Arabella Exploration, Inc. (ticker: AXPLF) is an independent oil and natural gas company focused on the acquisition, development and exploration of unconventional, long life, onshore oil and natural gas reserves in the southern Delaware Basin in Reagan and Pecos, Texas counties. The company is utilizing multi-lateral wells to develop the Wolfbone play. The Midland, Texas based E&P serves as the operator of its properties through its subsidiary, Arabella Petroleum Company, and was formed from an acquisition with Lone Oak Corporation in October 2013.

Wolfbone Background

A 2012 study by Search and Discovery commissioned by Eagle Oil & Gas concluded the Wolfbone territory overlaps two shales, providing a highly pressurized area with multiple pay zones. The formation has roughly twice the pressure as the nearby Wolfberry Shale (roughly 0.7 lbs. per square inch) and has an additional 2,000 feet of depth. Estimated ultimate recovery per well is 240 MBOE (80% liquids) at lengths of up to 12,500 feet. Data from April 2013 reveals development of the play is just beginning, and only 31 horizontal wells had been drilled at the time of the report.

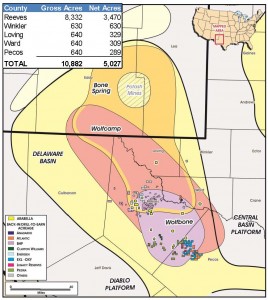

Arabella’s Acreage

The Permian Basin is the greatest producing region by volume in the United States. Arabella holds a position in what is regarded as an emerging unconventional play, surrounded by more established producers like Anadarko Petroleum (ticker: APC), Clayton Williams (ticker: CWEI), Occidental Petroleum (ticker: OXY) and Energen (ticker: EGN).. The company has a total of eight wells in various exploitation stages, with one completing, another drilling, and six drilled and awaiting completion. Its management team has worked firsthand in the area in previous ventures – some even hold a track record with companies now considered competitors.

Operations Starting Up

Experience in any facet cannot be understated, and Arabella’s management team is using innovative ideas to develop its territory. Jason Hoisager, President and Chief Executive Officer of Arabella, told OAG360 in an exclusive interview that his company believes the play is the best in the country. Drilling operations thus far have consisted of multi-lateral horizontal wells. The technique can also be used to re-enter old wells, and the company says it is the next advance in cost effective production.

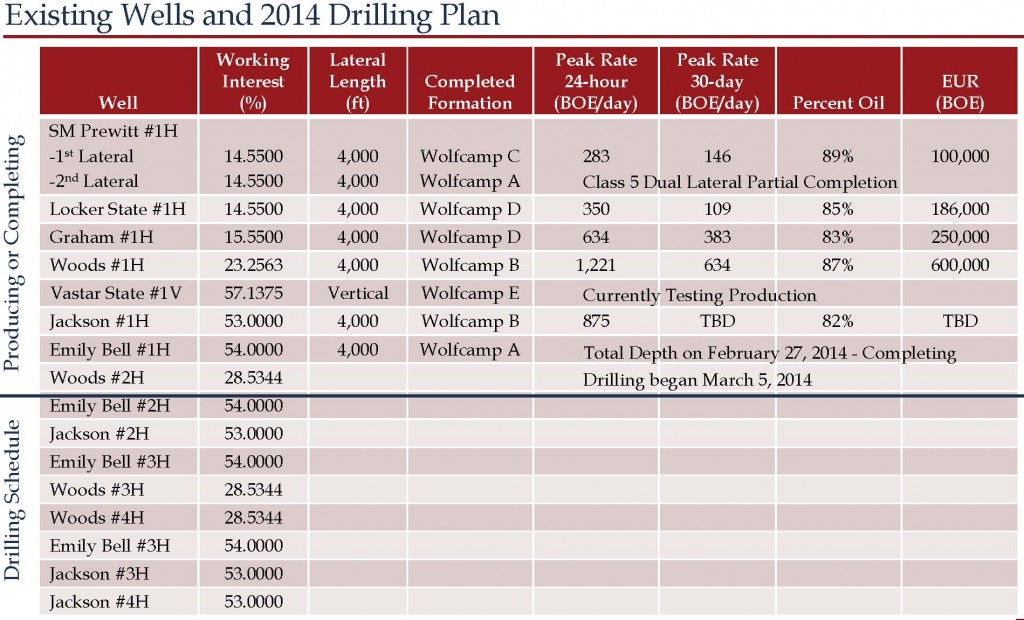

The switch from the development phase to the production phase will be apparent in 2014. Arabella’s daily rates were reported at 106 BOEPD in August 2013. With the completion, full credit and production from three separate wells to date, net production has jumped to roughly 1,000 BOEPD at this time of writing – double the 500 BOEPD at the beginning of the year. Management forecasts its 2014 exit rate could reach 2,500 BOEPD – all coming from one rig, and excluding all laterals. Rates from newer wells can be seen in the table below, including the Woods #1H well, which had a 24-hour peak IP rate of 1,221 BOEPD. Management also believes it can double its proved reserves by the end of the fiscal year.

Source: Arabella March 2014 Presentation

Peer Wolfbone Results

Arabella’s drilling program may be in its infancy, but neighboring operators can be used as a benchmark. Energen is operating to the north and tested 10 net wells in Q2’13 at an average 24-hour rate of 1,035 BOEPD (70% oil). Seven of the wells produced a 30-day rate of 695 BOEPD (68% oil). The results have prompted EGN to delineate its position by planning to drill an additional 10 net wells in 2014.

Arabella is adjacent to Occidental Petroleum operations in the south. OXY is ramping up operations in 2014 with the planned drilling of 45 wells compared to just three in 2013. The company refers to the Wolfcamp as its top portfolio opportunity and the Bone Spring (just north of Araballa’s and Energen’s position) as its second greatest asset, and, overall, plans to drill a total of 97 wells (50 horizontals) across the two regions in the upcoming campaign.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.