Williston Basin sale has closed

Halcon Resources announced third quarter results today, showing net income of $419.3 million, or $2.82 per diluted share. The vast majority of these earnings are due to Halcon’s sales of its Williston assets, which generated a gain of $491.8 million. After adjusting for these sales and other special charges, Halcon reported a net loss of $9 million, or ($0.06) per share.

Halcon produced 28,859 BOEPD this quarter, down from the 36,308 BOEPD the company produced last quarter. This value will drop next quarter, as Q3 production includes output from assets Halcon has since sold. The company estimates it will produce 7 MBOEPD pro forma in Q4.

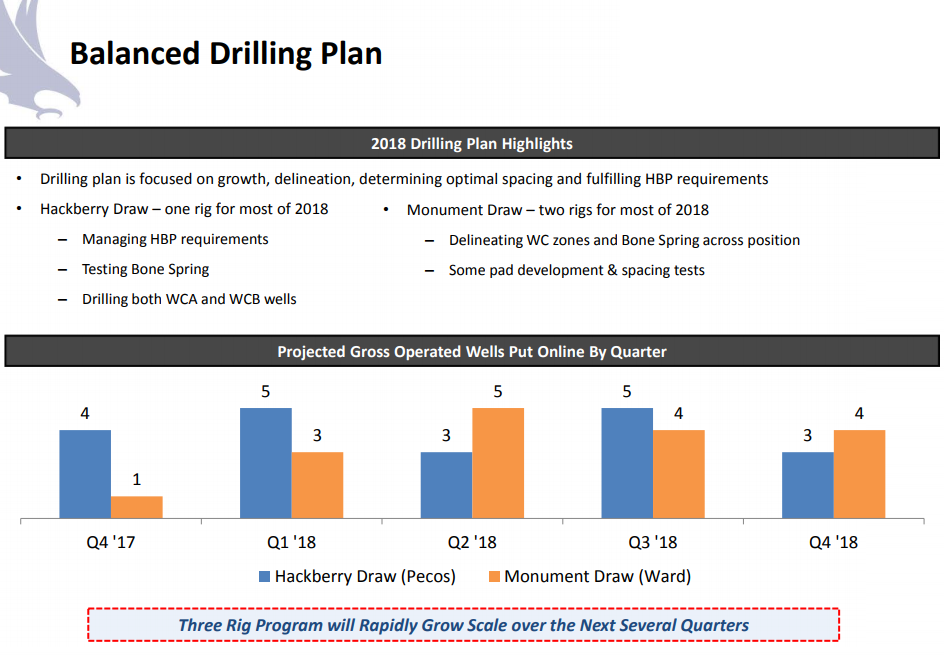

Current plans call for significant growth in 2018, as the company develops its Delaware properties. From 7 MBOEPD in Q4 2017, Halcon expects to grow about 215% to 22 MBOEPD in Q4 2018.

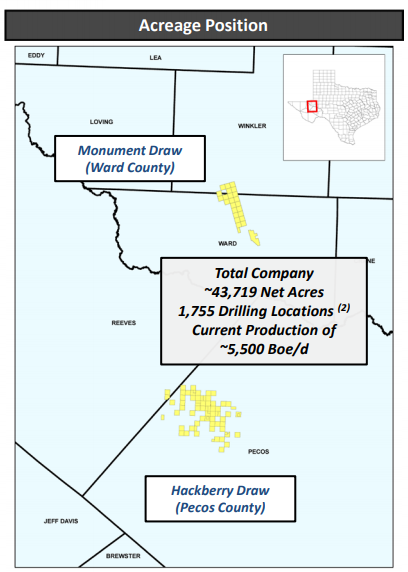

Halcon is now a pure-play Permian operator, with acreage primarily in Pecos County and Ward County. Halcon recently completed two 10,000 foot lateral wells in its Pecos County acreage, targeting the Wolfcamp A and B. These wells are still cleaning up, but the company reports early results are encouraging. The Ethel Jesper East 1H is outperforming its nearest offset well, which was put online in early 2016, and has an estimated EUR of 1.2 MMBOE.

