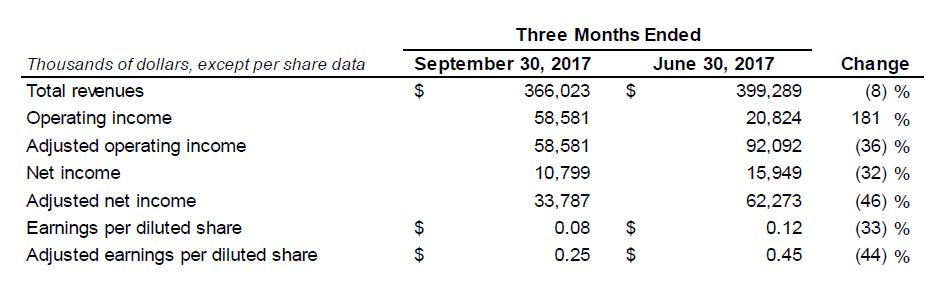

Diamond Offshore Drilling (ticker: DO) Q3 highlights:

- Net income of $11 million, or $0.08 per diluted share

- Adjusted net income of $34 million, or $0.25 per diluted share, excluding costs associated with the redemption of our 2019 senior notes

Diamond Offshore fleet updates

- Diamond Offshore said operating efficiency, excluding planned downtime, was 98.5% in Q3

- One sixth-generation drillship drilled and completed a well 47 days ahead of schedule

- The Ocean Valor contract has not changed from Q2. A court enforced injunction remains in place and Diamond Offshore continues to invoice and collect the contractual standby rate

- Diamond Offshore has spent $1.5 billion upgrading the MOD fleet over five years. According to Diamond, the most active areas suitable to MOD assets are Australia and the North Sea

Diamond Offshore said the company has secured additional time for two rigs. The Ocean Apex in Australia was extended by Woodside with an additional well added to the current program, the estimated contract expiry is early Q2.

The Ocean Patriot secured a new contract with Shell in the North Sea. Current term work with Shell will be completed, then the Ocean Patriot will be mobilized to undergo a special survey and top drive upgrade. After the upgrade, a drilling campaign from Mar. 2018 to May 2018 will begin. After May 2018, the rig will once again be mobilized to start a contract with Apache.

In the Gulf of Mexico, the cold stacked Ocean Onyx was recently loaded onto a heavy lift to begin transit towards Asia. No imminent plans have been made to reactivate Ocean Onyx upon arrival in Asia, though exploration for opportunities is underway.

Financial highlights

- Extended liquidity runway through refinancing 2019 senior notes with newly issued 2025 senior notes, these eight-year unsecured notes were issued with a 7.875% coupon rate, maturing in Q3 2025

- Costs associated with the retirement of the 2019 notes resulted in a Q3 pre-tax charge of $35 million or $0.17 per share after tax

- Additional $10 million of new debt issuance costs will be amortizing over the term of the new senior notes

- Contract drilling revenues of $358 million for Q3 represented a sequential decline of 9% driven primarily by two rigs, the Ocean Victory and Ocean Courage

- Contract drilling expenses of $198 million

- Net income tax benefit of $15 million due to the mix of domestic and international earnings inclusive of the loss when extinguishment of debt was recognized in Q3

For more financial details, refer to Diamond Offshore’s Q3 2017 press release.

Q4 2017 guidance update

Diamond Offshore predicts Q4 2017 operating expenses to be between $205 and $210 million. A special survey is planned for the Ocean Patriot, which is expected to increase Q4 operating expenditures. Additionally, the return of the Ocean Scepter to the U.S. site in the Gulf of Mexico and the previously mentioned Ocean Onyx move will also increase Q4 operating expenses. Diamond said both rigs are not being moved for a specific contract price and Diamond expects to expense both mobilizations. Capital expenditures are expected to be approximately $125 million for the year, the decrease from previous expectations is due to projects shifting into 2018 and project cancellations.

Conference call Q&A

Q: What are you looking for to be able to put a stake in the ground and say, okay, we bottomed out?

