Majority of Analysts Predict Increase Before Year-End

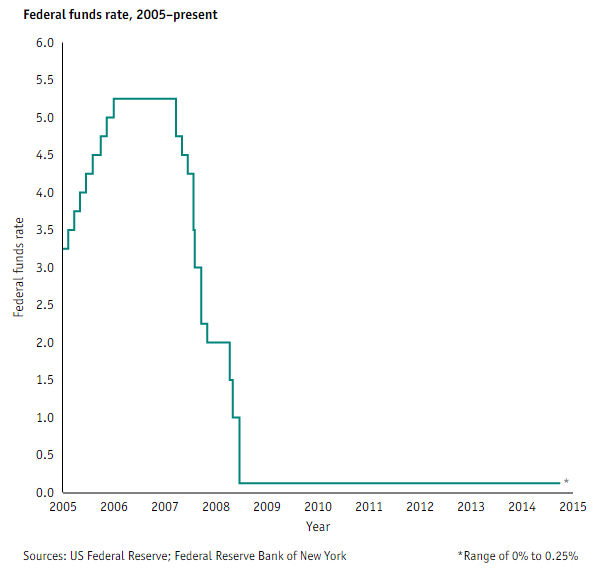

The Federal Reserve is maintaining the status quo of interest rates at 0.00% to 0.25%. For now.

The Committee wrapped up its latest meeting on June 17, and while seemingly encouraged by some factors, determined the signs are not enough to bump up the interest rate. The report cited “moderate” increases in economic expansion and household spending, but investment and net exports “stayed soft.”

The report adds, “Inflation continued to run below the Committee’s longer-run objective, partly reflecting earlier declines in energy prices and decreasing prices of non-energy imports; energy prices appear to have stabilized.”

The Committee expects inflation to remain low in the near-term and does not see any changes on its long-term forecast. Improvements in commodity prices and in the labor market will be key points in boosting its decision making process. The Fed says it will continue to monitor both elements of growth and is “reasonably confident that inflation will move back to its 2% objective over the medium term.”

Adjustments to GDP, Labor Markets

The Fed sharply cut its change in real gross domestic product to 1.8% to 2.0% in its latest update, down sharply from a forecast of 2.3% to 2.7% in March. GDP contracted 0.7% in the first quarter and, according to the Atlanta Fed, is likely to rise only about 1.9% in the second quarter. Unemployment was at the top end of March projections, reaching 5.2% to 5.3%. Personal consumption expenditures and inflation were unchanged. Inflation expectations remained between 0.6% and 0.8%, well below the Fed’s target of 2.0%.

The Committee will meet again in September, and any changes will be determined on a meeting by meeting basis. Interest rates have remained unchanged since December 2008. Of the 17 participating members, two believe the policy firming should not occur until 2016. The International Monetary Fund also believes 2016 would be the most appropriate timing, saying the strength of the dollar has weighed on domestic growth due to weaknesses internationally.

However, the IMF and the two Fed members favoring a 2016 hike may have a more bearish economic view than most. “There is consensus emerging that something should happen this year. That will certainly focus all of our attention on September,” said Carl Tannenbaum, chief economist for Northern Trust, in an interview with CNBC. “The debate is not whether to do something, but rather how much.”

Jim Caron, portfolio manager with global fixed income at Morgan Stanley Investment Management, said that the Fed will “keep rates low, but allow inflation pressures to build. Before they get out of hand, hike rates faster to stop any inflation.”

Phil Orlando, chief equity strategist and portfolio manager at Federated Investors, believes the Fed will likely increase interest rates in September and again in December.