Russia and Iraq are giants in the hydrocarbon industry. The two powerhouses were the third and sixth greatest oil producers in 2012, and Iraq’s oil reserves rank fifth in the entire world. Russia’s natural gas reserves are the highest on the planet, and its 2012 production average of 63.4 Bcf/d allowed it to export 76% of its natural gas across Europe and Asia. The Energy Information Association reports more than half of Russia’s federal budget is dependent on its oil and gas business, and its geographical advantage provides its plentiful resources to scores of energy-tapped nations.

From a pure energy economics standpoint, Russia and Iraq are the envy of many of their international neighbors. The violence and sanctions that embroil the two nations, however, make for an entirely different story, and an end to the turmoil is nowhere in sight. It may be “Business as usual,” thus far for international companies like Schlumberger (ticker: SLB), who conducts approximately 5% of its business in Russia, but the smoldering political landscape is being watched closely by those around the globe.

Provided below is a brief update on each country and the aftershocks being felt by the rest of the world.

Sanctions in Russia

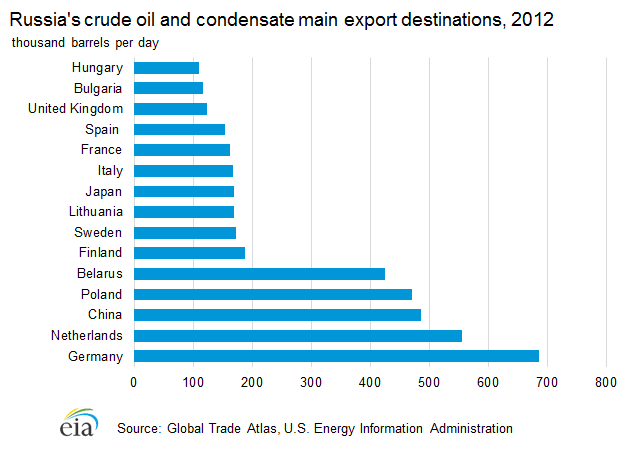

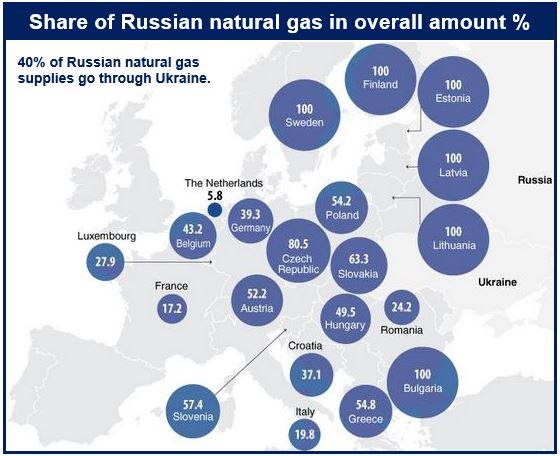

The United States has been joined by the European Union to enforce even tougher sanctions on Russia, with intent to specifically target its energy, defense and banking sectors. The EU was slow to adopt the sanctions due to the many countries dependent on Russian gas – more than 15 countries imported more than 100 MBOEPD in 2012, and five imported more than 400 MBOEPD. The entire market consists of an estimated $500 billion in annual trade investment.

However, controversy aimed at Russia over the Malaysian airliner tragedy and its unrelenting support to anti-Ukraine activists prompted the EU to take action. The United States is cutting off medium and long term financing for Russian banks (most of which have financing in American dollars) and EU will attempt to either stop or slow dependence on Russia’s hydrocarbons. “It is meant as a strong warning: Illegal annexation of territory and deliberate destabilization of a neighboring sovereign country cannot be accepted in 21st century Europe,” the EU said in a statement.

