Unconventional wells are becoming more economically difficult as prices remain low

With oil losing more than 50% of its value in six short months, United States shale producers are increasingly feeling the market squeeze as they struggle to competitively price their product in the global sphere.

In June of 2014, when West Texas Intermediate (WTI) prices reached a high of $101.18, U.S. shale producers were easily able to justify expanding operations to grow production. The business model has become much more difficult now that prices have endured its steepest, fastest slide since 2008.

Unconventional onshore projects require that the shale be hydraulically fractured and refractured over time in order to keep oil flowing over their relatively short lifespans. This model is not sustainable in a low oil price environment, says Rebecca Fitz, senior director of upstream strategy and completion at IHS Energy. “You have to drill to produce,” she says. “Some companies have told me the only way you make money is if you stop drilling, but then production decreases.”

This has led to what some refer to as the “Red Queen syndrome.” In Through the Looking Glass, the Red Queen tells Alice, “It takes all the running you can do to keep in the same place.” Many shale operators have followed the same mantra. E&Ps are constantly drilling to keep pace with the market, and now that commodity prices have fallen off steeply, some companies face a precarious situation in maintaining their position in the production scene.

Offshore drilling in the Gulf of Mexico offers high risk, high reward

While onshore operators are slowing operations in the low price environment, offshore producers in the Gulf of Mexico (GOM) continue to see returns on their investments.

Although the cost to drill an offshore well can be substantially larger than the price paid by onshore operators, the returns generated are equally impressive. The average cost of drilling an offshore well can range from $80 million to $150 million, depending on the depth, said John Snedden, a University of Texas Austin geologist, in an interview with FuelFix. However, the large, largely undisturbed deposits allow much longer, more productive lives than mature onshore fields.

