CDEV likes oil’s prospects and New Mexico well results

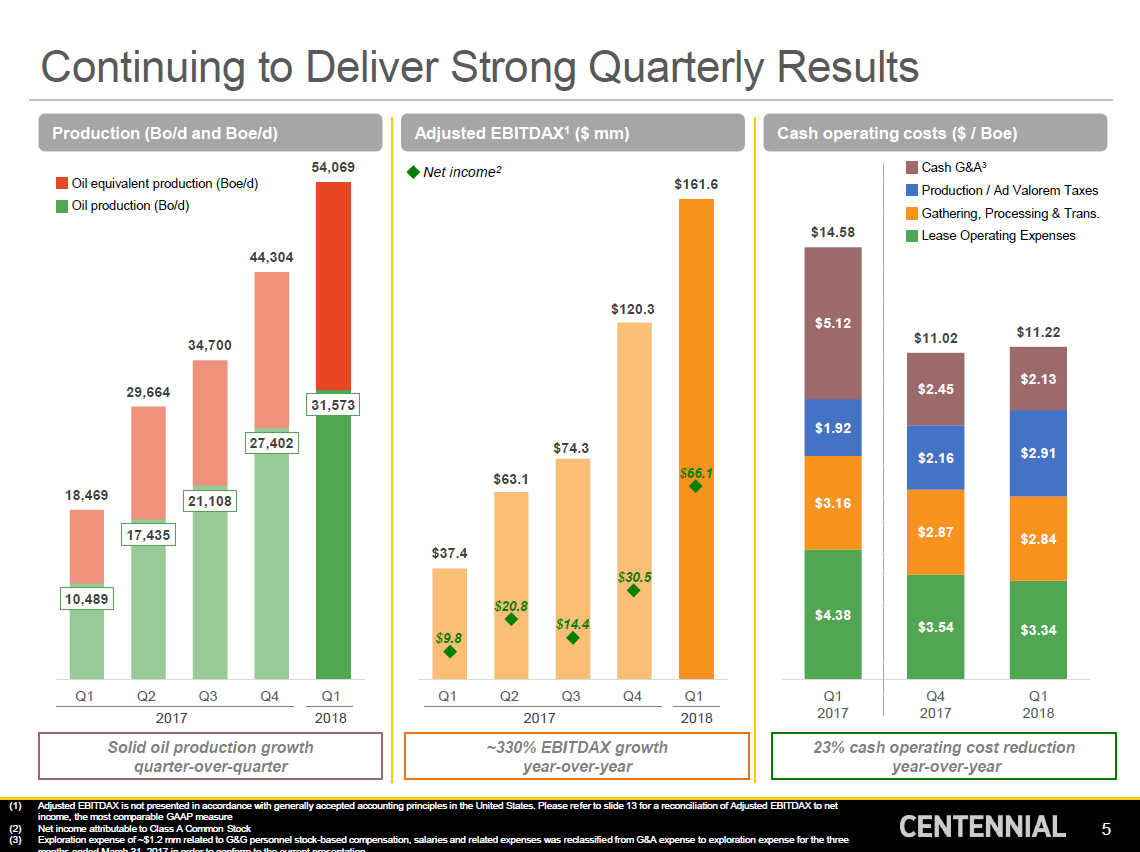

Centennial Resource Development, Inc. (ticker: CDEV) reported a net income of $66.1 million, or $0.25 per share for Q1 2018. The company’s average daily net production was 54,069 BOEPD for the quarter.

“We saw consistent well performance during the quarter, with the average well producing approximately 1,200 barrels of oil per day for the initial 30-day production period,” Chairman and CEO Mark G. Papa said. “These well results coupled with low unit costs were key to giving us very strong overall results for the quarter.”

More wells

In Lea County, New Mexico, the Juliet Federal Com 1H (85% WI) was drilled with an approximate 4,000-foot effective lateral and reported an initial 30-day production rate of 1,447 BOEPD (78% oil). The well averaged 282 BOPD per 1,000 feet of lateral for the first 30 days, and it produced more than 50,000 barrels of oil during its initial 60-day period.

