Halliburton and Baker Hughes decide to terminate merger

The world’s second- and third-largest oilfield service companies, Halliburton (ticker: HAL) and Baker Hughes (ticker: BHI), announced the termination of their proposed merger agreement. The deal, which was worth $35 billion before the crash in commodity prices and $28 million yesterday before the announcement, met with heavy resistance from the U.S. Department of Justice, which felt the deal violated anti-trust concerns.

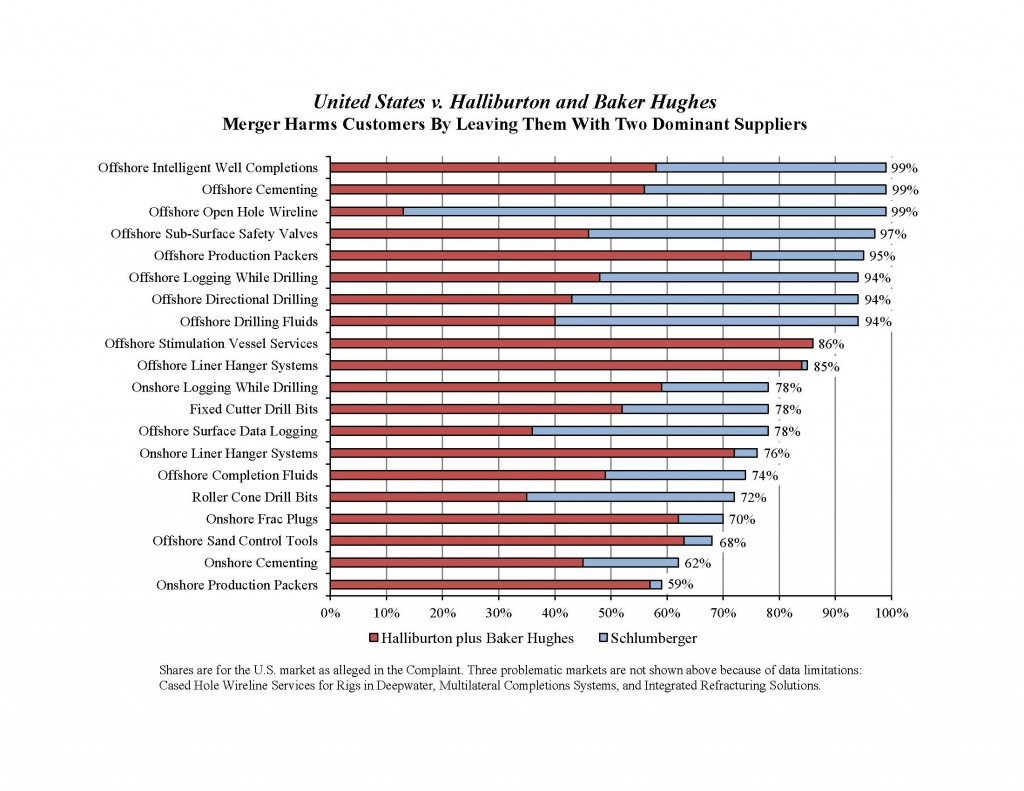

Bill Baer, the head of the DOJ’s anti-trust division, went as far as calling the deal “unfixable” and assailed the companies for proposing “the most complicated array of piecemeal divestitures and entanglements” he had ever seen. Baer and the DOJ felt the deal would leave an unacceptable number of oilfield service segments in the hands of the new combined company and Schlumberger (ticker: SLB), the world’s largest oilfield service provider.

“While both companies expected the proposed merger to result in compelling benefits to shareholders, customers and other stakeholders, challenges in obtaining remaining regulatory approvals and general industry conditions that severely damaged deal economics led to the conclusion that termination is the best course of action,” said Dave Lesar, chairman and CEO of Halliburton, in a combined press release.

Baker Hughes Chairman and CEO Martin Craighead echoed Lesar regarding the anti-trust issues, saying “This was an extremely complex, global transaction and, ultimately, a solution could not be found to satisfy the antitrust concerns of regulators, both in the United States and abroad,” highlighting the difficulty of meeting anti-trust concerns.

