North American revenue up 14%

Halliburton (ticker: HAL) has taken its standard place as the second major oil and gas service company to report quarterly earnings, releasing results today, on the heels of competitor Schlumberger (ticker: SLB) which reported Friday.

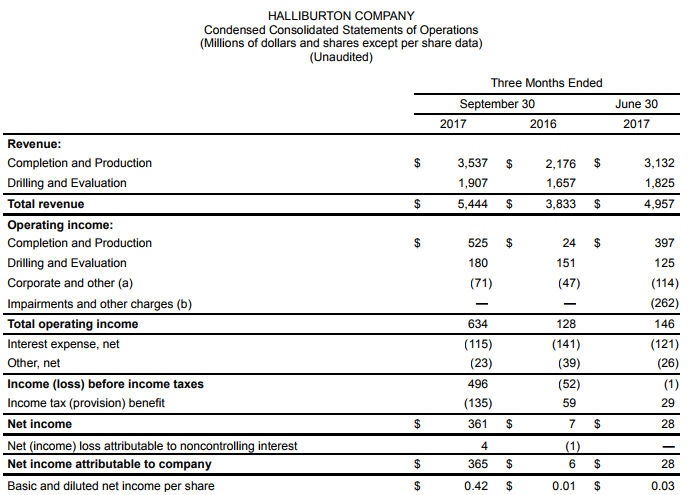

Q3 Stats

Halliburton President and CEO Jeff Miller said “We had a strong quarter and I am very pleased with our results. Our North American business is hitting on all cylinders and our international business proved resilient in a challenging environment.”

Halliburton’s Drilling and Completion divisions accounted for most of the increased revenue in Q3, with the divisions seeing revenue increase by 4% and 13%, respectively. This growth was achieved despite the effects of Harvey, which caused completions margins to drop by about 50 basis points.

Miller elaborated on the effects of Harvey, saying “In August, the Texas Gulf Coast was severely impacted by Hurricane Harvey, and our fantastic employees worked closely together to support those in our organization and the entire community affected by the storm. As a result of the weather, we had a few customers temporarily suspend activity in both the Gulf of Mexico and the Eagle Ford.

“We also experienced increased costs because diesel fuel was temporarily unavailable and reduced efficiency due to sand supply chain disruptions, both of which negatively affected our margins for the quarter. In spite of these disruptions, the sophistication and hard work of our supply chain organization allowed us to quickly adapt to these challenges and continue to execute and deliver superior service quality.”

Overall, North American revenue increased by 14% sequentially, which outperforms the land rig count growth of 6%.

Total sand use up, but sand-per-well flat

Miller also commented on some of the industry trends Halliburton has observed. Sand usage is one of the main topics in discussions of modern completions, as many wells use tremendous amounts of sand in fracturing jobs. However, Halliburton has not seen some of the trends in sand usage that are often reported.

“During the third quarter,” Miller said, “total sand volume for Halliburton continued to increase but our average sand per well remain sequentially flat.

“Data points from the last two quarters and my discussions with customers indicate customers are focused on cost-effective production. They hear a lot of conflicting anecdotes about sand use today because they’re based on individual operators and individual basins. But the facts are for Halliburton, sand per well was down in the Bakken, Rockies and Northeast and it was up in the Permian basin.

“This happened because customers that know the production characteristics of the reservoirs have streamlined their operations to focus on cost per barrel of oil equipment and are optimizing sand utilization. Conversely, those customers that are still drilling the whole acreage or exploring production boundaries of their reservoirs are continuing to pump jobs with higher sand loads. At the end of the day, Halliburton benefits from both scenarios.”

Companies try to avoid slowing down for maintenance

An additional current trend is steadily increasing completions intensity. Large sand volumes require large amounts of horsepower to complete an effective job, which means the wear and tear on equipment is increasing. According to Miller, most companies are deferring maintenance work to avoid slowing operations. “A proxy for deferred maintenance and the simplest place to see it is in the industry horsepower per crew size. And while Halliburton continues to operate with an average fleet size of 36,000 horsepower per crew and have for the last several years, the rest of the industry is now averaging closer to 45,000 horsepower per crew. Deferred maintenance is creating this equipment redundancy on location.”

