Chart of Week

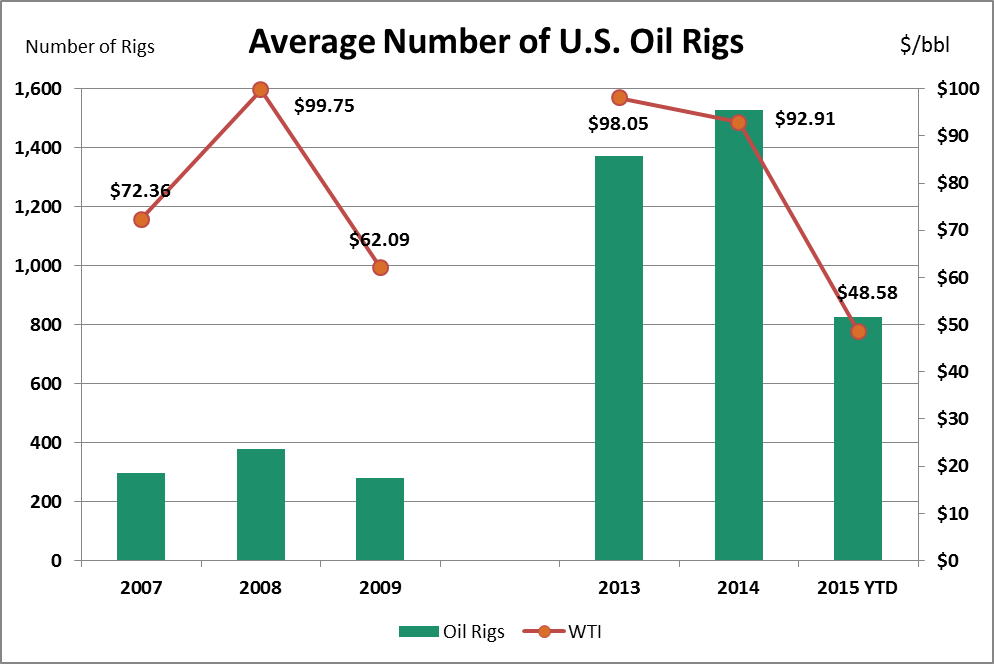

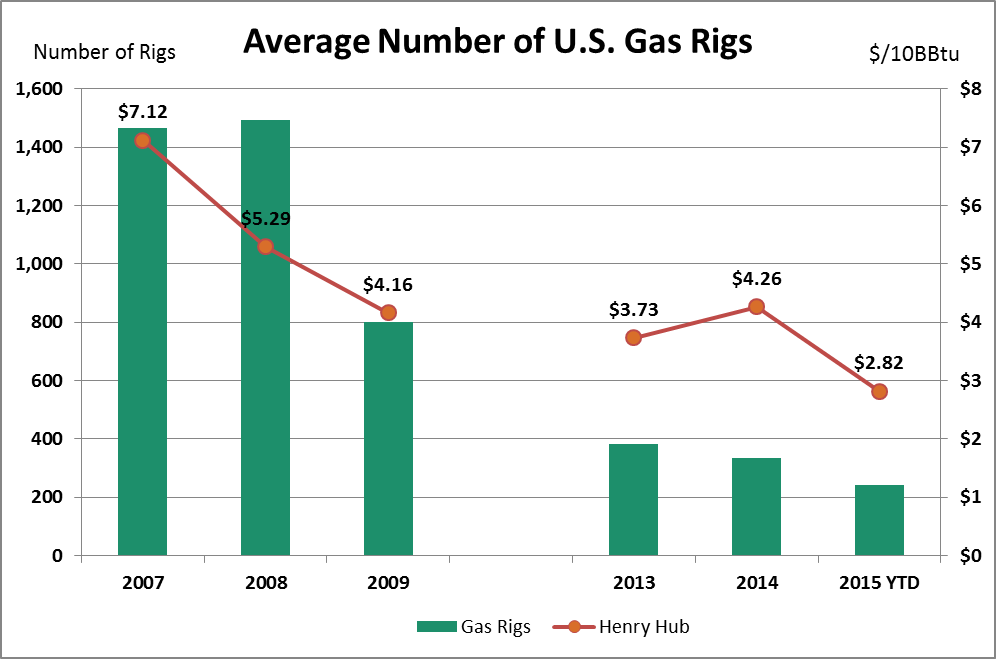

United States Rig Count Approaching 800 Following Largest Drop since April

Oil Rigs Reach New Five-Year Low

A few months ago, speculation of a rig count trough offered promise of the oil industry bottoming out. Since then, oil prices seem to have stabilized, but rig counts are a different story.

