Countries that Need Revenue Want to Produce and Sell their Oil

Before Gaddafi was removed from power as Libya’s chief, the country produced almost 1.6 MMBOPD. Today that number stands at just 436 MBOPD, according to Mustafa Sanallah, chairman of Libya’s National Oil Corp. (NOC).

“For the last three years, the other members, not only from OPEC but the others, they get advantage of [Libya’s production being so low],” said Sanallah. “So my colleagues work very hard to increase our production, to make the required maintenance.

With the next OPEC meeting on June 6 fast approaching, Sanallah says he is more concerned with Libyan production. “I’m not relying too much on the OPEC meeting,” he said.

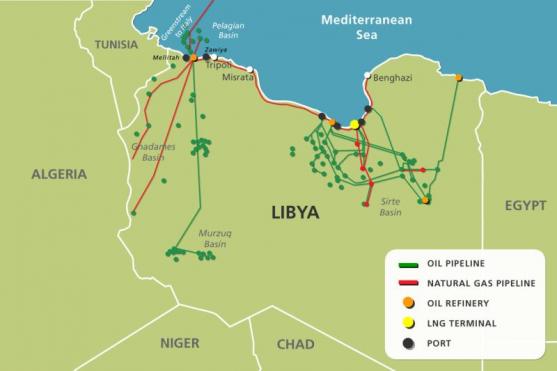

Sanallah’s comments come as Libya continues to struggle to increase production amid violence that has continued for the last four years, following the 2011 revolution which ousted Muammar Gaddafi.

Oil production has become a major concern for both sides in the conflict taking place in Libya, with about 90%-95% of the state’s income coming from the sale of oil.

Recently, NOC opened its books to international oil firms and is meeting regularly with the International Monetary Fund and World Bank to keep them on board with the current payment system for Libya’s crude oil exports. Sanallah said he and central bank Governor Saddek El-Kaber met with Libya’s major oil buyers to reassure them that none of the payments were going to fuel hostilities between rival factions or were being misused, reports Reuters.

Sanallah said international companies needed to “be sure the money is not going to some militias.”

The NOC chairman said he hopes to see production increase by 200 MBOPD over the coming two months as damaged oil fields are repaired and dialogue continues with groups who have blocked pipelines and oil fields.

Not concerned with OPEC

Sanallah said the NOC does not believe that OPEC should cut production at its coming June meeting, but that the NOC cares solely about Libya’s production and regaining its market share. “We want to gain market share…we are working hard on this,” he said. Eventually, he said, “the prices will go up, and the market will absorb the increase in production, from Iran and Libya.”

“There is a general consensus that oil prices will recover. The worst of the market is behind us now,” said Sanallah. “It is expected that the oil price will start to rise by the beginning of the second half of this year and continue to rise in 2016.”

Sanallah agrees with Saudi Arabian Oil Minister Ali al-Naimi that OPEC was right in maintaining its production last November, saying, “I do agree with him. So we are focusing on our market share also.”

Iraqi President Fuad Masum echoed Sanallah’s view, saying that Iraq would also be focusing more on recapturing its market share, regardless of OPEC quotas.

“We may have to sell oil beyond OPEC quotas,” Iran’s IRIB quoted Masum as saying.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.