Oil & Gas Publishers Note 3/7/2020: The Haynesville Shale continues to be a steady producer. With the recent decline in rig counts the Haynesville has even added one last week. Keep up to date on the rig counts at the Oil & Gas 360 Rig Count Dash Board

A Recipe for Success

-

300 Tcf of natural gas

-

9,000 square miles of drilling room

-

Excess takeaway capacity already in place

-

Fast-growing Gulf coast gas demand from new users: new PetChem plant capacity, a new crop of LNG exporters and Mexico

–An Oil & Gas 360 Special Report–

By Bevo Beaven, Editor, Oil & Gas 360

BP calls the Haynesville Shale “the most revenue generative gas play in the U.S.”

The northern Louisiana/east Texas gas giant recently celebrated a milestone: in 2018 the Haynesville Shale turned 10.

The Haynesville has won and lost the shale boom popularity contest a few times since it was discovered by Chesapeake Energy a decade ago. But the potential to create wealth from the vast natural gas resources within the Haynesville is largely on par with the other great U.S. gas plays. And according to some producers, its risk/reward potential beats some popular oil plays.

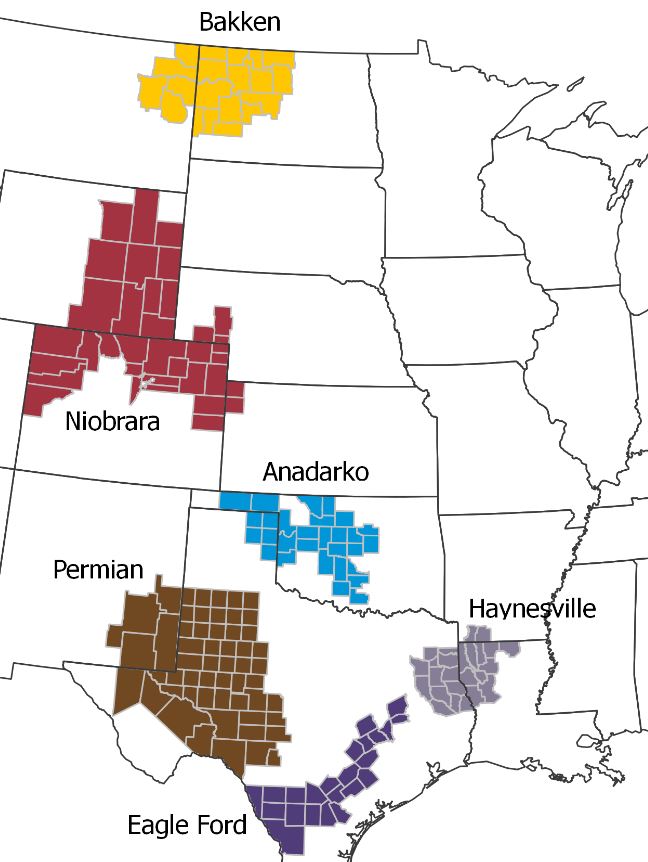

The Haynesville Shale is the farthest southeast shale play on this cutaway of the EIA’S U.S. shale basins map. The play stretches mainly across northwest Louisiana and east Texas.

The play, which lies primarily under East Texas and Northwest Louisiana, is considered one of the top three U.S. natural gas deposits. The gas is generally between about 10,500 and 13,500 feet beneath the surface and the play averages about 250 feet of pay. Another zone of gas called the Bossier is located above the Haynesville and companies often reference the two plays as the Haynesville/Bossier Shale.

Estimates of the natural gas held in the Haynesville Shale have ranged widely over the years since its discovery.

A conservative assessment reported by the Institute for Energy Research in 2010 gave the Haynesville 75 trillion cubic feet. In its 2010 assessment, the U.S. Geological Survey assigned the Haynesville 61.4 Tcf of natural gas.

But the Louisiana Oil and Gas Association sized up the Haynesville as follows: “It has been estimated that the Haynesville Shale holds more than 245 trillion cubic feet of recoverable natural gas. At that volume, it contains the equivalency of over 30 billion barrels of oil, or nearly 18 years of current U.S. oil production.”

A few years later, the USGS tossed its 2010 number out the window. In 2017 the Survey announced it had produced an updated calculation that shattered any other prior estimates of recoverable gas in the Haynesville.

The Survey’s new estimate was 304 Tcf of recoverable natural gas for the combined Haynesville and Bossier formations. That fattened up its prior estimate by a whopping factor of five.

“Changes in technology and industry practices, combined with an increased understanding of the regional geologic framework, can have a significant effect on what resources become technically recoverable,” Walter Guidroz, program coordinator of the USGS Energy Resources Program, said about his scientists’ new assessment of the Haynesville Shale.

The beginning: Chesapeake Energy discovers the Haynesville in 2008

Chesapeake Energy (stock ticker: CHK) started things off in the Haynesville when it drilled successful exploration wells in early 2008, earning the company credit for the discovery.

The core of the Haynesville is generally believed to be the Louisiana side of the play. Due to the hotbed of activity there, just a year after the discovery was announced, the Louisiana Department of Natural Resources calculated that in 2009, 3.6% of all disposable income within the state of Louisiana was being generated as a direct result of exploration and production activity in the Haynesville shale.

According to data from MineralWise, after Chesapeake Energy discovered the Haynesville, the company was indeed the largest leaseholder of the Haynesville Shale with more than 500,000 net acres followed by EnCana and Shell with over 300,000 net acres each. Petrohawk also had over 300,000 net acres targeting the Haynesville. Activity increased dramatically in mid-2008, and as of 2010, the Haynesville shale had more rigs drilling for natural gas than any other play in the U.S.

The Haynesville rush was on.

Oil and gas companies began moving the chess pieces in the Haynesville

Commodities prices and preferences change over time, and consolidation is a given within the oil and gas universe. To that end, during the past few years companies have bought and sold chunks of assets, shifting the power positions around in the Haynesville .

Petrohawk and its Haynesville assets were acquired by BHP in 2011. BHP’s oil and gas assets, including the Haynesville, were acquired by BP in 2018.

In 2015, Encana’s Encana Oil & Gas (USA) Inc. sold its Haynesville natural gas assets to GEP Haynesville, LLC, a joint venture of GeoSouthern Haynesville, LP and funds managed by GSO Capital Partners LP. Shell sold its Haynesville assets in 2014 when it entered into a deal with Vine Oil & Gas LP and its partner Blackstone to sell 100 percent of its Haynesville assets in Louisiana for $1.2 billion in cash. In late 2016, Anadarko (stock ticker: APC) announced the sale of its East Texas Haynesville assets to Castleton Commodities for more than $1 billion.

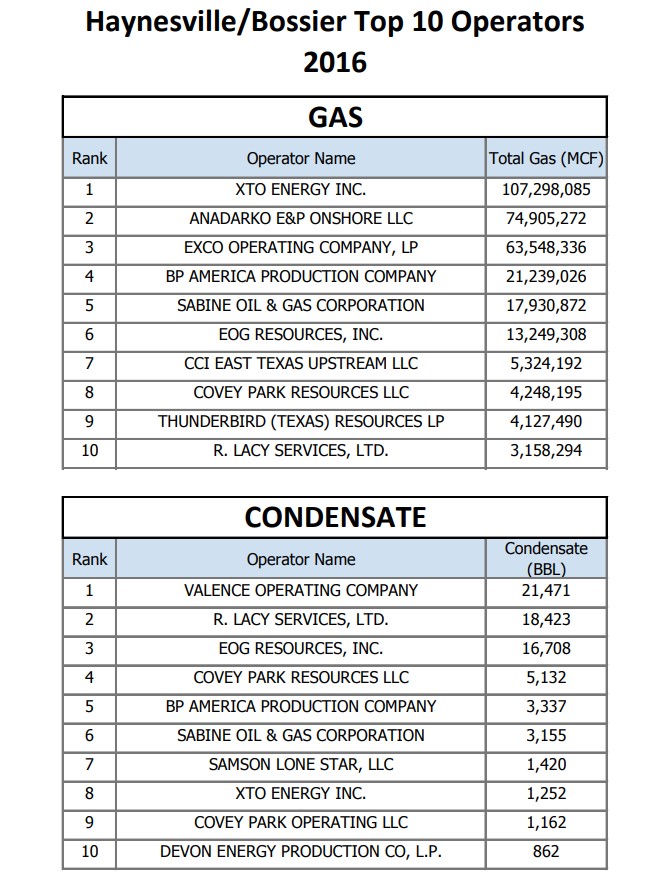

On the Texas side: Texas RRC lists 2016’s top Haynesville operators. Source: Texas Railroad Commission

