ExxonMobil says its tight oil production from Delaware and Midland basins will jump 5-fold by 2025

XOM plans to invest more than $2 billion in Permian terminal and transportation expansion

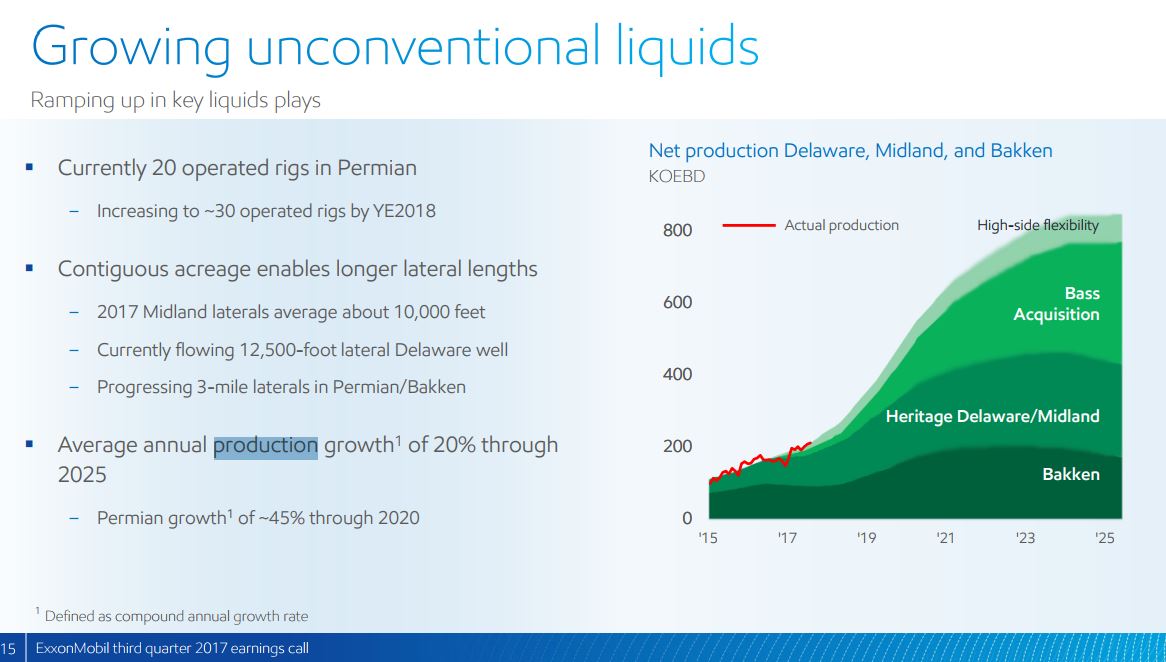

ExxonMobil (ticker: XOM) generally does things on a big scale. Today the largest publicly traded international oil and gas company said it will triple total daily production from its operations in the Permian Basin to more than 600,000 oil-equivalent barrels (600 MBOEPD) by 2025. Company-wide, Exxon reported Q3 2017 upstream volumes at ~3.9 MMBOEPD.

It also said tight oil production from the Delaware and Midland basins will increase five-fold in the same period. The increased production volumes will be driven by reduced drilling costs, technology improvements and expanded acreage, the company said.

Source: XOM Q3 earnings presentation

Last year Exxon acquired the Bass family interests—255,000 acres—in the Permian for $6.6 billion. The transaction allowed the company to add an estimated resource of 3.4 billion barrels of oil equivalent chiefly located in the Delaware basin. The company said it will rely on operating experience gained through drilling more than 5,000 horizontal unconventional wells and its technology to allow it to drill and produce its Permian resource profitably.

Exxon expects its horizontal rig count in the Permian to increase an additional 65 percent over the next several years. Exxon said it has doubled its count of footage drilled per day on horizontal wells in the Permian since early 2014 and reduced per-foot drilling costs by about 70 percent.

