Whiting Petroleum (NYSE: WLL) reported Q2 earnings and talked about operations, acquisitions, and returning value to the shareholders. Excerpts from the company’s Q2 call is included below.

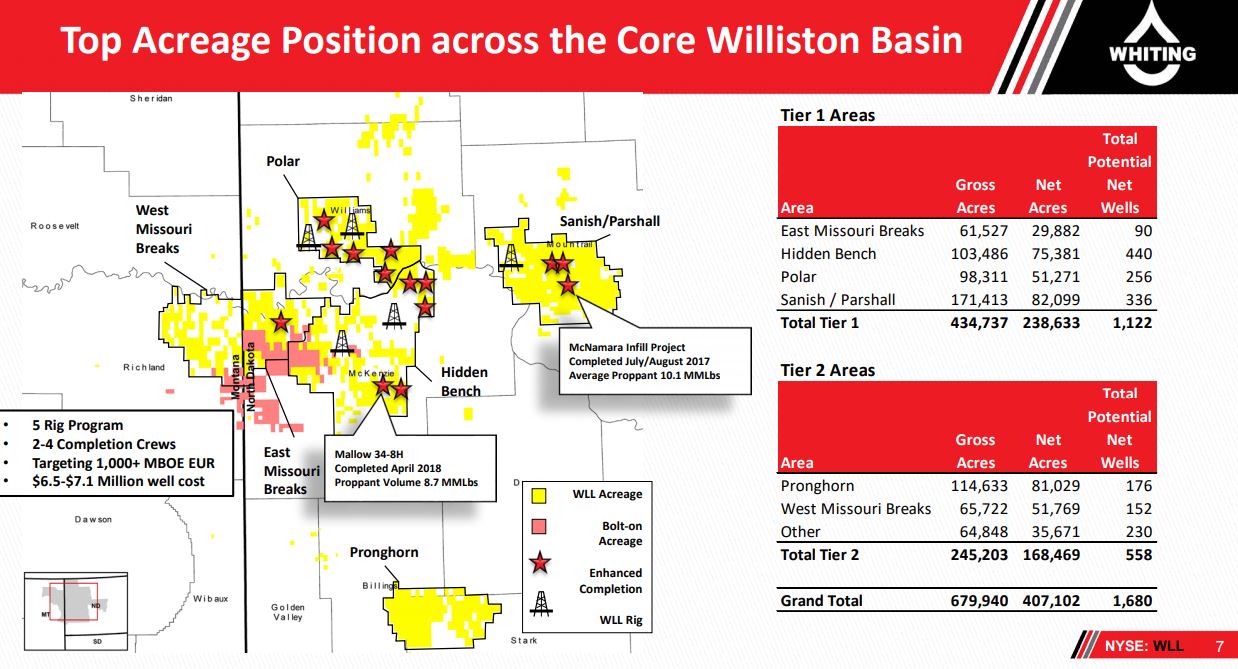

Q: Looking at that slide 7, it shows entire position there now including the bolt-on, your thoughts about moving rigs around. I see where you’ve got the rigs positioned there, could you talk about will they stay in generally the same area or do you see those moving throughout the year?

Chairman, President & CEO of Whiting Petroleum, Brad Holly: As you can see our rigs are spread out over our Tier 1 acreage position and a lot of the reason we’re doing that is to really maximize our returns by putting the rigs in areas that we have gas takeaway capacity and we can fully move our volumes.

We’re very excited to get over into the East Breaks and Hidden Bench area and both test our stuff there as well as test this new acreage. And so, we are moving that up in our priority list and plan to be – in the first quarter of 2019, we plan to be out on the new acquisition acreage drilling our first well.

Q: And then, just lastly, just your wells like number of other offset operators are very notable here in the last several months. Your thoughts about type curves as these wells continue to outperform the type curve, any thoughts of boosting those, or if you could just talk about sort of well performance you’ve seen here recently versus, I guess, that which was set – would set the type curves?

Chairman, President & CEO of Whiting Petroleum, Brad Holly: We’re certainly looking at that. It’s early on in the process of looking at these new wells. But we continue to update the curves and we continue to see just great performance. The Mallow well in our Hidden Bench area, as you see on slide 9, we are almost 90 days in. So, we’re still early. We’re three months in, but we’ve almost got a significant 30%, 40% more production – cum production at this point in the first 90 days. And so, we are not seeing the wells fall off. We’re seeing nice pressure behind the wells’ performance, and we’re certainly looking at our 2019 program through the lens of an updated type curve situation.

Q: Brad, I just wanted to follow up on that. The asset sale, it seems like with the bids on Redtail coming in below your expectations, maybe you’re taking the opposite end of that and taking advantage of weak bids in the market for assets. So, curious to hear how much additional appetite you have to acquire other bolt-on properties and what you’d be looking at is similar to this halo area as you’ve described it, or other parts, maybe it’s bolt-on core in the Bakken, or what’s of particular interest to you?

Chairman, President & CEO of Whiting Petroleum, Brad Holly: We think that we should be looking at other Bakken acquisitions. We think it fits in our strategy of being the best in the Bakken. We believe that we should be looking at all the packages out there.