Bigger than the Barnett

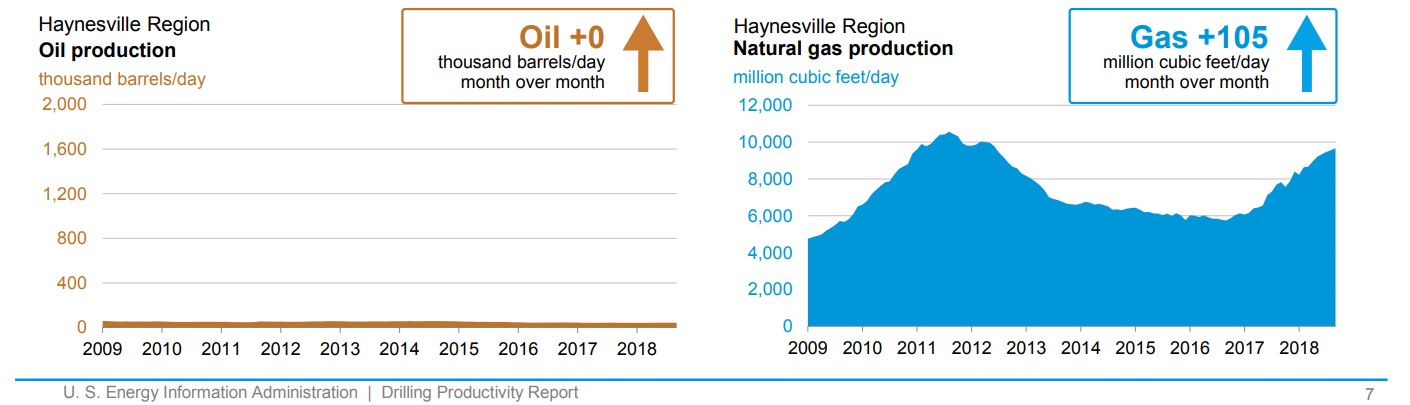

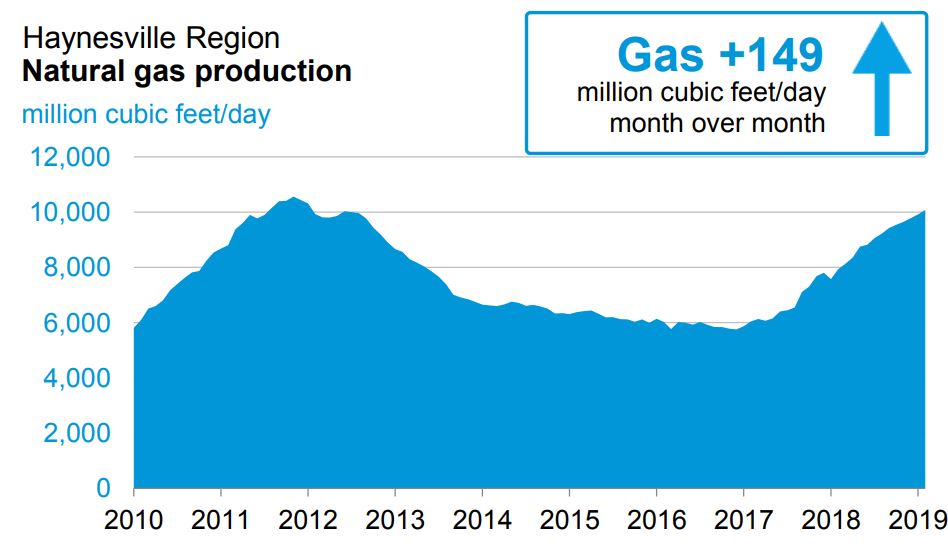

By 2012, the EIA named the Haynesville the highest producing shale gas play in the U.S., producing about 5.5 Bcf per day. The Haynesville was outproducing the Barnett shale, birthplace of the shale boom, by about two hundred million Mcf per day.

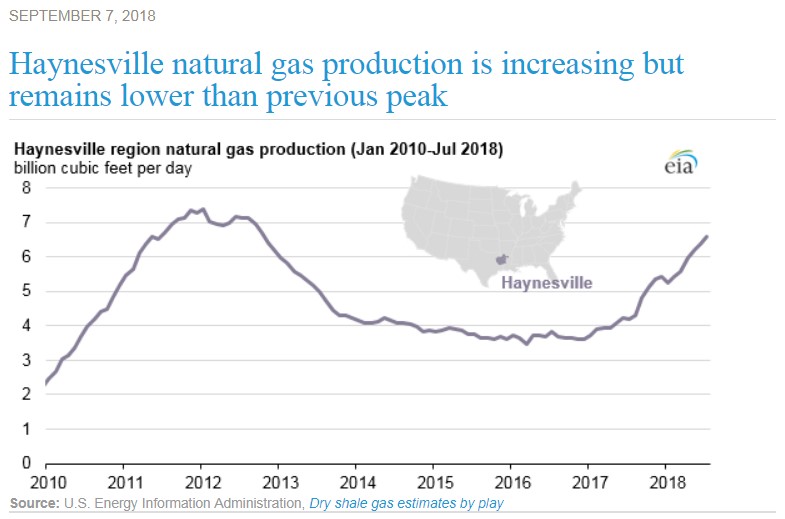

The Hayneville shale is generally overpressured, yielding very high IP-24s and subsequent rapid decline rates. Because of this the Haynesville’s monthly dry natural gas production peaked at 7.4 Bcf/d in January 2012 and fell to less than half that level by early 2016, the EIA reported.

Today’s Haynesville: even bigger

In its latest analysis of total U.S. reserves derived from company reserve reports, the EIA said the U.S. in 2017 reported the highest reserves of all time. Of all the major U.S. basins across the country, the largest relative change in reserves came in the Haynesville, which experienced a quiet resurgence in 2017.

Downturn: low natural gas prices, higher production costs

A higher relative cost to produce natural gas from the Haynesville region played a large role in the production decrease that the play experienced from 2013 to 2016.

The Haynesville formation lies at depths of 10,500 feet to 13,500 feet, much deeper than the Marcellus, according to reporting by the EIA, with the Marcellus at 4,000 to 8,500 feet deep. Because the deeper well depth makes drilling costs in the Haynesville shale generally more expensive than in the Marcellus and other shale plays, drilling activity and the follow-on production from the play is more dependent on the price swings of natural gas.

But things like drilling technology improvements, upgraded completion techniques changed the landscape. The EIA reports that in June 2018, natural gas production in the Haynesville formation averaged 6.4 billion cubic feet per day (Bcf/day), accounting for 8.5% of total U.S. dry natural gas production and the highest production from the region since September 2012.

Resurgence: Haynesville becomes third highest U.S. gas producer in 2017 after Appalachia and Permian basins

By 2017, the Haynesville formation was the third-largest producer of shale gas. It ranked after the Appalachian region—in Pennsylvania, West Virginia, and Ohio—and the Permian Basin region in Texas and New Mexico.

