ExxonMobil (ticker: XOM) is the largest publicly traded international oil and gas company, with an estimated 25.2 billion BOE of reserves in its 2013 year-end report. The company has a market cap of approximately $441 billion and is the world’s largest refiner and marketer of petroleum products.

ExxonMobil’s stock price opened at $104.25 per share on June 24, 2014 – a company record. At the close, the stock was down for the day, but it was up by approximately 75% compared to the June 28, 2010 closing price of $58.47 per share, which was reached roughly around the same period that the XTO acquisition was finalized.

XTO Deal in Review

Source: The Wall Street Journal

ExxonMobil’s acquisition of XTO Energy was valued at $36 billion, including the assumption of XTO’s $11 billion in debt. The remaining $31 billion was used as an all-stock deal as part of a tax savings move and involved issuing roughly 416 million XOM shares. At the time of the deal, the shale boom was ramping up and sent gas prices to below $3/MMbtu. The low prices strained XTO’s capital, which was compounded by $11 billion in acquisitions costs. Despite claiming 45 Tcf of recoverable resources and 485 MBOEPD of production, XTO believed future operations would be hamstrung due to its tight balance sheet.

Exxon’s cash availability would solve such a problem. In a conference call with investors and analysts on June 10, 2010, XOM management said the acquisition will allow the company to grow its resource base by 10% at a cost less than $1 per Mcf. The results in expenditures were immediate and very significant – XTO’s previous 2010 expenditure plan of $4 billion suddenly became part of XOM’s plan of $28 billion. Furthermore, XOM became the largest natural gas producer in the United States, tripling its total output pro forma for the XTO merger.

In the call, management stressed the importance of natural gas for the future and estimated global demand to grow annually by 1.2% through 2030. The company placed its total unconventional reserves at 70 Tcf and “conservatively” estimated its future inventory at greater than 10,000 wells. In addition, XOM moved away from XTO’s strategy of hedging production due to its capital availability.

“(Hedging is) not necessary with ExxonMobil’s financial strength and capacity,” said Rex Tillerson, Chairman and Chief Executive Officer of Exxon. “We’re very happy to take the exposure to price. That’s what we’ve always done.”

Source: The Wall Street Journal

Despite the acquisition focusing on natural gas, ExxonMobil management assured investors the company was not switching from its focus on oil. Tillerson summed up the purchase: “This opportunity came to us, and our consideration was the opportunity to obtain a material position now, with material production and an organization that then would allow us to participate in the future here in the United States and then integrate that into the global portfolio that we had built which was largely acreage.”

Exxon’s Reasoning

Analysts, including Fadel Gheit of Oppenheimer, said XOM’s size and urgency to jump into the US shale play was a driver in the deal. “Exxon can’t grow organically, they have to grow through acquisitions,” said Gheit.

Exxon management said its capital availability allowed the company to hold acreage and drill opportunistically, rather than drill and hedge its assets – XTO’s previous plan of attack.

“For us, it was a question of if we’re going to continue to be a material participant in the U.S. gas markets in the future, which we think are going to grow strongly, it had to be in the unconventional,” said Tillerson. “Part of why this transaction became attractive is because we’re at a time when gas prices are low.”

Source: XOM Analyst Day Presentation

Interestingly, only one question regarding liquefied natural gas (LNG) was asked in the conference call discussing the completion of the merger. When asked, Tillerson said the optionality was beneficial but the company would proceed on a value basis. “It’s a global market, so we can go a lot of places with LNG,” said Tillerson.

