

Preng said the challenge was that what the company wanted was “the rarest breed—someone 38-52, or probably 42-50 who is a value creator. Consider the demographic reality – at the University of Texas in 1980-’84 time frame, they graduated around 110-125 petroleum engineers. And the average for 1989-’90-’91 was down to nine. There just aren’t a lot in that age group to go around.”

“Right now, we’ve got private equity firms coming to us saying, ‘I’ve got capital to invest and I neet to achieve a rate a return. I need teams who can identify and capitalize on projects.’ The PE firms are out there scouring the market for talent. They’re hiring us to build teams for them: ‘Get someone to be the CEO and make sure you supplement his/her skills with quality engineering, financial, geoscience, land and business development talent’. That’s the crux of the teams that we’re looking to build out.”

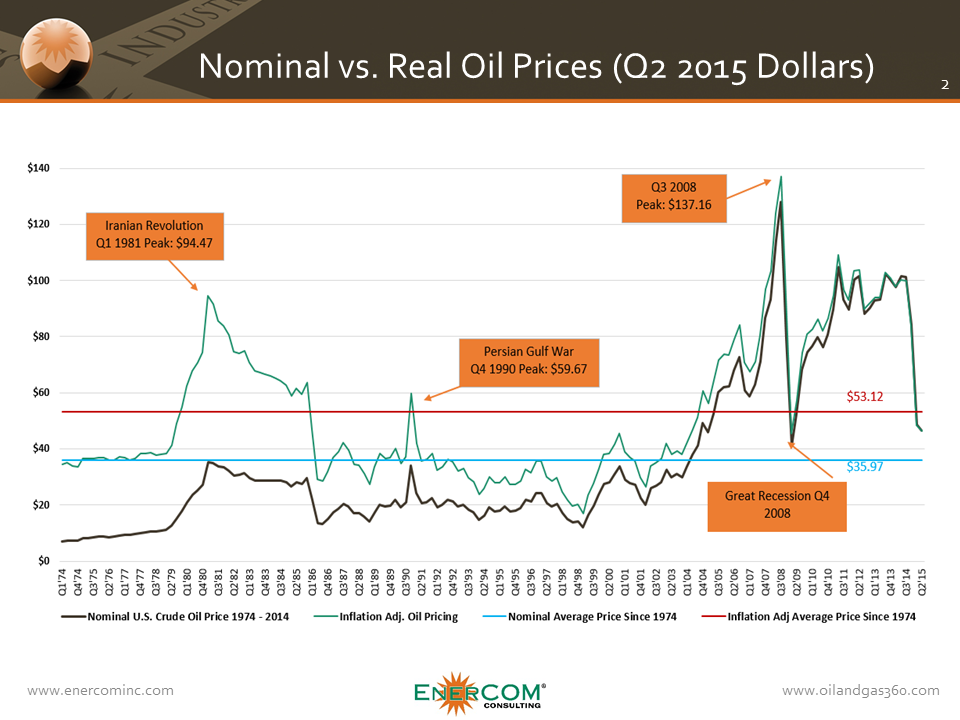

Tudor, Pickering & Holt is saying that oil will come back in the second half of 2016 and they have given it a price target of $80 per barrel. “That’s bullish, but they make a logical argument for it by showing that the demand-supply gap is a half million barrels or less, not two million barrels, supply is falling and demand is rising.”

“Whether it’s the latter half of sixteen or seventeen or eighteen, we will get back to $60-$70-$80 a barrel oil,” Preng said. “The people who are looking at this industry today have patient money; they’re looking to invest.”

What’s next for Preng & Associates?

“The next big step is cutting down on the search time. Time is valuable. People want a complete solution quickly. So we’re working on a technology that will help us deliver that benefit for our clients. I think it could revolutionize our part of the industry. It could, in theory, do for recruiting what George Mitchell did for the Barnett shale. The goal is this: you can call us and request a search, and we can have it done in 30-45 days.

“The energy industry is a constant pattern of change. The changes that are going on are creating new projects, and I love it.”