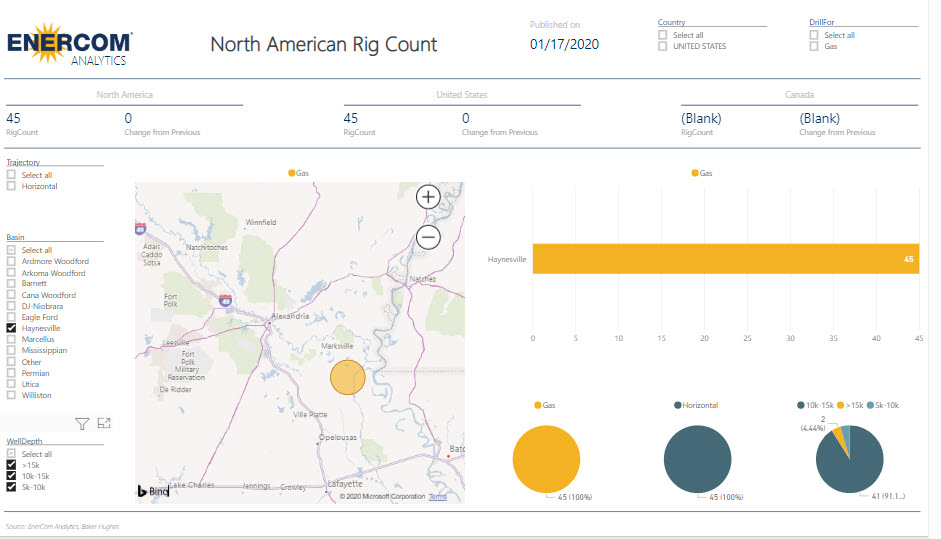

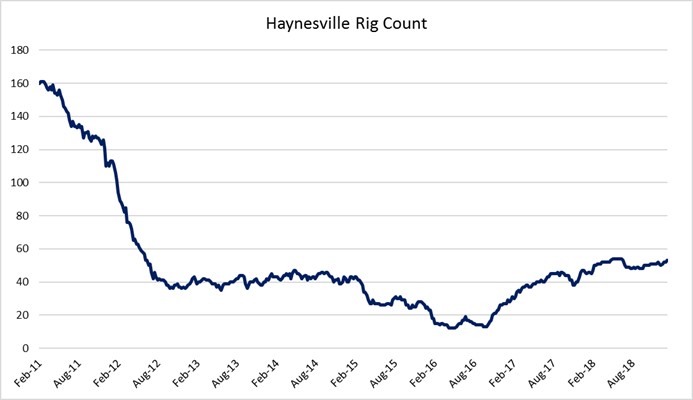

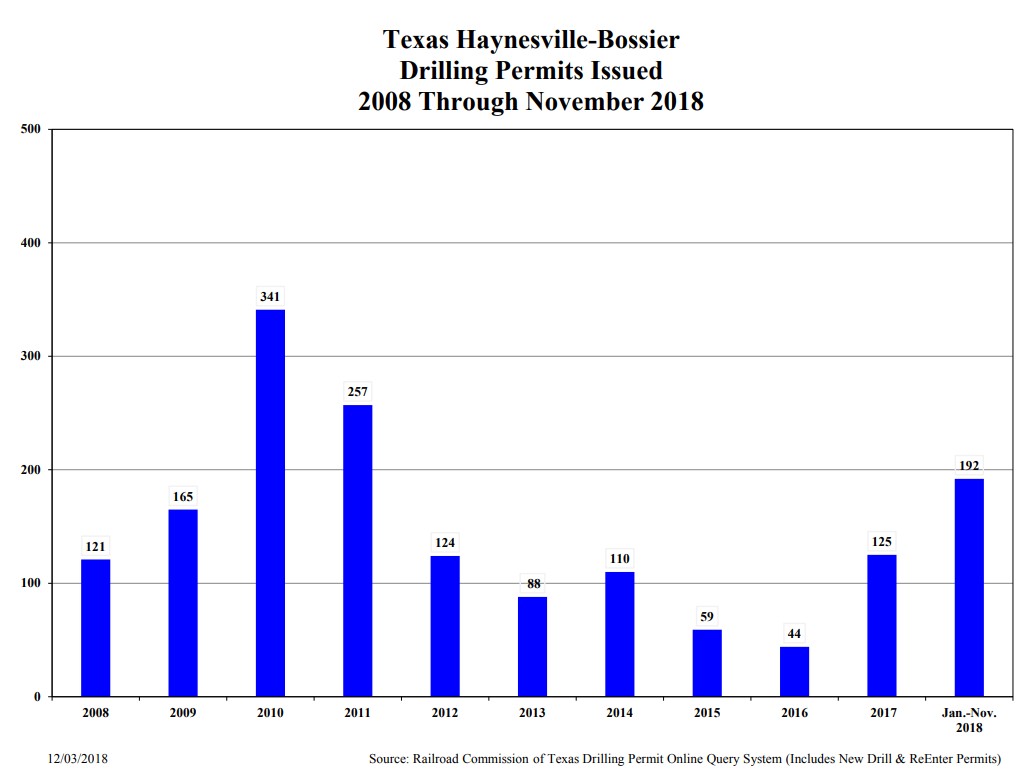

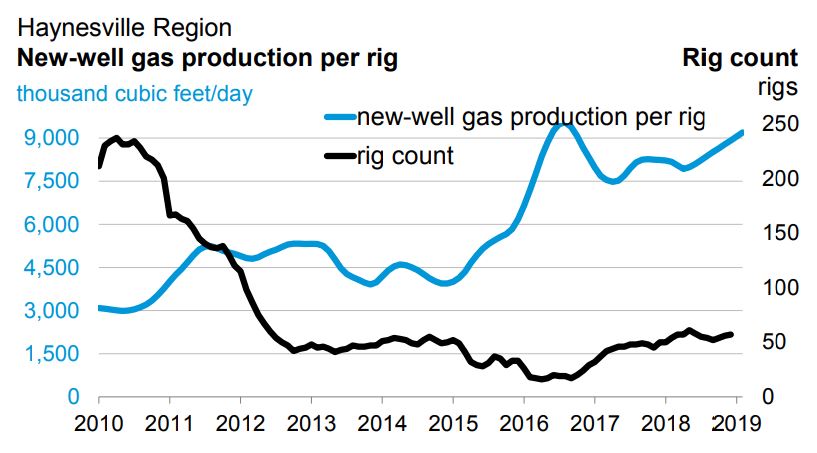

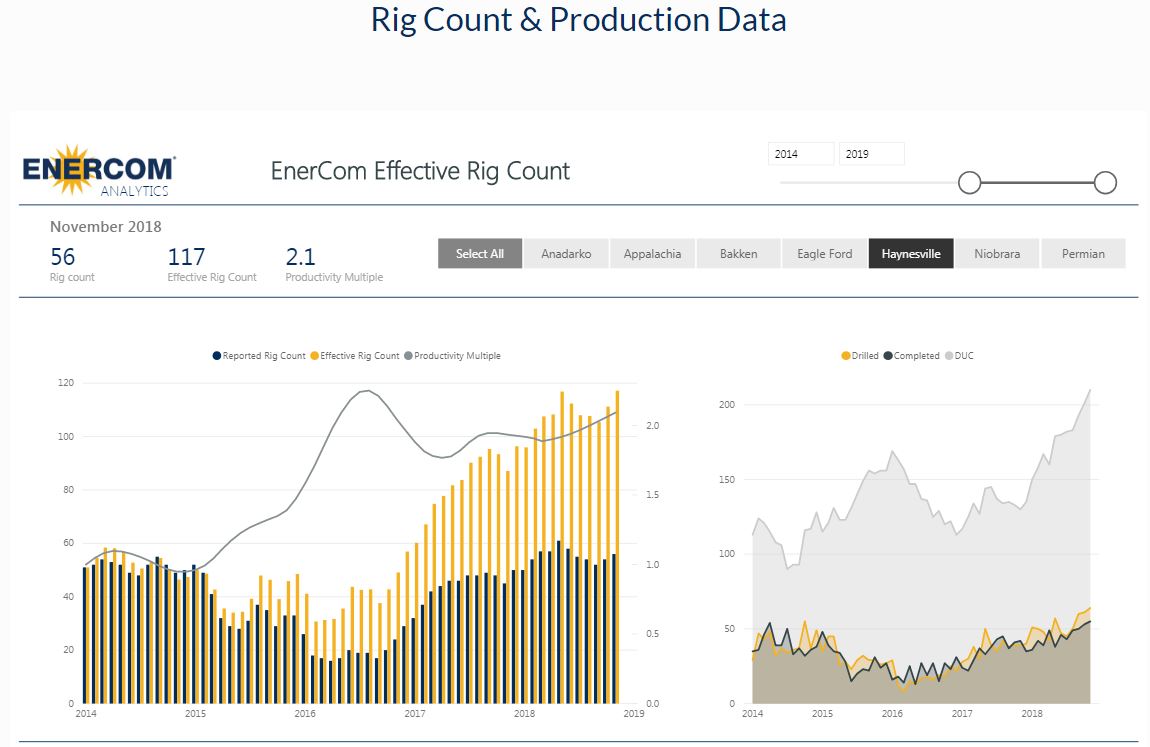

In 2010, when the Henry Hub price averaged $4.50 per million British thermal units (MMBtu), 223 rigs were operating in the Haynesville. As the Henry Hub price dropped, the rig count followed suit, ultimately reaching a low of 20 rigs in operation in mid-2016.

Source: EnerCom

When gas prices increased, surpassing $2.00/MMBtu, the Haynesville rig count began to climb, averaging about 50 rigs operating in each month in the first half of 2018.

In addition to a rising rig count, higher well productivity has contributed to the increase in production as the lateral length and initial production rate of each well have increased, the EIA reported. From 2010 to 2017, average lateral lengths per well have increased from 4,269 feet to 6,421 feet, according to EIA calculations, based on DrillingInfo data.

Back on top: well productivity and economics increase in the Haynesville

The initial productivity rate in the Haynesville region, calculated as the initial three-month cumulative production per well, nearly doubled from 2010 to 2017, increasing from 589 million cubic feet (MMcf) per well to 1,176 MMcf/well, according to the EIA.

The way wells are drilled and completed in the Haynesville has undergone an evolution, just like drilling and completions in all the other shale basins. Extended laterals and more intense fracs are increasing production from Haynesville wells.

During the commodity price downturn, dry gas plays fell out of favor and “wet gas” with high natural gas liquids content and oil plays grabbed the favor of the industry.

Many E&Ps retargeted capital investment toward wet gas to take advantage of the higher value of the natural gas liquids, which include ethane, propane, butane, isobutane, and pentane—natural gas products that add to revenue streams. Acquisitions and shifting portfolios were quickly moving away from dry gas plays to chase oil’s more robust economics.

But the Haynesville is a play that comes with a healthy set of advantages today. As Comstock Resources (stock ticker: CRK) CEO Jay Allison has been known to say at investor conferences, “all you need is the Haynesville.”

Players in the Haynesville today

Between increased activity and prices, reserves in the Haynesville nearly tripled from 2016 to 2017. NSAI reports the current 12-month average price for WTI, incorporating data through November of 2018, is $62.65/bbl. This is well above the $47.79/bbl seen last year and will provide a boost to reserve values when companies calculate their reserves in early 2019.

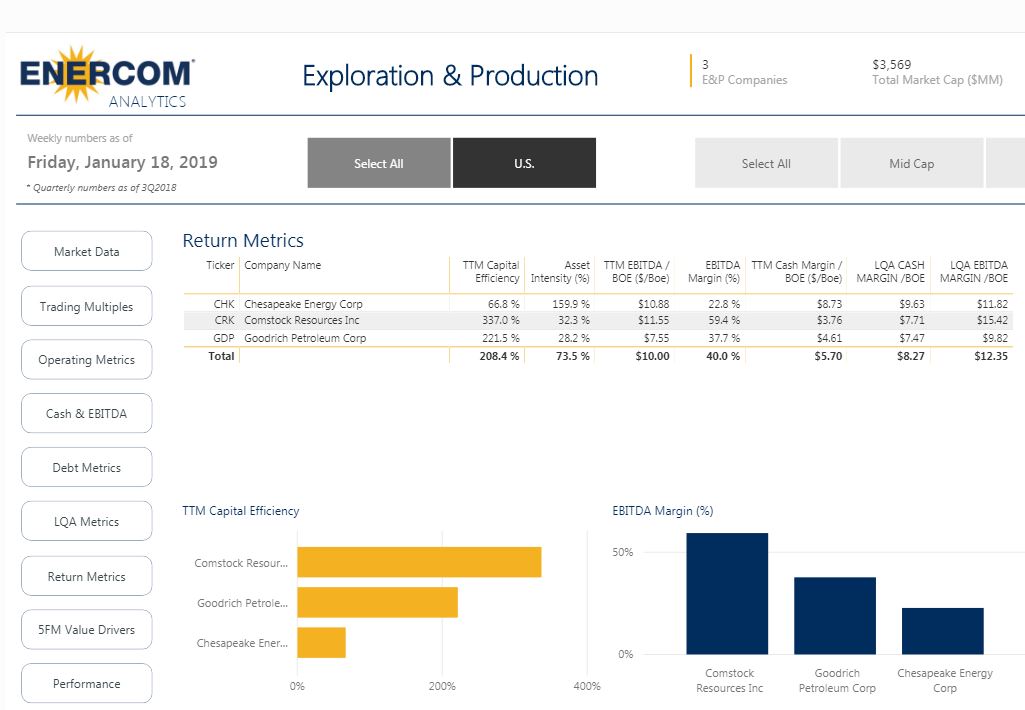

The dashboard below shows return metrics from three active Haynesville producers.

