Frontera Energy Corporation (ticker: FEC) reported a net loss of $217 million, or $(4.33) per share for 2017. In Q4 2017, the company posted a net loss of $33 million, or $(0.65) per share. The company attributed the year’s loss to impairment charges in the aggregate amount of $123 million and mark to market loss on risk management activities of $72 million.

Production reached 64.5 MBOEPD and 70.1 MBOEPD (38% heavy oil, 54% light and medium, 8% natural gas) for Q4 and the full year of 2017, respectively. Net production for 2017 was 32% lower compared with the previous year as a result of the loss of the company’s right to exploit the Rubiales field – the company’s largest producing field in 2016.

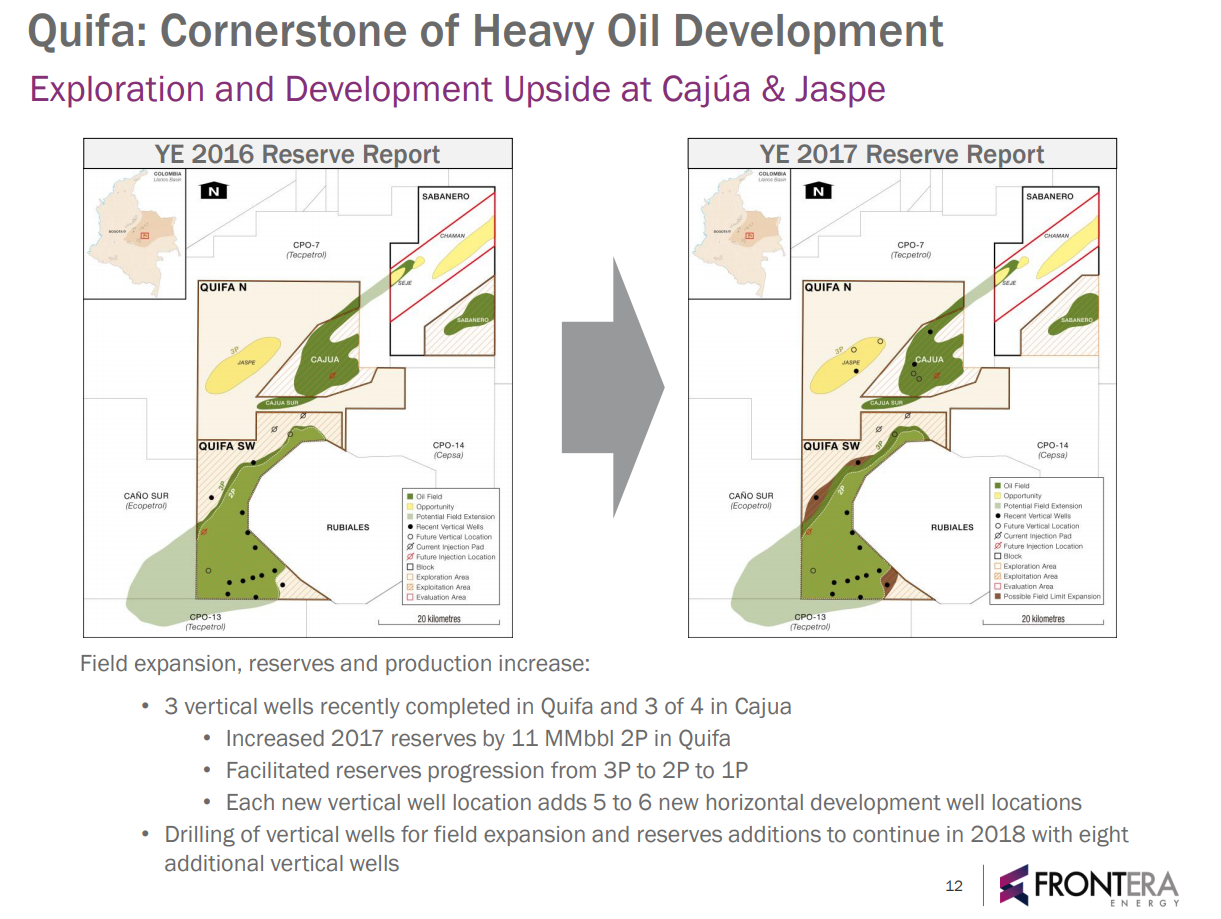

Frontera drilled 94 development wells and three exploration wells in 2017, compared to 27 total wells in 2016. In Q4, the company drilled 39 development wells while completing 32 workovers and well services. The company had a capital expenditure of $236 million in 2017, mostly spending to maintain stable production and reserves.

The company reported total net 2P reserves of 154 MMBOE and 1P reserves of 114 MMBOE.

2018 – drill, produce, spend

- Average production in the first quarter of 2018 was approximately 66,000 BOEPD

- Average and exit net production after royalties in 2018, is expected to be in the range of 65,000 BOEPD to 70,000 BOEPD (or between 72,000 BOEPD to 76,000 BOEPD before royalties)

The company had eight rigs operating throughout the first quarter of 2018, with five active in its Quifa heavy oil area, and three on its light oil-focused Guatiquia block. First quarter well activity included drilling 33 development focused wells, three exploration-focused wells and 26 workovers and well services. This is below previous expectations of 40 to 50 wells drilled in the first quarter, as activity originally planned at the Cajúa field was deferred due to water handing capacity.

Total 2018 capital spending is budgeted at $450 to $500 million, representing a 101% year-over-year increase from $236 million in 2017 based on the midpoint of the 2018 range. This spending includes $225 to $240 million on maintenance and development, $100 to $120 million on exploration and $125 to $140 million on facilities and infrastructure. The capital program is expected to deliver between 125 to 135 development wells, 11 to 15 exploration wells and 15 to 25 work-overs.

Leadership shakeup

Effective April 2, 2018, Frontera will appoint independent board member Richard Herbert CEO. Herbert will replace Barry Larson, who will remain with the company until April 30, 2018 to assist with the transition.

Herbert brings to the company over 36 years of experience in global oil and gas exploration and development, including with BP plc, Talisman Energy Inc. and Phillips Petroleum Company. Concurrent with his appointment as CEO, Herbert has stepped down from his role as a director. The board has begun the process to evaluate independent director candidates with proper qualifications.

Also effective April 2, 2018, David Dyck will join the company as CFO. Dyck brings to the company over 29 years of experience in senior financial and leadership roles within the Canadian energy industry, most recently as SVP and CFO of Penn West Petroleum Ltd.