Kinder Morgan (ticker: KMI), the largest energy infrastructure company in North America, is adding to its footprint.

On October 20, 2015, KMI announced a joint venture agreement with a subsidiary of BP plc (ticker: BP) for 15 terminals at a cost of $350 million. As part of the arrangement, KMI acquires a 75% interest in 14 terminals and will operate and market the assets. The one additional terminal will be owned outright by KMI. Total storage capacity is approximately 9.5 MMBO and the facilities are scattered throughout the United States. The deal is expected to close in Q1’16.

Kinder Morgan is scheduled to release its Q3’15 results on Wednesday, October 21, followed by a conference call at 4:30pm EST. BP’s conference call is scheduled for October 27.

BP’s Stance

The refinery agreement is the second reached by KMI since June, when it restructured interests in various refineries with Rosneft. The company’s Q2’15 results were driven by an “improved refining environment,” but management anticipated lower margins in Q3’15. Its refining marker margin (RMM) in the first half of 2015 was $17.30/barrel, up more than 20% on a year-over-year basis. RMMs in Q2’15 reached $19.40/barrel – the highest since Q3’12, fueled by increased gasoline demand, tight supplies on the United States west coast and low product stocks outside of the U.S.

In October 2013, the company announced plans to divest $10 billion in assets by year-end 2015. As of Q2’15, roughly $7.4 billion had been completed. A total of $45 billion of assets have been sold since 2010.

Kinder Morgan Locks Down Another Deal

Kinder Morgan, on the other hand, has been extremely active in the new commodity environment. The latest transaction is the seventh outright asset purchase in 2015 and excludes various shipping agreements that have been reached with other partners throughout the United States. A detailed list of 2015’s transactions are listed below.

KMI Transactions in 2015 |

||||

|

Date |

Seller/Partner |

Price (MM) |

Location |

Assets |

| 1/21/15 | Hiland Partners | $3,000 | Bakken | More than 3,000 miles of oil and gas gathering pipelines |

| 2/9/15 | Royal Vopak | $158 | NC, NJ, TX | Four terminals (including one undeveloped site) |

| 3/31/15 | Keyera Corp. (JV) | $264 (US) | Alberta | 50% interest in terminal with initial capacity of 4.8 MMBO |

| 7/15/15 | Royal Dutch Shell | $630 | GA | Shell’s 49% stake in the Elba Island LNG terminal, raising KMI’s stake to 100% |

| 8/10/15 | Philly Tankers LLC | $568 | PA | Four Jones Act product tankers with total capacity of more than 1.3 MMBO |

| 9/10/15 | Cheniere Energy | $212 | Gulf Coast | Expansion project on Gulf Coast mainline system with 385 MMcf/d of capacity |

| 10/20/15 | BP plc | $350 | Various | One terminal and a 75% interest in 14 additional terminals |

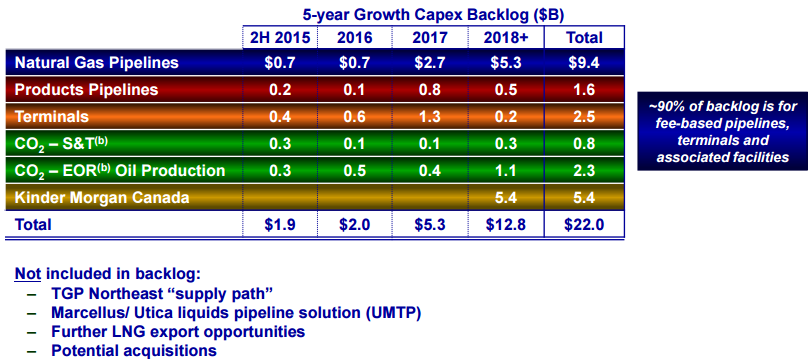

Overall, KMI has secured more than $26 billion in acquisitions since 1997. The midstream and downstream giant became the continent’s largest infrastructure provider in late 2014, following the merger of its three subsidiaries for a total transaction value of $76 billion. Combined, the entity had $22 billion in project backlog as of Q2’15 and the “overwhelming majority of cash generated by KMI’s assets is fee based and not sensitive to commodity prices,” says the company’s Q2’15 report. Roughly 87% of KMI’s budgeted earnings before depreciation and amortization is fee-based, while an additional 9% is dedicated to hedges.

KMI is on track to pay out an annual dividend of $2.00/share in 2015, representing a 15% increase from 2014, and believes its dividends will increase by 10% annually from 2016 through 2020. KMI has significant insider ownership, with insiders and 5% owners accounting for 35% of outstanding shares. Richard Kinder, Chairman and Chief Executive Officer, owns approximately 233 million of the company’s 2,192 million shares outstanding, equating to about 10% of Kinder Morgan.