Minnesota Commerce Dept. sees no need for Enbridge’s Line 3 Replacement Pipeline Project

The Line 3 Replacement Program is a multi-billion dollar private investment consisting of 1,031 miles of 36-inch diameter pipeline beginning in Hardisty, Alberta and ending in Superior, Wisconsin; it is one of North America’s largest infrastructure programs: Enbridge

Calgary-based energy transportation giant Enbridge (ticker: ENB) has said that its proposed Line 3 Replacement Program is the largest project in Enbridge’s history at approximately $7.5 billion.

But yesterday’s announcement from the state of Minnesota Commerce Department brought back memories of a long and volatile trip by another large Canadian energy transportation company that encountered rough rough roads navigating U.S. politics and federal and state permitting hurdles that plagued its proposed oil pipeline project for almost a decade–TransCanada’s Keystone XL.

On Sept. 11, 2017, the Minnesota Commerce Department issued a negative recommendation as to the need for Enbridge’s proposed Line 3 pipeline replacement project to traverse Minnesota, where Enbridge has proposed 337 miles of new 36-inch oil pipe to be installed.

“In light of the serious risks and effects on the natural and socioeconomic environments of the existing Line 3 and the limited benefit that the existing Line 3 provides to Minnesota refineries, it is reasonable to conclude that Minnesota would be better off if Enbridge proposed to cease operations of the existing Line 3, without any new pipeline being built,” testimony from the Commerce Department said.

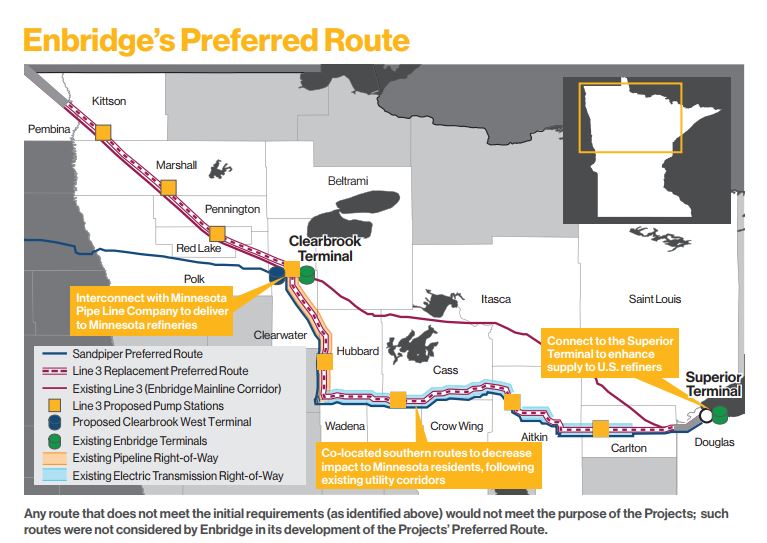

Source: Enbridge

The Minnesota Commerce Department said in a press release that the pipeline would primarily benefit areas outside Minnesota “and serious environmental and socioeconomic risks and effects outweigh limited benefits.”

In its statement the Minnesota Commerce Department said it disagreed with Enbridge’s forecast of demand for oil that would be supplied by the proposed pipeline, as well as the ability of current and planned facilities to meet future demand.

The commerce department said independent analysis by London Economics International found that refineries in Minnesota and the Upper Midwest “have been operating at high levels of utilization, which indicates both they are not short of physical supplies of crude oil, and that they have little room to increase total crude runs.”

The Commerce Department testimony also said capacity of Enbridge’s Line 67, which was granted certificates of need, are already meeting the need.

Enbridge has proposed that the existing Line 3 would be decommissioned and left in place after the new pipeline is installed and operational. The existing Line 3 operates at an annual average capacity of 390,000 barrels per day. The proposed new Line 3 replacement would have a capacity of 844,000 barrels per day.

Next steps

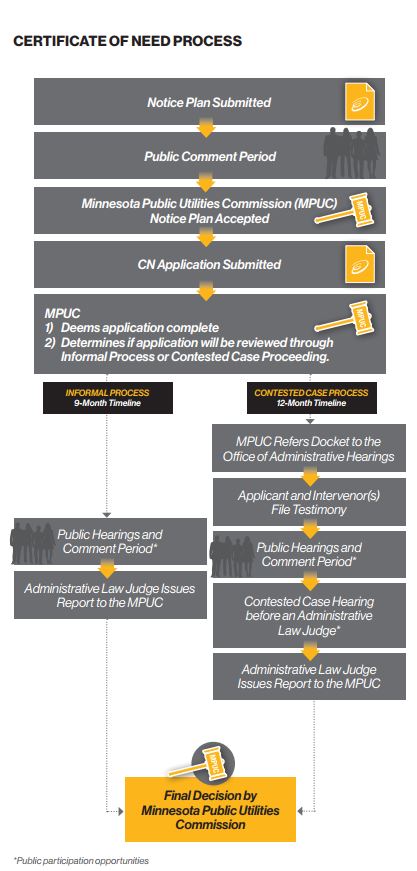

In November, an administrative law judge (ALJ) will hold an evidentiary hearing in Saint Paul for testimony and cross-examination of witnesses by the official parties to the proceeding, after which the ALJ will submit a report to the public utilities commission (PUC) including recommendations about issuing a certificate of need and a route permit for the proposed project.

