2017 demand will be 30% larger than 2014 peak

The current shale resurgence has led to a surge in drilling and completions activity. Modern completions need tremendous amounts of sand, meaning that demand for sand has skyrocketed in the past year. A recent note released by Credit Suisse outlines the current development in frac sand supply and demand.

Total U.S. demand for frac sand was highest in 2014, when the country consumed 56 million tons. Demand fell off during the downturn, and in 2015 and 2016 the U.S. consumed 48 and 34 million tons of sand, respectively.

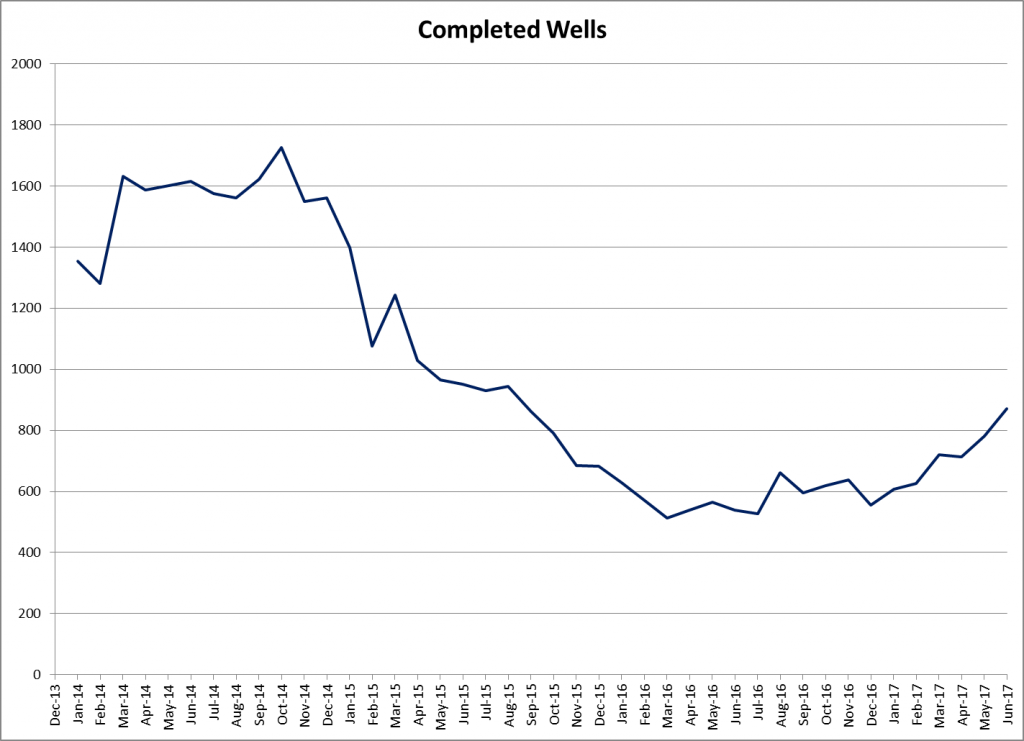

Increased activity has meant demand for sand is likely to break records in 2017, with 73 million tons of demand projected. More and more wells are being completed, according to the EIA. In 2016, an average of 590 wells were completed each month. In 2017, completions have been growing steadily, and 872 wells were completed in June.

In addition to the growing activity, completions intensity has been driving increasing sand demand. Virtually every company’s new completion design for the last few years has included increasing sand loading. Current designs often feature 2,000 pounds of sand per lateral foot, and some companies are testing even more intense designs. On average, each well completed in 2017 requires nearly 4,200 tons of sand.

Texas mines will supply much of the Permian’s needs

Unsurprisingly, much of the overall demand and demand growth has come from the Permian basin, which may grow by 600 MBOEPD this year. Historically, much of the sand used in fracturing operations has been mined in Wisconsin and Minnesota. However, operations in the Permian are driving large increases in Texan sand production capacity. According to Credit Suisse, 32 million tons per year of additional capacity could come online by the end of 2018 from Texas mines.

While most Texas frac sand is not as high quality as Northern White, as Northern White is typically stronger, it can be significantly less expensive to produce. Companies seem willing to accept slightly lower quality sand if it is both cheap and immediately available. According to Credit Suisse, a west Texas sand company can produce and deliver sand for around $40/ton, which is about half the cost of sand from Wisconsin and Minnesota.

The growth in Texas production is coming online much sooner than expected, based on recent permitting activity. Previous projections expected the sand industry to take three or four years to build enough sand capacity to serve the Permian in Texas. But companies’ announcements suggest that this could happen in 2019, only two years after the current resurgence began.