Kinder Morgan Canada Limited (ticker: KML) and Kinder Morgan, Inc. (ticker: KMI) completed an IPO of 102,942,000 restricted voting shares of KML at a price to the public of $17.00 per share for total gross proceeds of approximately C$1.75 billion.

The company said the proceeds of the offering will be used to indirectly acquire from Kinder Morgan an approximate 30% interest in a limited partnership that holds the Canadian business of Kinder Morgan. Kinder Morgan will use the proceeds it receives to pay down debt. Closing of the offering removed the final condition to Kinder Morgan’s investment approval for the Trans Mountain Expansion Project.

Shares in KML took a tumble shortly after the stock began trading, dropping about 7%, but by the end of trading had recovered, closing at $16.23, up from the $16.05 opening.

The offering was made through a syndicate of underwriters co-led and joint bookrun by TD Securities Inc. and RBC Capital Markets. The underwriters have been granted an over-allotment option to purchase up to an additional 15,441,300 restricted voting shares at the offering price, exercisable in whole or in part, from time to time, until 30 days after closing of the offering.

At the closing of the oering, Kinder Morgan holds approximately 70% of the issued and outstanding shares of KML through its indirect ownership of 242,058,000 special voting shares. Kinder Morgan also holds an approximate 70% interest in the limited partnership that holds the business. The restricted voting shares began trading today on the Toronto Stock Exchange under the symbol ‘KML’.

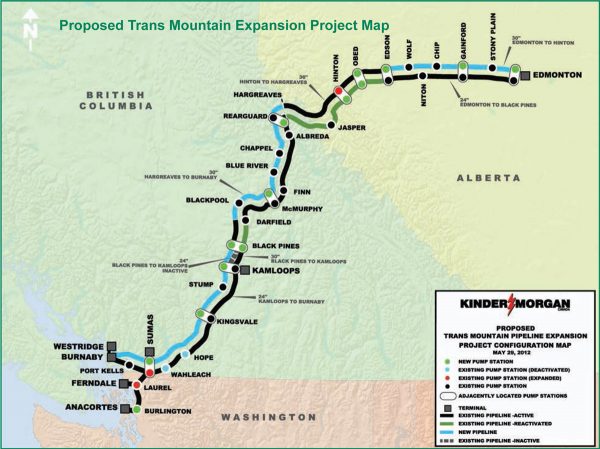

Kinder Morgan Canada Limited (ticker: KML) will operate the business, comprised of a number of pipeline systems and terminal facilities including the Trans Mountain pipeline, the Canadian portion of the Cochin pipeline, the Puget Sound and Trans Mountain Jet Fuel pipelines, the Westridge marine and Vancouver Wharves terminals in British Columbia as well as various crude oil loading facilities in Edmonton, Alberta.

The Trans Mountain pipeline currently transports approximately 300,000 BPD of crude oil and refined petroleum products from the oil sands in Alberta to Vancouver, British Columbia and Washington state.

On Nov. 29, 2016, the Government of Canada granted approval for the $7.4 billion Trans Mountain Expansion Project, to increase the nominal capacity of the system to 890,000 bpd. The expanded pipeline is expected to be in service at the end of 2019.

Kinder Morgan Canada Limited (ticker: KML) will operate a number of pipeline systems and terminal facilities including the Trans Mountain pipeline. On Nov. 29, 2016, the Government of Canada granted approval for the $7.4 billion Trans Mountain Expansion Project, to increase the nominal capacity of the system to 890,000 BPD. The expanded pipeline is expected to be in service at the end of 2019. Source: Kinder Morgan

Kinder Morgan, Inc. owns an interest in or operates approximately 84,000 miles of pipelines and 155 terminals. Kinder Morgan also produces CO2 for enhanced oil recovery projects primarily in the Permian basin.