Flotek Industries (ticker: FTK), with headquarters in Houston, Texas, develops and delivers prescriptive chemistry-based technology, including specialty chemicals, to global clients in the energy, consumer industrials and food & beverage industries.

Highlights from Flotek’s Energy Chemistry Technologies include:

- Segment revenues decreased 7.1% sequentially to $61.2 million, and increased 35.8% year-over-year.

- Global Complex nano-Fluid® (CnF®) volumes and revenue declined 12.9% and 11.2%, respectively, from the second quarter, and increased 23.1% and 28.7% year-over-year.

- Domestic Complex nano-Fluid® (CnF®) volumes and revenue declined 18.4% and 16.3%, respectively, from the second quarter, and increased 19.1% and 27.3% year-over-year.

- Conventional chemistry (Non-CnF) revenue increased 2.5% sequentially from the second quarter 2017 with continued success of our Prescriptive Chemistry ManagementSM (PCMSM) solutions.

- Sequentially, segment gross margins declined by ~400 basis points to 30.6% due to lower CnF® sales mix, while EBITDA margins declined ~500 bps to 19.2%.

- International revenues increased 85.3% sequentially from the second quarter and 14.3% from the third quarter 2016, primarily due to increased CnF® sales.

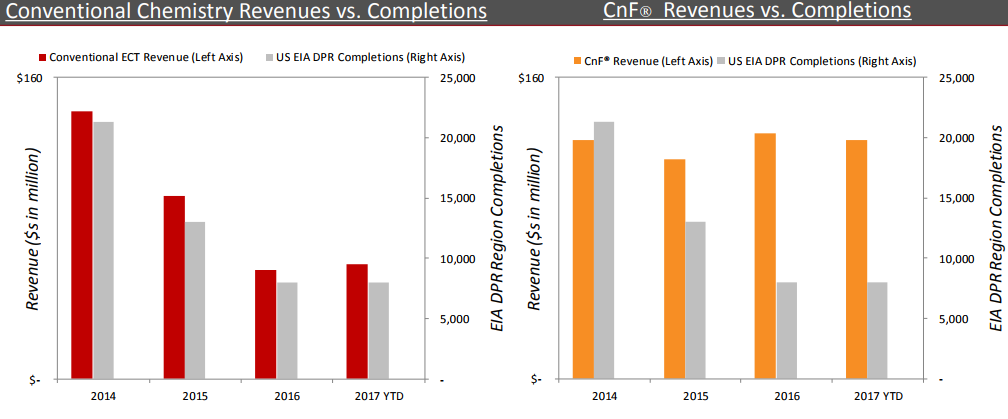

- Long term domestic CnF® trends remain positive as volumes have increased 98.5% since the cycle peak in 3Q 2014 relative to EIA completion data (as of 10/16/17), which has declined 44.6%, and the U.S. Land Rig Count, which is down 49.5%.

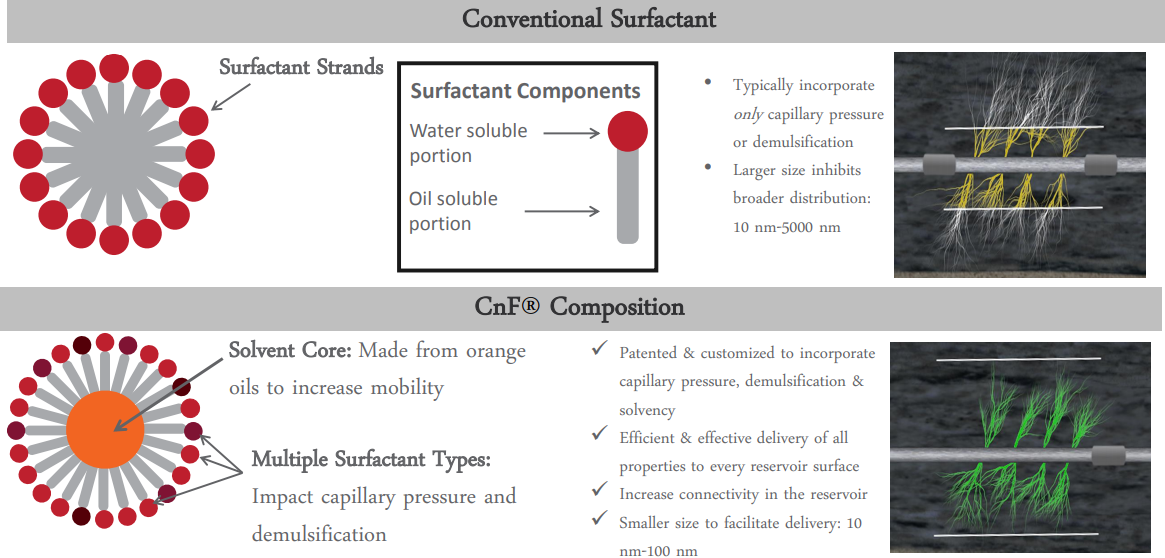

Flotek has 50+ formulations of Complex nano-Fluid (CnF®) technologies, and growing. Flotek also offers 100+ chemistry solutions for all applications and demands, compatible in most fluid designs with its CnF®. The fluid design treatments can be applied in the initial frac of the well through the full life-cycle.

Economics

- In a Delaware Basin Case Study, CnF® wells showed a 12% increase and a 76% increase in daily oil production rates through the first year of a well’s life when normalized for proppant and normalized for lateral length, respectively, vs. offset wells.

- Average EUR’s were 19% higher in CnF® wells vs. offset wells.

- Using a 500 mboe base EUR well (75% oil), a 19% uplift in EUR at $50 WTI/$2.75 NYMEX flat pricing resulted in a $1.4 mil. increase in NPV per well.

- In a hypothetical 50k acre Delaware position targeting 3 benches with 1,280 acre spacing, we estimate NPV uplift potential to be >$120 mil., or >$2,400/acre.

Flotek Industries will present at the EnerCom Dallas oil and gas investment conference February 21-22, 2018 at the Tower Club in downtown Dallas. The conference is focused on bringing together publicly traded E&Ps and oilfield service companies with institutional investors.

Buyside professionals and oil and gas company executives may register for the event through the conference website.