Return Metrics for three public companies that are active drillers and producers in the Haynesville. Source: EnerCom Analytics dashboards.

In 2019, the following companies are among the significant operators in the play:

- Aethon Energy – private equity – 50,000+ acres – recently completed buy of QEP Resources’ (NYSE: QEP) 49,700 net acres and 607 operated wells of natural gas producing properties and undeveloped acreage in the Haynesville in northwest Louisiana, adding more firepower to its Haynesville operations.

- BPX Energy (formerly ‘BP Lower 48’) – 194,000 acres. On the Texas portion of the Haynesville BP reported ramping from zero to 50 thousand barrels per day in about 30 months. BP says it is the leading operator in this portion of the play, and we expect to exit 2018 producing over 90 thousand BOEPD. BP says its fit-for purpose completions are generating returns between 30-45% at a Henry Hub price of $2.75, with a development cost of $3.45 per barrel.

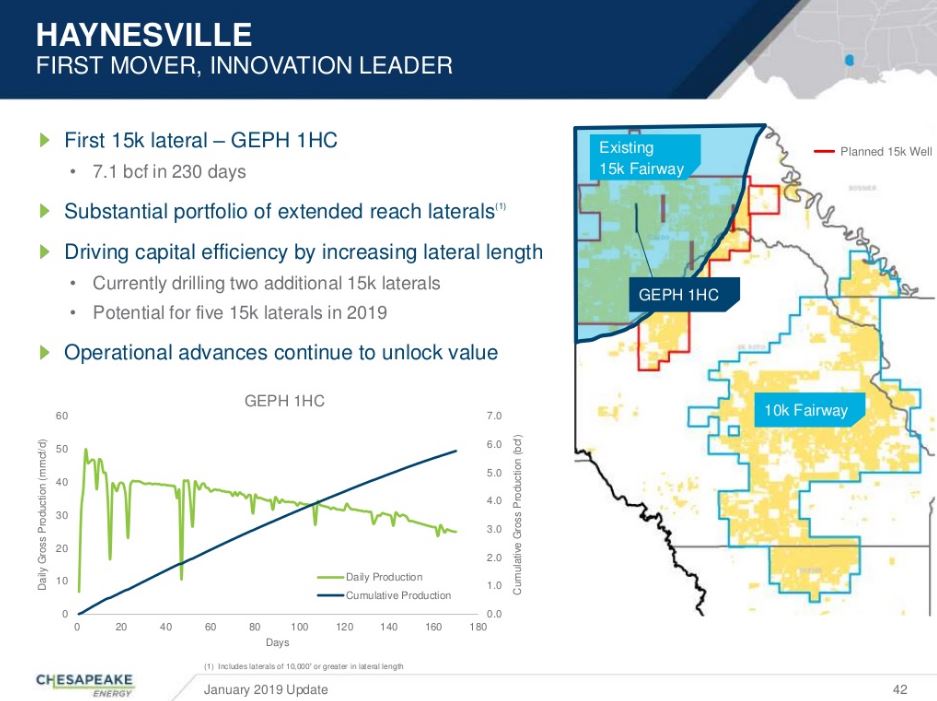

- Chesapeake Energy – 339,000 net acres, producing 128 MBOEPD

Chesapeake Energy discovered the Haynesville Shale in 2008. Slide: Chesapeake Energy investor presentation.

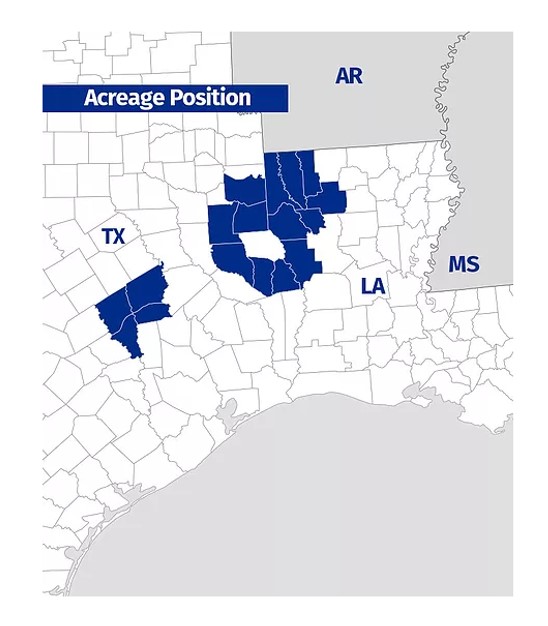

- Comstock Resources – 63,000 net acres, producing 197 MMcfe/day current plans are to operate four drilling rigs through 2018 increasing to five operated rigs in March of 2019 to drill 21 Haynesville shale wells (6.6 net). Comstock has made a habit of adding acreage in the Haynesville. In December 2018, the company announced an acquisition of 88% interest in 6,124 gross acres (6,023 net acres) in Shelby Shale LLC’s Haynesville shale rights in Harrison and Panola counties, Texas for $20.5 million. Last summer Comstock announced a buy of 9,900 acres primarily in Caddo and DeSoto Parishes in Louisiana and include 120 (26.2 net) producing natural gas wells, 49 (14.7 net) of which produce from the Haynesville shale. The acquisition fell under the Chapter 11 bankruptcy proceedings of Enduro Resource Partners LLC.

- Covey Park Energy – private Dallas-based Covey Park Energy LLC describes itself as one of the largest acreage holders and producers in the Haynesville/Bossier shales. Covey Park was formed in June 2013 with an equity commitment from Denham Capital, an energy private equity firm with more than $9.0 billion of invested and committed capital.

- Goodrich Petroleum – 22,000 net acres with 415 Bcfe proved reserves in the Haynesville as of yearend 2017.

- Vine Oil & Gas – Average operated working interest of approximately 80% in 175,000 effective net acres in the core of the Haynesville Basin in Northwest Louisiana, acquired from affiliates of Shell in November 2014. Vine operates approximately 780 MMcf/day of production across Sabine, DeSoto and Red River parishes in North Louisiana. Vine reports being among the most active drillers in the Haynesville since 2015.

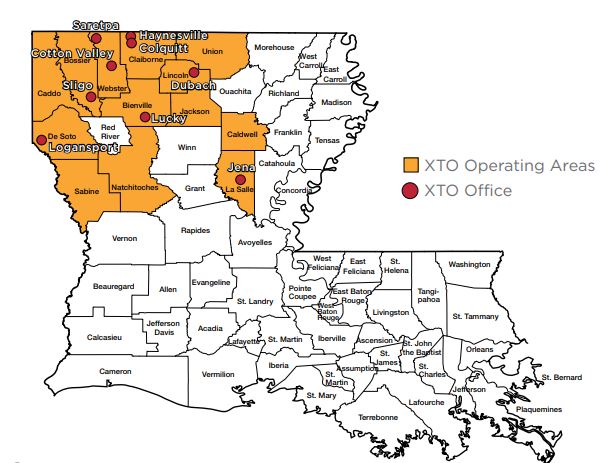

- XTO Energy (ExxonMobil) – 661,000 acres, producing 84 MMcfe/day in Northwestern Louisiana

Demand for dry gas will be strong through 2030

The U.S. Department of Energy reported that “while the long-term production trend remains highly uncertain, the growth trend [for natural gas] is expected to continue through 2030, with dry natural gas production forecasted to increase to more than 93.5 Bcf/d by 2030. In particular, the Marcellus, Eagle Ford, Anadarko, Utica, and Haynesville basins are expected to see the highest incremental production.”

EIA expects record-high dry U.S. natural gas production to continue to grow through 2020, from an estimated 83.3 billion cubic feet per day (Bcf/d) in 2018 to 90.2 Bcf/d in 2019 and 92.2 Bcf/d in 2020. Most U.S. production will come from the Appalachian Basin in the Northeast, followed by the Permian Basin in western Texas and eastern New Mexico and the Haynesville shale formation in eastern Texas.

Haynesville Shale: positioned to capitalize on diverse sources of natural gas demand growth

The Haynesville is well positioned to capitalize on four emerging trends on the demand side of the natural gas equation.

Petrochemical plant capacity growth on the Gulf coast

First, there is a robust growth-focused petrochemical industry that is adding capacity on the Gulf coast. New and expanded petchem plant capacity is the order of the day.

“After years of high and volatile natural gas prices, domestic supplies of abundant and affordable natural gas and natural gas liquids (NGLs) have created a competitive advantage for U.S. chemical manufacturers,” Petrochemical Update reported in March 2018.

Phillips 66 U.S. Gulf Coast Ethane Cracker, Cedar Bayou, TX

There are 325 projects cumulatively valued at $194 billion in capital investment that have been announced since 2010, with 49% of the investment completed or under construction, 45% in the planning phase, and 6% of unknown/delayed status, according to the American Chemistry Council.

Companies investing in new projects to build or expand shale gas-advantaged petrochemical capacity in the U.S. are numerous. Eight new ethane-fed steam crackers and 13 new polyethylene plants are planned to come online from 2017 to 2019, according to Petrochemical Update.

All or most of that 6.4 million tonnes/year of new output — 5% of which is operational — is targeted for exports. Another 14 new PE plants are planned along the U.S. Gulf Coast, and Northeast U.S. beyond 2020. Petrochemical plants require steady supplies of natural gas feed stock to create plastic and other products.