One, it helps us to better understand the basin and our competition. But consistent with our acquisition announced today, we’ll consider transacting if we feel the package fits well with our current acreage position, has the potential to compete in our current drilling program inventory and we can apply the Whiting stock completion and operations to that.

And so, we do feel like that we’re getting much better performance with the Gen 4.0 completions and we think there’s more acreage out there to be prosecuted that way. Based on our really detailed geologic mapping, we see substantial oil in place across a large area of the Bakken and it’s an incumbent upon us to apply the right completion technique to be able to get that out.

Q: And just a follow-up there on the completions you mentioned. Do you have data to confirm you’re actually seeing shorter frac lengths with the Gen 4.0 completions than with the bigger 10 million pound completion?

SVP, Operations of Whiting Petroleum, Rick Ross: We certainly model all of our completions. We’ve got calibrated models for each of our development areas. So, we do have a good feel for frac length and we really design that based on each specific well situation, well spacing and try and design that appropriately. So, I don’t know if I’m answering your question directly but I think the answer is yes on frac length that we understand that.

Q: And they’re a bit shorter?

SVP, Operations of Whiting Petroleum, Rick Ross: That’s correct.

Q: I just want to make sure I understood. It sounds like you plan to operate Redtail as a managed decline that throws off free cash. I mean is that an accurate characterization and do you have kind of a target decline rate over the next year or two in mind?

Chairman, President & CEO of Whiting Petroleum, Brad Holly: I think that’s fair. We are going to invest in the highest return projects that we have on our portfolio and I think we’ve consistently said that currently, while our last round of Redtail wells were encouraging and we got better results, they’re still not competing today with our Bakken inventory. And so, we’ll continue to focus our CapEx investment in the Bakken.

And, we are going to go to work with the team on Redtail to optimize our existing wells to flatten that decline as much as we can. We’ve said before that our fourth quarter exit rate at Redtail is about 15,000 barrels of oil equivalent per day and we are challenging ourselves to do better than that and see if current well performance can – we’ll be working very hard to channel that decline as much as possible and to keep those oil rates high.

Q: Just looking at the CapEx for the quarter, it looked like a little higher than the run rate expected for the year. Anything that was significant for the quarter that led to that?

Chairman, President & CEO of Whiting Petroleum, Brad Holly: Yeah. I think we talked a little bit on the last call is, we had about 40 wells coming online in the first half of the year. We’ve got over 80 wells coming on in the back half of the year. And so, a lot of that second quarter spend was getting wells that, a lot of those are getting turned on in July and August here. And so we had some big pads, 14 well pads that we primary did all of our completion work in the second quarter. And you’re seeing that reflected in the CapEx.

Q: So, some of that CapEx for the second quarter is really going to benefit production for third quarter. Is that the right way to think about it?

SVP & CFO of Whiting Petroleum, Michael Stevens: Correct.

Q: I had a question about a little bit of detail on the midstream relationships there and in terms of gathering and transportation. Do you see any potential bottlenecks beyond 2018, and what plans would you like to make, I guess, to ensure that any don’t develop?

Chairman, President & CEO of Whiting Petroleum, Brad Holly: Sure. I just went over the crude takeaway. So, we really don’t see any issues with the crude takeaway going out. Future gas, gas is tight. It’s tightening towards the end of this year. It will be tight early next year. We are well aware of where the constraints are. So, we’ve put plans to manage that. We’re expanding one of our gas plants up there and we’re bringing some portable units and some other strategies to manage that. But I think the thing to keep in mind is there’s a lot of midstream expansion going on right now, in total about 500 million cubic foot of capacity is being added. So, by year-end 2019, we think the takeaway capacity will be over 3 Bcf a day, and that should address any kind of tightness that we see right now.

Q: And then can you just I guess move into the kind of bolt-on as an allocation of your free cash flow? Can you walk us through the framework you used in that capital allocation decision between bolting on versus potentially thinking about buying back your own stock? I appreciate that it was contiguous. You all think that the market was mispricing the potential for completion optimization there but you also had opportunities to kind of buy back your own portfolio there. So, can you just walk through how internally you all kind of evaluate that capital allocation process?

Chairman, President & CEO of Whiting Petroleum, Brad Holly: I think the way we looked at it is we’ve generated about $270 million of free cash flow to date as we detail in our portfolio here. And so, about half of that’s going to debt paydown. And about half of that we really saw is we – is we saw an opportunity here, we saw a special opportunity to add something that fits perfectly with our current inventory. And based on the recent results in the area, we really felt like that, that provided some real high quality opportunities for us to best 55,000 acres as you’ve heard that’s been lightly drilled.

And so, we kind of felt this was a special bolt-on that really fit nicely to that. We obviously debated that heavily as we still have a really strong desire and a commitment to paydown our debt and reduce the leverage on the organization going forward. And so, we’re trying to do both at the same time and we’re holding those strong intentions.

SVP & CFO of Whiting Petroleum, Michael Stevens: I’ll add on. With the run that our stock has had, it’s not quite as attractive to think about buying that back. There is – where our debts at right now, that’s really where the focus is at right now, getting that reduced.