International requires “higher for longer” prices to resume activity

The outlook for the international market is not quite so positive, however. International projects are not able to move as quickly as U.S. activity, and require confidence in sustained higher prices for investment to resume.

“Outside North America, Miller said, “our more conservative outlook for the last several quarters is proving accurate. Our customers around the world have different breakeven thresholds and production requirements that all face the headwinds of the current commodity price environment. Due to lower cash flow and project economics, they are more focused than ever on lowering costs. The result of this combination is less activity and more pricing pressure.

“In contrast to North America, where we believe that a $50 oil price drives significant activity, customers tell me the longer-duration international markets will react less to absolute oil price but more to a positive view of where price will be for several years. This isn’t surprising given the longer investment cycle that many of our customers face.

“I believe we that we found a floor in the international rig count earlier this year. However, due to the longer-term contractual nature of international markets and the level of continuing price pressure, I expect discounts will offset activity gains over the near term.”

Q&A from HAL Q3 conference call

Q: Back in September you’d talked about how HAL is not interested in financing E&P projects. It’s been a subject that’s been coming up quite a bit lately. Can you update us on your thoughts around performance-based contracts? And is there any desire on Halliburton’s part to invest in these type of projects alongside your customers?

Jeffrey Allen Miller: Yeah. Thanks. This is for us we call that integrated asset management and it is really a capital allocation question. And it’s where do we put our capital and what will make the best returns. And so – and along with those better returns, in my view, a key part of that is asset velocity and to produce returns for our shareholders. And so we’re not going to tie up our cash in things that we think have longer duration and likely lower returns. We have done some smaller deals. We’ve done a few things. We understand this space. And when we do it, we’ll do it with other people’s money to maintain those kind of returns.

Q: I wanted to start with your digital transformation strategy. I think Halliburton is doing more than many investors realize. Can you discuss your broader strategy around this effort, such as the OpenEarth initiative, the Microsoft alliance. And importantly, are E&Ps more willing to share data in the current environment, or how do you work around their reluctance to share data if not and still deliver value-enhancing tools?

Jeffrey Allen Miller: We’re very excited about our strategy and I think we’ve laid that out, but it is – at its heart, and this is an important distinction, an open architecture strategy which makes it a lot easier for customers to use. I think there will always be competition around data between customers. And I think customers are taking a closer and closer look at their own data and who owns and controls that data, and I suspect they will control it more so. I mean, it’s just very competitive for our customers. And so when we think about that, we want to make certain that we have the right set of tools that can be used effectively by them. And they’re open in the sense that our customers’ uptake of those tools, then they can make them do what they need them to do.

And I think tools is probably an oversimplification, I’m describing more of a platform and a philosophy. But as we work with the Microsoft, for example, that’s again an ability to leverage I think a lot of investment and R&D and cloud that will help our customers. But again, I will tell you, we are very returns oriented. And so when I think about what we do, we’re very specific about where we create value and what accrues to us versus necessarily scatter shooting across the space.

Q: What are you hearing from your customers regarding their potential response to falling sand prices as the new local Permian mines come on? Do you anticipate them using more sand per well? Does that uptrend begin anew? Do they simply go out and drill more wells which you may hear about through in discussions around fleet expansion? How do you think they respond to falling sand price, particularly in the Permian?

Jeffrey Allen Miller: Well, lower cost will create more headroom for our clients to work, no question. But I think the more important dynamic in the Permian than price necessarily today is, as they better understand those reservoirs and how to make the best production at the lowest cost per BOE, that’s why I held out the Permian as one where we see sand per well increasing, and I think that’s more evidentiary of a market that’s being learned as opposed to one being optimized, and that is – makes perfect sense, and that’s what our customers do.

I mean, they make the best investments and they manage their business very carefully. And so when they make decisions to do more of something, there’ll be a reason for that, I think that’s more the reason in West Texas today. As reservoirs are better understood in other parts of the country, that’s where you start to see more of that optimization. But I would expect that it does free up more cash for doing more work, which is certainly positive, but I would not assume they don’t optimize in West Texas at some point either.