The …

Chart of the Week: U.S. Energy Use in 2014

Petroleum, NatGas, Coal & Nuclear Delivered 89% of U.S. Energy in 2014

U.S. Energy Use: in its September release of the second Quadrennial Technology Review (QTR), AN ASSESSMENT OF ENERGY TECHNOLOGIES AND RESEARCH OPPORTUNITIES, the U.S. Department of Energy …

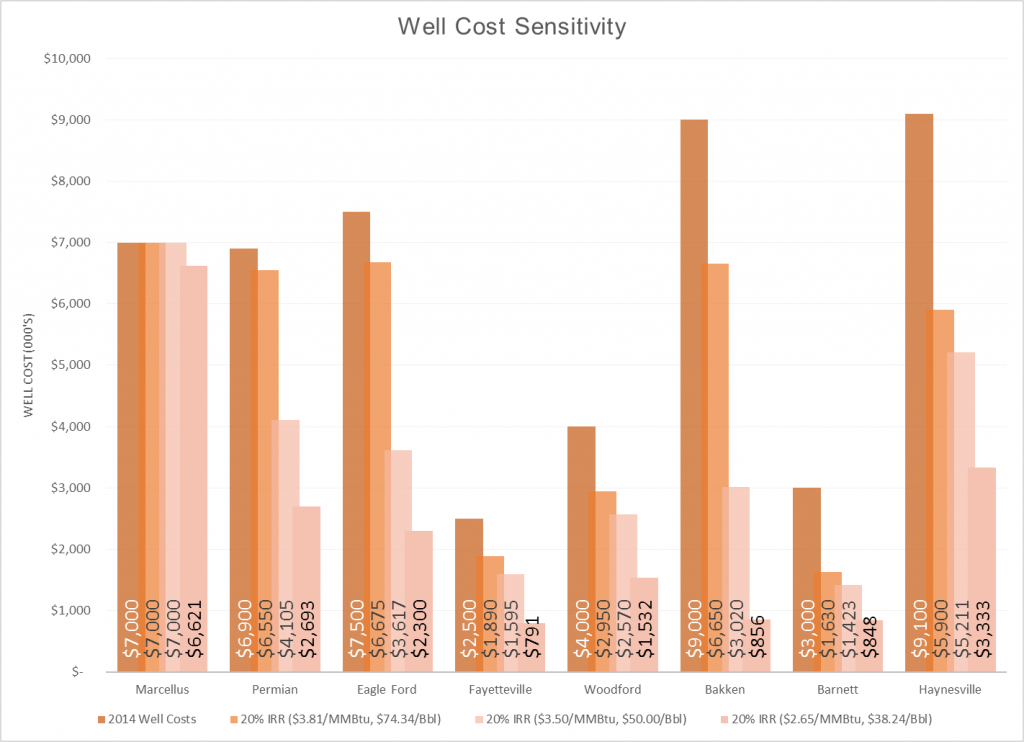

Generating 20% IRRs with $38 Oil

EnerCom Analytics’ well cost sensitivity by basin

EnerCom Analytics ran an analysis of well costs for various basins in December to help illustrate at what cost wells needed to be drilled to generate at least 20% IRRs. With oil prices …

Coal vs. Natural Gas: NatGas Takes the Lead

As natural gas prices come more in-line with coal, generators make the switch

This chart, provided by EnerCom Analytics, shows the increasing use of natural gas as opposed to coal for electrical generation. April 2015, marked the first time ever …

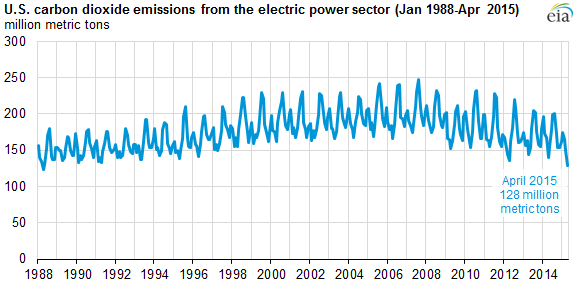

Power Sector Carbon Dioxide Emissions Hit 27-Year Low

Carbon emissions from the power sector at lowest level since 1988

The electric power sector emitted 128 million metric tons of carbon dioxide (MMmt CO2) in April 2015, according to information from the Energy Information Administration (EIA). This …

