Full-year growth of 220% expected

Jagged Peak Energy (ticker: JAG) announced second quarter results today, showing net earnings of $16.4 million, or $0.08 per share. This exceeds the $5.7 million loss the company experienced in Q2 2016, before it was publically traded.

Jagged Peak produced 14,614 BOEPD this quarter, 81% of which was oil. This is 50% higher than Q1 2017 levels, and a full 166% higher than Q2 2016 production. Further growth is expected in the rest of the year, with the company predicting about 20.4 MBOEPD in Q3 and 27 MBOEPD in Q4. This equates to 39% sequential growth in Q3 and 32% sequential growth in Q4. Overall, Jagged peak will grow by around 220% from 2016 to 2017.

Jagged Peak drilled 13 gross wells in Q2, and put 14 wells on production. Current guidance suggests similar completion levels throughout the year.

Second Bone Spring well promising

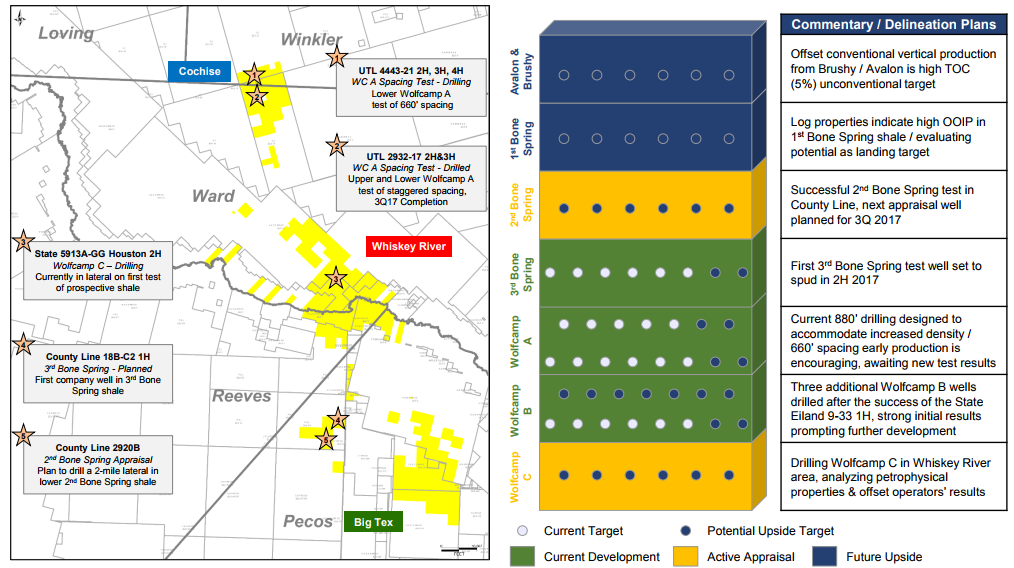

Jagged Peak reported that its first Second Bone Spring well has produced an IP30 of about 180 BOEPD per 1,000’ lateral, from a lateral length of 4,843’. This makes the well comparable to the company’s Wolfcamp A wells, and means that this is one of the most prolific Second Bone Spring wells in the area. Jagged Peak estimates that the Second Bone Spring is prospective on about 85% of its acreage, and represents over 200 potential locations.

Jagged Peak also plans to test other zones and spacings, which could potentially significantly increase the company’s available drilling locations. The company is currently drilling a Wolfcamp C well on its central acreage, which could help delineate that zone. A test Third Bone Spring well will also be drilled this quarter. Increasing density will be examined using one project testing staggered spacing in the Wolfcamp A and another testing 660’ spacing in the Wolfcamp A.

Jagged Peak Chairman, President and CEO Joe Jaggers commented on the company’s plan going forward, saying “Our strong operating results, premier acreage position and experienced organization are evident in our outstanding financial results. We remain well capitalized with ample liquidity to fund our multi-rig program even in the current commodity price environment. Our contiguous acreage position allows us to drill extended length lateral wells across our leasehold; these extended length laterals represent approximately 70% of our inventory. Additionally, we are actively working to keep costs under control and to combat service cost inflation. As evidenced by our strong second quarter results and our July net production rate of 17,800 Boe/d, I have the utmost confidence in our team’s ability to continue to execute our development plan and climb the production ramp. In fact, we have seen production continue to climb beyond July with production averaging an estimated 20,000 Boe/d during the first week of August.”

Jagged Peak presenting at EnerCom

Jagged Peak Energy is a presenting company at EnerCom’s The Oil & Gas Conference® next week, which runs Aug. 13-17, 2017, at the Denver Downtown Westin Hotel. To register for the EnerCom conference, please visit the conference website.

Q&A from JAG Q2 conference call

Q: I want to see if you are able to talk about 2018. It looks like you have got a fair bit of flexibility around your future spending. I think you only have to drill 31 wells next year to hold your acreage. Can you just discuss how are you looking at 2018, what your spend might be if you see oil prices stay here around 50 and what you might do if oil were to pull back into the low 40s?

Joseph N. Jaggers: It’s a good question and something that we are currently thinking through, but at current prices we clearly want to maintain the program that we have set out for 2018, which is roughly 55 to 60 wells. You are right in pointing out that we only have 31 obligations or continuous development wells to HBP and our modeling to date is that level. As we could run three rigs, we could be within cash flow and still grow by 50% with that sort of a program. But as we get a little closer and certainly as we approach the November earnings call for Q3, we’ll have that ironed out and be able to provide investors with our plans for 2018.

Q: Can you remind us how much water per barrel of oil your average well produces and what is your water disposal procedure right now? Which zone do you inject it in and is it within your producing area?

Joseph N. Jaggers: We generally are around a three barrel of water per barrel of oil ratio, and we do dispose of it in the Delaware sand groups principally, above our producing area. We have seen no problems though created by this. It’s historically been a disposal zone for even the Delaware sand group’s oil production, which produces at a much, much higher water/oil ratio than the deeper Wolfcamps and Bone Springs.