Bakken production up 11% over Q1 2017

Hess Corporation (ticker: HES) reported a net loss of $106 million, or $(0.38) per common share in Q1 2018. This compares to a net loss of $324 million, or $(1.07) per share in Q1 2017.

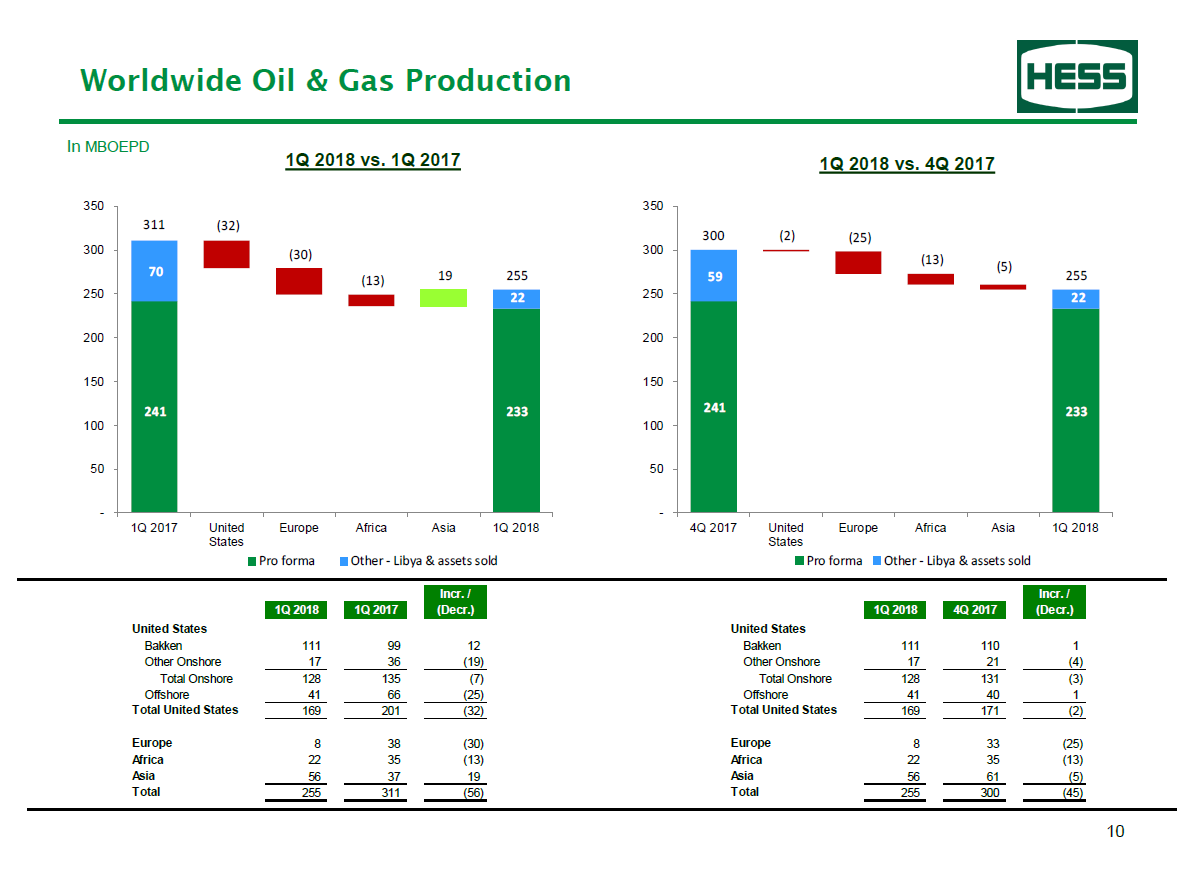

Oil and gas production went above the company’s guidance estimates. Net production averaged 233 MBOEPD (excluding Libya) and Bakken production was 111 MBOEPD. Libya net production was 22 MBOEPD in the first quarter of 2018.