Halliburton and Baker Hughes look for buyers for billions of dollars in assets

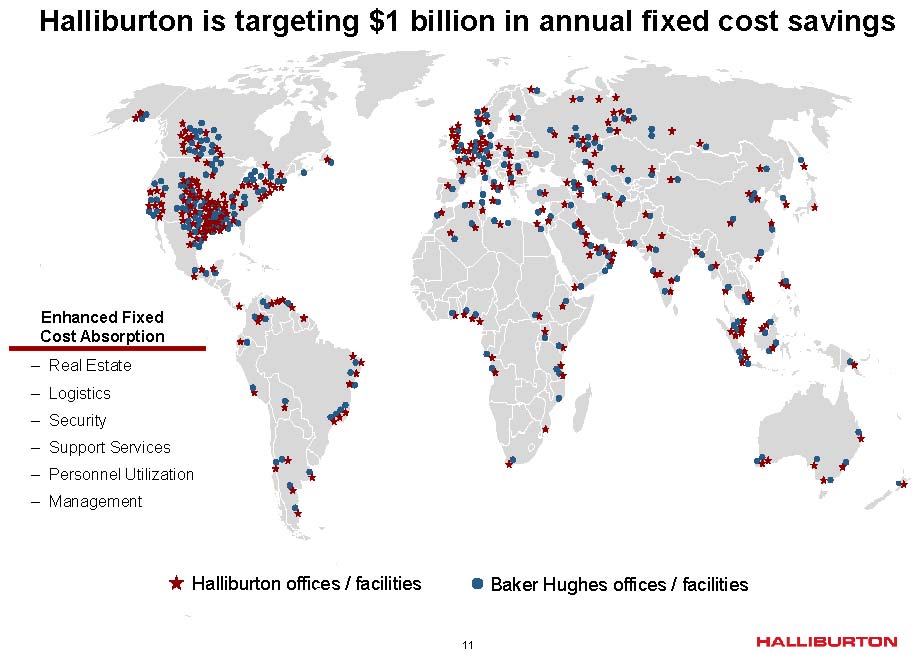

The companies searched for buyers interested in the various business segments HAL and BHI hoped to sell in order to meet anti-trust standards, but were unable to close on deals to satisfy the DOJ.

The two oilfield service companies were in talks with General Electric Co. (ticker: GE) regarding certain assets, but were unable to come to an agreement on price, reports The Wall Street Journal. These negotiations were followed by others with private-equity firm Carlyle Group, which specializes in creating stand-alone businesses from castoff units of larger companies, for more than $7 billion in assets.

The assets up for sale to meet the regulatory concerns on Halliburton’s side included its expandable liner hangers business, fixed cutter and roller cone drill bits, and its directional drilling and its LWD/MWD business. Baker Hughes was searching for buyers for its core completions business, which includes its packers, flow control tools and subsurface safety systems, its sand control business in the Gulf of Mexico, and its offshore cementing business in Austrailia, Brazil, the Gulf of Mexico, Norway and the United Kingdom.

Halliburton and Baker Hughes merger becomes target for DOJ

Aside from the anti-trust concerns centered on the merger, the DOJ also took action against ValueAct Capital, a hedge fund associated with both companies, increasing the complexity of the merger.

The Department of Justice alleged that ValueAct, which holds a stake in both HAL and BHI, did not disclose its activist status in line with regulations. The fund held a position in Halliburton starting in 2012, buying into Baker Hughes shortly after the deal was announced. In January 2015, ValueAct filed a disclosure showing more than a 5% position in BHI, the threshold at which the fund has to disclose whether it is a passive investor or an activist.

The DOJ said emails dated December 5, 2014, the day ValueAct’s Halliburton holdings crossed the 5% marker, a ValueAct partner sent an email to the fund’s founder and CEO Jeffrey Ubben suggesting a new compensation structure for HAL’s chief executive. The DOJ argues that this exchange marks more than a passive interest in the companies’ governance, a claim ValueAct said it plans to fight.

