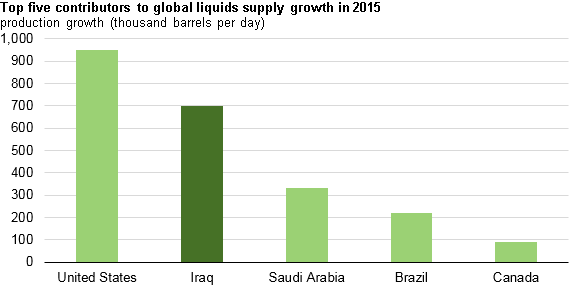

After U.S.A., oil production in Iraq increased the most, averaging 700 MBOPD last year

Oil production continued to grow last year amid a global glut. Over the course of 2015, the U.S. saw the largest growth in oil production, followed by Iraq and Saudi Arabia.

In 2015, oil production in Iraq, including fields in the Kurdistan Region in norther Iraq, averaged 4 MMBOPD, 0.7 MMBOPD higher than in 2014, according to the Energy Information Administration. Iraq is OPEC’s second largest producer after Saudi Arabia, and accounted for 75% of total OPEC production growth last year.

Production of heavy crude oil in Iraq grew substantially last year following a decision in June 2015 to begin marketing Basra Heavy crude separately from Basra Light. Previously, the distinction had not been made between the two, and Iraq limited the production of heavy oils to maintain the minimum standard of Basra crude oil. This, in addition to infrastructure improvements throughout the country, allowed Iraq to increase production both in the south, where about 90% of production originates, and in the Kurdish northern regions.

Continued production expansion in Iraq could prove difficult

Despite the massive gains through 2015, continued production growth could be difficult for Iraq. In a letter from the Iraq Oil Minister, international oil companies were asked to submit conservative spending plans for 2016, as the country anticipated problems reimbursing them for production.

IOCs operating in Iraq are paid through government funds, which are becoming more strained amid the drop in crude oil prices and Iraq’s ongoing conflict with the Islamic State. The letter warned companies like Eni (ticker: E), Lukoil (ticker: LKOH), Royal Dutch Shell (ticker: RDSA) and BP Plc (ticker: BP) that there would be less funding available to IOCs in 2016 to expand production.

“Because of the drop in our oil-sales revenues, the Iraq government has sharply reduced the funds available to the Ministry of Oil,” Iraqi official Abdul Mahdy al-Ameedi worte. “This will…reduce the funds available for the reimbursement of petroleum costs to our contractors.” Ameedi added that the oil ministry did not expect lower funding to “reduce production from the levels that were [already] stipulated.”

Officials from European oil majors said the 2016 budget would likely allow them to maintain production for the year, but that it could begin declining without further investment.

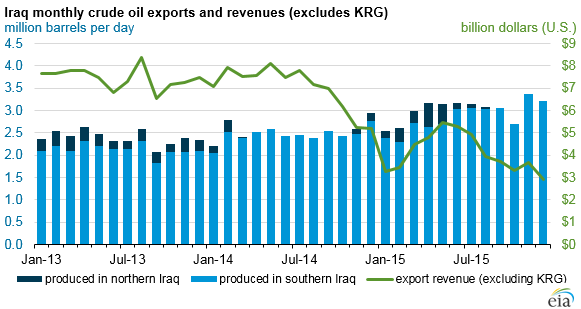

Last year, Iraq saw slightly more than $49 billion in crude oil export revenues, excluding Kurdish Regions, about $35 billion less than in 2014. Crude oil export revenue accounted for 93% of total government revenue in 2014, according to the IMF, meaning the drop in oil prices dramatically affected the country’s budget.

Ongoing issues between the central government in Baghdad and the semi-autonomous Kurdish region are also taking their toll on Iraq. A deal was brokered between the two to export oil through the Kurdish region to Turkey, but both sides failed to maintain the agreement, and the Kurdish government has not transferred any oil produced in the north to Baghdad since August 2015.