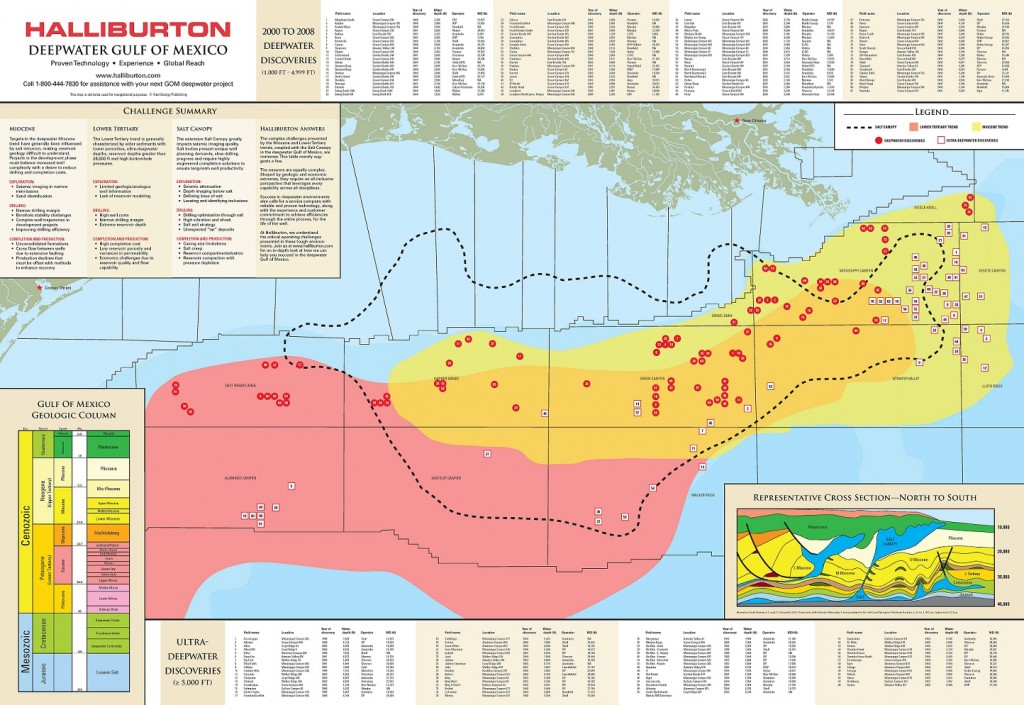

Source: Halliburton

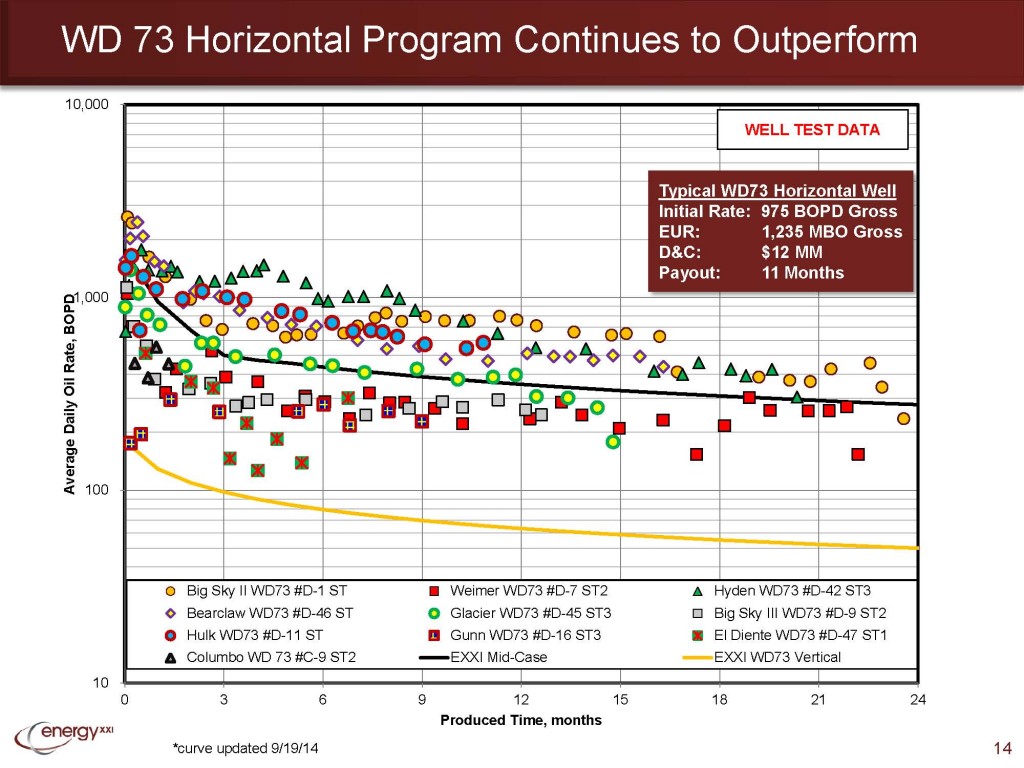

While shallow onshore shale wells might cost $3 million to $5 million, Snedden estimates that the average costs in the Lower Tertiary formation run around $150 million. Lower Tertiary wells are technically challenging to drill because of the extremely high pressures and depths of up to 30,000 feet. Wells in the Miocene trend, a more easily accessible target starting at 20,000 feet, are usually much cheaper, averaging “only” $80 million. Energy XXI (ticker: EXXI), which operates mostly in the shallow waters of the GOM, expects its wells to cost approximately $12 million each, based off an October 2014 presentation.

Despite the massive price tags associated with deepwater projects, they are still able to attract investment because of their high yields and long lifespans. Many of the wells currently in operation have been producing since they came online more than 20 years ago, according to the Bureau of Safety and Environmental Enforcement (BSEE). Some of the projects, like Chevron’s (ticker: CVX) Jack/St. Malo fields, offer massive production. CVX announced in December that Jack/St. Malo came online with volumes of 170 MBOPD and 42 MMcf/d, with the potential for future expansions. The Jack/St. Malo project is just one of over 560 discoveries in the Gulf of Mexico, according to the BSEE.

