TPG Pace Energy acquires EnerVest’s South Texas Division in $2.66 billion handshake; forms new public company – Eagle Ford, Austin Chalk pure-play – Magnolia Oil & Gas Corp.

TPG Pace Energy Holdings Corp. (ticker: TPGE), an energy-focused special purpose acquisition entity led by former Occidental Petroleum Corporation CEO Steve Chazen, has entered into definitive agreements with funds managed by EnerVest, Ltd to acquire the oil and gas assets within EnerVest’s South Texas Division for approximately $2.66 billion in cash and stock.

As part of the transaction, TPGE and EnerVest are partnering to create Magnolia Oil & Gas Corporation, a new public company led by Steve Chazen, who will serve as Magnolia’s full-time chairman, president and CEO.

Upon closing, Chazen will be joined by his long-time colleague and business partner, Christopher Stavros, who will serve as the new company’s CFO.

Chazen “perfected the OXY playbook”: John Walker

“I have known Steve for more than 20 years and I cannot think of a better executive to lead Magnolia,” said EnerVest CEO and founder John B. Walker. “The playbook he perfected at OXY is a great match for the outstanding acreage we have assembled in South Texas over the last 10 years.”

Pending regulatory and shareholder approvals, the new company will trade on the NYSE under a new ticker upon closing the deal, which is expected to occur late in the second quarter of 2018.

Eagle Ford, Austin Chalk Assets, Mar. 2018

Starting off right: 40,000 BOEPD of production and a 90-member professional/technical team in place

In addition to Chazen’s leadership, Magnolia will benefit from the corporate support, experience and local knowledge of EnerVest’s South Texas team, which will continue to operate the assets following the closing of the transaction under a long-term services agreement with EnerVest. Under the terms of this services agreement, EnerVest will provide more than 90 dedicated operating, technical and field level employees.