Diamond Offshore President and CEO Marc Edwards: I think we’ve got to first see utilization stabilize. We’re still going to see utilization, certainly in the sixth-generation fleet, track down over the next few quarters. Clearly, the number of opportunities that are in the pipeline is less than the number of contract rollovers that we see over the next 12 months.

So, utilization needs to stabilize, but at the same time, I think some of the older sixth-gen assets, as they remain stacked for a significant period of time, need to truly exit the market. One could suggest that the reactivation cost has become a barrier to reentry in the market in the long term, which would then allow pricing to perhaps track back upwards, and then who knows, maybe we reach the level of pricing where those – it might become attractive for those assets to be reactivated. But I think that’s quite some distance into the future.

In the moored fleet, I think that market seems to be fixing itself a lot faster than the DP fleet for example, so we’ve had close to 100 assets stack. The vast majority of those are in the moored fleet, and we’re seeing more activity in terms of tendering in that sector, certainly in the two geographies of Australia and the North Sea. We’re also able to take third and fourth-generation assets and put them to work, at rates that are meaningful of – meaningfully above cash breakeven.

I think we’ve got to see more scrapping and we’ve definitely got to see more activity in the tendering space. We’ve got to see our clients become more active in sanctioning projects, bring them back over the horizon so that demand for these deepwater assets increases as well.

Q: I think you said that you had beat your drilling curve with one of the block ships by 47 days. We’re hearing more of that, but I’d like to hear if the trend is so pronounced that it dovetails into new contract structures that are more performance based for the industry and for Diamond going forward?

CEO Edwards: It’s somewhat of a double-edged sword. If you’re on a fixed scope of work it does mean that that scope might come to an end ahead of schedule, but for our critical sixth-generation assets, all those contracts are time based and not well based or scope based. But if you’re looking at a spread cost, let’s say spread costs have not come down to $800,000 or close to $1 million. That 47 days of accelerating the well is close to, you could say, $40 million or $50 million of savings to the client. And that’s quite appreciable in anybody’s world. This was part of our strategy from well over two years ago when we decided to go down this price control by that construct, driving efficiencies into offshore drilling by taking out unnecessary nonproductive time, especially if it’s related to the stack. One of our rigs here in the Gulf of Mexico had only six hours of downtime in 90 days. None of that was associated with the stack – the subsea stack.

Day rates or performance based contracts?

In 2014 Diamond Offshore launched Pressure Control by the Hour® as a new service model for deepwater drilling that includes performance incentives to reduce BOP system downtime and improve system reliability for Diamond Offshore and its customers.

The company said that by transferring the maintenance and services of pressure control equipment to GE Oil & Gas, Diamond Offshore is simplifying operations and optimizing between-well maintenance.

Q: I guess my follow up to the previous question is really what that means with regard to how you approach your business, from either a performance based contract structure or a day-rate business going forward. And whether you have had sufficient engagement in the contracting process yet to really explore how you get paid for better performance, because clearly most of your contracting lately has been well-to-well and on your moored rigs. But do you think that that’s going to be the future of contracting when the Black ships roll on to the next contracts?

CEO Edwards: One of the reasons we embarked on this pressure control by the hour construct was to differentiate our drillships, the sixth-gen assets in the market that was significantly oversupplied. We wanted to push to the top of the line in terms of attractiveness, we thought that perhaps the best way to do this was to eliminate nonproductive time.

Nonproductive time in any industry is a burden on the end user. So, in terms of being able to differentiate that, I think we’re beginning to see a tangible differentiation moving forward.

Diamond Offshore Senior VP and CCO Ronald Woll: I think the follow-up question makes a lot of sense. There is a general trend for operators to favor performance-based consideration in contracts away from legacy models. We think per-hour works to our advantage. As we think about the upcoming contracting cycle that includes our drillships, our Black ships have had a deep and positive resume, the kind of experience that is very rich and challenging.

Many of these rigs have worked in some pretty tough drilling and completion programs, well depths of over 32,000 feet, so they’ve really been working at the deep end of the pool, if you will. We know that the operators look for proven performance, not just the hardware, but also the crews themselves in terms of how closely knit they are and how well that translates into performance. For the operators, that does make sense. When you think about re-contracting the black ships, by the time these drillships come up for re-contracting, they will have had two to three years of pressure control by the hour behind them.