Current operations in the Gulf

Based on information from the BSEE, there are more than 60 active deepwater projects as of the week of January 5, 2015. They include some of the largest operators in the industry like Chevron, Shell (ticker: RDSA), Anadarko Petroleum (ticker: APC), Noble Energy (ticker: NBL), ExxonMobil (XOM), BP (ticker: BP), Statoil (ticker: STO) and Apache (ticker: APA).

As of December 2014, there are 5,406 active leases in the GOM. Of those, 979 of the leases are producing, with the total acreage of the producing leases standing at 4,784,426 acres.

One of the longest operating wells today, based on the BSEE’s information, is Fieldwood Energy’s Bullwinkle Field, which started production in 1989 and continues to this day. Fieldwood purchased the asset and associated Gulf projects from SandRidge Energy (ticker: SD) for a total of $750 million, according to the company. At the time of purchase in January 2014, the acquired assets had total proved reserves of 57,200 MBOE (51% oil) which was 72% developed. The field’s production was in excess of 25 MBOEPD.

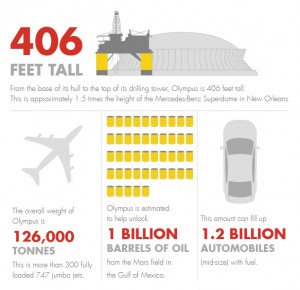

Source: Shell

Other notable projects in the Gulf of Mexico include Shell’s Mars B/Olympus, which is expected to have an estimated resource base of 1,000 MMBOE. The project’s current production capacity is approximately 100 MBOEPD and is expected to be reached in 2016. The Mars field to date has produced 700 MMBOE, with an expected field life that will last to at least 2050.

Anadarko’s Caesar/Tonga development in the Green Canyon area of the Gulf of Mexico has an estimated resource base of 200 to 400 MMBOE, and is expected to ramp up production to approximately 45 MBOEPD from three wells. BP’s Thunderhorse field has the capacity to produce 250 MBOPD and 200 MMcf/d.

Energy XXI, the largest operator on the Gulf of Mexico shelf, reported that it planned to develop its West Delta 73 program, which the company expects to produce 400 BOEPD from each of its 40 active wells, for a total of 16 MBOEPD. EXXI’s other projects, like Main Pass, Ship Shoal 208 and South Pass 49 also continue to deliver for the company. Main Pass wells have an estimated ultimate recovery (EUR) of 1,027 MBOE, and the Ship Shoal 208 and South Pass 49 blocks have EURs of approximately 2,480 MBOE per well. Guidance for 2015 includes production of 59 to 64 MBOEPD from more than 140 existing wells.

The Gulf boom is coming

Even as low oil prices continue to put pressure on onshore operators, the Gulf is getting ready for record levels of production. Analysts predict deepwater oil production is headed into one of the industry’s biggest growth spurts in history, reports USA Today. Production is expected to reach 1.5 MMBOPD by 2016, surpassing the previous record set in 2009. Production will increase 21% from 2014 levels this year and continue growing in 2016, according to Imran Khan, a deepwater GOM analyst at Wood Mackenzie.

Drilling in the Gulf of Mexico has come a long way since the first well in the Creole field was built on a wood platform back in 1938. A wood design was chosen so that the project could be easily abandoned if the operators were unsuccessful in finding oil. The well was drilled in 13 feet of water in a joint venture by Pure Oil and Superior Oil just a mile and a half offshore and only produced 4 MMBO in its first 25 years of production.

The rigs today are technical wonders, built to last. Such impressive structures are necessary in the Gulf now, when the wells are expected to produce from huge deposits for decades. At the end of 2013, the Department of the Interior estimated that 48 billion barrels of oil remained to be discovered in the Gulf. The new commodity environment presents a challenging chapter in the onshore shale boom, but production in the Gulf of Mexico continues, unabated, with its billion dollar projects ready to stand the test of time.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.