Natural gas power plants: cranking out nationwide newbuilds

Second, natural gas-fired power plants are replacing coal fired electricity generation across the U.S. Between Sept. 2017 and Sept. 2018 alone, natural gas-fueled power generation at utility scale facilities increased by 15% year over year, according to the EIA.

During 2019, natural gas planned capacity additions will total 7.5 gigawatts (GW) in the United States, and 4.5 GW of coal-fired capacity will be taken offline, according to projections by the EIA. The analysts at EIA believe natural gas will continue as the primary source of U.S. electricity generation, increasing from 35% in 2018 to 37% in 2020. According to the EIA’s January Short Term Energy Outlook forecast, coal-fired electricity generation will fall from 28% in 2018 to 24% in 2020.

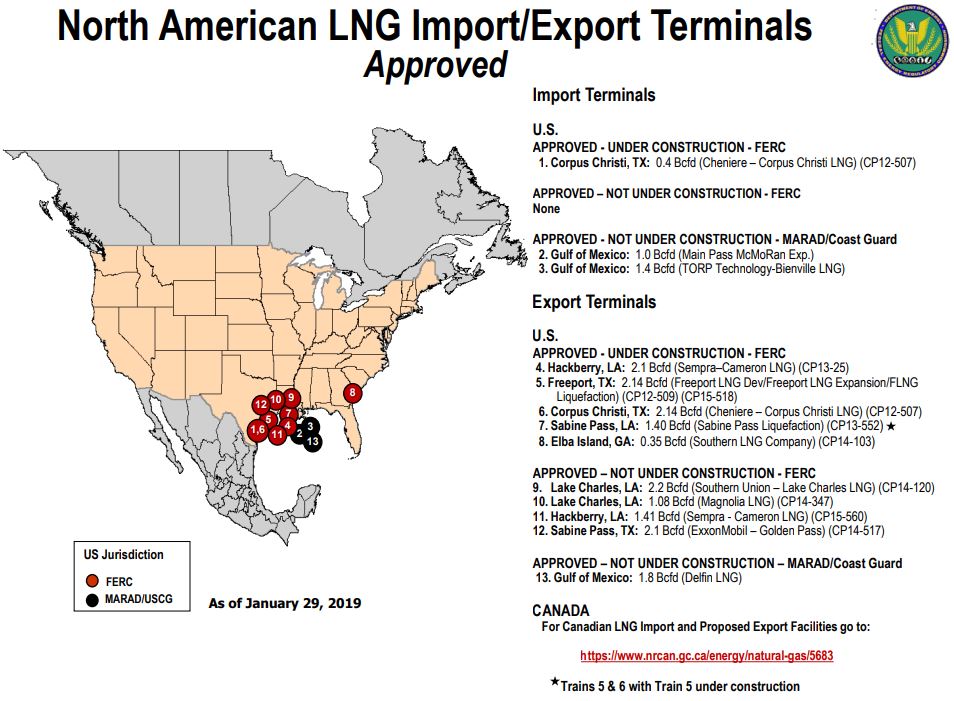

LNG export boom: new liquefaction projects under construction on the Gulf coast

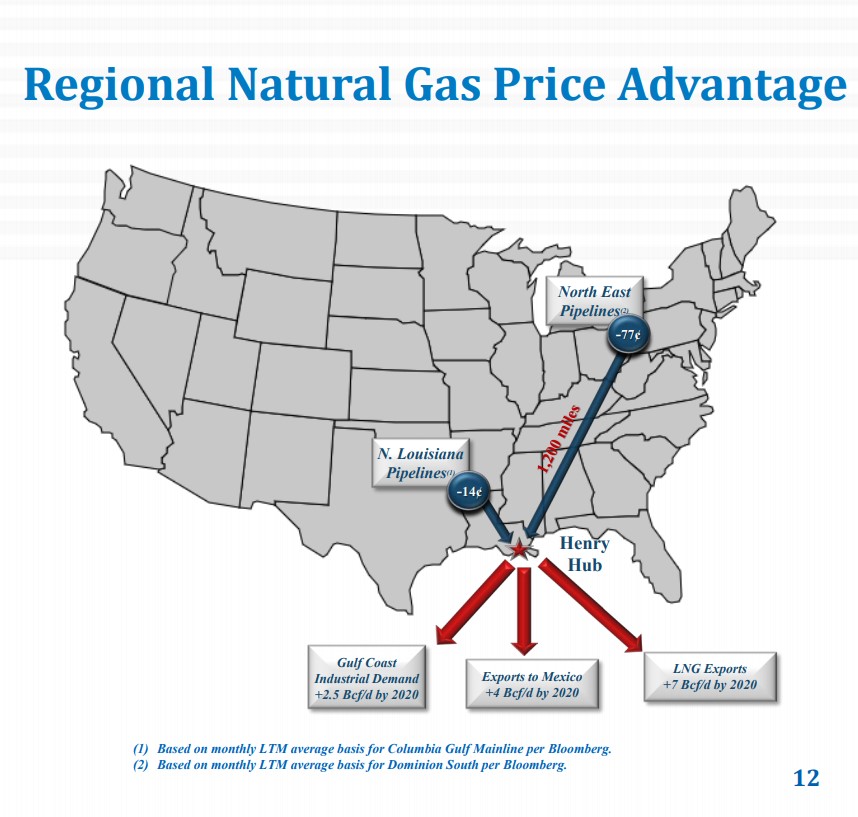

Third, there is a boom in growth of U.S. natural gas exports. The Haynesville and its vast quantities of natural gas are located only 200 miles from the U.S. Gulf coast, where new natural gas liquefaction plants and export facilities are on the drawing boards and/or under construction.

Cheniere Energy (stock ticer: LNG) built and operates the first new LNG export facility in the lower-48 states. The project is sited at Sabine Pass in Louisiana. Cheniere’s first cargoes started shipping from Sabine Pass in 2016.

Cheniere’s second LNG export facility project at Corpus Christi, Texas is targeted to begin shipping cargoes at yearend 2018 or early in 2019 from train 1, making it the third new U.S. LNG export facility. Cheniere has five liquefaction trains in operation at Sabine Pass and expects to have a FID in early 2019 for construction of a sixth train at Sabine Pass. Cheniere has three trains under construction at Corpus Christi.

In the meantime, things are just starting to get hot for U.S. LNG. There is a swarm of additional proposed export projects that are poised to make the U.S. a much bigger player in the global LNG supply chain. Forbes calls 2019 “the beginning of the boom” for U.S. LNG.

“For an industry that just started in February 2016, U.S. LNG has quickly been extending to all corners of the globe. Yet, neighbor and friend Mexico has received 20% of all U.S. LNG exports, with South Korea second at 19%,” Forbes said.

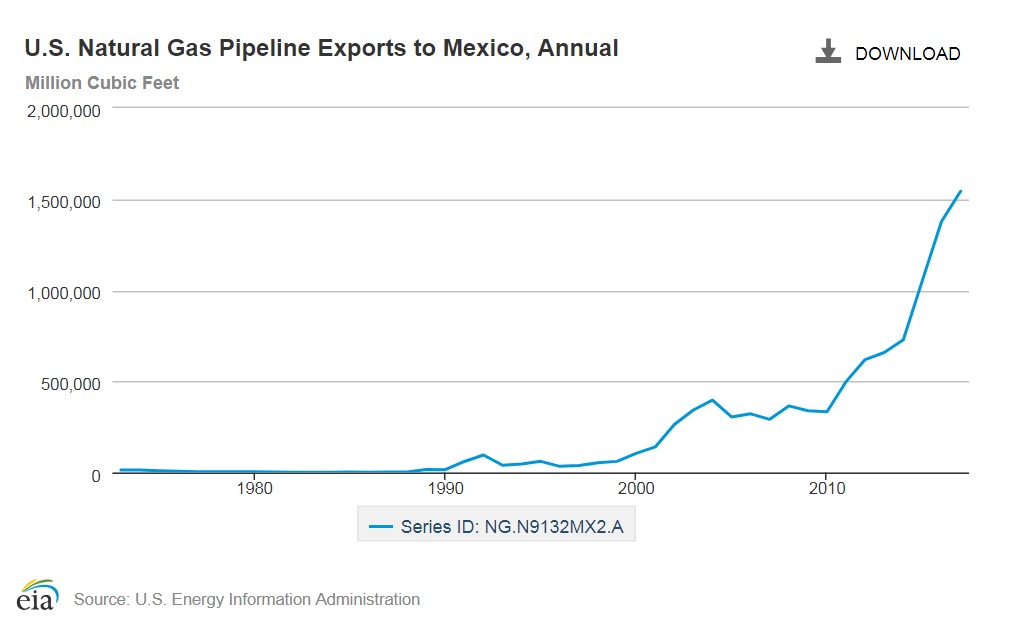

U.S. gas to Mexico: hockey stick export graphs show rocketing growth rate

Fourth, total gross exports of natural gas by pipeline will continue to grow according to the EIA, increasing to 8.1 Bcf/d in 2019 and 8.4 Bcf/d in 2020, or 19% higher than 2018 levels. The EIA projects that most of the increase will be driven by increasing natural gas demand and pipeline projects in Mexico that are scheduled to come online by the end of 2020.

The Haynesville has another big advantage

The Haynesville has the right location and the follow-on advantages that will set up producers to benefit from the growing demand trends, but it also has an infrastructure advantage, compared to other plays.

There are many gathering facilities and pipelines already in place in the Haynesville region, and infrastructure bottlenecks, takeaway constraints and other transport problems are not expected to be an issue in moving gas from Haynesville to domestic and global markets.

