Chinese-made oilfield equipment will head to Iraq; crude oil trade, E&P, oilfield engineering services, chemical refining get a bump; construction of storage and transport facilities on tap

During a visit to China, Iraqi Prime Minister Haider al-Abadi signed a memorandum of understanding (MOU) with Chinese Premier Li Keqiang to establish a long-term, stable energy partnership. As part of the MOU, China has agreed to cooperate with Iraq on oilfield projects and refinery construction in the Middle Eastern country, reports The BRICS Post.

“More investment will be channeled to the energy sector and governments and enterprises will be encouraged to cooperate in the areas of crude oil trade, oil-gas exploration and development, oilfield engineering service technology, construction of storage and transportation facilities, chemical refining engineering and energy equipment,” the MOU read.

The two prime ministers agreed that Chinese-made equipment would support exploration projects taking place in Iraq.

The MOU came as part of larger economic deal, which included five new agreements in the “economic, technological, military, diplomatic and energy fields,” said a statement from the Iraqi Prime Minister’s Office. The initiatives come as part of China’s “One Belt, One Road” plan to build a modern Maritime Silk Road to boost trade by more than $2.5 trillion in a decade.

Iraq looks to form joint venture with Sinopec

Iraq’s State Organization for Marketing of Oil (SOMO) has also been in talks with China’s largest refiner, Sinopec (ticker: SNP), in order to form a joint venture, reports The Wall Street Journal. The partnership would be split equally between the two entities, and would focus on marketing Iraqi crude in China. Iraq will supply tankers from its fleet to the partnership while Unipec, the trading branch of Sinopec, would provide the financing.

The move comes as the world prepares for Iran to return to global oil markets, and Iraq looks to defend its share of China’s energy demand. Iran could bring as much as 1 MMBOPD of production back online quickly following the lifting of sanctions, some of which could flow to China.

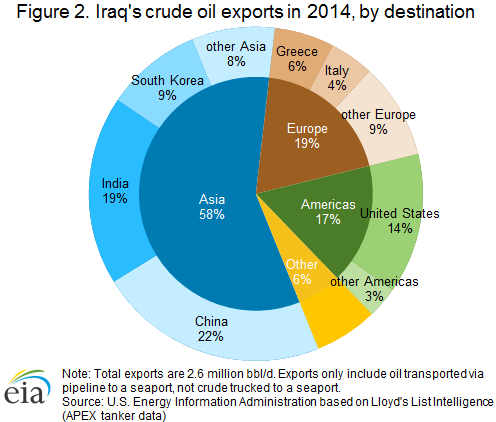

China represents Iraq’s largest market, with the Asian country buying 22% of Iraqi oil exports, according to the Energy Information Administration. Increased production from Iran could push Iraq out of one of its most important markets, something the cash-strapped government in Baghdad would like to avoid.