Includes $3.5 Billion Payout to Baker Hughes if Merger Fails to Gain Antitrust Approval

The rumblings of a landmark oilservices deal that began on Thursday evening came to fruition over the weekend. By Monday, November 17, 2014, Halliburton (ticker: HAL), the second largest oilservices provider, announced plans to merge with rival Baker Hughes (BHI). BHI, the world’s third largest oilservices provider by market capitalization, provides HAL with a greater stake in the United States.

Total consideration for the deal is an equity value of $34.6 billion on consideration of $78.62 per BHI share (40.8% premium). BHI shareholders are in line to receive 1.12 HAL shares and $19 in cash for each share of Baker Hughes, equating to a split of 76% stock and 24% cash. Following its completion, BHI shareholders will own approximately 36% of the new HAL. The transaction was unanimously approved by both Boards and is expected to close in 2H’15. The proposed new Board of Directors will expand to 15 members, with three additions from BHI.

Source: HAL/BHI Merger Presentation

Halliburton, Pro Forma

According to a Halliburton news release, the combined company will hold operations in more than 80 countries and totaled 2013 revenues of $51.8 billion. It will be based in Houston, Texas – HAL’s headquarters.

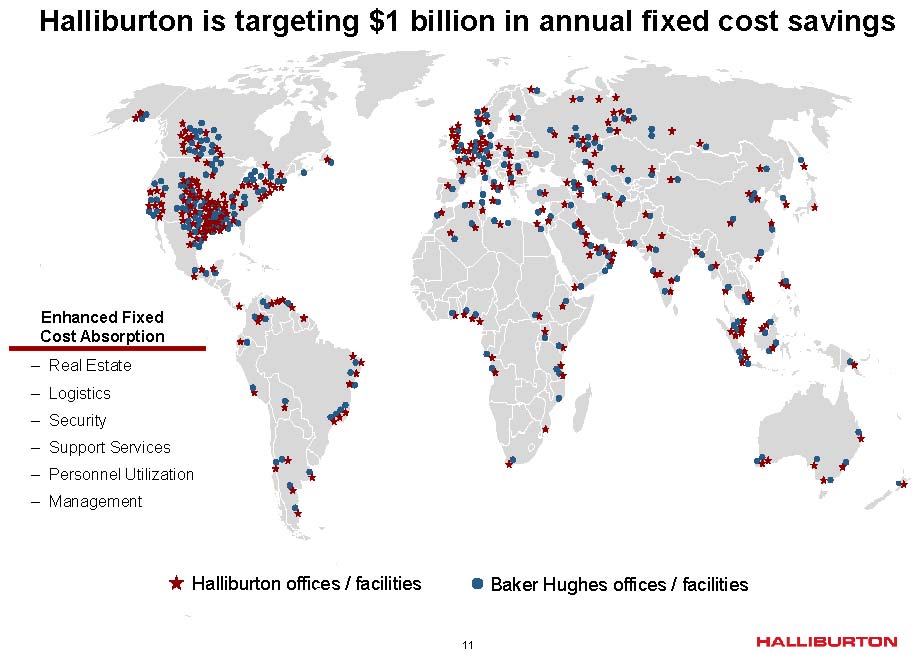

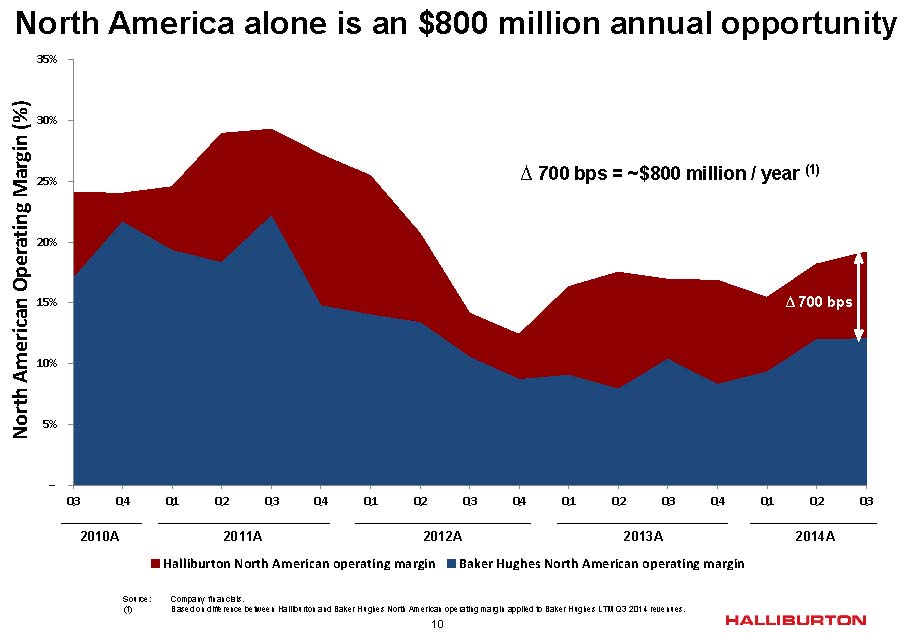

“Once fully integrated, Halliburton expects the combination will yield annual cost synergies of nearly $2 billion,” said Dave Lesar, Chairman and Chief Executive Officer of Halliburton, in a conference call following the release. “These synergies are expected to come primarily from operational improvements, especially North American margin improvement, personnel reorganization, real estate, corporate costs, R&D optimization and other administrative and organizational efficiencies.”

Management said it expects the deal to be accretive to Halliburton’s cash flow by year-end 2015 and accretive to earnings per share by the end of 2016. The combined company expects roughly $2 billion in pre-tax synergies, including $800 million on improved logistics and efficiency, and another $1 billion in fixed cost savings related to real estate, personnel utilization and support services.

