22% of GOM oil down, 26% of GOM gas down, 25% of Gulf refining offline

Hurricane Harvey has made landfall, becoming a major disruption to the U.S. oil and gas industry.

The Gulf Coast is the heart of U.S. oil refining, with most of the country’s refining capacity. According to Wells Fargo, about 25% of Gulf Coast refining capacity has been forced to shut down and will remain so for at least most of the rest of the week.

A note from Reuters released Sunday stated that the storm has forced about 22% of U.S. GOM oil production and 26% of gas production offline. The Bureau of Safety and Environmental Enforcement reported today that 98 platforms have been evacuated, and half of the drilling rigs in the gulf are evacuated.

In addition, many companies have shut down production and suspended drilling operations in the Eagle Ford, further decreasing output.

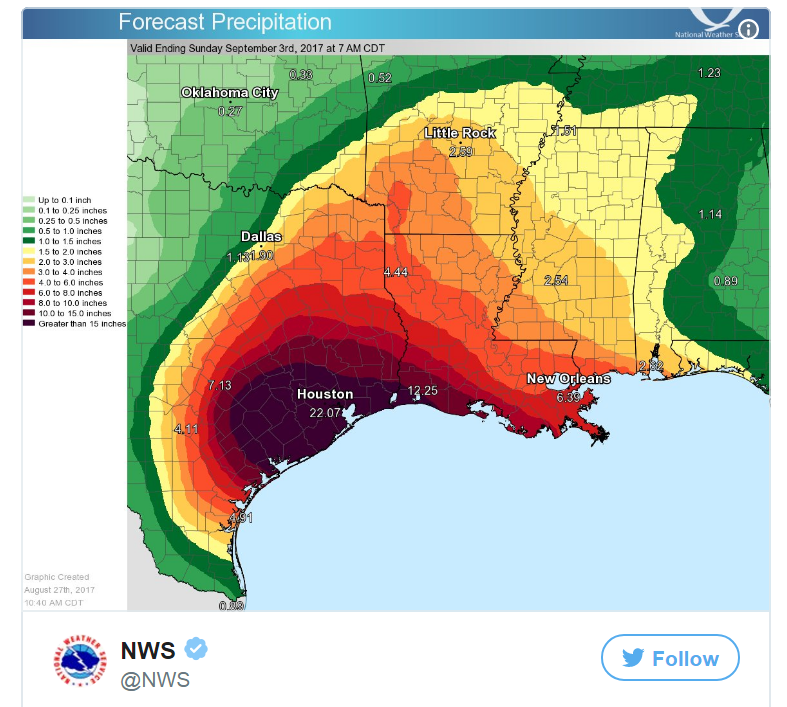

DIRECTLY FROM THE NATIONAL WEATHER SERVICE LAST NIGHT: This event is unprecedented & all impacts are unknown & beyond anything experienced. Follow orders from officials to ensure safety. #Harvey 9:44 AM – Aug 27, 2017

Ike last hurricane to hit Texas

One of the big questions facing oil and gas traders is how the storm will affect markets. Oil production and refining capacity have both fallen, making impacts on oil and gasoline prices difficult to judge.

SunTrust compares and contrasts the storm with the last hurricane to hit the Texas coast, Hurricane Ike in 2008. Ike caused oil prices to spike about 33% in one week, but gasoline prices were relatively unaffected. That storm resulted in the temporary loss of a total of 18 million barrels of oil output. The Gulf represented a larger proportion of total oil production in 2008, 25%, compared to 17% today.

However the Eagle Ford, which represents 17% of current production, is also in the path of the storm as was previously noted. SunTrust suggests that while the GOM shutdowns alone are not likely to significantly impact oil production, the GOM plus Eagle Ford could have material impacts.

SunTrust believes that like in 2008, Hurricane Harvey will cause increases in both oil and gasoline prices, but smaller increases in oil and larger increases in gasoline.

Unaffected refineries will see increased margins

It seems likely that Hurricane Harvey will be a temporary positive for those refineries that were not shut down by the storm. An increase in gasoline prices will likely lead to a higher refining margin for those plants that are still operational. Wells Fargo notes that in the aftermath of previous major hurricanes, refining equities have outperformed the major XOI and SPX indexes by 6% to 19%.

Natural gas demand down temporarily

RBC Capital Markets noted that the storm is a definite negative for natural gas. Demand destruction has occurred in several sectors. Power outages are widespread, as on Saturday the Electric Reliability Council of Texas reported that more than 300,000 customers had been without power. RBC estimates that power usage fell by several Bcf/d over the weekend. The situation is being improved, but immediate demand will likely remain low for some time.

According to RBC, LNG seems to have been spared by the storm. Sabine Pass, currently the only operational LNG export facility, has only experienced minor damage.

Harvey will move northeast

Harvey is currently moving off the Texas coast, and is expected to begin a slow northeastern trek on Tuesday. Forecasts indicate an additional 15-25 inches of rain through Friday in the upper Texas and southwestern Louisiana coastlines.