Violence in Iraq

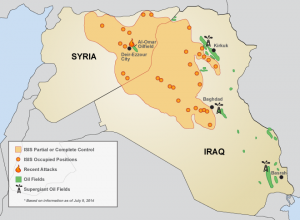

Meanwhile, the violence in Iraq has escalated to “alarming” levels, according to the United Nations High Commissioner. ISIS, a radical Islamic militant group, has captured six oil fields across Syria and Iraq and seeks to build its own state through the sale of stolen hydrocarbons. The situation set up an unusual predicament in Houston, where an oil tanker carrying $100 million in crude oil sits in wait while Iraq and Kurdistan verbally battle for ownership. The United States originally granted the tanker access to the port, but suspicions of Kurd origin have placed operations on hold. The United States has publicly discouraged buyers from associating with Kurdistan crude, saying it contributes to the ongoing war in the northern part of the country.

Meanwhile, the violence in Iraq has escalated to “alarming” levels, according to the United Nations High Commissioner. ISIS, a radical Islamic militant group, has captured six oil fields across Syria and Iraq and seeks to build its own state through the sale of stolen hydrocarbons. The situation set up an unusual predicament in Houston, where an oil tanker carrying $100 million in crude oil sits in wait while Iraq and Kurdistan verbally battle for ownership. The United States originally granted the tanker access to the port, but suspicions of Kurd origin have placed operations on hold. The United States has publicly discouraged buyers from associating with Kurdistan crude, saying it contributes to the ongoing war in the northern part of the country.

What This Means for the United States

Both conflicts can be potentially damaging to America’s public image, but most current effects lie directly in the markets. “The oil market is all about geopolitical tension at the moment,” said Matt Smith, commodity analyst at Schneider Electric SA a French energy-consulting firm. Alan Greenspan, on the other hand, said oil prices would be as much as $20 lower per barrel if not for unrest in the Middle East. Ole Hansen, vice-president and head of commodity strategy at Saxo Bank, said prices per barrel could spike as much as $20 per barrel in a worst case scenario, i.e. Iraq returning to Gulf War levels. However, OPEC leaders announced total output from the group will remain consistent despite additional clashes in Libya and Nigeria. Saudi Arabia, the top-producing OPEC member, is already pumping out record amounts of crude and has claimed it can increase rates even further.

The U.S. was recently estimated to have surpassed Russia in terms of oil and gas production, and imports are at the lowest levels since 1996. The U.S. economy may not be hampered by the sanctions, but the revenues of large international companies like Halliburton (ticker: HAL), Royal Dutch Shell (ticker: RDS.B), BP (ticker: BP), and ExxonMobil (ticker: XOM) may not be as fortunate.

What It Means for the World

Source: Market Business News

Countries in close proximity to the affected regions are not as immune as the United States. Social instability in areas immediately next to the affected regions is a chief concern.

From an energy standpoint, Russia’s prominence clearly carries more weight on an international level than Iraq’s growing conflict. To date, Russia’s leaders have staunchly denounced the sanctions, with Putin saying the sanctions will hurt America more than Russia. NBC News estimates the levied restrictions will hurt Europe as a whole, claiming “Europe’s economy is barely moving ahead right now; GDP in the euro zone expanded just two-tenths of a percent in the latest three months, less than expected. Falling prices have stymied efforts to revive growth, so any loss of exports will hurt.”

The International Monetary Fund and a report from Fitch ratings both said the sanctions will be felt across the majority of Europe. Charles Seville, Director at Fitch, said: “In common the EU economy is much more exposed than [the] U.S. to the Russian market. I think Europe does have more to lose… And the Russian economy was already slowing when this happened so it essentially pushes Russia closer towards a recession.” Seville also warned Russia’s economic decline might have a serious impact on the European economy.

Russia has extended its reach to Chinese markets in recent months, and exports are expected to soar once additional pipelines are completed by 2018. Since full disclosures on the sanctions have not been released, it is premature to evaluate Russia’s position. Vladimir Putin, per his status quo, insists his country will prevail.

“Sanctions usually have a boomerang effect, and without a doubt will force U.S.-Russian relations into a corner,” Putin said. “The measures taken by the U.S. administration towards Russia, in my view, contradict the national interests of the United States.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom, Inc. has a long only position in Shell.