Adjusting to the Market

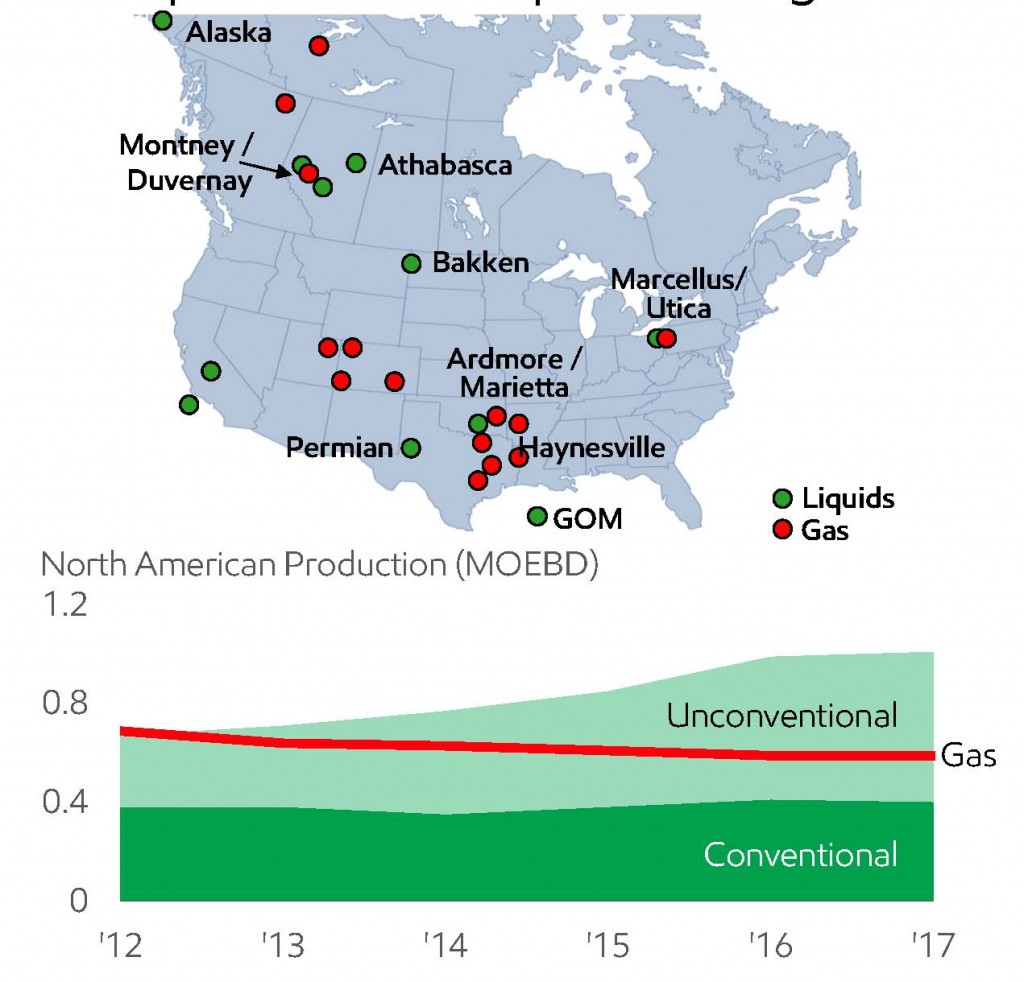

Management warned the results wouldn’t be seen immediately, and some analysts wondered if Exxon had overpaid for XTO, especially since the purchase cost came at a 25% premium to XTO’s value at the time. While gas has not performed as well as Exxon initially expected (Tillerson famously said in June 2012 that they were “losing our shirts”), the company has built up its oil stream through the purchased acreage. In its 2014 Analyst Day, XOM revealed oil accounted for 50% of its stream in 2013 but will rise to 53% in 2017. The rise will come despite three LNG startups throughout Asia and Australia.

Mark Albers, Senior Vice President of Exxon, said 85% of its rigs are currently focused on liquids-related projects. Eight of the ten projects starting in 2014 are aimed at developing liquids, and 18 of its 40 rigs are active in the Permian and Bakken. Unconventional resources were a key point of the presentation and XOM says its free cash flow provides the option to ramp up activity if demand increases. Production from unconventional resources is estimated to reach 225 MBOEPD by 2017 – up 165% from 2010’s total.