Halcon is currently running three operated rigs, one dedicated frac fleet and one spot frac fleet. Current plans call for this situation to continue through the next year, using the spot frac fleet off and on when needed. At the moment, Halcon is drilling a Third Bone Spring well and two Wolfcamp A wells. A further nine wells are being completed or are waiting on completion.

Current plans call for drilling 23 wells through mid-2018, primarily focusing on the Wolfcamp B. completions will lag behind drilling activity, like in most other companies, as 21 wells will be brought on sales through the first half of 2018.

The company will use the proceeds from its Williston sale extensively to fund this growth, as Halcon Chairman, CEO and President discussed. “Our 2017 acquisition, divestment and financing activities have set us up to deliver strong, responsible growth over the next several years. Our 2018 guidance assumes a three rig program and results in year over year pro forma production growth of 280%. If we were to keep three rigs running through 2019, we would expect to achieve cash flow neutrality by the end of 2019 while generating significant growth with production of around 35,000 boe/d by year end 2019. Higher oil prices would shorten the time to our achieving cash flow neutrality. All of this can be accomplished without the need for additional capital while keeping our leverage levels very low. We continue to like the performance we are seeing in our wells in addition to the wells of offset operators near our acreage positions. Our drilling plans over the next year include a combination of development drilling, spacing tests, some delineation drilling in Monument Draw and a bit of drilling to hold acreage in Hackberry Draw. In addition, we plan to test the Bone Spring in both areas over the next 6 months.”

Q&A from today’s Q3 earnings call

Q: On comparing Ward and Pecos, you’ve given us some EUR guidance broadly, but could you compare and contrast the two areas in terms of well costs kind of taking as depth oil cut, any early expectations that you can share with us?

HK: Our Ward County area is more complex geology, but really Pecos is fairly homogeneous. So that’s one way to look at both of those areas. Pecos County, we’re getting some amazing drilling results that’s included in our slide pack. We’ve recently drilled the 10,000 foot lateral in 18.5 days from spud to TD, which is a pretty solid result. We expect it to improve upon that.

With those type of drilling results, you’re going to see a lower cost structure in Pecos County and that’s noted in our deck as well. Both areas have outstanding EUR or expectations the type curves and results thus far show that. So, the south area of Ward County being about a 1.8 million barrel type curve on a 10,000 foot lateral, very strong results there, but in Pecos County, we’re seeing with our type curves and our well results with existing PPDs 1.1 million barrels to 1.3 million barrels. That’s our expectations.

Q: Over the past few quarters, a number of the major E&Ps and the Permian have moved towards patch completions or they’ve talked about cube development of multiple productive zones to avoid parent child production effects on pad completions. I’m just wondering, what your view is on this issue and how it will affect your pad development practices if any?

<A>: So we’re somewhat smaller than some of those companies. It’s the obvious right answer to do that kind of development, but I think, I need to suggest that at least for our company we need to step back and fully evaluate in all ways that we can what’s our frac jobs or leading us to – in terms of spacing. So I am – we are absolutely not prepared to cube out one of our drilling spacing units right now. Even if we were willing and have the fortitude to be on a pad like that for over a year and not have any income out of it, which were just not set up for that, as you know right now either. And we’re very conscious of the parent-child relationship in all of these plays, we measure the hits, we get in producing wells and when wells are proximate, Jon is fracking them simultaneously or zipper fracking them and not put them on until the same time. So we’ll do the best as we can to narrow the difficulties you might have from those things, but we’re – again, we’re not really in a position to drill 20 wells or 30 wells in one cubular development and we’re still evaluating some of the other zones in these areas.

The upper Bone Spring, the Third Bone Spring, coming relatively clear. Then we’ve got some deeper zones in the Wolfcamp and if you’re really going to do a cube, I mean, you pretty much need to have all that stuff in front of you.