Production guidance raised, predicts 22% yearly growth

Gulfport Energy (ticker: GPOR) announced first quarter earnings today, showing net income of $90.1 million, or $0.50 per share. After excluding derivatives and other special charges, Gulfport earned $101.9 million this quarter, almost double the adjusted $52.9 million the company earned in Q1 2017.

Gulfport produced about 1.29 Bcfe/d in Q1 2018, comprised of 88% natural gas, 8% NGL and 4% oil. While this represents modest sequential production growth, only about 2%, it is higher than the company originally predicted for Q1 and at the high end of Gulfport’s previously announced full-year production guidance.

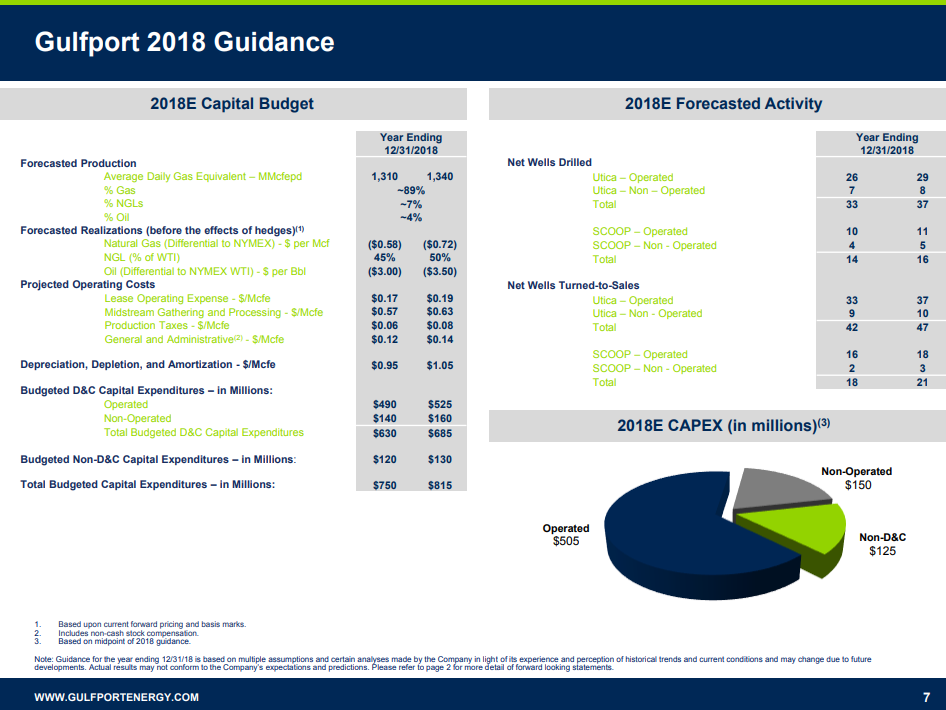

This outperformance has led Gulfport to increase its full-year guidance to roughly 1,325 MMcfe/d, from a previous estimate of 1,275 MMcfe/d. The company does not plan to increase its CapEx spending from previous estimates, with all $780 million funded within cash flow.

Utica midstream JV sold

Gulfport has had a busy year so far, with several important developments.

The company sold its 25% stake in Strike Force Midstream, a Utica gas gathering JV between Gulfport and EQT (ticker: EQT), to EQT Midstream (ticker: EQM). Gulfport received $175 million for the sale, and eliminated its capital obligations associated with the JV.

Gulfport brought a total of 12.8 net wells online in the quarter, split almost evenly between the company’s Utica and SCOOP properties. Operations during the rest of the year are expected to be less evenly split, as the company expects to bring a net 38.4 Utica wells and 12.8 SCOOP wells online in the rest of the year.

Previously-announced 2018 repurchase plan already completed

Gulfport provided an update on its previously-announced $100 million stock repurchase program, which was expected to run through the year. The company instead moved rapidly, and completed the program in full in Q1. With that in mind, Gulfport has decided to double the size of the program, repurchasing an additional $100 million in stock in 2018.

Gulfport CEO and President Michael Moore discussed the company’s results, saying “Gulfport began the year strong both operationally and financially, delivering on several of our strategic objectives planned for 2018. The outperformance of our base production wedge and new well delivery in the SCOOP positioned us well in the first quarter and led to an increase in our forecasted average daily volumes for the full year, highlighting the quality of our asset base and further bolstering the free cash flow generated from our 2018 activities. Gulfport remains steadfastly committed to funding our total 2018 capital budget from cash flow and estimate that roughly two-thirds of the capital budget will be invested during the first half of the year, with spend decreasing significantly in the third and fourth quarters.”

“We were opportunistic and aggressive with our stock repurchase program and completed the full $100 million authorization in the open market prior to the end of the first quarter. We remain committed to realizing the most value for our stockholders. As we evaluate the best uses of our available liquidity, we will consider a range of options, including stock repurchases and debt reduction, practicing discipline as we allocate capital to programs and strategic initiatives that we believe have the highest return potential. Furthermore, our commitment to demonstrating capital discipline is highlighted by our board’s decision to include a metric relating to Gulfport’s return on average capital employed into Gulfport’s 2018 annual incentive plan targets, which are intended to maximize the value of every dollar we invest and our commitment to the Gulfport stockholders.”

Q&A from GPOR conference call

Q: You didn’t need a liquidity event in the first quarter to start buying back the stock and now you’ve got one under your belt. So it looks like your EBITDA growth in the back half of the year will kind of get you down to where you want to be from a leverage perspective? I don’t want to put words in your mouth, but it seems like maybe you’re leaning toward further buybacks?

GPOR: So the Board approved an additional 100 million of stock buybacks. Certainly should we generate more cash in the back half of the year with proceeds from a liquidity event. We certainly have the ability to increase that. We had with the first a 100 million tranche. We certainly had line of sight to the Strike Force liquidity event, which gave us a lot of confidence to get started on that, quickly be aggressive and opportunistic. Obviously as expected we borrowed a little money here in the first quarter and that was per the plan. So as we move forward, the excess cash flow, as I mentioned to Neal will be a balance of debt repayment and stock repurchases. And then depending on how much we could possibly recognize and some other liquidity events, we’ll have to evaluate it at that time.

Q: I was hoping, maybe get a little bit more color on the out performance that you’re seeing in SCOOP right now. Evidence of the first quarter results and the guidance raise throughout the rest of the year, just curious what you’re seeing right now, is it sort of a shallower decline in the initial periods relative to the type curve, is it less amounts of downtime. Just any color there where you feel like your beating your internal projections?

GPOR: If you think about our beat here in the first quarter and even second quarter, that’s a combination across both assets. Really the base production performance, Utica and SCOOP. If you think about our base production, about a large percentage of that is our 2017 new wells that we brought on and those wells in both assets we really are performing our budgeted forecast. And then as you mentioned the SCOOP, we brought on the seven new wells and you add that on, and their continued out performance of our type curve really, really left us no choice, but to increase our guidance.

Yeah, and in the SCOOP, we’re definitely seeing that early on, initial rates are much higher. But something I think I mentioned in the first quarter call back in February, this pressure management that we worked on in the Utica for a number of years where we’re really focused on, not initial rates, but long-term production and preserving that frac that we just installed in the well. We’re doing that in the SCOOP now, gathering more data on it. And as we get more and more of that data, we’ll continue to see how the performance plays out.