The company’s E&P expenditures were $384 million in the quarter. Hess said that the 2018 activity reflects increased drilling in the Bakken and ongoing Liza Phase 1 development. However, E&P net loss was $25 million, compared to a net loss of $233 million in the first quarter of 2017. On an adjusted basis, first quarter 2018 net income was $12 million.

“Our focus for 2018 is on execution and we believe we are off to a very strong start to the year,” CEO John Hess said. “In the first quarter, we increased cash returns to shareholders, reduced debt, exceeded our production guidance, continued to lower our costs and announced two significant oil discoveries offshore Guyana – Ranger and Pacora.”

The company’s average realized crude oil selling price, including the effect of hedging, was $59.32/barrel in the first quarter of 2018, up from $48.58/barrel in the year-ago quarter. The average realized natural gas liquids selling price in the first quarter of 2018 was $21.11/barrel, versus $18.71/barrel in the prior-year quarter, while the average realized natural gas selling price was $3.86/Mcf, compared to $3.20/Mcf in the first quarter of 2017.

Conference call Q&A excerpts

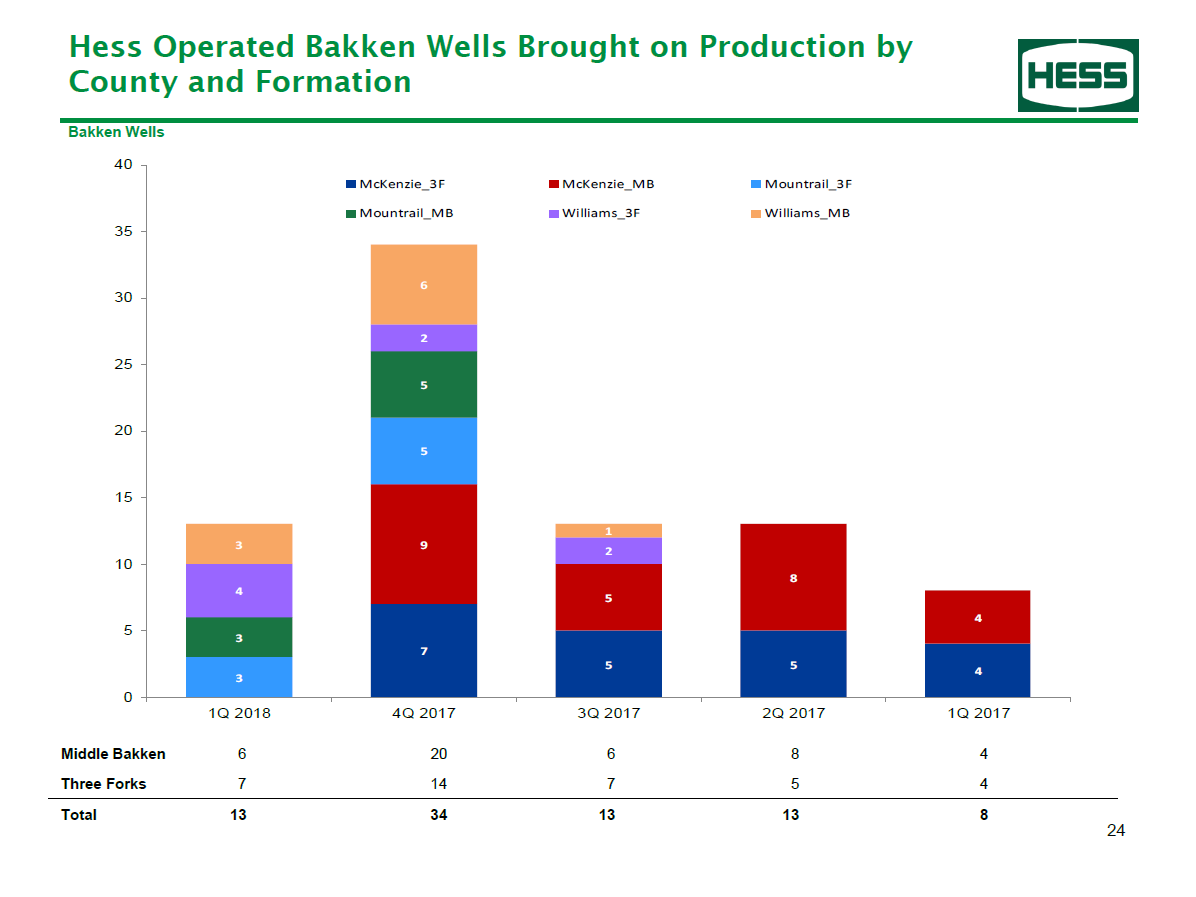

Q: Can you tell us more about your Bakken results?

President and COO Gregory P. Hill: In terms of the cost first, we’re really in this process and costs are running between $6.5 million and $7 million for those 200-stage, 8.5 million pounds proppant wells. But, we believe that’s going to come down as we apply lean manufacturing just like we did with sliding sleeves. As we apply lean manufacturing to that process, we know that we’ll be able to bring those costs down.

As I said in my opening remarks, we really don’t have any wells that we have plug-and-perf. We have seven online right now, but we don’t have any of their past – their IP90 dates. So, it’s a little bit premature. The results are encouraging, but it’s premature because we just don’t have a statistical enough sample yet to be definitive about what the uplift is. It’s positive, but I don’t want to get specific beyond that. Now, our plans are because of the encouraging results, we are going to complete 40 plug-and-perf this year and we’ll have 25 wells online by year-end.

And as I also said in my opening remarks that data was going to be critical for the study that we’re conducting on the Bakken, which is really designed to – on a go-forward basis determine what now is the optimum methodology used – to use for each area of the field as we think about further development of the Bakken.