It’s Time for Us to Stomp on the Permian Accelerator: Exxon; source: XOM Q3 presentation

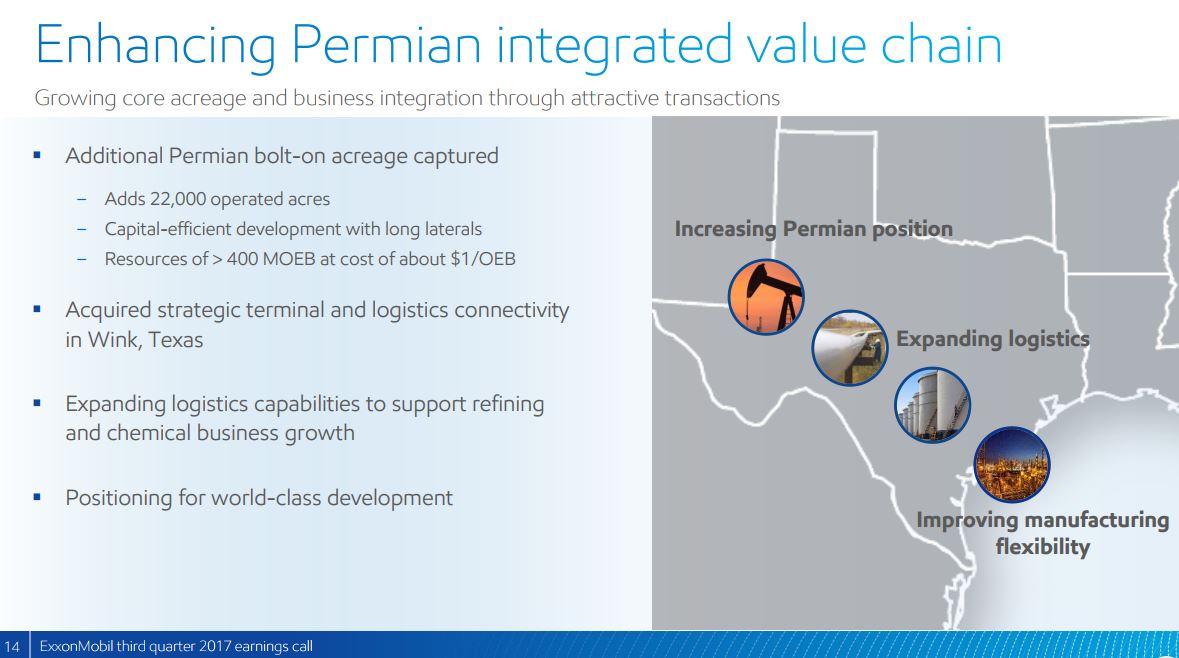

Sara Ortwein, president of ExxonMobil’s XTO Energy subsidiary, said that her company has logistics and technology advantages over its competitors. “With this production growth, we are well positioned to maximize value as increased supply moves from the Permian to our Gulf Coast refineries and chemical facilities where higher-demand, higher-value products will be manufactured,” Ortwein said. She pointed to the fact that the increased production would provide low-cost supply for Exxon’s petrochemical operations—polyethylene and synthetic lubricant production—in south Texas and Louisiana.

Exxon’s crude oil terminal in Wink, Texas will take Permian crude oil and condensate from Delaware basin sources near the Texas-New Mexico border for transport to Gulf Coast refineries and marine export terminals.

New light crude oil processing capacity coming to south Texas

The company said it plans $2 billion in expansions to the Wink terminal combined with key infrastructure upgrades that will move oil production from the Delaware, Central and Midland basins in the Permian to the Gulf Coast. XOM said that its previously announced expansions at its Baytown and Beaumont refineries will add more than 300,000 barrels per day of light crude processing capacity.

U.S. corporate tax rate changes moved the company to head in the direction of increased future capital investments, Exxon said in a press release and on its CEO’s blog. This includes its plan to spend more than $2 billion on transportation infrastructure to support its Permian operations, the company said.

Oil prices pulled back slightly during the past two sessions. West Texas Intermediate crude oil traded down in the $64 per barrel range today. The U.S. benchmark has climbed up from the low $40s in June 2017.