The EIA predicts fuel prices will be at their lowest since 2009 this summer

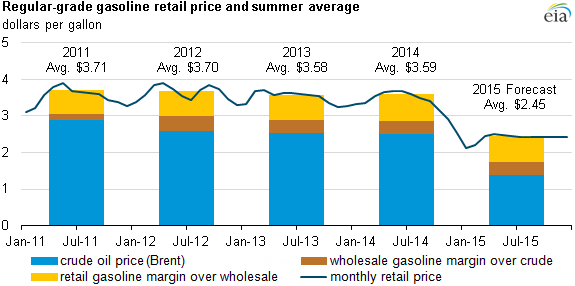

Drivers in the United States are expected to pay the lowest gas prices this summer since 2009, reports the Energy Information Administration (EIA). Drivers are projected to pay an average of $2.45/gallon for regular gasoline this summer (April through September), down 32% from $3.59/gallon during the summer of 2014.

The lower consumer gas prices are due in large part to the low oil price environment, allowing refiners to produce retail gasoline for less. For summer 2015, the Brent crude oil spot price is projected to average $58/bbl, which translates to $1.38/gallon for the crude oil portion of the gasoline price. During the summer of 2014, Brent averaged $106/bbl, or $2.52/gallon, says the EIA.

The news comes at a perfect time for drivers in the U.S. as they gear up for summer road trips. “The glut in global petroleum supplies has come at the perfect time as people hit the road,” Michael Green, a spokesman for AAA, said. “Even if demand rises, there’s more than enough petroleum to supply motorists this summer.”

U.S. motorists drove a record 237.3 billion miles in January, the most for that month in government data going back to 1970, reports Bloomberg. January driving grew by 4.9% over the previous year, the biggest increase in 15 years.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.