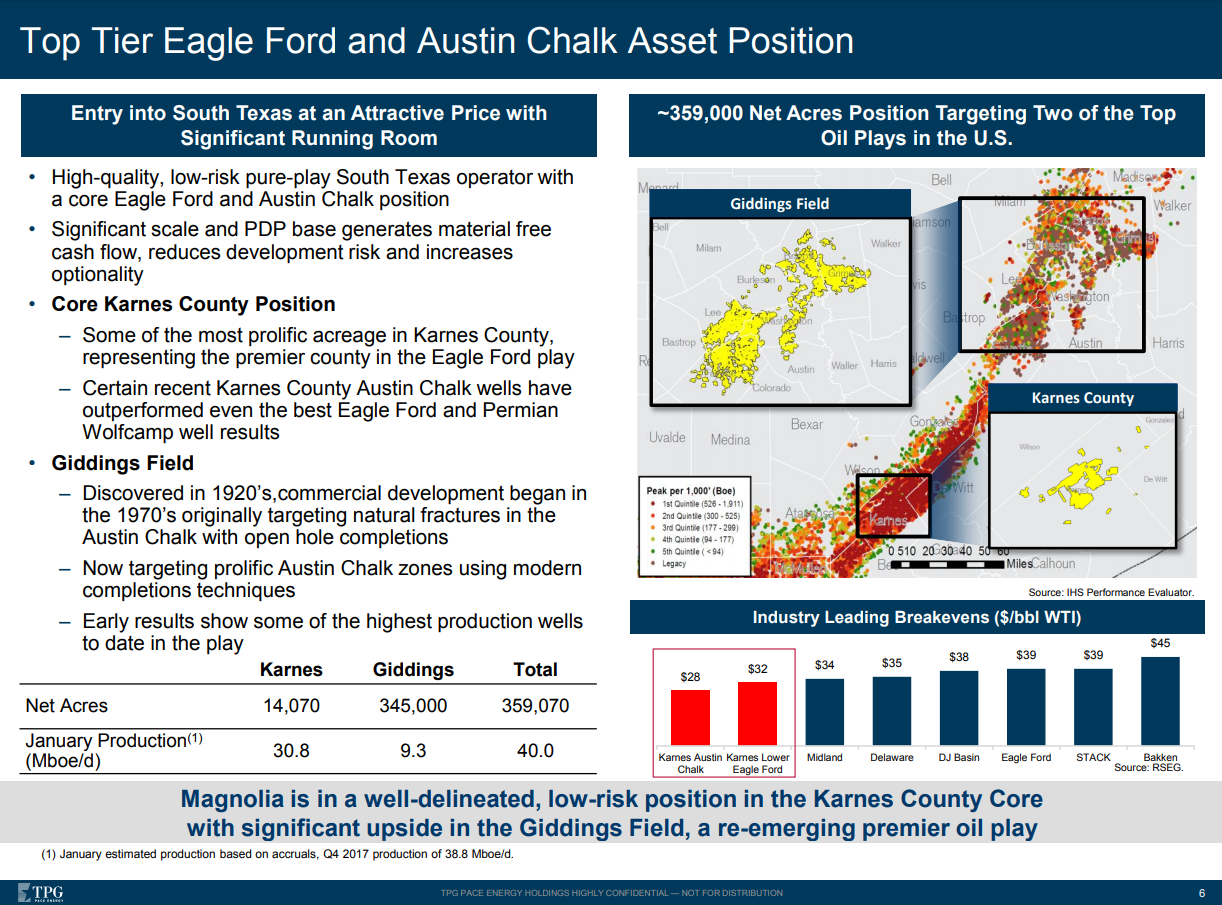

40,000 BOEPD South Texas pure-play with 360,000 Eagle Ford and Austin Chalk acreage position

The formation of Magnolia creates a large-scale, pure-play South Texas operator with Eagle Ford and Austin Chalk asset positions with more than 40,000 BOEPD of production. Magnolia will acquire EnerVest’s approximately 360,000 total net acres in South Texas, which consists of approximately 14,000 net acres in Karnes County and 345,000 net acres in the Giddings Field.

The Giddings Field is projected to produce 9,000 BOEPD. Overall, the total production base is 62% oil and 78% liquids. According to the company, the acreage position is almost entirely held by production and the production from the combined asset base is heavily weighted toward oil.

“In creating Magnolia, we have a unique opportunity to build a new company anchored by what we consider to be some of the highest quality oil producing acreage in the country,” said Chazen.

Strategy: Magnolia plans to invest less than 60% of cash flow to fund drilling program that delivers 10%+ annual production growth, assuming ‘moderate commodity prices’

“Our objective is to maximize shareholder returns by generating steady production growth, strong pre-tax margins in excess of industry norms and significant free cash flow.

“Assuming moderate commodity prices, we plan to invest less than 60% of cash flow to fund a drilling program that consistently delivers more than 10% annual production growth. I look forward to leading this rigorous capital allocation process at Magnolia,” Chazen said.