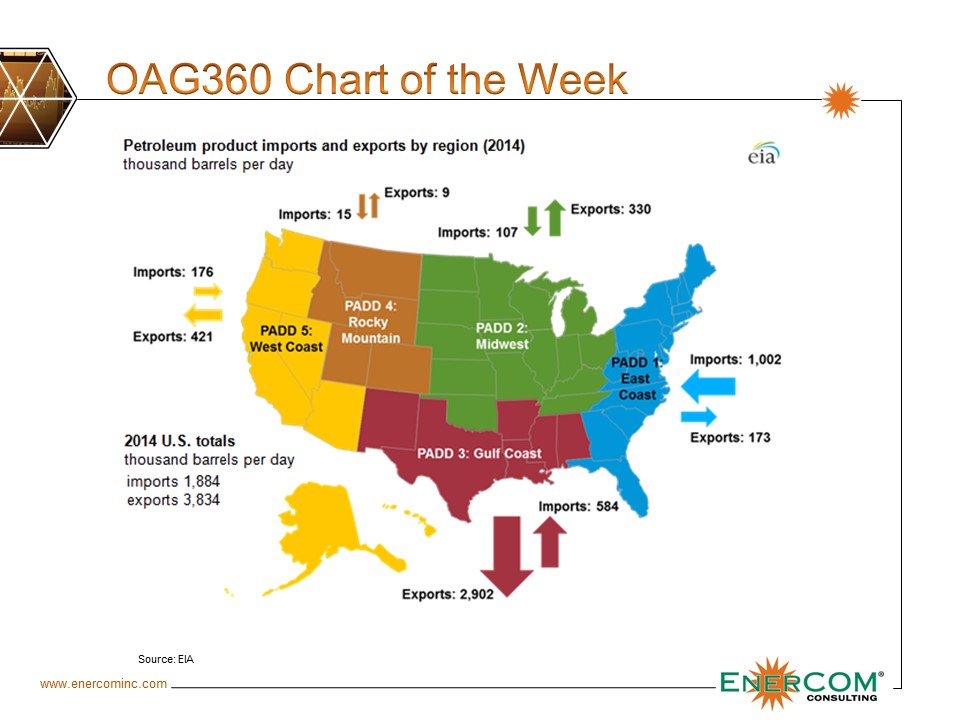

U.S. petroleum exports averaged 4.1 MMBOPD for the first four months of 2015

U.S. Gulf Coast Makes up 75% of Petroleum Product Exports

Roughly 75% of exported petroleum products come from the U.S. Gulf Coast, according to information from the Energy Information Administration (EIA). More than half of the country’s refining capacity is …

Free Falling Prices for Goods and Services in Oilfields

Extraction pricing feeling the most pressure

The decision by E&P companies to cut capital expenditures and increase efficiencies following the dramatic fall in oil prices put downward pressure on other sectors of the oil and gas industry.

The Bureau of …

Texas Produces More Natural Gas than any OPEC Country

Texas crude oil production beats all but OPEC’s three largest producers

Information from the American Petroleum Institute (API) shows that Texas produces more dry natural gas than any OPEC nation. On a global scale, the only country that beat dry …

Chart of the Week: Comparing OPEC Rig Counts

Saudi Arabia has the highest number of active rigs in its history

The global oil market has changed drastically since the last meeting of the Organization of Petroleum Exporting Countries (OPEC) in November 2014. However, the intentions of each of …

