Husky Energy (ticker: HSE) is moving ahead with several projects expected to contribute to a compound annual production growth rate of 7% over the next four years, with production rising to 400,000 BOEPD in 2021.

2018 plan highlights

- Funds from operations are anticipated to exceed $4 billion and free cash flow is expected to be about $1 billion at pricing of $55 US WTI, $2.50 AECO and a $15 US per barrel Chicago 3:2:1 crack spread

- Capital spending of $2.9-3.1 billion: $1.0-1.1 billion growth capital and $1.9-2.0 billion sustaining and corporate capital

- Current net debt of $3.3 billion, representing approximately one times net debt to expected 2017 funds from operations, anticipated to remain well below target of less than two times 2018 funds from operations

- 2018 annual production is expected to average 320,000-335,000 BOEPD, despite 20,000 BOEPD in 2017 asset sales expected to close by year end

- Thermal bitumen production is expected to grow 12 percent and Asia Pacific production is anticipated to grow 16 percent

- 2021 production target of 400,000 BOEPD, representing a seven percent compound average annual growth rate

- Two 10,000-barrels-per-day Lloyd thermal bitumen projects and Liuhua 29-1 have been sanctioned and are forecast to start up in 2021

- More details regarding these highlights can be found further below

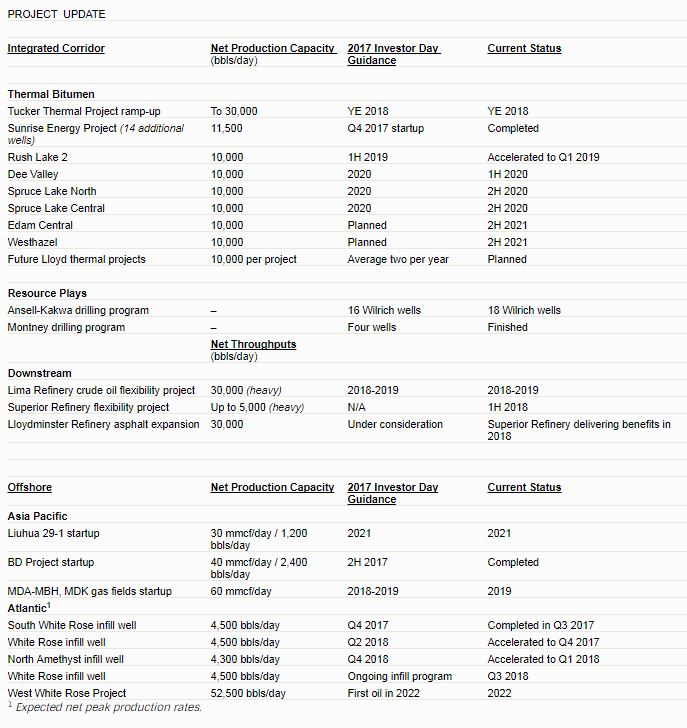

Husky’s operational focus in 2018 is to ramp up the Tucker Thermal Project, Phase 1 of the Sunrise Energy Project, and the BD Project in Indonesia to full rates. In addition, the company will integrate its newly-acquired Superior Refinery, advance six Lloyd thermal projects, move forward with the Liuhua 29-1 field development offshore China, and progress the West White Rose Project offshore Newfoundland and Labrador.