“The Juliet is Centennial’s first operated well targeting the Wolfcamp A in Lea County,” Papa said. “Since entering this part of the basin last year, essentially every well has either met or exceeded expectations.”

On the Texas side of the Delaware Basin, Centennial said it is operating a six-rig drilling program, and D&C operations have largely shifted to multi-well pad development where possible.

“During the first quarter, the average completed lateral length increased more than 20 percent over the previous quarter. The impact of cost savings from drilling longer laterals from multi-well pads and higher well productivity is reflected in our improved bottom line,” Papa said.

Using modern completion techniques, the Weaver C T34H (86% WI) was Centennial’s first Reeves County well in the Third Bone Spring Sand. The well, drilled with an approximate 9,350-foot effective lateral, reported an initial 30-day production rate of 2,129 BOEPD, or 1,563 BOPD (73% oil).

Papa said that the Weaver well produced 82,000 barrels of oil in its first 60 days and the Third Bone Spring Sand extends over a significant portion of Centennial’s Reeves County position.

Drilling and completion capital expenditures incurred for the first quarter were approximately $181.8 million. Centennial’s facilities, infrastructure, land and other capital totaled approximately $56.5 million during the quarter.

Conference call Q&A excerpts

Besides the preloaded Q1 comments, Papa let loose with his shale theory in the company’s Q1 conference call.

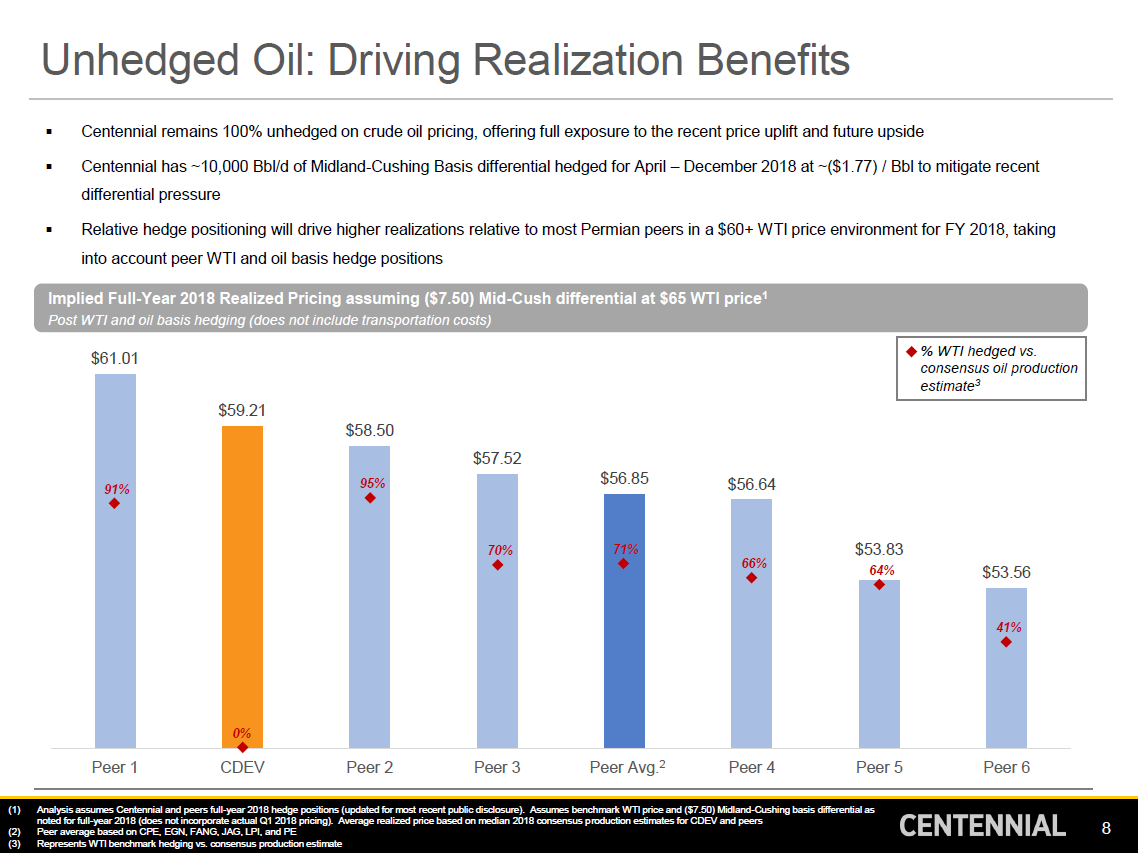

Q: Can you talk more about CDEV’s hedging?