Management identified executing its key strategies in three areas, including;

- Unconventionals, supported by its sub-surface technologies,

- Deepwater, with complementary technologies to increase reliability, and

- Mature fields, by finding bypassed pay zones and optimizing production.

Source: HAL/BHI Merger Presentation

Shareholder Return

Capital One Securities said the deal is “extremely positive” for both sides in a note released the day of the announcement.

Raymond James awarded both companies with a “Strong Buy” rating, but warned of a “long, drawn out process” on the legal side involving the Department of Justice. The firm does believe the deal holds accretive cash of 5% to HAL shareholders. Mark McCollum, Chief Financial Officer of Halliburton, reminded the public that the company recently announced plans to increase HAL’s dividend by 20% – nearly double the quarterly dividend for the previous two years. “We’ve returned $7 billion in cash from dividends and share repurchases since 2010 and remained focused on achieving cash returns of 35% of operating cash flows to shareholders going forward,” he said in the conference call. “The proceeds from the breakage will likely be used to buy back shares in coming years. And so we’ll be able to adjust the leverage as we go through the buybacks and get our final financing in a way that we’ll still have a very strong investment-grade credit profile, but don’t expect that this is where we’re going to end up on a debt-to-equity ratio when the smoke clears.”

The Department of Justice Hurdle

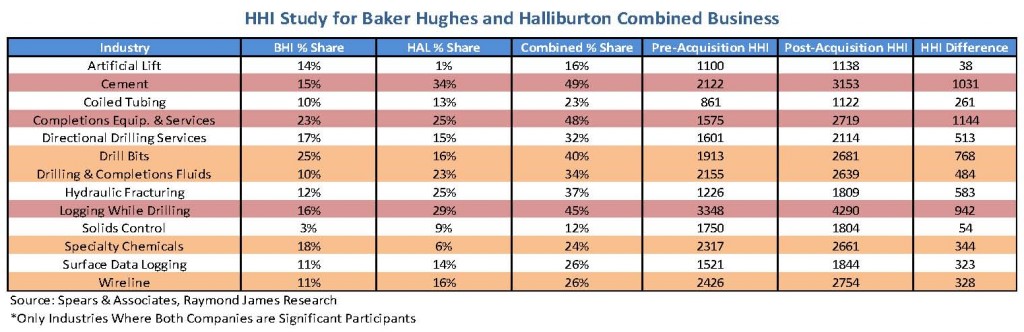

Several analyst notes prior to the transaction questioned HAL’s ability to complete the deal with the Department of Justice. Raymond James’ note on Friday said: “As demonstrated below [with the Herfindahl-Hirschman Oilservices Index (HHI)], we expect the DoJ to place scrutiny on a number of segments. The market segments that screen the most concerning by this metric are Cementing, Completions Equipment and Services, and Logging While Drilling.” HAL management specifically pointed out its intent to grow its prominence in with artificial lifting in the call.

If necessary, HAL and BHI have both agreed to divest segments that generate up to $7.5 billion in revenues if they receive any brushback from the DOJ. Lesar said discussions with regulatory authorities have already begun. “We have the best antitrust counsel available on this, and we clearly would not have done this deal if we didn’t believe it was achievable from a regulatory standpoint,” he said. “That’s why the reverse breakup fee is there and at the size it is because we are absolutely confident that we’re going to get this thing done.”

The current instability of commodity prices, combined with the length of finalizing the deal, may also play a more prominent role in the long term. In a note from Susquehanna Financial Group, the firm said “Market share losses and execution challenges have plagued the company in the past and could be an overhang going forward.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

Analyst Commentary

Raymond James & Associates (11.17.14)

The potential Baker Hughes and Halliburton merger would significantly change the landscape of the oil service market, combining the second and third largest oil service companies worldwide. Both Halliburton and Baker Hughes have very similar operational structures with ~50% leverage to the North American market and a robust completions portfolio centered on pressure pumping. While it is certainly possible that a deal can be struck, it would likely require high scrutiny by the Department Of Justice (DoJ, as demonstrated by our study of the Herfindahl-Hirschman Index impacts). Nevertheless, a potential acquisition would be a game-changer for the entire oil service arena.

* The Potential Deal: Yesterday, speculation began regarding a potential deal in which Halliburton was in talks to acquire Baker Hughes. Baker Hughes later announced that it was in "preliminary discussions" with Halliburton regarding a potential merger, though it wouldn't indicate anything further. The potential acquisition would combine the second and third largest oilfield service companies worldwide, and would create the second largest company in the oil service arena, just behind Schlumberger. Given the strength in Baker Hughes's business, we would expect that if an acquisition were to occur, it would occur at a higher share price than Baker Hughes's current market value. For reference, Baker Hughes's current market cap of ~$25.4 billion implies a ~5.1x 2015E EBITDA multiple on RJ estimates, roughly equivalent to Halliburton's current 2015E EBITDA multiple. While it would appear an acquisition of equals could be difficult, we would expect a considerable level of synergies could still allow for an accretive acquisition to occur.

* Why Would Halliburton Want Baker Hughes? Halliburton and Baker Hughes have significant overlap in terms of operations, with both companies operating in most of the same market segments, namely an overall ~50% North American market share. However, this is an opportunity for Halliburton to look to further grow its footprint in the North American oil service market and develop itself as the leader in the growing market. With one of the major discussions in the industry focusing on the integration of services, this larger company would be able to offer a more full scale suite of services. It could also offer an opportunity to step further into the coveted artificial lift market, as well as an entry into the Baker Hughes-Aker subsea alliance.