Transporting the Haynesville’s natural gas to the Gulf coast: no problem

The EIA estimates that between 2004 and 2013, the natural gas industry spent about $56 billion expanding the natural gas pipeline network. Between 2008 and 2013, pipeline capacity additions totaled more than 110 Bcf/d.121 Approximately 10 percent of this investment was dedicated to completing the 1,768-mile REX pipeline, linking production fields in Wyoming to markets as far east as Ohio. A substantial portion of the rest of the investment was used to link the Barnett, Haynesville, and Eagle Ford Basins in Texas and the Fayetteville Basin in Arkansas to markets in the East, EIA said.

According to Natural Gas Intelligence, the major gas pipelines in the Haynesville are Acadia Gas Pipeline, Atmos, Carthage Hub, CenterPoint Energy, Enterprise Products, Gulf South, HPL, KM Tejas, Louisiana Intrastate Gas, Mississippi River Transmission, NGPL, RIGS, Southern Natural, Tennessee, Texas Eastern Transmission, Texas Gas Transmission and Tiger Pipeline.

According to the DOE, if natural gas demand were to increase substantially, the additional needed interstate pipeline capacity is far less than the additional needed natural gas production. Quadrennial Energy Review analysis found that for the power sector, increased switching from coal to natural gas would result in an increase of about 10 Bcf/day of production, but only 3.9 Bcf/day of new pipeline capacity additions.

In effect, the DOE said the pipeline network in the Southeast U.S. is already designed to handle large natural gas flows to distant parts of the country and needs little expansion to handle new flows within a more constricted region. Like Haynesville/Bossier to the Gulf coast.

One new pipe targeting Haynesville takeaway has been proposed–with LNG demand growth in its sights

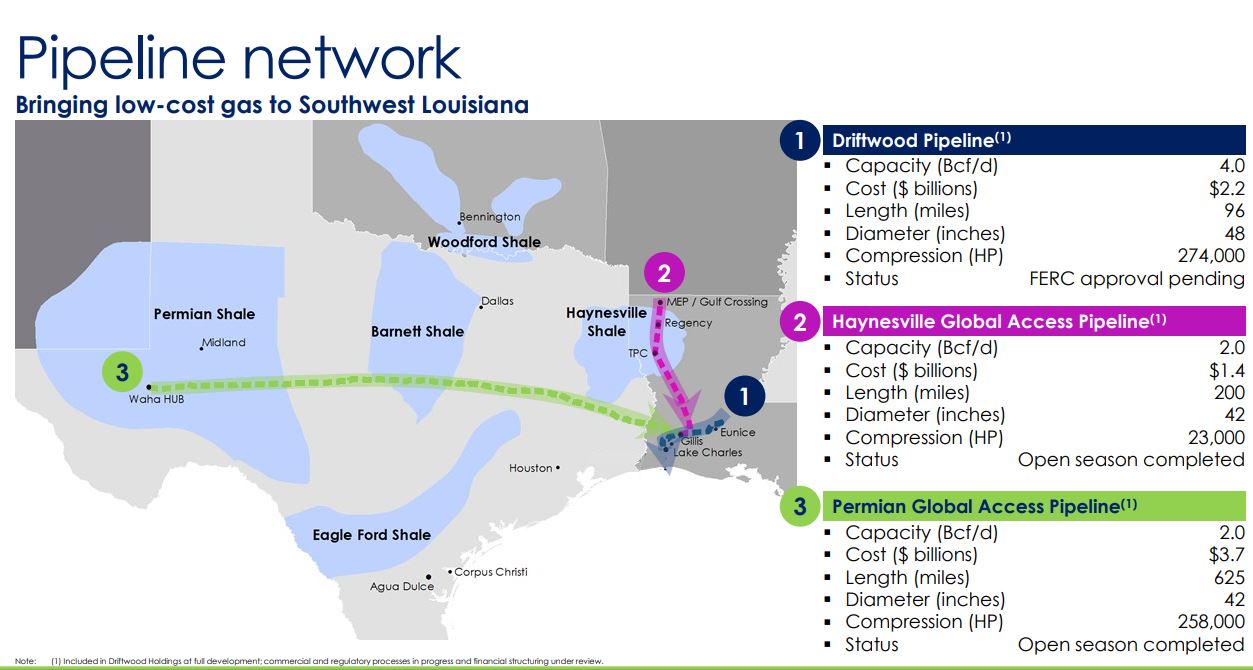

Purple indicates the Haynesville Global Access natural gas pipeline to interconnect with Tellurian’s Driftwood Pipeline. Image: Tellurian Inc.

In February 2018, Tellurian (stock ticker: TELL), the gas marketing and nascent LNG export project founded by Cheniere Energy founder and former CEO Charif Souki along with former BG COO Martin Houston, announced its plan to build a proposed $1.4 billion 42-inch natural gas pipeline connecting the Haynesville and Bossier shale region to the Gulf coast. Tellurian’s proposed pipeline would allow transport up to two billion cubic feet of natural gas per day. Construction is projected to begin in 2022, with an in-service date of mid-2023, according to the company.

Tellurian said its proposed Haynesville Global Access Pipeline will stretch approximately 200 miles and interconnect with the Midcontinent Express and Gulf Crossing pipelines in Claiborne Parish and to other pipelines located near Gillis in Calcasieu Parish, Louisiana.

The goal is to bring natural gas to its proposed $15.2-billion Driftwood LNG which the company aims to build near Lake Charles, Louisiana, on the Gulf coast.

Proposed Driftwood LNG liquefaction and export facility from Tellurian Inc. received a final environmental impact statement in January. The company expects to have a FID and begin construction in 1H 2019.

Tellurian purchased $85.1 million in Haynesville producing acreage in 2017 from an unnamed private seller. The assets are located in Red River, DeSoto and Natchitoches Parishes, and include 9,200 net acres with up to 138 operated Haynesville and Bossier drilling location and about 1.3 trillion cubic feet (Tcf) of total natural gas resource potential, according to Tellurian.

In December, Tellurian Trading UK Ltd. entered into an MOU to supply 1.5 mtpa of liquefied natural gas from its proposed Driftwood LNG export terminal. The transaction price is based on the Platts Japan Korea Marker (JKM) and is for a minimum term of 15 years, the company said. The agreement depends on Tellurian receiving regulatory approvals and reaching a final investment decision (FID) to construct its planned Driftwood LNG export terminal.

Tellurian believes Gulf coast area natural gas demand will triple in the coming years, reaching approximately 12 billion cubic feet per day by 2025.

That is good news for the Haynesville and the E&P companies drilling in the play and producing its gas. Oil & Gas 360 spoke to two producers, both with a firm Haynesville focus.

Interviews with E&Ps operating in the Haynesville

Aethon Energy: running 6 rigs in the Haynesville

One of the larger private operators in the Haynesville, Dallas-based private equity firm Aethon Energy, closed its acquisition of QEP Resources’ (stock ticker: QEP) Haynesville assets on January 11, 2019.

The QEP assets that Aethon bought comprise approximately 49,700 net acres and 607 operated wells of natural gas producing properties and undeveloped acreage in the Haynesville, according to Aethon. Aethon III also acquired all of QEP’s associated gas gathering and treating systems related to the assets, supporting up to 600 MMcfe/day of production.

Aethon Energy Partner and Co-President Gordon Huddleston’s organization is an active Haynesville driller.

Oil & Gas 360 interviewed Aethon Energy Partner and Co-President Gordon Huddleston about the Haynesville Shale play, his firm’s recent addition of the Haynesville assets from QEP, and Aethon’s development plans for the play in 2019.

OAG360: Aethon recently announced it had entered into an agreement to acquire QEP’s Haynesville assets, which is expected to close in January. With so much activity focused on oil in the past few years, why did you look to the Haynesville for your newest opportunity?

Aethon Energy Partner and Co-President Gordon Huddleston: We’ve been active in the Haynesville for some time, starting with first our acquisition from Noble Energy in 2014. What we like about the Haynesville is the proximity to Henry Hub relative to a lot of demand coming from the LNG export and the petrochemical industries.

We also like the high quality of the rock and the resource. When we first entered the Haynesville there wasn’t a lot of focus on the play. In fact, a lot of people were leaving, and we saw the opportunity to bring our technical expertise from other basins where we were active and apply those completion methodologies to the Haynesville, and that’s been very successful for us.

OAG360: There are strong projections for future gas demand for LNG exports.

Gordon Huddleston: We definitely believe in the macro story of natural gas. From a long-term energy mix, we think it makes sense as a transition fuel in a low-carbon economy. We’re seeing that in emerging markets. There is a focus on reducing emissions and not just around CO2, but traditional emissions, particulate matter. Natural gas has a lot of good things going for it that we like from a fundamental perspective.

OAG360: What do you think is the key to developing the Haynesville play?

Gordon Huddleston: We’ve done seven major acquisitions in the Haynesville to date, and we like to focus on vertically integrating.

One of the attractive things about the QEP assets is that they come with a robust midstream component. We’re looking to really expand our margins as much as we can, so for example we look at companies with ancillary services and businesses where we can start to provide those services to other operators. Those are the types of opportunities we look to capture greater margin and I think the Haynesville has been a good place to do that.

And given that it’s dry gas, it makes the midstream component simpler to build out—less costly relative to a rich gas play, like what you’re having in the Permian where it’s very expensive to build those gas plants; it’s a different type of midstream.

OAG360: Natural gas prices have been pretty strong in Q4 of 2018, higher than we’ve seen for quite a while. Could you talk to what $4.50 [per Mcf] natural gas prices mean for you guys in the Haynesville?

Gordon Huddleston: We have a long-term outlook. Aethon is quite aggressive around hedging. While the prices come up into the March and April contracts of next year, I think you’re still seeing the long-term curve goes to $2.60 and five to six years out, so while it’s certainly great for us in the short term to make a higher-realized commodity price, it doesn’t really change our long-term plans.

