Oil production guidance up 12%, CapEx up 18%

Jagged Peak Energy (ticker: JAG) reported second quarter earnings last week, showing net income of $45.1 million, or $0.21 per share.

Jagged Peak produced a record 34.6 MBOEPD in Q2, 8% above the high end of guidance. This means the company’s production grew by 25% sequentially and 135% year-over-year.

Like many other major E&P companies that have been reporting, Jagged Peak is increasing full year guidance for production and capital spending. The company now expects to produce an average of 33 MBOEPD in the year, 12% above previous estimates.

3D seismic has big impact on well results

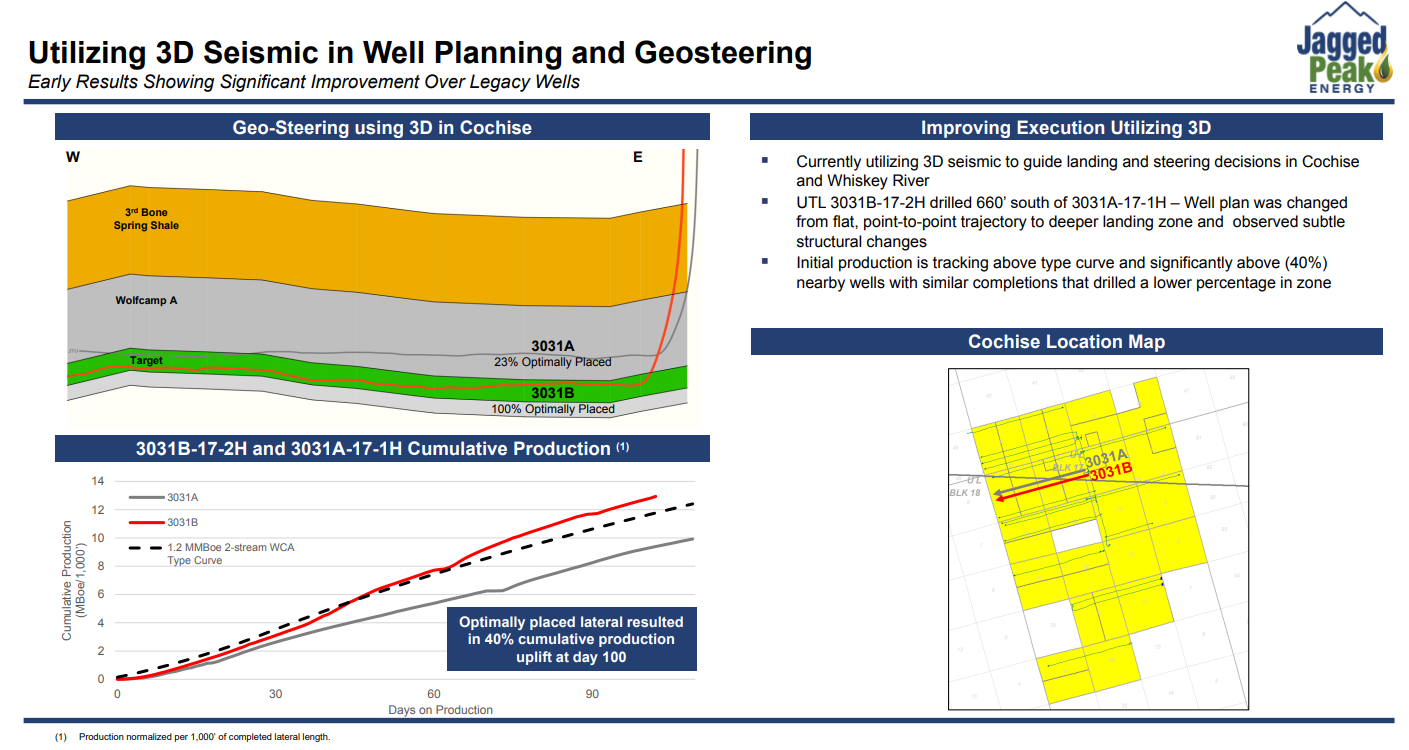

Jagged Peak is making good use of its 3D seismic data and is using the results to adjust its drilling plans. As an example, the company offered the 3031A and 3031B wells, which were drilled very close together targeting the same formation. The A well was drilled before the seismic data was available, while the B well was designed based on the 3D results.

Only 23% of the A lateral was on target, compared to 100% of the B well. This difference has a large impact on the productivity of each well, and the B is currently outperforming both its neighbors and the type curve.

While Jagged Peak currently only has interpreted 3D data on its Cochise area, it is participating in shoots in its other two areas, Whiskey River and Big Tex. The company has already received the data for Whiskey River and expects to receive the data for Big Tex in Q3. Interpreting the data takes about three months, so Jagged Peak should have full 3D seismic results for its acreage by the end of the year.

Jagged Peak President and CEO Jim Kleckner commented on the results, saying “I am pleased with our team’s second quarter execution as we posted very strong results with record production volumes and increased operating efficiencies. We have started integrating the first of our licensed 3D seismic data into our drilling program, which is expected to drive enhanced well performance and program returns going forward across our acreage position.”

“As we increase second half production targets, we remain confident in our ability to get our oil to market as we are a committed shipper on the Oryx system with 60 MBbls per day of committed capacity, and have a long-term sales agreement in place for our oil with a third-party marketer. To protect the returns of this increased investment, we have significantly added to our hedge book through 2020, further insulating our cash flow from commodity price fluctuations and widening basis differentials.”