Several key new projects approved in Northeast Utica and Marcellus; 50 more in process

Without pipelines to take Marcellus and Utica natural gas and liquids production to the markets that need the gas, the shale boom stagnates—it’s been a problem in the Northeast since shale gas drilling took off over a decade ago. But with the loud cry for takeaway capacity, midstream providers have answered the call, designing pipelines and expansions, applying for permits, raising capital and jumping through hundreds of regulatory hoops in advance of obtaining approvals and certifications for big midstream takeaway projects.

The government agency needed to move the big projects forward but had a hiccup caused by a drought of commissioners at the beginning of the year. At one point the Federal Energy Regulatory Commission (FERC) had only two, then only one commissioner. The commissioners couldn’t mathematically reach a quorum. So proposed projects sat and waited.

But the agency the received new leadership when the Trump administration appointed replacement commissioners. In Aug. 2017, the U.S. Senate confirmed two new FERC commissioners, Neil Chatterjee and Robert F. Powelson. Now big pipeline projects once again have a way forward.

Saw it coming

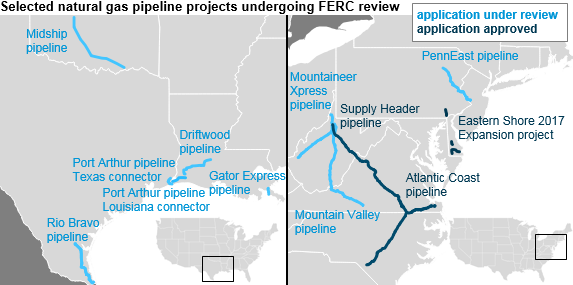

FERC did certify seven projects between Jan. 30, 2017 and Feb. 3, 2017 in anticipation of the no-quorum period. These seven projects have a total capacity of more than 7 Bcf/d and include more than 1,500 miles in natural gas pipeline construction and expansion, according to the EIA.

But with the new commissioners in place, the business of completing the approval process could at last proceed, ending a seven-month limbo.

Projects approved in October 2017

- $500 million Supply Header Pipeline: a 1.5 Bcf/d, 38-mile pipeline from West Virginia to Pennsylvania

- $5 billion Atlantic Coast Pipeline: a 1.5 Bcf/d, 600-mile pipeline from West Virginia to North Carolina

- $99 million Eastern Shore 2017 Expansion Project: 40 miles in pipeline expansions, providing 0.061 Bcf/d from Pennsylvania to Delaware

12 new pre-filing applications submitted since last Tuesday, with 50 more pipeline applications in process

Since Oct. 24, 2017, 12 pre-filing applications have been submitted to FERC for domestic natural gas pipeline projects and an additional 50 pipeline applications are in the process. The combined capacity of all these projects total approximately 43 Bcf/d, covering slightly less than 3,000 miles worth of new and upgraded pipeline.

U.S. LNG export terminals driving much pipeline activity: nine projects represent 63% total pending capacity under application and five are tied to LNG terminal approvals

FERC will look at nine large projects that have a projected total capacity of more than 21 Bcf/d, 63% of the capacity for all pending natural gas pipeline applications.

The EIA report pointed to six of these projects which are located in Texas, Louisiana, and Oklahoma.

Five of the six are tied to LNG terminal approvals:

- $2.2 billion Rio Bravo Pipeline: in Texas with a capacity of 4.5 Bcf/d, connecting the proposed Rio Grande LNG terminal from NextDecade (ticker: NEXT) to available interstate pipelines. The purpose of the terminal is to provide natural gas liquefaction, export and vessel and truck loading services to third parties. The facilities will be in the counties of Jim Wells, Kleberg, Kenedy, Willacy and Cameron, Texas.

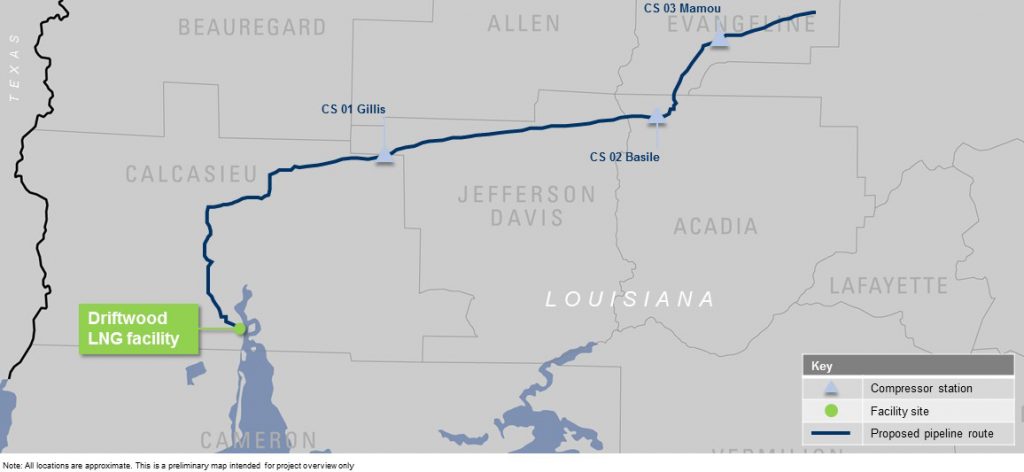

- $16 billion Driftwood Pipeline: a 96-mile pipeline in Louisiana with a capacity of 4 Bcf/d, connecting the proposed (ticker: TELL) to available interstate pipelines. The pipeline will pass through the counties of Evangeline, Acadia, Jefferson Davis, and end at the Driftwood LNG facility in Calcasieu, Louisiana.

- Port Arthur Pipeline–Louisiana Connector: a 135-mile pipeline with a capacity of 2 Bcf/d, mostly in Louisiana with a small segment of pipeline in Texas to connect to the Port Arthur LNG facility in Texas. The pipeline will pass through the Louisiana counties of Calcasieu, Beauregard, Allen, Evangeline and St. Landry Parishes, and Jefferson County in Texas.

- Port Arthur Pipeline–Texas Connector: a 34-mile pipeline with a capacity of 2 Bcf/d, mostly in Texas with a small segment of pipeline in Louisiana, terminating at the Port Arthur LNG facility in Texas. The Texas Connector is located in Jefferson and Orange Counties, Texas and Cameron Parish, Louisiana. The 42-inch diameter pipeline is projected by Sempra Energy to be in commercial operation in 2022.

- $284 million Gator Express Pipeline: a 27-mile pipeline south of Plaquemines Parish, Louisiana, with a capacity of 1.9 Bcf/d, connecting the Plaquemines LNG facility to the Tennessee Gas pipeline and the Texas Eastern Transmission pipeline

- The pipeline will connect new gas production from the emerging STACK and SCOOP plays in the Anadarko Basin. The pipeline will begin in Kingfisher County, Oklahoma and terminate at interconnects with existing interstate natural gas pipeline near Bennington, Oklahoma.

Oil & Gas 360® recently reported on the Mountain Valley Pipeline in the Q3 2017 EQT Corporation (ticker: EQT) earnings article. The Mountain Valley Pipeline will run from West Virginia to Virginia, carrying approximately 2 Bcf/d over 303-miles.