The PUC is expected to decide on Enbridge’s certificate of need and route permit applications in the spring of 2018.

The testimony recommends that if a certificate of need is issued, regardless of its decision about removal of the existing Line 3 for its entire right-of-way, the PUC should (where it has regulatory authority) require Enbridge to remove all 223 segments (8,496 feet) of exposed pipeline in Minnesota.

Canadian government gave Enbridge the green light for Line 3 Replacement in Canada

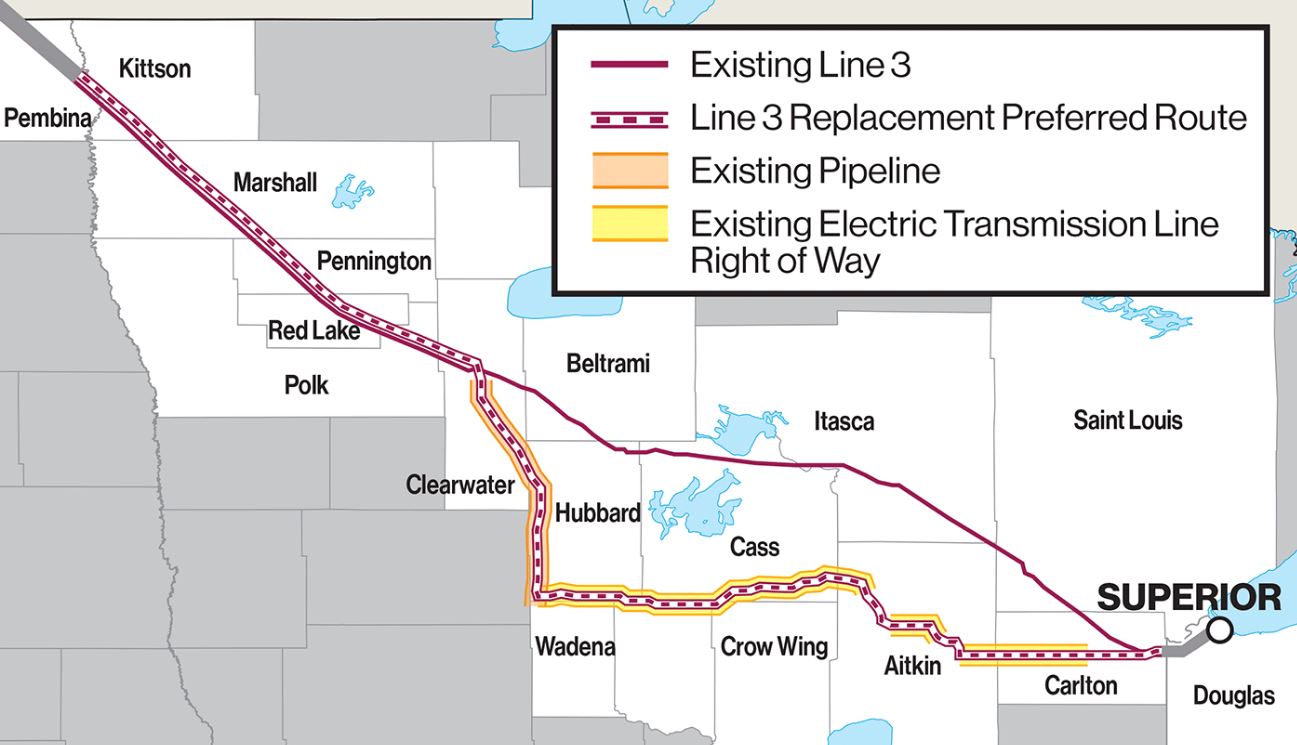

Enbridge’s existing Line 3 pipeline, which has been in service since 1968, runs from Edmonton, Alberta to Superior, Wisconsin. The Line 3 Replacement Program will replace the majority of the existing 34-inch-diameter pipeline with a 36-inch-diameter pipeline from Hardisty to Gretna on the Canadian side, and from Neche, N.D., to Superior on the U.S. side. Source: Enbridge

In a statement issued by Enbridge in Nov. 2016, after it received approval from the Canadian government for the Canadian portion of its Line 3 Replacement Project, Enbridge said Replacing Line 3 “is the most timely and reliable solution for transporting Western Canadian crude oil to the Chicago, U.S. Gulf Coast, Eastern U.S. and Canadian refinery markets.”

