This month’s historic swoon in oil prices has some on Wall Street worrying that crude will settle in a range under $40 a barrel. For the industry’s hundreds of thousands of workers, the bigger worry is their jobs.

Source: CNBC

Though West Texas Intermediate crude has only plumbed its new lows for about a week, some are already warning that energy workers could see layoffs sometime soon if oil doesn’t rebound.

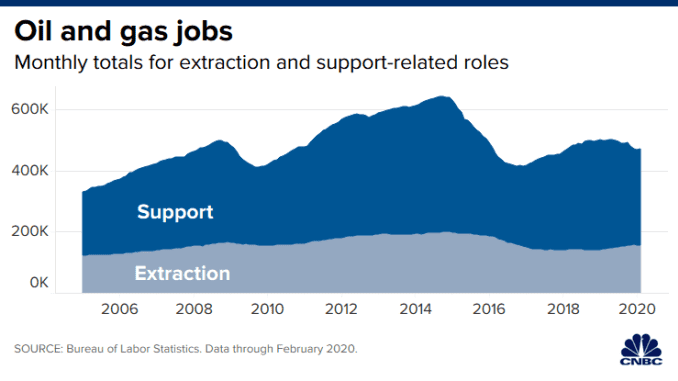

“During the downturn in 2015/16, U.S. employment in the oil sector fell by about one-third. In recent years, some of that has been clawed back, but a period of sustained low oil prices would no doubt push employment back toward previous troughs,” he added.

U.S. West Texas Intermediate crude and international benchmark Brent crude both posted their worst day since 1991 last week.

WTI plunged 24.59% to $31.13 a barrel on March 9 after OPEC failed to broker a deal with ally Russia on production cuts to support oil prices. That, in turn, led the Saudis to cut their own prices and fanned fears of a global price war. WTI was trading Tuesday at $27.89 a barrel.

Historically, big declines in the price of oil tend to have a mixed impact on Americans. Quick sell-offs followed by equally quick rebounds can keep the impact to a minimum, but more sustained swoons can have real economic consequences.

On the upside, a fall in oil prices usually leads to cheaper gasoline at the pump and offers the vast majority of U.S. consumers the freedom to spend their cash elsewhere.

President Donald Trump voiced that optimism on March 9, when he touted the decline in oil as a catalyst for American consumer.

“Saudi Arabia and Russia are arguing over the price and flow of oil. That, and the Fake News, is the reason for the market drop!” Trump tweeted amid the stock market’s plunge. “Good for the consumer, gasoline prices coming down!”

But a reduction in income for the fraction of U.S. workers who make their living in or supporting big energy can have more serious ramifications for the states that host oil and gas production. Those typically include Texas, North Dakota, Alaska, California and New Mexico, which together account for about 67% of U.S. crude oil production.

“Low oil prices are good for consumers: All else equal it is a stimulus for the U.S. economy,” said Raymond James energy analyst Pavel Molchanov. “Obviously, in regions of the country where there is significant oil and gas activity there is a counter-effect that is negative.”

“There are some derivative job losses beyond the oil patch states because of manufacturing, trucks, rail cars, various steel tubes, metal manufacturing that pertain to the oil and gas industry,” Molchanov added.

Even companies that have nothing to do with oil and gas, such restaurants, can come under pressure in the months after a slide in oil prices if the communities which they serve are home to crude production, the analyst said.

“The economic stimulus from cheap gas to the consumer has to be counterbalanced,” Molchanov said.

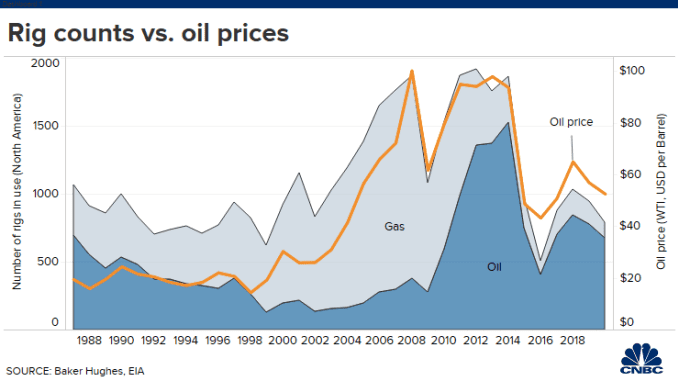

The first such “counterbalance” at major exploration and production companies — which find and extract oil then sell it to refiners — is often a pullback in capital spending as companies rein in rigs to keep costs under control.

Occidental Petroleum, weighed down by debt after its $38 billion acquisition of Anadarko, announced Tuesday that it’s slashing its quarterly dividend to 11 cents a share from 79 cents. It also said it plans to rein in spending this year by about 32% to about $3.6 billion.

Diamondback and Occidental are the two worst-performing stocks in the S&P 500 in 2020, down more than 70% each. Marathon is the fourth-worst with a decline of 69%.

“The shale industry has been an extraordinary engine of innovation for the U.S. economy in recent years. The increase in oil production has reduced U.S. exposure to the Middle East and helped narrow the current account deficit,” PGIM’s Sheets told CNBC.

“The reality, however, is this industry consists of many firms that will be vulnerable in the event of a sustained downturn in energy prices,” he added. “Their pockets simply aren’t as deep as those of major sovereigns like Russia and Saudi Arabia, who they compete with in the oil market, and the price they need to cover their costs is higher.”

Industrywide layoffs may come later and occur more gradually as companies wait to see how long oil remains at the new lows or if Russia comes back to the negotiating table.

Looking back at prior slides in the price of oil, such as the 2014–2015 crash, could hint at the path forward if crude continues to settle in a range under $40 a barrel.

The number of U.S. workers operating, extracting and servicing oil fields from Pennsylvania to Texas reached well north of 500,000 as recently as six years ago. Lofty oil prices courtesy of OPEC’s stronghold on global supply and a relative inefficient American supply chain kept prices above $100 a barrel.

But as the U.S. grew more focused on its energy independence and improvements to the production of shale oil, North American production began to reach critical levels. Combined with geopolitical rivalries among OPEC members and softer demand from a decelerating Chinese economy, the global glut in oil led to an eventual plummet in oil prices.

The damage was both large and size and persistent as WTI crude prices sank from its yearslong range above $100 a barrel to a low around $36.60 between August 2014 and January 2016. It meandered between $50 and $60 for much of the last four years, never trading north of $80.

The sustained collapse in price meant big changes for the energy industry in the U.S., which was forced to curb spending from wells to pipelines. Cheaper oil, coupled with technological innovation, also foreran a steep fall in the number of American energy workers.

Broad estimates aggregated by the Labor Department show oil and gas employment (including companies that service fields and rigs, and contracted workers) down 30% between November 2014 and November 2016.

“Investment came back following the stresses in 2015-16. But this is the second such disruption in a few years’ time, the world is awash in energy supply, and many consumers are increasingly focused on environmental concerns,” Sheets continued.

“Given the nature of this industry, a sustained downturn in oil prices is likely to lead to a shake-out among U.S. shale producers,” he added. “The deeper question is whether, following a shake-out, investment will return to the industry.”