Source: XOM Analyst Day Presentation

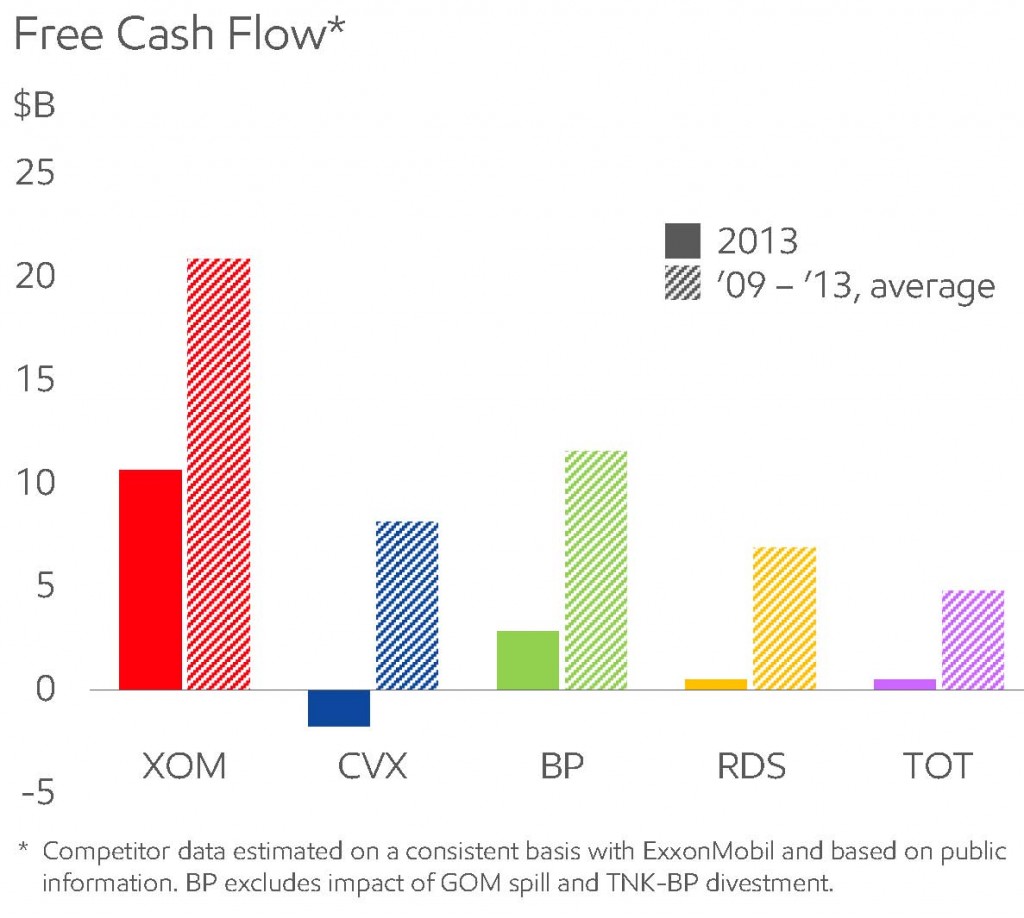

Exxon’s Premier Asset: Free Cash Flow

Even though XOM has missed production guidance for four of the last five years, its stock price has grown at a compounded annual rate of 10% for the same time period. Exxon has historically padded its department of free cash flow and estimates compiling $17.3 billion by 2017. The company returned 54% of its earnings to investors through dividends and share repurchases in 2013.

XOM’s massive worldwide acreage and liquidity, combined with the recent turmoil in Ukraine and Iraq, will allow the company to adjust accordingly to global energy needs. In a conference on June 23, 2014, Exxon representatives continued to speak of natural gas’ long-term prominence. The company says an estimated 200 years of global supply remain untapped.

The comments are in line with Tillerson’s remarks following the XTO acquisition roughly four years ago. He said: “We recognize that a fair amount of this value is out in the future. It’s not about today and we just want to make sure that today it’s cash positive and generates some net cash to the corporation that will improve value. Over the long-term we will generate returns that will be attractive, probably not this year, maybe not next year.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.