Chairman and CEO Mark G. Papa: Yeah, just kind of the overview, as you know the IEA and EIA were forecasting total U.S. oil growth this year of in the range of 1.3 million barrels a day to 1.4 million barrels a day.

My forecast is about 0.95 and my forecasts for 2019 is lower than that. And I think that you know with that in 2018 or 2019 we’ll see just a further constriction in global supply and demand even if you exclude this Iranian sanction situation.

So even at the current $70 WTI price level I see a strong possibility of further strengthening in WTI over the next the next couple of years. So we would intend to remain unhedged. Yes, there is certainly a price when we would lay on some WTI hedges, but at this point you know I wouldn’t divulge what that price is, it would be a fluid situation, but I can tell you that price is not $70. And as far as the futures curve with the severe backwardation, I would say it’s laughable that would be my term for it, it’s ridiculous. So that’s kind of my view of the macro.

And then CDEV strategy is simply, we would intend to be one of the fastest oil growth entities in the U.S. in what we believe will be a very strong WTI pricing environment over the next multiple years.

And the last comment, I would make to you is you know one of the groupthink items that’s out there is short cycle times. The concept is you have strong oil prices that’s turns on the shale machine and the shale machine generates a vast amount of oil which pushes oil prices down, i.e. short cycle times. And I believe that, that groupthink is a 100% wrong and the concept of short cycle times is incorrect because even if capital gets poured into the shale machine, the shale machine will disappoint in terms of aggregate oil production growth.

So I think the industry and the world is going to have to conclude that the short cycle time groupthink is an incorrect way of looking at the global supply demand over the next multiple years.

Q: Can you talk about oil cuts, rigs and targeted zones in the Delaware?

Papa: Just briefly, we would intend to run pretty much one rig in the Northern Delaware in Lee County throughout the year. That’s a higher oil cut. That’s about an 80% oil cut. So that’ll be relatively constant. The subtle shift between 58% to 62% is really just how many rigs we run on our silverback acreage, if you will, and at what point in time do we run those rigs there.

The Silverback acreage is slightly gassier than the rest of our Reeves County acreage. And so what you see there is that, as we have the wells scheduled, the fact that our mix will change a little bit there throughout the year is just a function of how many wells we have slotted and when they are slotted to go onto the Silverback acreage… the Silverback acreage in Reeves County has a little higher gas oil ratio and so that’s what swings it a little bit between this 58% and 62% throughout the year.

Q: Do you guys have any expectation as to sort of where oil dips may settle out if we work our way into the second half of 2018?

Papa: We don’t think those oil dips are going to reach the point where it would change our drilling program, if that’s the direction of your question.

We think it – if oil dips did get wide enough it would kind of activate more rail out of the basin, which there hasn’t been a lot of rail out of the Permian Basin here just in the last couple of months. So that’s kind of the safety valve if you will on there.

And of course, we believe that by the second half of 2019, those differentials will shrink again and that’s pretty much indicated by the futures market for the differential just as you get additional pipeline capacity. So we think it is a transitory item that’s probably nine months in duration at the most, but we can’t really give you an idea of whether – is it differential going to stay at $10 or $12 or is it going to shrink back to $7.

We don’t have enough intrinsic knowledge to give you a good estimate of what it might be for the second half of the year. And we can’t pretend to understand how much is the downtime on the border refinery and some of those things, how big of a factor is that in this whole differential thing.

Our guess is there is a fair amount of emotion in this differential right now, which makes it even harder to forecast for the second half of the year.

So sorry, we can’t give you a lot of specificity on that.