The Bakken Shale and the state of North Dakota are symbols of the hydraulic fracturing revolution, and innovations on hydrocarbon extraction continue to improve the process with each passing day. The technological advances vary across all lines of production, spanning from operations at the wellhead to lab research at the company headquarters.

Among the innovators is GTUIT®, LLC, a privately held firm specializing in mobile well-site flare gas capture. 2015 has been a banner year for the Montana-based company; it secured an equity investment from Caterpillar Oil & Gas in April and was presented an award of excellence from the World Bank Global Gas Flaring Reduction Partnership in September.

The company currently operates 28 mobile units, and 15 are currently running at seven well site locations for Hess Corporation (ticker: HES) in North Dakota. The combined project is currently processing 10 MMcf/d of associated gas, along with recovering and selling approximately 833 barrels of natural gas liquids (NGL) on a daily basis. The NGL sales from GTUIT®’s contributions alone account for 4% of Hess’ liquid volumes in Q2’15.

Oil & Gas 360® spoke with Brian Cebull, President and Chief Executive Officer of GTUIT®, from his office in Billings, Montana, in this exclusive interview.

OAG360: Can you give us some insight on your company’s progression throughout the years?

We started out actually with just a concept – it was myself and two other engineers, Jim Haider and Mark Peterson who co-founded the company. We started out with the idea of trying to address the problem of flaring in our own backyard in North Dakota. My background is in upstream E&P and I have spent my entire 21 year engineering career working in the Williston Basin. We had production in the Williston, so I was out there and witnessed the flaring firsthand. We thought it was a significant issue, and it was an issue from our perspective that wasn’t being addressed.

When we started GTUIT® in 2011, all we had was a great idea, a PowerPoint presentation, and some good 3-D models and drawings to give our first customer the confidence to take a chance on hiring GTUIT. I give that first customer, Denbury Resources, great credit for their vision and corporate responsibility because, at the time, there were no regulations forcing them to do anything about flaring. They just wanted to take care of the problem.

Our business really kicked off from there. We got our first systems out in the field in May 2012 – those were systems built utilizing off-the-shelf gas processing components and we now consider them to be our prototypes. We really learned a lot about the operating systems in that first summer. Each of us founders and our first field employees spent a lot of time out in the field, turning wrenches, seeing what worked and what didn’t work and really trying to understand the systems and the dynamics of operating right on a well site.

OAG360: Being somewhat of a niche company, what was the learning curve you experienced with gas capture?

Well, we quickly learned that many things associated with gas processing were not designed to handle the rich flare gas generated from shale production. We worked with other suppliers and manufacturers to develop equipment specifically for our application. We got our next generation systems out into the field in 2013, and, despite having a small footprint, those proved to be much more effective in recovering the liquids from the gas. But an added benefit to producing liquids was that we produced a very clean stream of residue gas as a byproduct that created its own value.

Cebull in the Bakken with GTUIT mobile unit in 2012

Photo Credit: The Billings Gazette

So that’s really where the whole idea of power generation and gas conditioning came from. We really derive two products from our systems; we take a mixture of the rich hydrocarbon gas that is produced in association with crude oil, which has methane but it also has many other heavy hydrocarbons in it. We strip it into the gaseous phase, which is mostly methane and ethane, and a liquid phase, which is comprised mostly of propane, butanes, and heavier components. The liquids have marketable value by themselves, and the residual gas can be used for fuel and to feed other processes such as wellsite LNG and CNG systems. Because of that, we were able to get a contract with a Caterpillar dealer in North Dakota and build some systems specifically to condition natural gas fuel for CAT generator sets.

We showcased our ability to condition gas and also demonstrated some good run times and reliability, and that was really the impetus for Caterpillar making an investment in us from their venture fund, because they had been looking for a solution. It wasn’t because we came out of the gate with proven equipment, it’s because we took the time to start, develop and really learn what works best and what actually made sense to operate on a well site. As we found out, what’s on paper compared to reality is completely different.

OAG360: Considering Denbury specializes in C02 enhanced oil recovery, what kind of benefits can GTUIT provide to companies with similar operations?

Well I can’t speak for Denbury, but I do have a lot of respect for them and really respect their focus on tertiary oil recovery. They were pioneers in the sense that they noticed an issue with Bakken flaring that they wanted to address. I don’t think there was any connection with their tertiary projects and their core business, but I do think that their idea of C02 sequestration, and any time they can use that C02 and keep it in the ground that there was an environmental benefit there, and that was just a piece of their corporate philosophy.