The Calgary-based midstream giant said that the Line 3 Replacement Program is the largest project in Enbridge’s history at approximately $7.5 billion. The company said the project would restore Line 3’s original capacity of 760,000 barrels per day. In November following the Canadian government approval for the project, Enbridge said it expected the anticipated in-service date for this project would be 2019, pending U.S. regulatory approvals.

Enbridge said it pays more than $30 million in Minnesota property taxes annually and “this will increase incrementally by $19.5 million beginning the first full year of service.”

Enbridge Line 3 Replacement pipeline route in the U.S., as proposed. Source: Enbridge

Enbridge said the original Line 3 pipeline, built in 1968, transports crude oil 1,097 miles from Edmonton, Alberta to Superior, Wisconsin, as part of its Mainline System.

A new 36-inch diameter pipeline will replace the existing 34-inch diameter pipeline along most of the Line 3 route, the company said. In the U.S., the replacement pipeline will follow Enbridge’s existing Line 3 route from Joliette, North Dakota to Clearbrook, Minnesota, and then will primarily follow existing pipeline and transmission routes from Clearbrook to Superior, Wisconsin.

The U.S. portion of the program take the new 36-inch pipe across 13 miles in North Dakota, 337 miles in Minnesota and 14 miles in Wisconsin.

Enbridge pegs the overall estimated cost of the U.S. portion of the project at US$2.9 billion, with more than $2.1 billion in Minnesota alone.

Enbridge: here is why Minnesota needs Line 3 replacement

“The replacement of Line 3 will ensure that Enbridge can transport the crude oil required by refiners in Minnesota, neighboring states, Eastern Canada and the Gulf Coast. As with the existing Line 3, the project will continue to transport crude oil from Hardisty, Alberta, Canada to Superior, Wisconsin,” according to Enbridge on its Line 3 project website.

Enbridge said the Line 3 Replacement project would provide approximately 4,200 construction jobs in Minnesota, with the expectation that half of the construction jobs will be filled locally. It calculates the economic activity as “a $2 billion boost to U.S. economy during design and construction; a local and regional economic boost during construction from the purchase of local products/materials and use of local hotels, restaurants and services.”

Source: Enbridge

Minnesota House report itemizes state’s refining capacity and locally sourced refined product usage

According to a report last fall published by the research department at the Minnesota House of Representatives dated October 2016, more than five billion gallons of petroleum products were produced in or imported into Minnesota in 2015.

“As a state with no indigenous sources of petroleum,” the House report says, “Minnesota must import both the crude oil its petroleum refineries process and additional quantities of refined products, such as gasoline and fuel oil, that its residents demand. Minnesota has two petroleum refineries, which produce more than two-thirds of the state’s petroleum products. Seventy percent of these products are refined from Canadian crude oil, supplemented by supplies from North Dakota’s Bakken field.

“An extensive system of pipelines brings crude oil to Minnesota’s refineries and distributes refined products throughout the state, including products transported from refineries located in three other states. Twenty-five major petroleum storage terminals located along the routes of these pipelines, 15 in Minnesota, store refined petroleum products. The stored products are accessed by rail and truck for delivery to retailers throughout Minnesota,” the report said.

The report looks at the state’s two refineries. The Flint Hills Resources refinery in Rosemount and Western Refining’s St. Paul Park facility refined an estimated 130 million barrels of crude oil in 2015. Flint Hills is more than three times larger, with a capacity of 290,000 barrels per day, compared with St. Paul Park’s 88,900.

About 80 percent of the crude processed by Flint Hills comes from Canada, compared with 41 percent for St. Paul Park, the report said.

Output from the Minnesota refineries

In 2015, the St. Paul Park facility produced 712 million gallons of gasoline, 511 million gallons of distillate fuel oil, and 168 million gallons of asphalt. Eighty-eight percent of the gasoline and diesel was sold in Minnesota, more than 400 million gallons of which were retailed through the 264 company-operated and franchised SuperAmerica stores located in the state.

The Flint Hills Resources refinery supplies about half of Minnesota’s motor fuel and 40 percent of Wisconsin’s, as well as the bulk of jet fuel for the Minneapolis-St. Paul International Airport.

Minnesota refineries exported about 149 million gallons of gasoline and 59 million gallons of fuel oil to other states in 2015, the report said.

The Minnesota Commerce Department’s expert testimony may be accessed here.