U.S.’s 2020 crude oil production en route to 13.3 MMBOPD – EIA

By Bevo Beaven, Editor, Oil & Gas 360

There’s no doubt that production around the U.S. oilpatch is continuing its significant upward momentum.

In the heart of the price-crash doldrums, the EIA reported in April 2016 that U.S. crude oil production fell below the 9 MMBOPD mark for the first time since October 2014.

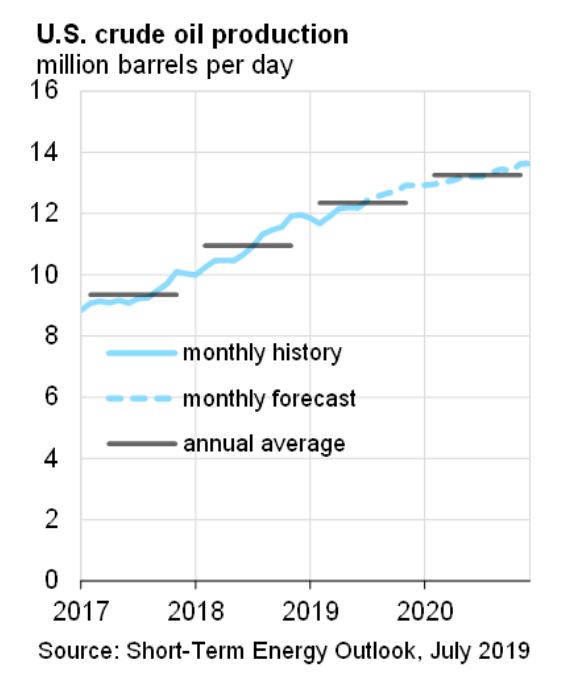

Compare that to the EIA’s latest STEO, out yesterday. “EIA expects U.S. crude oil production, which reached a record-high 11.0 MMBOPD in 2018, to average 12.4 MMBOPD in 2019 and 13.3 MMBOPD in 2020.”

The publicly traded oil and gas producers who will be on the presentation stage at the 2019 EnerCom’s The Oil & Gas Conference® are contributing to that rising production trendline, altogether representing 7 MMBOEPD of energy production. That’s 47% higher production than the comparative EnerCom conference presenters just two years prior. That number includes presenting companies operating worldwide, not just in the U.S.

Producers, oilfield service and royalty companies presenting at EnerCom’s annual The Oil & Gas Conference® Aug. 11-14 together represent a combined total of:

- $160 billion market capitalization;

- $212 billion enterprise value;

- 7 million barrels of oil equivalent production per day; and

- 19 billion barrels of proved reserves.

Looking at how things looked two years ago, this year’s EnerCom conference looks like this:

- Total market cap for the 2019 public company group is 36% higher than the combined market cap of the 2017 presenters as of August 2017;

- Enterprise value for the 2019 presenting companies is 29% higher than it was for the 2017 public companies; and

- Oil equivalent production for the 2019 presenting companies is 47% higher than the combined production for the 2017 presenting upstream companies.

Companies on the agenda range in size from multinational supermajors to microcap junior producers.

Day three presenters

EnerCom has released the presenting companies for day three of its upcoming conference, including:

(NYSE: CHAP) – Chaparral Energy, Inc.

(NASDAQ: ROSE) – Rosehill Resources Inc.

Privately held – Ameredev II

(NYSE: FTK) – Flotek Industries, Inc

(NYSE: WFC) – Wells Fargo & Company

(NYSE: E) – Keynote Lunch: Eni, SpA

(NASDAQ: PVAC) – Penn Virginia Corporation

(OTCMKTS: BNKPF) – BNK Petroleum, Inc.

(TSE: JOY) – Journey Energy Inc.

(NYSE AMERICAN: NES) – Nuverra Environmental Solutions

(NYSE: NBR) – Nabors Industries

The complete daily schedule of presenters is posted on the conference website (presenters, days, times are subject to change). The conference investor presentations begin at 7:30 a.m. and run through 4:30 p.m.

Luncheon Speakers

Completing online registration well in advance of The Oil & Gas Conference® will provide your best chance to gain insight from:

- Occidental Petroleum SVP and chief financial officer – Cedric Burgher,

- Continental Resources Chairman and CEO – Harold Hamm, and

- global supermajor Eni, SpA VP of North America Investor Relations – Andrew Lees.

Global sponsors of EnerCom’s conferences are Netherland, Sewell & Associates; and Drillinginfo. Sponsors for The Oil & Gas Conference® 24 include CIBC; Credit Agricole CIB; McGriff, Seibels & Williams; Haynes and Boone; Moss Adams; PNC; Preng & Associates; Bank of America Merrill Lynch; DNB Bank ASA; Holland & Hart; MUFG; Petrie Partners; SMBC; and Wells Fargo.

EnerCom launched ‘The Oil & Gas Conference®’ in 1996 in Denver.