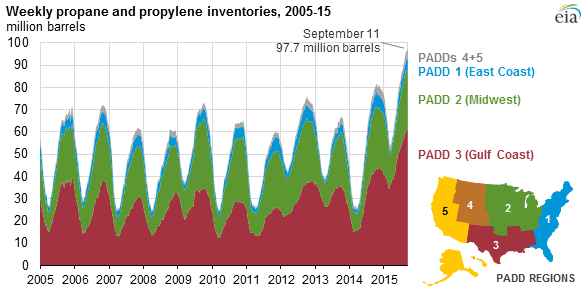

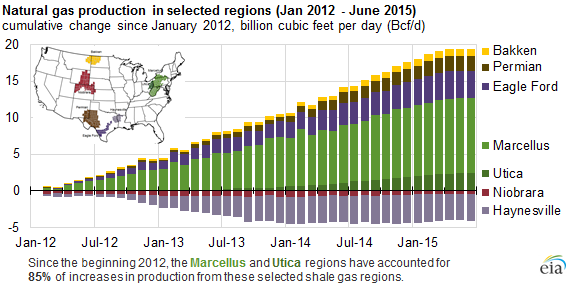

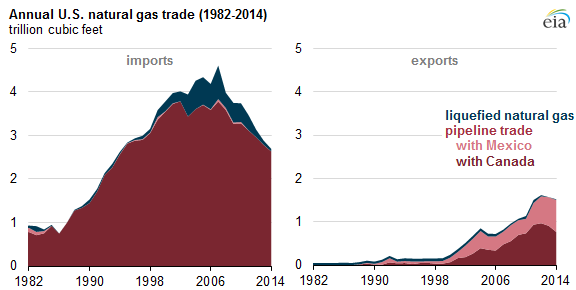

Chart of the Week: Net Natural Gas Imports Lowest Since 1987

Natural gas imports continue 8 year decline

Net natural gas imports to the United States decreased 9% in 2014, continuing an eight-year decline, according to the Energy Information Administration (EIA). As U.S. dry natural gas production has reached record highs, …

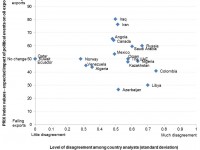

PRIX Index Predicts Increased Oil Exports from Iraq and Iran

Geopolitics in commodity markets can be one of the hardest factors to predict when forecasting global market movements.

The most recent update to the PRIX Index, published April 30, showed an overall value of 56, meaning exports from the …

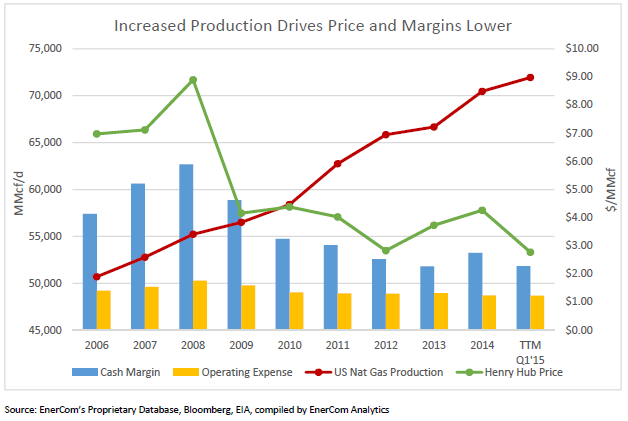

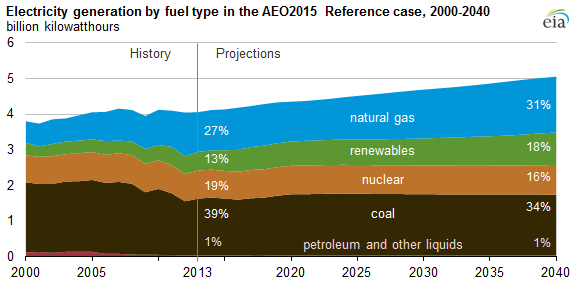

EIA: Expect Natural Gas to Carve Out a Greater Market Share

Natural gas continues to grow

The Energy Information Administration (EIA) expects natural gas to account for 31% of electricity generation by fuel type by 2040. In the EIA’s Annual Energy Outlook (AEO) 2015, the administration predicts that the percentage …

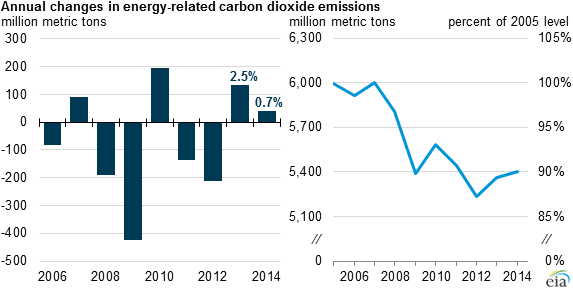

Chart of the Week: U.S. Energy Intensity Declining

U.S. energy intensity has declined by 13% since 2005

The Energy Information Administration (EIA) released annual statistics about carbon dioxide (CO2) emissions in the United States today. CO2 emissions in the U.S. increased for a second year in a …

Chart of the Week: How much do States Rely on Severance Taxes?

