Bankers/Analysts/Money Managers: Netherland Sewell is Hosting Seminars in London, Singapore in June, July

Last week Netherland, Sewell & Associates (NSAI), the half a century-old Dallas-based petroleum engineering and geological consulting firm, held its Oil and Gas Property Evaluation Seminar in Dallas. This was the twenty-second year for the popular seminar, which many industry professionals refer to as “The Netherland Sewell School.”

To teach its seminar content, NSAI draws from its 150+ seasoned in-house energy professionals. These are skilled experts who provide petroleum property analysis to industry, financial, and governmental concerns worldwide. The same people who provide engineering, operational, geological, geophysical, and petrophysical solutions for all facets of the upstream energy industry, globally.

Learn How to Evaluate Companies’ Oil & Gas Reserves

The firm holds its oil and gas property evaluation seminars in three cities: Dallas, Singapore and London. The goal is the same in each city—to teach a large room full of non-technical, primarily financial people, what all goes into finding, defining, measuring, and evaluating oil and gas properties and reserves estimates.

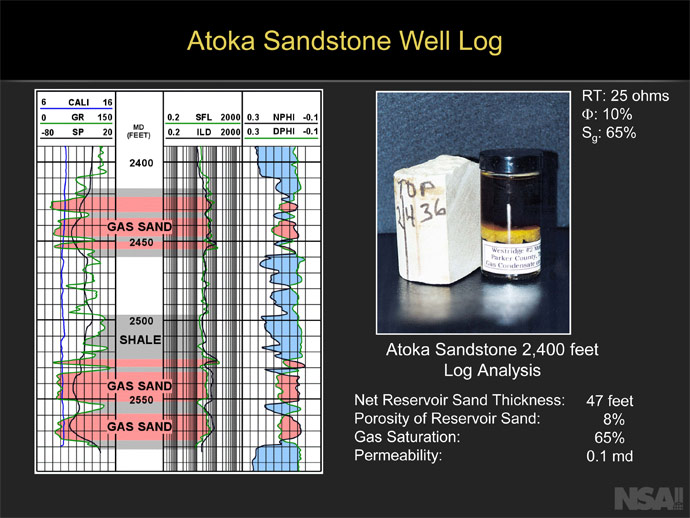

Each two-day seminar session is packed with facts, figures, charts, graphs, underground formation images, and photographs—delivered by the NSAI subject matter experts in such a way that the non-energy-focused banker, analyst or portfolio manager, even a journalist, can go back to the office from his or her two-day session knowing the basics of how to use the oil and gas industry’s financial benchmarks. If you forget something, you have a 2-inch notebook full of what you just learned as a permanent reference to use back at home.

5,500 NSAI Graduates and Counting

Scott Rees, Netherland Sewell’s chairman and CEO, said that the firm has graduated about 5,500 people internationally during 31 cumulative years of seminars in Dallas, London and Singapore.

Rees told Oil & Gas 360® that a review of last year’s attendees showed that about 30% of the attendees were analysts, another 30% commercial bankers, and the rest identified themselves as “other” – which included attorneys, accountants, private equity, oil and gas company business development people, insurance, underwriters, landmen, corporate finance, investment bankers and money managers. This year’s Dallas seminar attendees included some bank regulators and an analyst from the Federal Reserve Bank.

NSAI Seminar: It’s Two Days You Will Not Forget

The NSAI seminar is not the place for someone looking for a couple of mental vacation days away from the office. You will be pleasantly slammed by a plethora of oil and gas data from an engaging group of super-smart NSAI geologists, engineers, reservoir analysts and possibly a former roughneck turned engineer.

If you are new to the oil and gas space and you don’t know the difference between the Middle Bakken and the Gulf of Mexico Shelf, the “Netherland Sewell School” professionals will clear that up right in front of your eyes with beautifully rendered 3-D cutaway images.

An Attendee’s First Hand Report

Tyler Jones, Oil & Gas 360®’s international energy reporter, talked about his experience at the 2016 NSAI Oil & Gas Property Evaluation Seminar in Dallas.

OAG 360: What was your primary takeaway from the NSAI Oil & Gas Property Evaluation Seminar, what did you bring home?

TJ: It helps you tie the numbers back to what is actually going on in the ground. At first, when you look at all these oil and gas company financial statements, you are just seeing numbers on a page. But they show you what you’re looking at, what those numbers represent. You start to realize that “this group of assets is worth more because certain geological differences will result in this kind of a decline curve, or the oil flows more easily in this section of the formation because of certain factors about the rock,” that kind of thing.

OAG 360: What would you tell a prospective attendee who is thinking about attending an NSAI seminar in Singapore or London this summer?

TJ: There’s a lot of information to absorb; be prepared for eight hours of knowledge being thrown at you for two days. Being around the industry for a year and a half definitely helped me understand what they were referencing in the seminar, but I don’t think you need a deep understanding of the industry to get a lot out of an NSAI seminar.

OAG 360: What was your favorite part of what they presented, your favorite section?

TJ: Personally, I enjoyed the petrophysics part of it. It was really interesting just to hear all the different variables as to how the hydrocarbons actually flow in the rock formations. And I think the most helpful to me from a utility point of view was the product pricing and economic calculations part of it—it’s something I can use every day.

What’s covered at NSAI Oil and Gas Property Evaluation Seminars?

The areas that the NSAI professionals covered on ‘day one’ of the recent Dallas seminar included reserves and report reliability, reserves and resources-definitions and risk, reserves determination methods, reserves report evaluations, petroleum geology, seismic basics, isopach mapping, hydrocarbons-in-place and recovery factors and rates.

‘Day two’ covered operating expenses and capital costs, product pricing and economic calculations, reserves report content, an overview of unconventional gas, EOR technologies, oil field operations, an overview of unconventional oil, reading between the lines of oil and gas company news releases and an overview of global energy supply.

“Amazing”

Some participant comments after the Dallas sessions last week included: “it was an amazing and informative seminar”; “I learned a lot and enjoyed you all taking the time to organize this”; “it was very well done—you can tell they’ve been refining this over the past 20 years.”

“It seems like every year, either at IPAA-OGIS or at EnerCom Denver, someone stops me to tell me that they are a proud graduate of our seminar and how much they appreciated attending,” Rees commented.

Up Next: London – June 21-22; Singapore – July 12-13

On June 21-22, 2016, NSAI will host an Oil and Gas Property Evaluation Seminar in central London at the Grange City Hotel, 8-14 Cooper’s Row, London EC3N 2BQ.

On July 12-13, 2016, NSAI and the Singapore Exchange will host an NSAI Oil and Gas Property Evaluation Seminar at the SGX Auditorium, 2 Shenton Way, #19-00 SGX Centre 1, Singapore 068804.

You can register for the London or Singapore seminars on the NSAI website. There is no charge to attend the NSAI seminars.