Oil & Gas 360

Historic plunge in oil to NEGATIVE $37, WTI!?!?

A Red Herring… For Most, For Now.

How Can Prices Go Negative? That doesn’t make sense.

You’re correct- it doesn’t make a whole lot of sense unless you understand the relationship between the financial market (paper) and the physical market.

At the end of the day, speculators in the paper market got pinched at the last minute with contracts that settle physically. Most of the commotion surrounding this historic event can be ignored.

Futures Contract Basics

The WTI Crude Oil futures contract is a MONTHLY legal contract to buy or sell crude oil of a specific quality, delivered at a specific location- in this case at Cushing, OK. The contract is traded on a financial exchange (NYMEX) and the price of the FRONT MONTH is often quoted by the financial press as the price for oil. (Around the world, there are many different prices for oil- WTI Crude is just one price.)

Because the WTI Crude Oil futures contract is physically settled, those holding the contract at settlement must take delivery of the physical barrels of oil at Cushing, OK. This rarely occurs.

Every month, the front month contract changes to the next month. When the contract “rolls” to the next month, it is settled and closed. The roll often starts a few days before the official settlement of the contract- trading volumes migrate to the next monthly contract. This roll from month to month is usually a smooth transition.

You can buy or sell any month/year contract, but the trading volume declines rapidly after the most active front month. (Link to CL Monthly Contracts) Also note, the contract is for future delivery of the commodity- trading May contracts in the month of April for example.

The Negative Contract

The contract that traded negative $37.63 is the May 2020 contract. As you can see, most of the volumes have already moved to the June 2020 contract. In fact, April 15th was the last day the May contract traded more volume than the June contract.

Storage for Physical Crude is Low

Demand destruction, directly related to COVID-19 and the associated economic shutdown, is causing produced oil to sit in storage tanks instead of being sent downstream to refineries and consumers. This is causing storage to rapidly fill without a clear end in sight.

If you can’t use the crude oil and you can’t store the crude oil, but you are long a futures contract on settlement date, what do you do?

You sell at ANY price.

Remember, the paper futures contract converts to a physical delivery.

What happens when normal buyers, who take physical delivery of the commodity, are unable to accept any additional inventory? The price goes down fast as liquidity evaporates.

Since the paper long is unable to accept delivery of the physical oil, they pay for someone else to take the delivery- leading to negative prices.

So, if the Price of Oil is Not -$37.63, What is the Price of Oil?

If asked, I would quote the June 2020 WTI contract delivered at Cushing, OK at ~$20/barrel. (At time of writing, the settlement price is $20.43 in the quote chart above.)

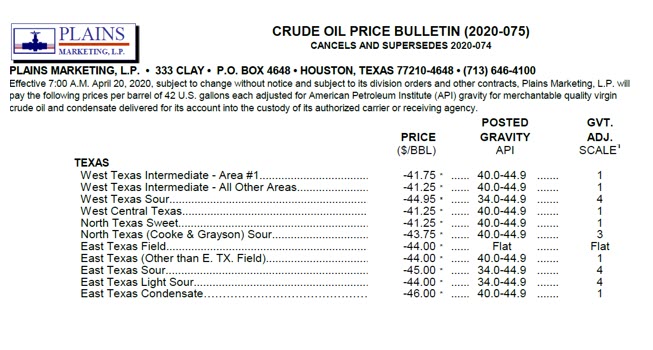

That price is also inaccurate… this is part of the published price sheet for today (4/20/20) from Plains Marketing- they buy oil. Those are negative prices.

Looking Forward

Historical events are usually a reflection of historic stress. The domestic oil market is under historic stress.

Across the country, physical storage is tight with no solution in sight. This stress is already causing problems and will have consequences for the broader energy sector. Anecdotally, I’ve spoken to a number of producers who received less than $10/barrel for their production back in Feb/March. They have shut in wells in response. Buyers of crude are clearly telling producers they do not want any more inventory.

Also, being long the WTI contract, without storage, means going forward you have additional risks since liquidity for long positions is less predictable with extreme consequences.

Finally, similar to when interest rates went negative, the breaking of zero for the futures contract changes assumptions of the past, investment models of the future, and ushers in a new paradigm.

*********

David Forsberg, CFA is the Managing Partner of Ascent Energy Ventures an investment fund focused on the digital transformation of the energy sector. He has over 15 years experience in alternative investments deploying capital for institutions, private investors, and a single-family office. He began his career is quantitative finance.

David Forsberg is also one of our Oil & Gas 360 Contributors. David’s LinkedIn Address.