$16.7 billion in 2013

Tax season is nearing a close for Americans, and earnings season is just around the corner for oil and gas companies preparing their quarterly results. E&Ps and service providers have felt the impact from the oil …

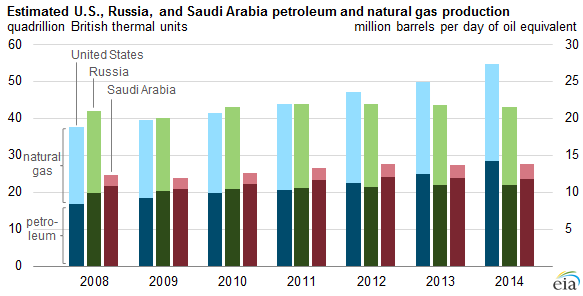

Chart of the Week: The Big Three

Chart of the week: U.S. remains the largest hydrocarbon producer for the third straight year

The Energy Information Administration (EIA) released the annual statistics on the world’s three largest oil and gas hydrocarbon producers this week. The United …

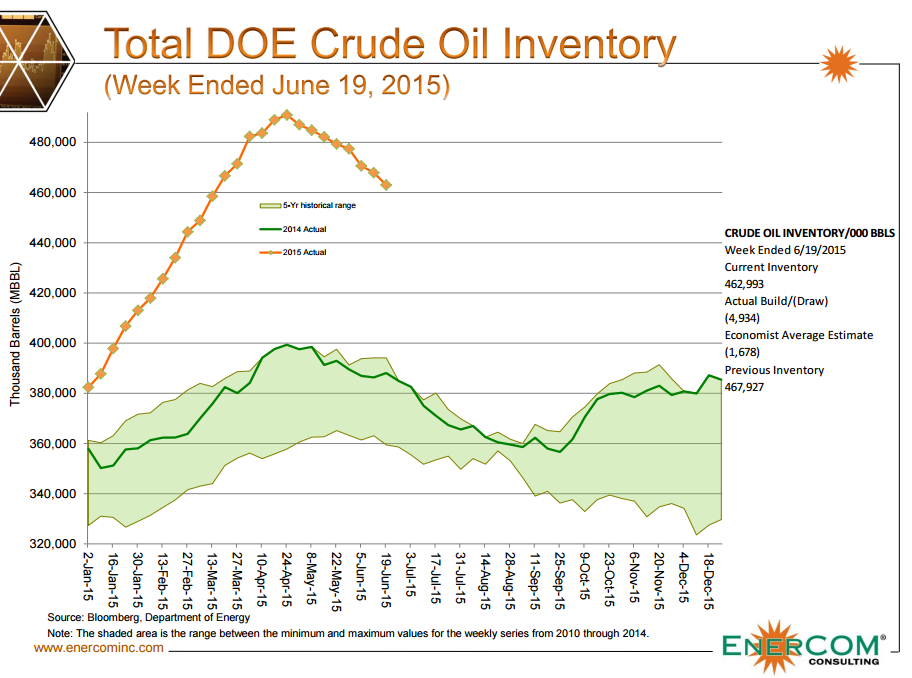

Chart of the Week: When will the Crude Oil Builds Stop?

Inventories at 88% of working capacity

Production may be slowing in the United States, but the builds to crude oil inventories are not. The Department of Energy (DOE) reported gains for the tenth straight time in its Weekly Petroleum Status …

Chart of the Week: Rig Counts by Oil Plays

Rig counts have fallen for 13 straight weeks heading into the latest update, scheduled for tomorrow, March 13. Rigs in gas plays have remained relatively steady, but the drop-off in oil-focused regions has been severe. In this edition of Oil …

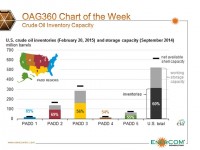

Chart of the Week: How much Storage Capacity do we have left?

The Energy Information Administration (EIA) reported yet another monster build to crude inventories for the week ended February 27, 2015. The latest Weekly Petroleum Status Report added 10.3 million barrels to inventories that are already believed to be the highest …

Chart of the Week: WTI/Brent Spread Widens

So it appears the “floor” for West Texas Intermediate prices (at the moment) is $40, as evidenced by a January Fed survey by CNBC. Prices are currently roughly $5 above the January 28 low of $44.45 – a climb …

Chart of the Week: U.S. Production vs. China Demand

United States crude production is expected to be at its highest since 1986, according to information compiled from Bloomberg and the Energy Information Administration. The increased domestic production has allowed the U.S. to diminish its need for imports – a …

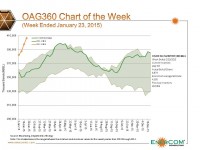

Chart of the Week: Crude Inventories Highest on Record

The rig count is dropping, but crude inventories continue to grow. In fact, EnerCom’s Crude Oil Cuttings inventory report is at risk of expanding the maximum range of barrels, a move we’ve never been prompted to make.

The Energy Information …