We’re very happy with the economics where pricing was before the commodity move. We also think it’s important to have a stable price environment. Like I said, we’re interested in the long term—we want to see demand growth to continue. We’d prefer to see more of a stable commodity price, we don’t want to see demand drop over the long term.

OAG360: Could you talk about your plans for your Haynesville assets?

Gordon Huddleston: Today we’re running about six rigs in the Haynesville on our existing assets, and for these new assets we will look to add several rigs next year and continue to ramp development activity there over the next three years. Drilling plans will be dependent on commodity pricing and the general economic climate.

OAG360: In the past two years, the Haynesville has come back quite a bit, as far as drilling and production. Could you talk how things have changed in your view?

Gordon Huddleston: I think the industry has realized that completion methods have caught up in the Haynesville. Now, they are more in line with what other basins have done around longer laterals and larger amount of proppant being pumped, resulting in greater recoveries and production.

That has obviously driven economics higher. So now, within larger major type portfolios, I think the Haynesville competes very robustly for capital during their budgeting cycles. XTO and BP and others have been allocating capital to the Haynesville.

BHP had a sizeable position in the Haynesville and BP already had some interest in the Haynesville. So as they digest that acquisition, there’s going to be some changes around their capital allocation. But I think overall, the proximity relative to the Gulf coast and the challenges the Marcellus is having getting its gas to market have led to a greater interest in the Haynesville.

OAG360: Does the Haynesville have a better takeaway situation than the Marcellus, at least historically?

Gordon Huddleston: Certainly, and in the Permian as well you see everybody having transport challenges, with the exception of the operators that are within close proximity to Henry Hub. Also, the Haynesville is particularly well positioned relative to the Houston ship channel—the source of a lot of incremental LNG demand.

OAG360: We’ve seen recently that some of the companies particularly in the Marcellus are drilling the super-long laterals, 15,000-feet plus. Every basin is different, but do you think we’ll see superlaterals in the Haynesville?

Gordon Huddleston: They’re already being done today by Chesapeake in the Haynesville and we’re participating in some of those wells. The Haynesville is a high temperature, high pressure-type drilling environment that is more challenging than the Marcellus, maybe not the Utica. Overall, I think that trend is going to continue because there are just great efficiencies on the completion side by drilling longer laterals.

Something people don’t think about as much is the amount of land required to put together those larger units. It can be challenging to get the acreage you need to drill those longer wells, depending on where you are. One thing about the Haynesville is it is a very old basin with a lot of legacy production so there are some constraints there, but that usually doesn’t mean you can’t do it. It’s a question of how long is it going to take you, from a land perspective, to pull all of the permitting and to get other operators to work together to design those types of pads to accommodate the superlateral wells. But I think that’s going to continue for sure.

OAG360: It sounds like there are different constraints that show up whenever you try to extend the laterals out much longer, whether it’s drilling and then completions, or just getting the rights to the area.

Gordon Huddleston: The Haynesville was pretty early in the cycle, from a shale development perspective, so you’ve got drilling section-long laterals and so maybe you are bounded by two sections that both have short laterals, and it’s just not possible. Unlike in the Marcellus, which has a lot of what I’d call virgin-type optionality that is attractive.

OAG360: Is there much dodging of old wells? You see that in some plays like the Niobrara and some parts of the Permian as well.

Gordon Huddleston: For sure. I think that the more historical development you had in an area that’s in the same horizon, the more issues you’re going to have putting these longer laterals in, but I think the economics are compelling and certainly technically, from an execution standpoint, they are more challenging, and there is a learning curve there.

There are certain operators that are more willing to take that risk earlier than others, but it certainly has been the trend in the industry to move to longer laterals, and the technology has been allowing that. I think that will continue and I think it’s one reason why we’ve seen lower commodity pricing. Because we’re just getting more efficient, and margins are holding steady even as pricing’s coming down, because we get better at getting the gas or the product out of the ground. It’s pretty amazing, actually, just in 10 years how quickly that’s changed.

OAG360: Could you talk about the management team you have in place to develop the Haynesville assets?

Gordon Huddleston: Aethon is an owner- operator oil & gas private equity firm founded in 1990. We’re a registered investment advisor and an operator. We are more in line with Merit Energy or Sheridan Production Partners in terms of operating structure but are more focused on development.

We have a team of about 120 professionals in Dallas.

Through the 90s and mid-2000s we were focused on mature, waterflood oil outsets. But we decided to make a shift in the late 2000s into unconventionals, and we brought in additional professional engineering staff who have a lot of experience in that area.

My father, Albert Huddleston, is our founder and CEO. He has more than 40 years of experience in the business. My mother’s family was also in the business. I’m the fourth-generation in our family to work in the oil & gas industry. Our chief operating officer is Paul Sander. He ran the Dallas office of Encana Oil and Gas and has a great depth of unconventional development experience. He leads a team with robust backgrounds in the industry.

I think what’s interesting is Aethon is really focused on lower-risk technology development. We aren’t looking at pure exploration, which comes with a lot of risk. We like to be more of a follower than the leader in a play. When it comes to execution, for instance, drilling a 15,000-foot well, we’re happy to let Chesapeake go do that and we’ll participate and learn from that. Whereas we tend to focus on investments that we think can produce asymmetric risk-adjusted returns where we deploy our significant industry knowledge to unlock value the broader industry hasn’t recognized.

Regarding the Haynesville assets we’ve acquired, we’re excited about the opportunities we have in front of us. It’s a great resource and we’re looking forward to years of producing natural gas.

Goodrich Petroleum: $100 million budget in North Louisiana

Oil & Gas 360 interviewed Goodrich Petroleum (stock ticker: GDP) President and COO Rob Turnham.

Goodrich has assets in the TMS, Eagle Ford and the Haynesville shale plays. In late 2018, Goodrich announced a target range of $90 million to $100 million investment for 2019, with the vast majority of the budget for drilling and completing core Haynesville Shale wells in the Bethany-Longstreet and Thorn Lake areas of Caddo, DeSoto and Red River Parishes, Louisiana.

Goodrich announced that it plans to start 2019 with one rig in the Haynesville and will add a second rig in Q2.

Interestingly, because of the strong economics of the Haynesville wells, the recent Goodrich announcement represents a $40-million reduction of its planned 2019 capital budget, yet the company expects to maintain its previous production guidance for 2019 due to outperformance of its wells relative to its type curves, the company said.

Turnham goes into considerable detail below to explain how this result can be achieved in the play.

OAG360: What’s Goodrich’s history in the Haynesville and what do you like about the play?

Goodrich Petroleum President and COO Rob Turnham was interviewed at The Oil & Gas Conference last summer in Denver. Goodrich is an active Haynesville operator.

GOODRICH PETROLEUM PRESIDENT ROB TURNHAM: It’s a stepchild in essence since it’s natural gas, but people really don’t know how robust the rates of return are, because of the volumes and low cost.

We were an early mover in the play. Frankly, so early that we didn’t even know it was there. No one knew it was there. We were there in 2003 playing the Cotton Valley and Hosston zones. We put a big block together, and we had drilled a number of wells. We were adjacent to Chesapeake in the play. We knew that they were testing something deeper that was adjacent to us.

We then got a call from Aubrey McClendon [the late CEO of Chesapeake Energy] to try to buy us out of our block, so we knew it was something of interest. We ultimately wound up selling Chesapeake 10,000 net acres of a 30,000-acre block, and formed a joint venture on a portion of our acreage and then expanded our footprint. So from our entry in 2003 to really 2008, we were playing the Cotton Valley and Hosston and then benefited from the Haynesville discovery. And ultimately, what played out for us is that we’re right in the core of the play, in the sweet spot of the play.

We’ve drilled probably 100 wells in the play. I would say about 80 of those were old vintage wells where you just drilled 4,600-foot laterals and put really inferior completion recipes on it, where you had too wide of frac intervals, 1,000 pounds of proppant per foot over a 300-foot interval, and therefore those older wells were only getting probably 1.0 Bcf to 1.1 Bcf per 1,000 feet of lateral. And it’s because you just weren’t effectively stimulating the rock and therefore you were recovering a much smaller amount of gas than what was in place, versus the modern completion—which obviously is long laterals, tighter intervals, and a lot more proppant per foot generating, call it about 2.5 Bcf per thousand feet.

And it’s that increase in productivity with well costs actually being less than what they were back in 2009 to 2014 when we were still drilling old vintage wells. The cost per linear foot to drill those wells with inferior results was higher than what we’re currently spending in the play on a well today. Pretty remarkable.

So it’s technology around the ability to drill longer horizontals. But what’s really been a predominant change and a material change is the completion recipe, how best to stimulate the wells, which is leading to a much higher recovery factor of the gas that’s in place.

OAG360: I’m looking at the map of where your assets are, and the Goodrich Haynesville acreage is – you’ve got it sort of delineated into two groups there, the core, which you talked about, and then the Angelina River Trend. Can you talk about the differences in those two?

ROB TURNHAM: Very little difference in rock quality between the core in north Louisiana and the Angelina River Trend. But because it’s 3,000 to 4,000 feet deeper in the Angelina River Trend, your well costs are higher. And therefore, when you’re looking at rates of return, you’re having to spend $2.5 million to maybe $3 million more to drill in the Angelina River Trend, so your economics aren’t quite as good as what we see in the core of the play.

The Angelina River Trend also has the Bossier shale present there, and it’s of equal quality.

But again, if you’re looking like we are, at a manufacturing play where you have a high degree of confidence in hitting your cost objectives or estimates and you want repeatable results, when you combine those two in the core of the play versus a little more risk in the deeper Angelina River Trend and certainly more cost, then it’s easy to see why we’re concentrating all of efforts currently in north Louisiana—in the core.

