Oil major ExxonMobil looks to acquire natural gas producer InterOil Corp. for $2.5 billion

ExxonMobil (ticker: XOM) has made a $2.5 billion all-stock offer for InterOil Corp. (ticker: IOC), a U.S.-listed company with natural gas assets in Papua New Guinea.

The deal marks the first time that ExxonMobil has attempted to make a major corporate acquisition since its $2.6 billion purchase of Celtic Exploration Ltd. in 2013, which expanded the company’s shale assets in Canada.

Many oil companies have been cautious about making acquisitions in today’s markets, with oil prices fluctuating too rapidly for buyers and sellers to agree on a price for assets.

Contingent resource payment of $7.07 per share

Exxon’s deal is comprised of a payment of $45.00 per share of InterOil, paid in Exxon shares, plus a contingent resource payment (CRP). The number of ExxonMobil shares paid per share of InterOil will be calculated on the volume weighted average price of XOM’s shares over a measuring period of ten days ending shortly before the closing date, according to an IOC press release.

The CRP will be an additional cash payment of approximately $7.07 per share for each Tcfe gross resource certification of InterOil’s Papua New Guinea asset, the Elk-Antelope field, above 6.2 Tcfe—up to a maximum of 10 Tcfe.

IOC acquisition delivers XOM a Barnett-sized gas source for its PNG LNG plant, takes out potential LNG competitor

The InterOil acquisition would add more natural gas to Exxon’s portfolio, and offer more supply for the company’s $19 billion PNG LNG plant. InterOil proposed a second LNG facility in the country, meaning that the acquisition would not only offer more reserves to feed XOM’s facility, but also put a stop to a potential competitor before its plans get off the ground.

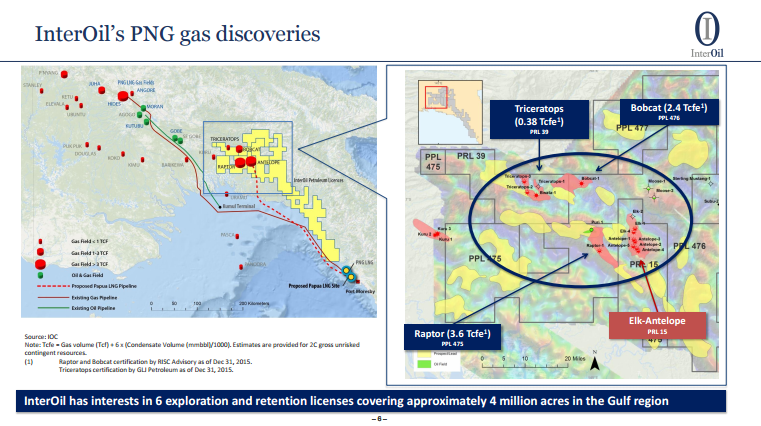

According to IOC’s corporate presentation, the company’s “key asset” is a 36.5% gross interest in PRL 15, and the associated Elk-Antelope discovery. The PRL 15 assets cover roughly 4 million acres, via 6 petroleum licenses, and is similar in size to the Bakken or Barnett Shale.

The deal is “a solid bolt-on acquisition for XOM,” said Roger Read with Wells Fargo Securities. “With its existing LNG operations on Papua New Guinea (PNG), XOM is an experienced operator in PNG. In our view, XOM would expect to leverage its existing LNG facilities as a more cost effective way to develop IOC’s natural gas discoveries. The addition of IOC’s known gas reserves (Elk and Antelope fields) with potential upside from future extensions and discoveries should support additional LNG train(s).”

ExxonMobil offers a “superior” deal

ExxonMobil is not the only company with their eye on InterOil, however. On June 30, InterOil encouraged its shareholders to vote in favor of an acquisition by Oil Search Limited. Oil Search Limited hoped to acquire IOC in an all-stock transaction as well, offering 8.05 shares of its company for each InterOil share, for a total value of roughly $2.2 billion. Oil Search also offered a CRP for potential reserves upside over 6.2 Tcfe on the Elk-Antelope field, but without the 10 Tcfe cap.

After considering both deals, IOC announced “the ExxonMobil offer constitutes a ‘superior proposal’ as defined in InterOil’s arrangement agreement with Oil Search Limited.” Under the terms of their agreement, Oil Search has three days to propose a new offer for IOC that beats the roughly 10% premium XOM offered for the company compared to Oil Search’s initial deal.

If Oil Search walks away from its bid for InterOil this week, it is entitled to a $60 million breakup fee, 20% of which would go to French oil major Total (ticker: TOT), which partially backed Oil Search’s offer.

Exxon’s bid presents the potential for a win-win-win

Even if Oil Search decides not to make another offer on InterOil, the company still stands to gain from IOC’s acquisition. Oil Search hoped the acquisition would generate cost savings, but even if ExxonMobil ultimately acquires IOC instead, it will likely continue to invest in expanding existing LNG infrastructure it co-owns with Oil Search.

Oil Search is the largest oil and gas producer for ExxonMobil’s PNG LNG facility, and operates all of PNG’s currently producing oil and gas fields, according to an overview of Exxon’s co-ventures in the project. The company holds a 29% interest in the PNG LNG project, and stands to gain from the Exxon acquisition even as it loses the bid to acquire InterOil itself.