By Bevo Beaven, Editor, Oil & Gas 360

Goodrich Petroleum Corporation (stock ticker: GDP, $GDP) reported that its proved oil and natural gas reserves as of December 31, 2018 increased by 12% to 480 billion cubic feet equivalent (“Bcfe”) versus 428 Bcfe at year-end 2017. The present value, using a 10% discount rate of the future net cash flows (the “PV10”), was $418 million. PV10 was comprised of 94% natural gas and 35% of PV10 was developed. Oil and natural gas prices used to determine proved reserves were $65.56 per barrel of oil and $3.10 per MMBtu of natural gas.

Goodrich said it had reserve additions of 100 Bcfe and PUD conversions of 11 Bcfe, for total additions and conversions of 111 Bcfe. Drilling and completion capital expenditures in 2018 were $102 million, for an organic adjusted finding and development cost of $0.92 per Mcfe. Proved developed reserve additions had a finding and development cost of $1.20 per Mcfe.

Haynesville wells outperform

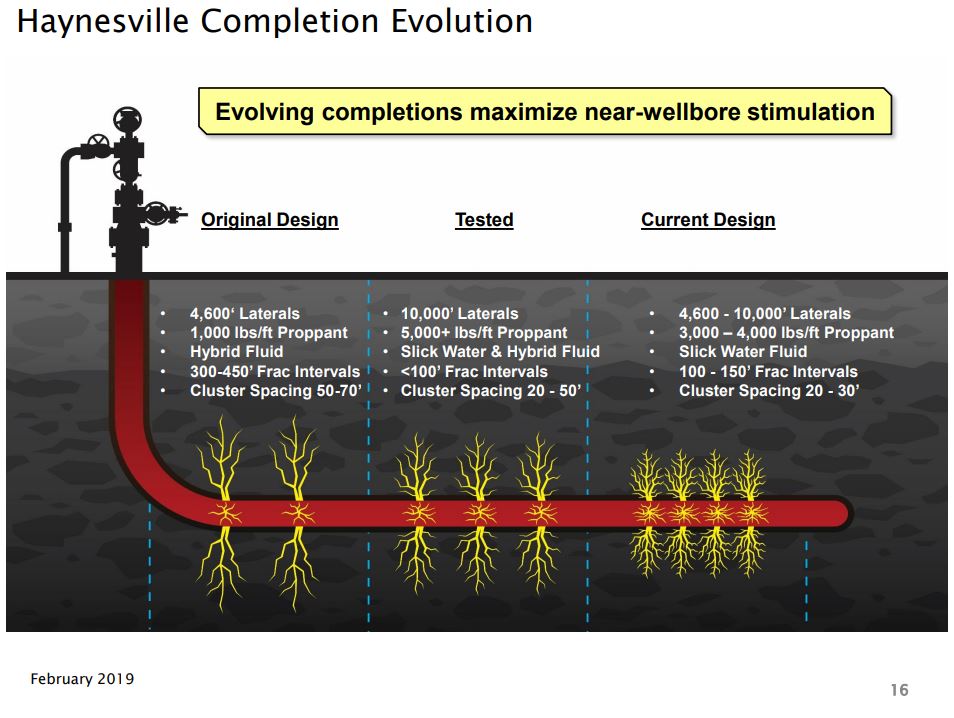

Goodrich updated its Haynesville Shale well economics based on early time outperformance of its type curves.

Two wells, the Cason-Dickson 14&23 No. 3 (99% WI) and Cason-Dickson 14&23 No. 4 (99% WI) were completed off of a common pad in Red River Parish, Louisiana. The wells, which have an average producing lateral length of 9,300 feet, have achieved a combined 24-hour peak rate to date of approximately 62,000 Mcf per day.

Goodrich drilled and cased its Loftus 27&22 No. 1 (97% WI) well and has reached total depth on its Loftus 27&22 No. 2 (97% WI) well, both of which are in DeSoto Parish, Louisiana. Both wells are approximately 7,500 foot laterals, with frac operations expected to commence in 30-45 days.

You can catch the Goodrich Petroleum presentation with additional details, live at EnerCom Dallas, the oil and gas investor conference, Feb. 27-28, 2019. Register for the conference here.