SM Energy Recently held its Q2 Earnings Call. Selected excerpts from the call are below.

Q: As we look at CapEx coming down a little bit in the fourth quarter and a large pad looking to start up sometime during the first quarter, realizing that can move around, what’s the thoughts around the potential for fairly lumpy growth as you move out of the back half of 2018 and into the start of 2019?

Executive VP of Operations Herbert S. Vogel: If you look at it, we’re on a growth trajectory and the Permian’s definitely got some great momentum going and we should see Permian grow into 1Q 2019 but by how much it grows will really depend on that big Merlin-Maximus set of pads, the 25 wells. So, as we get closer to the end of the year, we’ll pin down where we’re actually going to be 1Q versus 4Q. So that’s really where it stands. But you got it right that it’s going to be lumpy for those 25 wells coming on line or any time we do the co-development on big pads.

Q: Okay. And then, I guess, just following up on the Merlin-Maximus pad, how do you guys look at infrastructure and takeaway, I guess on two parts, one on the gathering and processing and just general oil transportation on the pad and around the pad, and then on the long haul as well from kind of such large slush production?

Executive VP of Operations Herbert S. Vogel: Okay. So there’s a lot there in your question, but the key is that we really planned ahead for this and we have very good ability to forecast what the volumes are going to be out of the wells. And there’s some timing issues, but we’re building the capacity and then we have the ability to tie-in pads nearby so that it’s efficient capital-wise on the facility’s sizing. In terms of the takeaway, I think you probably heard in the remarks from yesterday that we’ve got all our forecasted volumes pretty much lined out on where they go and who’s taking them and they’re all firm contracts. So that’s all already integrated into all our plans.

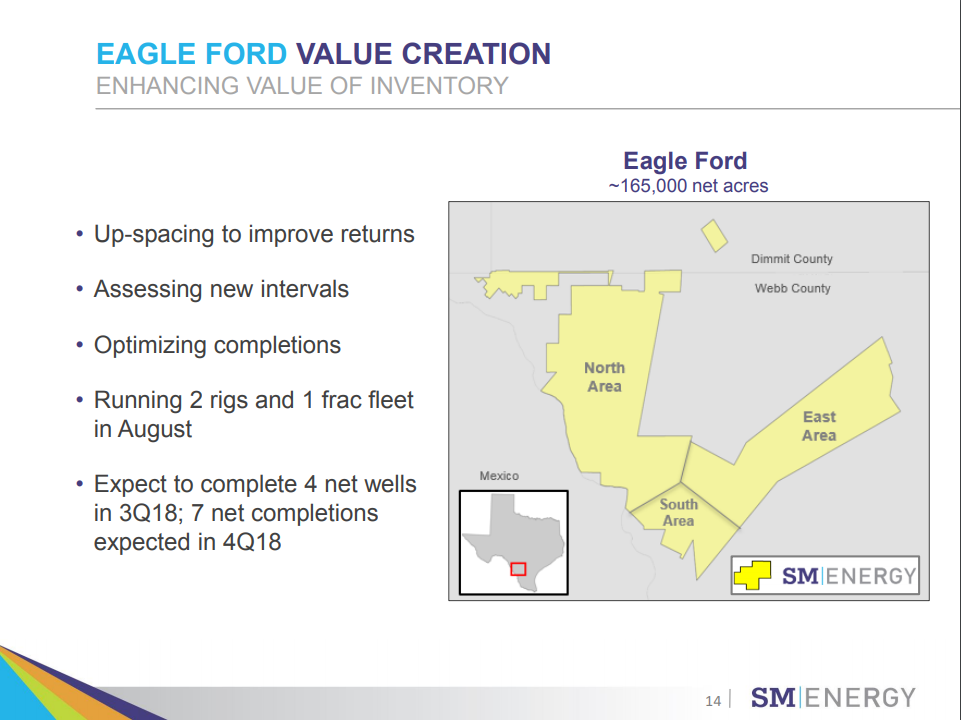

Q: I was hoping that I could get more color on [Eagle Ford valuation], specifically, the comment that says in this current commodity price environment, because that implies to me that as long as oil is above $60, this is an area that maybe not can compete one-to-one with what’s going on in the Permian, but does have an attractive quality to it that fits the SM model. Is that the way to look at it?

President and CEO Javan D. Ottoson: Well, that’s kind of an interesting question. I guess our view of this is that we’re talking really about the gas price environment in the Eagle Ford because it’s largely a gassy asset. It’s a great asset, but obviously we started developing that asset when gas prices were much higher. So we’re adjusting our spacing, adjusting our program to the fact that we think gas is going to be $3 or a little less for a significant period of time.

So what we’re doing through the up-spacing, longer laterals, better completions that we’re doing, is we’re really pushing that project to make the kind of returns that we make in the Permian so that we can be truly competitive there. And as we said a bunch of times, we think our best course of action for now in the Eagle Ford is just to further demonstrate what we believe is the large value of our undeveloped acreage there.

Q: Okay. So, it’s not like you’re targeting things that are more of liquids; it’s just that you’re trying to make it more attractive or you’re trying to figure out what you have that can work in a $3 price environment. Is that the way to look at it?

President and CEO Javan D. Ottoson: I think we know that this acreage will work in a $3 price environment if you drill at the right spacing. Over time, what we had done when gas prices were higher, we had drilled this down to a much tighter spacing. This is Javan by the way. And what you’ve seen, and Herb talked about this during the recorded comments, is we have progressively now started moving back to a wider spacing and drilling much longer laterals. And we know based on our history in the asset and the work we’ve done that those longer lateral, wider spaced wells can make much higher returns in this gas price environment.

Your comment on higher liquid content, we are looking at landing zones that have higher liquid content. In fact, Herb mentioned the Austin Chalk just a minute ago. Clearly, we anticipate those having higher liquid contents as well, which simply improves the economics as we look at that. NGL prices, of course, have been very strong and all this is wet gas generally, and so NGL prices have actually been significantly helping our economics. So the overall position here is we have a very sizable position there with a lot of inventory in it. We think we can demonstrate to people that that inventory can compete at a Tier 1 kind of economic level, and that’s our current program in the Eagle Ford.

The Oil and Gas Conference®

SM Energy is presenting at EnerCom’s The Oil & Gas Conference® at the Denver Downtown Westin Hotel, Denver, Colo. Aug. 19-22, 2018. EnerCom expects to have more than 80 presenting oil and gas companies and more than 2000 financial professionals attending this year’s conference.

To learn more about the conference and presenter schedule please visit the conference website here.