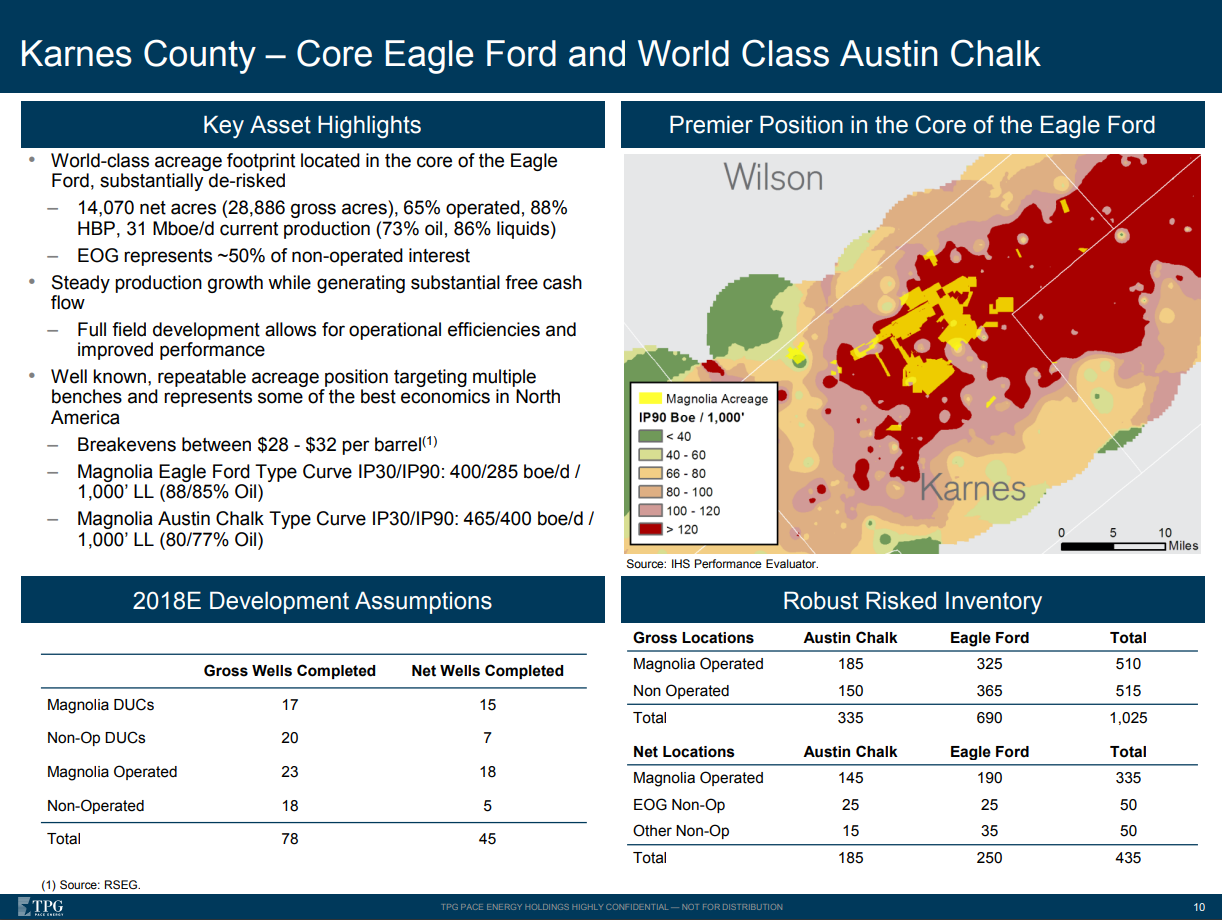

Karnes County, Mar. 2018

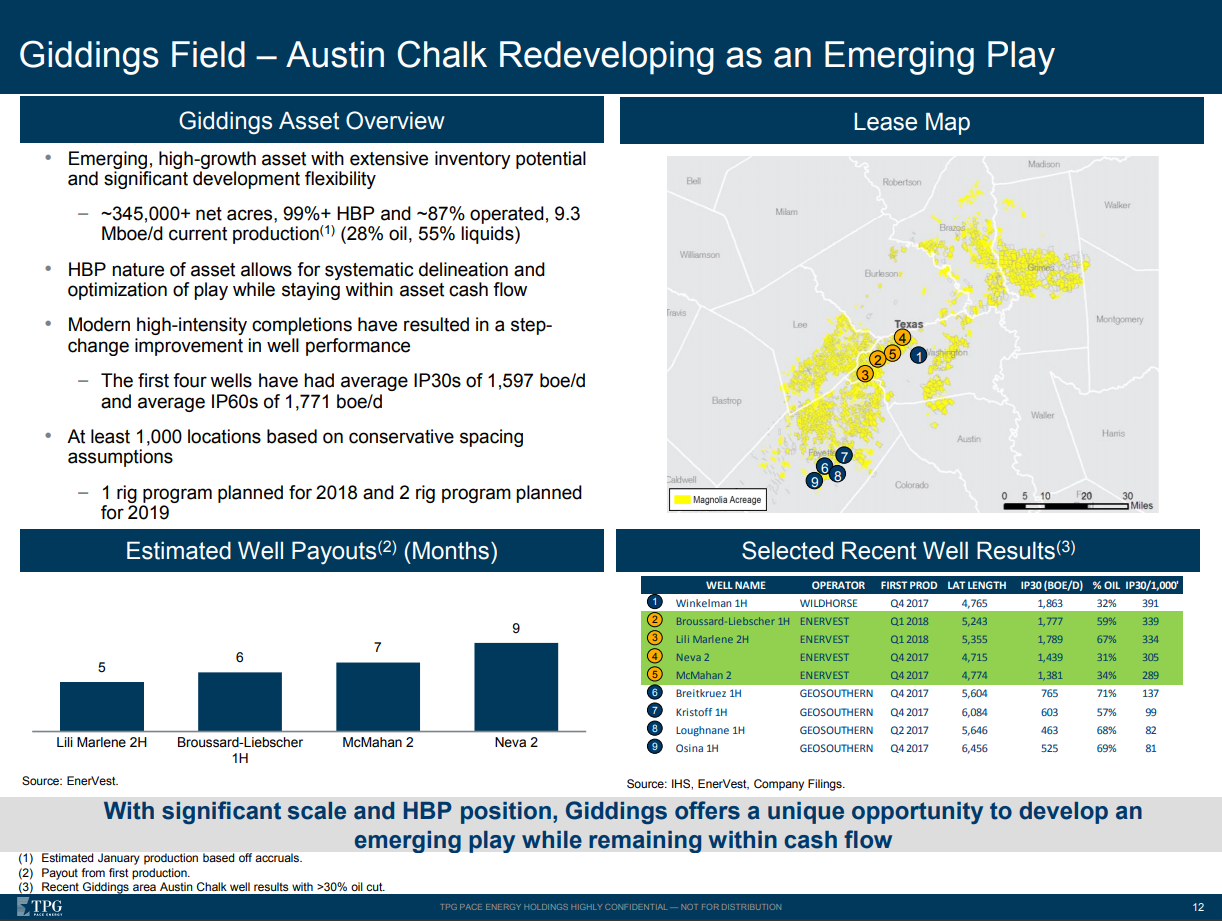

Giddings Field, Mar. 2018

- Estimated new well paybacks of less than one year in both Karnes County and Giddings Field

- Estimated 2018 EBITDA of $513 million and approximately $240 million of estimated 2018 free cash flow after capital investment

- Investor presentation can be found here

Financing the deal

The company will largely be equity financed as TPGE anticipates $300 million of funded debt (0.6x 2018 estimated EBITDA) at closing alongside a $550 million undrawn credit facility. EnerVest will receive approximately $1.2 billion in cash at closing and will retain roughly 120 million shares of common stock.

In connection with the transaction, TPGE has entered into agreements to raise approximately $330 million through a private placement of roughly 33 million shares ($10/share) of Class A common stock.

Chazen, TPG executives will subscribe for $25 million

In addition, Chazen and certain TPG executives will personally subscribe for an additional $25 million investment on the same terms. The private placement is expected to close concurrently with the transaction.

Ownership breakout; company estimates public float of $1 billion after private placement

The public float after giving effect to this private placement is expected to be approximately $1 billion. Assuming no redemptions of TPGE public shares, the EnerVest funds will own 51% of the issued and outstanding shares of common stock of Magnolia immediately following the closing, the TPGE public investors (including the PIPE) will own 43% and the remainder will be owned by TPG. Following the closing, EnerVest may earn up to an additional 17 million shares if certain operating and/or stock price targets are achieved.

TPGE has secured financing commitments for the anticipated funded debt and RBL (reserves based lending).

After giving effect to any redemptions by the public shareholders of TPGE, the balance of the approximately $650 million in cash held in the TPGE trust account, together with approximately $350 million of private placement proceeds and the debt financing will be used to pay the seller’s cash consideration and closing costs.

Upon closing, Magnolia will maintain a seven-person board, which will include Steve Chazen as chairman, two appointees named by each of TPGE and EnerVest and two additional independent directors.