The market largely expected the deal to fall through

Despite the complications surrounding the deal, news that it would not proceed was largely unsurprising for markets today, which expected the two companies might part ways considering the significant headwinds from regulators. As the April 30, 2016, merger deadline approached with no apparent headway being made with the DOJ, analysts began to speculate about how the two companies might look on their own, with most concluding that the end of the merger agreement might not be such a terrible outcome.

“Given the recent market movement, we believe the deal overhang has become greater than is warranted and both stocks actually appear to exhibit value without the deal,” read a note from Raymond James on April 6. The analysts also felt that “Halliburton’s growth prospects are one of the strongest given its outsized exposure to U.S. pressure pumping, which should be first to recover.”

Baker Hughes looks to use $3.5 billion termination fee to reestablish itself in the market

Baker Hughes, in particular, looks to gain from the end of the merger. The company will receive $3.5 billion this week from Halliburton as part of the termination.

In a separate press release from BHI today, the company said it would use the money “reduce costs and simplify its business, enhance its commercial strategy, and optimize its capital structure.” Baker Hughes plans to use the fresh infusion of cash to buy back $1.5 billion in shares (roughly 7% of market-cap), and pay off $1 billion in debt.

Currently, the company has $3.8 billion in debt with nothing drawn on its $2.5 billion credit revolver, which the company said it plans to refinance before it expires in September 2016. The company’s debt is just 20% of its market capitalization, well below the oilfield service median of 55% on EnerCom’s OilService Weekly. The company’s strong balance sheet will be further enhanced by the capital BHI will receive following the end of the merger negotiation.

The next set of loans to come due for the company are a pair totaling $1 billion, due in 2018. While it is unclear if BHI plans to use some of the $1 billion it is allocating for debt repayment for longer-term debt, if the company decides to pay off the debt coming due in 2018 completely, it will have until 2021 before any other loans fully mature.

In 2015, the company paid $242 million in interest payments. BHI estimates that total interest payments on its debt as of December 31, 2015, over the next five years will total $943 million, according to the company’s 10-K. Paying down debt and removing some of the interest payments could play a part in the company’s wider goal of “broader structural changes,” which it expects to result in $500 million in annualized savings by the end of the year.

Pursuing global markets while maintaining a “selective footprint” in the U.S.

As part of the wider changes Baker Hughes plans to initiate now that the merger is dead, the company said that it will look to “[evolve] its go-to-market strategy to align with a changing marketplace and maximize its return on invested capital.”

In EnerCom’s weekly, Baker Hughes has an ROIC of 8%, below the group median of 14%, giving it good reason to focus on this particular metric.

In order to achieve that goal, BHI plans to build a broader range of global sales channels for select countries, including tailored operating models. Baker Hughes said this would allow the company to take its products to market more efficiently and participate differently in existing markets with lower investment and fewer risks.

While the company looks to strengthen its presence in global markets, it said it would maintain a “selective footprint” in its U.S. onshore pressure pumping business. BHI struggled with the logistics of integrating BJ Services, a hydraulic fracturing firm it acquired in 2010, which included delivering massive amounts of sand, water and manpower to well sites around the country. Staying focused in other areas could make the transition back into an already difficult market easier.

“As we implement these changes, we remain focused on running the business efficiently while capitalizing on our strengths as a product innovator to create new growth opportunities,” said Craighead. The company is “energized to turn [its] technology expertise into the latest game-changing product innovations that create even more value.”

The restructuring should allow for the company to remove some capital overhang which it held as part of the deal. Analysts at Stephens felt the process could take 12-18 months, increasing inefficiencies as the company works through the process.