OAG360: What are Goodrich’s plans for drilling the Haynesville assets in 2019?

ROB TURNHAM: We’ve established a budget of approximately $100 million in north Louisiana. That’ll get us about – call it 11 gross, 9 net wells. And the blended average lateral length of those wells is close to 7,500-foot length. So it’s a combination of a couple of shorter laterals, a handful of 10,000-foot laterals, and then the remainder being 7,500s.

OAG360: I wanted to ask if you are seeing anybody doing the “super laterals,” the extra-long laterals that we’ve seen in some other plays? Is any of that being done in the Haynesville?

ROB TURNHAM: Yes. Chesapeake has drilled one 15,000-foot lateral, and the results have really been outstanding. The well cost is quite a bit higher as you extend out in the Haynesville versus in the Marcellus or Utica, mainly because the Haynesville is 11,000 feet true vertical depth in north Louisiana, versus a much more shallow target in the Marcellus.

And because of the depth in the Haynesville, we’re in an over-pressured reservoir, and therefore you have to set an intermediate casing string. So you have your surface casing, and then you have an intermediate casing string that you also have to run before you can drill your lateral. And that added cost required because of the extra string of casing adds some extra cost.

And then when it becomes time to complete the well, if you drill a 15,000-foot lateral – frankly, it’s the same for a 10,000-foot lateral – when you want to drill out your frac plugs after you frac your well, you have a lot of friction lockup on your coil tubing the farther out you go. And if you want to think about this from a visual standpoint, it’s like pushing a water hose; the farther you go, the less ability to push it.

And so when you think about the Haynesville at 11,000 feet [vertical depth] and then going out 10,000 feet for a lateral length, you’re at 21,000 feet of measured depth. And if you want to go another 5,000 feet, you’d be at 26,000 feet of measured depth. When you get to about, I would say, 18,000 feet, maybe 19,000 feet in measured depth, that’s when we start to see the friction impact our ability to drill out frac plugs from that point forward.

That’s been mitigated to a great degree because they now have very reliable, dissolvable frac plugs. And so what you wind up doing is estimating, “Okay, I’m expecting friction on our coil tubing from this depth to the toe of the well. Therefore, let’s run those dissolvable plugs at that point.” And those dissolvable plugs are working extremely well.

It really does apply in the Haynesville in particular, and you could say the same thing probably for the Marcellus: it’s not about EUR, because no question the highest EUR is the longer laterals. The question is IRR. And so, where is your sweet spot relative to generating the best rates of return?

The farther you go in a lateral, the more risk you bring on. It’s not really risk of losing the well in a more traditional manner. It’s really risk of exceeding your AFE, or your estimate on drill cost. Because you can be 1,000 feet from your total depth that you want to drill and your bottom hole assembly or bit wears out, and you have to come all the way back out of the hole to replace it. And that may be unexpected.

The farther out you go, the more unexpected things can happen. And unfortunately, when you’re 9,000 feet out and you’re drilling a 10,000-foot lateral, if you want to get that last 1,000 feet and your bottom hole assembly or bit is no longer working or you can’t measure while drilling, it’ll take three days to come out of the hole, replace the assembly or the faulty equipment, and then get back on down on bottom.

The daily cost while you’re on location, at three days that interruption and repair could add $250,000 to $275,000 to your well cost. And then if you have that happen a couple of times, obviously, then you could exceed your AFE or your estimate for the well.

OAG360: So it’s all about risk and reward for that last 1,000 feet.

ROB TURNHAM: It is, yes. So where do you have the most confidence that you can drill them on AFE without issues? And we would say the likely scenario is probably more like 7,500-foot laterals just because you tend to have less motor failures, less bit problems, that sort of thing. And therefore is it a more predictable cost per well versus the 10,000s, which generate higher returns, higher EURs, certainly, but probably have a higher risk factor relative to cost.

OAG360: Where are the markets for the gas coming from the Haynesville, and what’s the takeaway situation for it?

ROB TURNHAM: The good news is we have excess takeaway capacity in the Haynesville. There were very big intrastate pipelines built that connect both west into Carthage or east to Perryville, and then you can head south to the Gulf Coast where all the petrochemical plants and LNG export terminals are.

So the Haynesville has a very strategic advantage to any other gas basin out there—close proximity to the Gulf Cost and multiple outlets with excess capacity.

So for us – and it depends on price – most of the time we sell our gas within our acreage, but we have multiple outlets. So depending on bids and price realization that we’re being offered, we’ll swing gas one way or another. So you have the ample gathering facilities in place with excess capacity. Then you have to figure out: who am I selling to? Because in the end, the pipelines will just transport your gas. You’re not really selling directly to the pipeline company.

So for us it’s just multiple outlets whether it’s Kinder Morgan or CenterPoint or Williams or Energy Transfer. We have multiple pipes that take our gas and then the purchasers can vary. But right now our average basis off Henry Hub is probably 12 to 15 cents per Mcf. And our gathering fees when we operate are as low as 15 cents on some acreage to 35 cents in our Thorn Lake area. And then in some cases, we have higher gathering fees if we don’t operate the wells, if the operator has a higher cost structure.

But on the blended average basis, we think we’re going to be kind of in the 40-cent-per-Mcf range on transportation in 2019, then trend lower in 2020 and beyond as we add volumes, operated volumes, at these lower rates.

OAG360: For the past few years many operators moved to oil and liquids plays, and with the Haynesville you’re describing a play that’s really economic—and it’s a gas play.

ROB TURNHAM: Even at $2.75 gas, we’re probably on average generating 50 to 60 percent IRRs. And in fact, we think that number could be going up based on our new year-end reserve report. We’re waiting on it, but wells have outperformed our time curve, so we may be generating upwards of close to 100 percent IRR on some wells.

And people really don’t understand it. They just assume that it’s gas and therefore it can’t work, not nearly as well as the oil plays. But in reality, we’re generating better returns than many of the oil plays. And it’s really because the volumes coming out are so high and the per-unit costs are so low. For example, our lease-operating expense here is about 5 cents per Mcf on a new well, extremely low. And you don’t have any severance tax in the state of Louisiana until the earlier of payout or two years.

And so when you bake in an extremely low cost structure with high volumes and a good price, you can generate really competitive rates of return.

OAG360: And you don’t have to fight all those battles that the guys in the Permian are fighting.

ROB TURNHAM: Exactly right. With ample capacity to sell your gas, and as long as you’re in the core, if you drill it and complete it the same way, the results are very similar. The repeatability of this play, the ability to use your existing facilities – you might have to expand it a little bit because these production rates are so high – but using existing facilities to coordinate your completions at a very low cost structure is really advantageous.

The Haynesville Shale: a recipe for natural gas success

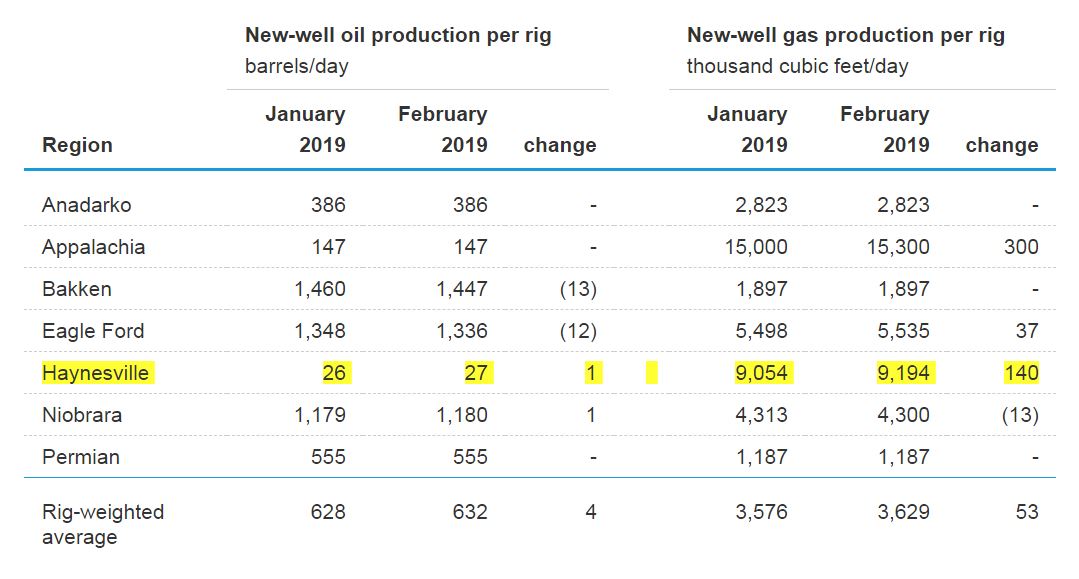

Haynesville is second only to the Appalachian region for new-well natural gas production per rig. Source: EIA

The Haynesville recently recorded the second highest results according to the EIA’s calculation of ‘new-well gas production per rig’, among all the U.S. shale plays. A testament to operators’ efficiency in drilling and producing the play.

For gas plays such as the Haynesville that offer easy access to the U.S. Gulf coast markets, the coming reshuffling of demand metrics for natural gas at the Gulf coast will open new doors for producers to sell their gas.

With an estimated 300 trillion cubic feet of recoverable natural gas, ample takeaway capacity to the Gulf coast, and terrific well economics being delivered by the new drilling and completion technologies, the Haynesville Shale is one U.S. onshore natural gas play that is well-positioned for a highly successful decade.

The E&Ps who are developing the play will have full opportunity to build highly economic natural gas production for a diverse and growing group of demand sources for a long time. It’s a tasty recipe for success.