2017 CapEx doubles 2016 levels; Colombian F&D costs less than $1.50

GeoPark (ticker: GPRK) reported fourth quarter results Wednesday, showing a net loss of $20.4 million. Full year results are a loss of $49.1 million. These results are significantly better than those of 2015, when fourth quarter and full year losses were $157.6 million and $234 million.

Total proved reserves are up 10% to 78.1MMBOE. GeoPark’s reserve replacement ratio for 2016 is about 187%. Almost all of this growth is due to successful activities in Colombia, where the company’s oil reserves grew by 25%. GeoPark reports a 26% increase in the value of its reserves in 2016, to $1.12 billion.

GeoPark estimates that 2017 CapEx will be around $80-$90 million, roughly double 2016 spending of $42 million. This spending will primarily be focused on funding Colombian activities. This spending will drive production growth of 20%-25%. Unless oil prices change significantly the company expects to operate 1-2 rigs in Colombia. A total of 33 gross wells are planned for this year.

Columbian development driven by strong economics

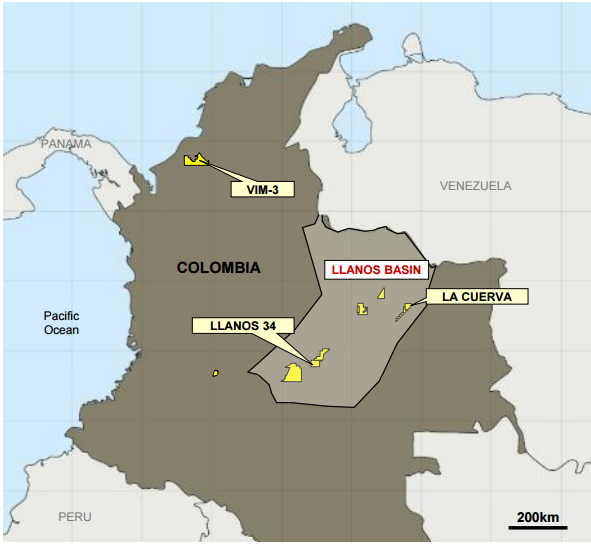

GeoPark’s main asset is the Llanos basin is Colombia. The company owns about one million acres in the basin, where it has identified multiple oil plays. Since GeoPark first bought Llanos acreage in 2012, production from these fields has grown from zero to 39,000 BOPD. In 2017 the company plans to continue to explore its acreage, with four exploration wells expected. An additional seven wells will appraise several previously identified plays and nine more wells will develop the best-understood plays.

According to GeoPark, these wells are very economic even at current oil prices. “Our F&D costs are less than $1.50,” GeoPark CEO James F. Park told Oil & Gas 360® on February 13. “Our drilling costs are $3 million. Recovery of the wells are two to three million barrels per well, meaning the wells payout in six months, even at a $40 oil price.”

GeoPark also has activities in the southern tip of Chile, on the border with Argentina. As the first private oil and gas producer in Chile, the company believes that it is uniquely positioned to take advantage of opportunities available. GeoPark is targeting the Magallanes basin, where the Ache gas field was discovered in 2014. While this field is the current target of development, its source rock has significant future development potential as unconventional shale oil.