Halliburton also sheds some dead weight following the end of negotiations

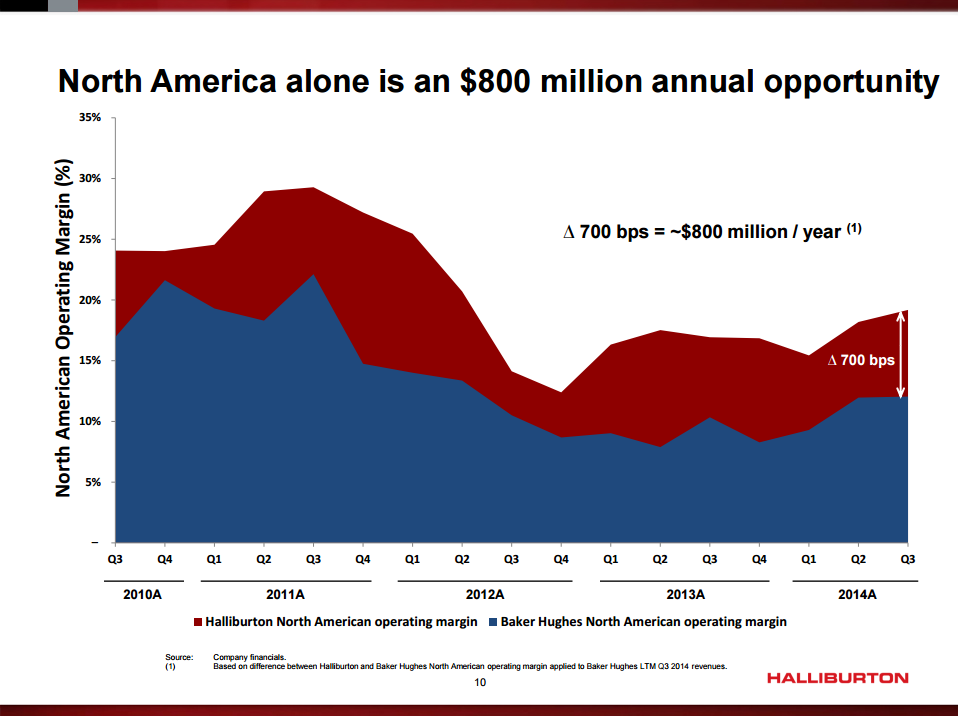

The larger of the two oilfield service giants also has some upside in negotiations ending without a merger, said a note from Raymond James today.

HAL is currently holding around $300 million in annual excess costs in North America due to the merger, said Raymond James, which the company could quickly right-size. “While the $3.5 billion termination fee would be a headwind,” notes Raymond James, the capital “has already been financed through the company’s recent debt offering in anticipation of the merger and would leave the company at just ~27% net debt-to-cap.”

Combined with a strong North American supply chain, Halliburton looks well positioned to scale activity as prices improve.

The company may also be ready to purchase other technology focused competitors now that it is free from the Baker Hughes merger. An analyst note from early April suggested that the end of the deal could kick off a wave of consolidation throughout the oilfield service sector. Halliburton could go after smaller targets that would not draw the negative attention of the DOJ in the same way the Baker Hughes deal did.

The ugly side of the deal

While both companies appear relatively well off even as their merger falls through, neither has been able to escape the oil price downturn that has battered their competitors and the E&P companies they work with, alike.

Halliburton announced last week that it would cut another 6,000 jobs, meaning the company has downsized by roughly one-third since late 2014. Baker Hughes, similarly, has reduced its workforce by more than one-fifth since year-end 2014 when the company reported employing 62,000 people. BHI’s 2015 annual report showed the company employed 43,000 people. A report from Forbes indicated that at least 13,000 of those employees were laid off.

While much of this is likely due to the price of oil, Baker Hughes did list the merger as a potential risk to retaining employees. In its 10-K, BHI said the merger could “adversely affect [its] ability to attract and retain key personnel during the pendency of the merger.”

Baker Hughes saw a 30% reduction in its general and administrative costs from the time the deal was announced in the fourth quarter of 2014 to the first quarter of this year. As the company shed positions along with the rest of the industry, its G&A costs fell from $294 million at the end of 2014, to $207 million in the most recent quarter.