Q: Your CapEx was relatively light in the quarter – how much of that was timing related? Fewer well completions in the Bakken in the quarter… are you seeing any continued efficiencies that could drive lower than expected CapEx for the year?

CEO John Hess: Right now, it’s really timing. I mean we were early in the year that always happens with our CapEx program. As we move through the year, we’re bringing in a fifth rig into the Bakken in the third quarter and then the sixth six rig in the fourth quarter.

We are also going to have two rigs running in Guyana. So, there is, as we move through the year, was kind of more back-ended on the CapEx.

So, again, everything is going with the execution and the CapEx plan is going really well.

Q: When you’re talking about the Bakken, can you also talk about – that you’re going to reach 175,000 barrels per day by 2021?

Hill: We do expect the cost trends, they increased by some, 5% to 15%, very different than the Permian simply because if you look at the rate of growth of rigs in the Bakken, it’s much smaller than it is in the Permian. So, it’s kind of one Z, two Z, I say, people grow by one or two rigs. So, the rate of increase is not substantial.

Now, we’ve taken a lot of steps to contain those costs by locking in some rig rates, putting in place longer term contracts, forming strategic partners with our key suppliers. And we’re pretty confident that the steps we’ve taken and our lean manufacturing approach is going to enable us to deliver our 2018 program with minimal inflation. There’ll be some but it’ll be minimal, we think we can cover most of that. So very different than the Permian.

Regarding the 175,000 barrels of oil a day in 2021, that’s the only assumption in there is that we maintain six rigs for the next couple of years to get us to the 175,000 barrels of oil a day…

I think at this point, the 175,000 barrels of oil a day appears to be the sweet spot. Then we can maintain that for several years in the Bakken and of course, that’s a combination of infrastructure build out and whatnot.

And that’s why the 175,000 barrels of oil a day appears to be a sweet spot. The only caveat I will put on that is we are conducting this comprehensive Bakken study this year and so depending on the outcomes of that study, that could dictate how long you hold that peak, how fast you get there are some other factors.

So that’s the only caveat I’d put on that.