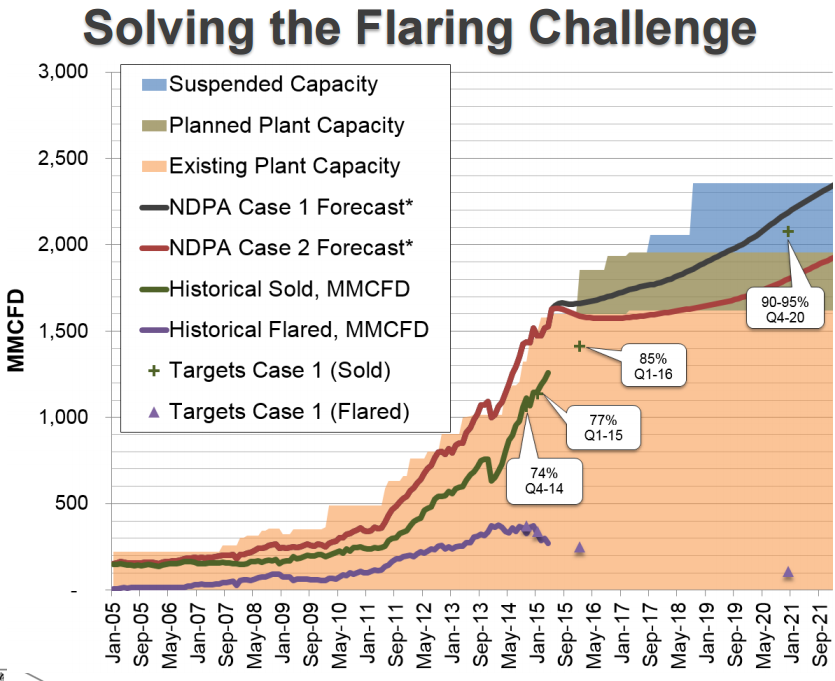

Hess, for example, is our largest customer and they took the initiative on flaring as well before the North Dakota rules were put in place . They have their own gas plant out in the Bakken and we are their main provider for well site gas capture. What we’ve done is taken gas processing, which is typically a midstream process, right back to the upstream well site and added the element of mobility.

We currently produce about 35,000 gallons of NGLs per day to Hess, and that’s just a part of our overall production. We have some other customers that have helped us get to the 60,000 gallons per day mark, which is pretty amazing for us considering we’re producing nearly 2,000,000 gallons per month as a whole.

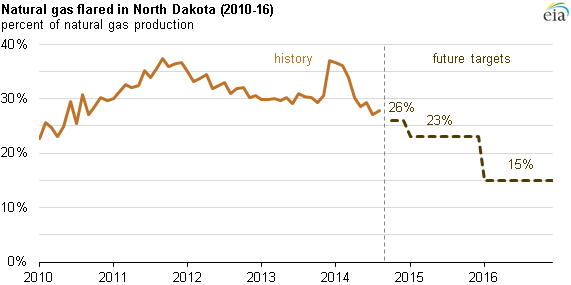

OAG360: Do you believe the industry really jumped on your technology for its own sake or is it more focused on meeting North Dakota’s flaring standards?

In all honesty, when we started this project and up until 2014, prices for oil, gas and NGLs were very strong. Our liquids tended to follow oil spot prices while others generally tend to follow natural gas prices, so there were some pretty compelling economics to capturing the liquids in the flared gas. That’s what initially drove us into the market, the whole idea of making an economic case for doing what we do.

As you know, prices have fallen. NGL prices are no different – there’s a huge glut of propane in the market right now, and margins have certainly become more challenging. It’s not impossible, but it’s certainly become very difficult to justify it solely on an economic basis.

But we do certainly realize and understand that a lot of our business was pushed by the regulations in North Dakota, and now we have 28 systems active in the field. That’s reality and we won’t deny what reality is, but that doesn’t take away from the steps taken by companies to tackle the issue. Hess Corp. signed with us long before there were even discussions of a rule from the North Dakota Industrial Commission (NDIC). So Hess and many of our other customers had a lot of foresight with corporate responsibility and being at the forefront of this issue.

In recent years, jobs have picked up as flare capture rules have become stricter, but the pioneers like Hess just knew it was the right thing to do.

OAG360: What’s your opinion on the NDIC’s decision to push back its gas capture requirements by 10 months?

Well I come from the E&P side and I’ve spent my entire career in petroleum reservoir engineering. Quite frankly, I agreed with the extension. I thought with the amount of uncertainty regarding prices and the general unknowns from the rig count perspective, I believe it was very prudent by the NDIC to push back that deadline. If things were the same as, say, $100/barrel in 2014, they probably wouldn’t have even considered it.

Quite frankly, these flare capture deadlines tend to create a bit of a panic and short term deals. GTUIT’s goal is to be partners with our customers and provide them long-term, reliable gas capture. We build the systems ourselves. They’re extremely mobile and can be moved from one site to the next in just one day. They’re all on trailers and all of our systems are integrated. Our logistics and pre-planning has all improved. Our goal is to be on the gas wherever it’s being flared. We don’t do short-term contracts or day rates, those are not typical contracts for us.

To their credit, most operators have a plan in place with midstream and downstream. However, a lot of things can happen and then suddenly the pipeline they thought they would have is delayed or even cancelled. I don’t blame them for it, but we really appreciate the long-term thinking. It fits GTUIT’s strategy of being a partner with the operators, and that leads to greater efficiencies for both sides once we coordinate on how to work together.

OAG360: Does the Environmental Protection Agency’s Clean Power Plan have any effect on your business moving forward?

Well it won’t have a negative impact but it is not part of our future business plans at this time. I would certainly hope that, over time, the EPA would recognize the companies that capture flared gas and use it to their benefit. The emissions reduction on site and the efficiency of its uses is pretty amazing when it comes to the CO2 and that’s what the EPA Plan addresses. We have captured and prevented more than 333,000 barrels of natural gas liquids from being burned onsite through our partnerships with our customers. That’s a whole lot of CO2 that won’t be emitted needlessly from those sites in North Dakota.

ENERGY COMPANIES USING TECHNOLOGY INNOVATIONS

Whiting Petroleum (ticker: WLL) has invested in imaging technology that delivers 3-D imaging of rock porosity delivered directly from its operations in the Williston Basin. Oil & Gas 360® took its video cameras behind the scenes for an in-depth look at Whiting’s in-house geoscience lab and its successes using its scanning electron microscopes to maximize drilling and production performance throughout the Williston basin. Stay tuned for an Oil & Gas 360® Special Report: “Whiting’s Wildcatters – Micro Scale, Macro Vision.”