About Chazen and Stavros

Chazen

Source: LinkedIn

Chazen has been the CEO and president of TPG Pace Energy since February 2017, and its chairman of the board since May 2017. Some of Chazen’s previous roles have been listed below:

- CEO of Occidental from May 2011 to April 2016

- President of Occidental from December 2007 to December 2015

- COO of Occidental from August 2010 to 2011 and CFO from 1999 to 2010

- Director of project evaluation and reservoir engineering at Columbia Gas Development Corporation from 1977 to 1982

- Chazen began his career at Northrop Corporation in 1973 as laboratory manager at the Johnson Space Center, where he worked until 1977

Stavros

Source: LinkedIn

Stavros was the CFO at Occidental from July 2014 until May 2017. He served as Occidental’s SVP from 2015 to 2017. Stavros joined Occidental in 2005 as the director of investor relations, then became VP of investor relations from 2006 to 2014 and then he served as its treasurer from May 2012 to July 2014.

Conference call excerpts

Chazen said during today’s conference call, “To provide a little prospective on the attractiveness of the basins we are buying, Karnes County properties are as good as any acreage in the United States. They have five to six-month paybacks, which are about one-third of a typical Delaware basin Wolfcamp well. We also have a ten-year inventory of locations, which have economic characteristics similar to the wells we are currently drilling. About 75% of Magnolia’s production comes from this highly prolific area.

“The Giddings Field properties provide the rest of the production. This is an emerging area with modern fracking techniques and a fresh view of the prospective areas have rejuvenated the prospects in this nearly 100-year-old producing region. New wells are generating payback periods of around six to nine months, therefore drive very high rates of return.

“One key element of how I manage the business is that we target on a full cycle margin basis. Our models are based on $58 oil and $2.75 gas price assumptions. At those levels Magnolia should generate positive net income which will grow over the next few years. Margins are improved by low differentials (to either Henry Hub gas or the WTI marker). We expect the finding and development cost to be around $9 per barrel.

“G&A and lease operating costs on a per barrel basis will be well below industry averages. In the presentation attached, on page 17 and 18, you can find details of this. Thus Magnolia should have some of the lowest break-evens and margins that are above even 50% with a reduction in oil prices.

“A distinct characteristic of Magnolia versus its peers is its positive free cash flow. We estimate 2018 EBITDAX of $513 million, with capital spend of $262 million, or around 50% of EBITDA. The rest of the cash flow is undesignated. This results in an industry leading 10% free cash flow yield. January production was ~40,000 barrels of oil equivalent per day, with 62% oil and 78% liquids. We expect 2018 to be around 46,000 barrels of oil equivalent per day.

“The plan I have crafted after this year to spend around 60% of EBITDA on drilling, which should generate an average low-to mid-teens annual improvement in both EBITDA and production. In other words, free cash flow generation would be $200 to $250 million dollars per year. These funds could be used for debt reduction, acquisitions, or share repurchases.

“Organic production growth at the indicated capital levels should nearly double production over a five-year period. Additionally, the company would have accumulated around $1 billion dollars of excess cash before making new investments, reducing debt, or buying back shares,” Chazen said.

TPG’s Director and Managing Partner, Michael G. MacDougall was also on the call.

MacDougall said, “Steve believes that oil and gas companies should have no leverage to low leverage, and that is certainly the case with Magnolia. Of the initial $2.66 billion of enterprise value, we anticipate having only $300 million, or just over half a turn of Total Debt-to-EBITDA on the balance sheet…

“With an anticipated initial enterprise value of $2.66 billion and an estimated $513 million of EBITDA for 2018, Magnolia will be valued at approximately 5.0x 2018 estimated debt–adjusted EBITDA. We project the business to generate an industry leading 10% free cash flow yield…

“As detailed in our investor presentation, we’re using a base commodity price assumption of $58 per barrel for oil and $2.75 per Mcf for gas. We’ve also included a full-cycle margin sensitivity on page 18 of the materials that demonstrates how the company is able to make money through the commodity cycle, with some of the lowest break-evens in the lower 48. We built in a modest growth in rig count in our guidance for 2019, taking rig count from 2.7 this year to 4.0 next year. This leads us to guidance of approximately $550 million in EBITDA in 2019. Our more detailed financial assumptions are shown on page 25 of the materials…,” MacDougall said.

The full conference call transcript can be found here.