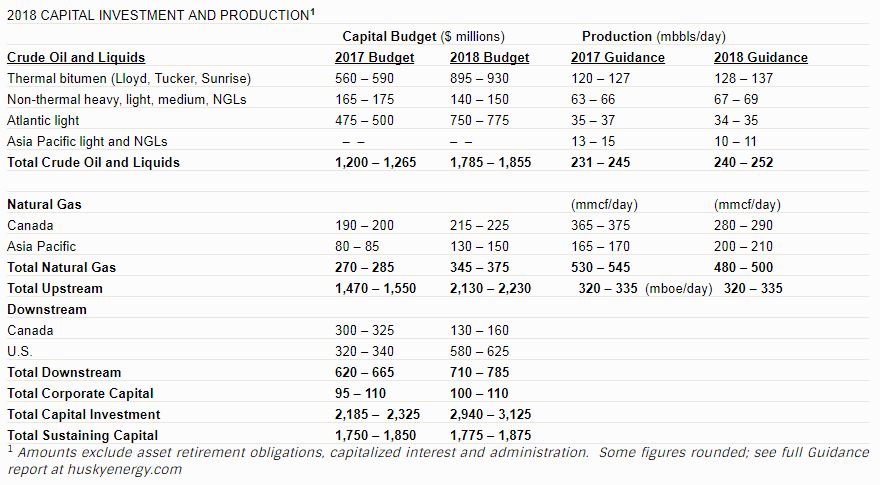

2018 capital program

Capital spending for 2017, not including the acquisition of the Superior Refinery, remains within guidance at $2.2-2.3 billion. Including the acquisition, which closed in November, total capital spending in 2017 is expected to be about $2.9 billion.

Upstream project spending is expected to be largely allocated to growing the Lloyd thermal portfolio, with 60,000 bbls/day of new production scheduled to be brought online between 2019 and 2021, and the construction of the 75,000 bbls/day West White Rose Project in the Atlantic region (52,500 bbls/day Husky working interest), with first oil planned in 2022.

The capital program remains flexible, with about 75 percent of upstream spending directed toward short and medium-cycle projects. Downstream project spending includes the Lima crude oil flexibility project, which will add 30,000 bbls/day of additional heavy oil capacity by 2019, and a project to increase heavy oil processing capacity at the Superior Refinery.

2018 upstream production

Annual production in 2017 is expected to average approximately 324,000 BOEPD, within the guidance range of 320,000-335,000 BOEPD, despite the sale of assets representing about 2,500 BOEPD of annualized production.

Husky has agreed to sell the Ram River Gas Plant and select legacy assets in Western Canada representing 18,000 BOEPD of gas-weighted production. The transactions, which are expected to close by the end of 2017, were not included in the five-year plan presented at Investor Day 2017.

The Western Canada asset disposition program is now substantially complete. Since December 2015, about 52,000 BOEPD of higher-cost legacy production has been sold or is expected to be sold by the end of 2017, with an associated reduction in asset retirement obligations of approximately $840 million. Over the same period, Husky added approximately 66,000 BOEPD of new, lower-cost production, largely from the thermal and offshore businesses.

In Western Canada, the company plans to drill 17 net liquids-rich gas wells in the Wilrich formation in the Ansell and Kakwa areas. In the Montney formation, eight wells are scheduled to be drilled.

In the Atlantic region, two infill wells are planned in the Jeanne d’Arc Basin. The first is scheduled to be drilled at the North Amethyst satellite extension in the first quarter and the second well at the main White Rose field is planned in the third quarter. The net peak production rate of each well is expected to be approximately 4,400 bbls/day.

2018 downstream throughputs

Downstream net throughputs are expected to increase seven percent to approximately 360,000-370,000 bbls/day, compared to average 2017 throughputs of about 342,000 bbls/day.

At the Lima Refinery, the crude oil flexibility project to increase heavy oil processing capacity from 10,000 bbls/day to 40,000 bbls/day is continuing. A project to increase heavy oil processing capacity at the Superior Refinery will be completed in the first half of 2018.

Improving cost structure and efficiencies

The 10,000 bbls/day Rush Lake 2 thermal project has been accelerated and is expected to come on production in the first quarter of 2019.

Improved operating efficiencies have resulted in faster drilling times at the Ansell and Kakwa resource plays. Drilling days have been reduced by 30 percent since the start of 2017, contributing to a 22 percent reduction in per-well drilling costs.

A planned 16-well drilling program targeting the Wilrich formation was completed. Due in part to increased rig efficiency, two additional wells scheduled for 2018 were drilled in the fourth quarter of 2017.

The Atlantic infill well drilling program has been accelerated as a result of drilling and installation efficiencies. Two wells originally planned for 2018 were advanced to 2017. The first well at the main White Rose field was drilled at the end of the third quarter and is now on production. A second well at North Amethyst is currently drilling, with first oil expected in early 2018.