GPOR Offers Stock, Debt to Finance Purchase of Paloma Partners

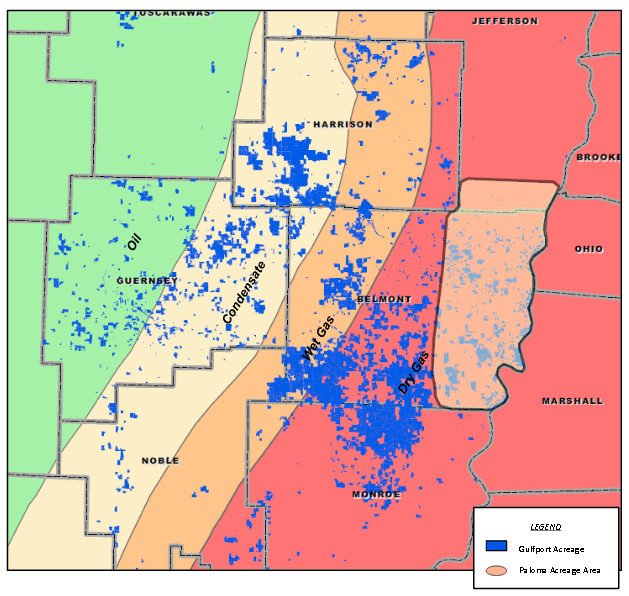

Gulfport Energy (ticker: GPOR) has increased its Utica Shale footprint to approximately 212,000 gross leased acres (208,000 net) with the purchase of 24,000 net nonproducing acres in Belmont and Jefferson Counties from Paloma Partners III, LLC. As announced in a news release on April 15, 2015, the sale has a price tag of $300 million and is expected to close in Q3’15.

GPOR believes the new acreage provides 150 drilling locations on 160-acre spacing and plans on adding a full-time rig to the area in Q4’15.

Analyst reports believed the deal was reasonably priced. SunTrust Robinson Humphrey put the deal in line with estimates and Capital One Securities said the cost was below its modeled price of $15,000 per acre. “We view the deal as fair but it was not inexpensive, which we think is an indication of the continued high level of interest for any remaining blocky portions of available acreage in the dry gas window of the Utica,” said the report from Capital One. “While it may not have come cheap, opportunities for operators in the Utica to add sizable chunks that overlap their existing positions will only become more rare.”

Paloma Partners is a privately held E&P company that had slated operations to begin in the region by late 2015. Gulfport’s other areas of operation include the Louisiana Gulf Coast and a 24.9% interest in an Alberta oil sands project.

Comparative Deals in Eastern Ohio

| Date | Buyer | Price (millions) | Acres (net) | Price/Acre | Spot Price at Time of Sale* | 3-Year Futures Price* |

| 4/16/15 | Gulfport | $301 | 24,000 | $12,700 | $2.68 | $3.39 |

| 11/5/14 | Antero Resources | $185 | 12,000 | $15,417 | $4.19 | $4.08 |

| 7/30/14 | PDC Energy | $35 | 13,000 | $2,692 | $3.79 | $4.12 |

| 6/9/14 | American Energy Partners | $475 | 27,000 | $17,592 | $4.65 | $4.29 |

| 5/7/14 | Antero Resources | $95 | 6,363 | $14,930 | $4.74 | $4.29 |

| 2/26/14 | Gulfport | $185 | 8,200 | $22,560 | $4.86 | $3.57 |

*Henry Hub price according to data compiled from Bloomberg

Prepared for the Move

Immediately after the M&A announcement, Gulfport padded its balance sheet with debt and equity raises, including:

- Private, Rule 144A unregistered upsized offering of $350 million aggregate principal amount of 6.625% senior notes due 2023, priced at par.

- Upsized public offering of 9.5 million shares of common stock at $47.75 per share (increased from 7.5 million shares). Net proceeds on the upsized offering, after discounts, expenses and commissions, will be approximately $436.4 million. Underwriters will hold a 30-day option to purchase an additional 1.425 million shares. The offering is expected to close on April 21.

The net proceeds of $786.4 million are intended to:

- finance the $300 million Paloma Partners acquisition;

- pay the current figure of $100 million in outstanding borrowings on its secured revolving credit facility of $450 million; and

- fund a portion of its 2015 capital development plan, which was listed at $545 to $595 million in its Q4’14 release (96% intended for Utica Shale development).

GPOR reported $142.3 million in cash on hand at year-end 2014. If the equity and debt raises are taken into consideration and used in the exact order listed above, approximately 93% of its 2015 development plan will be funded (granted adjustments have not been made to account for development of its new properties). Capital One Securities maintained its “Overweight” rating on GPOR and explained, “[The] moves to add to core acreage and slightly delever an already strong balance sheet, while posting stronger-than-expected first quarter production, all offset the 9% share dilution in our opinion.”

Gulfport has also secured additional firm transportation and will have total commitments of 900 MMcf/d, effective year-end 2016. An additional 54 MMcf/d will be added to its portfolio in April 2017. GPOR expects its 2015 volumes to double on a high-end, year-over-year basis, jumping to 432 to 480 MMcfe/d from its 2014 average of 240 MMcfe/d.

The company’s production for Q1’15 is off to a good start, with volumes averaging 424.4 MMcfe/d – far above its initial guidance of 384 MMcfe/d (midpoint), 11% higher than Q4’14’s average of 382 MMcfe/d and 161% higher than Q1’14’s average of 162 MMcfe/d. Wells Fargo called the guidance “conservative,” and implied a revised uptick is certainly possible.

The Best Ahead for Gulfport?

SunTrust Robinson Humphrey believes Gulfport will become cash flow breakeven by late 2016, fueled by a “strong balance sheet with sizable debt capacity, significant hedge contracts and prescient takeaway agreements.” The bolt-on acreage will contribute to more efficient operations in the region, and, as mentioned, GPOR has plenty of spare capacity in place for its future development.

Gulfport measures up favorably to its 86 peers in EnerCom’s E&P Weekly Benchmarking Report, with its debt-to-market cap percentage of 18% below the median of 62%, and its three-year production replacement coming in at 13th overall. When compared to its 43 large-cap and mid-cap competitors, GPOR’s production replacement ranks fifth and its change in production (on a percentage-based, trailing twelve month basis) leads the entire group. The company is one of only 13 E&Ps to post stock gains in the last six months. Its cash margin per Mcfe (on a trailing twelve month basis) of $6.07 ranked first out of 18 gas-weighted large and mid-cap peers.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.