British Columbia has said it will block the line

Canadian oil producers were dealt a major blow today, only a few weeks after the country saw the lowest differentials in years.

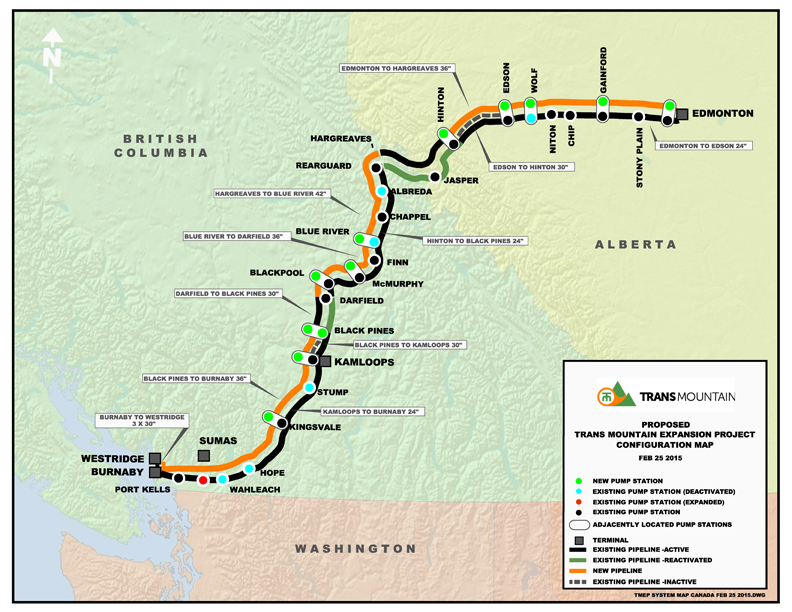

Kinder Morgan Canada Limited (ticker: KML) announced it is suspending all non-essential activities and spending on its Trans Mountain Expansion pipeline. The Trans Mountain Expansion is one of the most important Canadian pipeline projects in the current landscape, and plans to bring oil from Alberta to a terminal near Vancouver. With a capacity of 590 MBOPD, the line would represent a major new takeaway source for Canadian oil sands operators. The vast majority of this new takeaway would be exported to Asian markets, an opportunity oil producers, which are still experiencing differentials near $15/bbl, have long desired.

Trans Mountain Expansion, as the name suggests, is an expansion on the original Trans Mountain Pipeline, which was built in 1953. Plans call for the expansion to run parallel to the existing pipeline for almost all the line’s 700-mile length.

Alberta, Canada’s federal government support project

Kinder Morgan has received regulatory approval from Alberta and the federal government, and has strong support from each. Prime Minister Justin Trudeau considers the project a core national interest.

Despite this support, the expansion has had significant difficulties clearing its path to operation.

The pipeline is furiously opposed by the Province of British Columbia, where the new left-wing government has made blocking the line a core goal. The province has proposed blocking any additional oil shipments, which sparked a minor trade war between Alberta and B.C.

Political ground has become too shaky to risk further capital investment

Kinder Morgan, however, seems to have had enough, and is suspending all non-essential operations on the line, just as construction was beginning to ramp up. The company is unwilling to risk shareholder capital on a line that may be blocked by forces outside of its control. Bloomberg estimates the company will spend $200 million to $300 million per month when building at full speed, so significant shareholder capital would be at risk.

Kinder Morgan estimates the line will cost $7.4 million in total, and it has spent $1.1 billion thus far.

Kinder Morgan expresses its frustration

KML Chairman and CEO Steve Kean extensively discussed the company’s reasoning, and frustration, in a press release today.

“Today, KML is a very good midstream energy company, with limited debt. The uncertainty as to whether we will be able to finish what we start leads us to the conclusion that we should protect the value that KML has, rather than risking billions of dollars on an outcome that is outside of our control.

“While we are prepared to accept the many risks traditionally presented by large construction projects,” Kean said, “extraordinary political risks that are completely outside of our control and that could prevent completion of the project are risks to which we simply cannot expose our shareholders.

“We appreciate the support shown by the Federal Government and the Provinces of Alberta and Saskatchewan, and are grateful for the strong endorsements among the majority of communities along the route and 43 Indigenous communities, as well as customers, contractors and unions.

“The fact remains that a substantial portion of the project must be constructed through British Columbia, and since the change in government in June 2017, that government has been clear and public in its intention to use ‘every tool in the toolbox’ to stop the project. The uncertainty created by BC has not been resolved but instead has escalated into an inter-governmental dispute.

“A company cannot resolve differences between governments. While we have succeeded in all legal challenges to date, a company cannot litigate its way to an in-service pipeline amidst jurisdictional differences between governments.”

Here’s the ‘go-no-go’ date

While Kinder Morgan is not giving up on the project entirely, it has set a decision deadline of May 31st.

The company must reach certain windows in the construction process, and ramping up operations takes time. Therefore, Kinder Morgan will engage with the stakeholders until the end of May to try to find a resolution, but is unlikely to go beyond that point.

“If we cannot reach agreement by May 31st,” Kean said, “it is difficult to conceive of any scenario in which we would proceed with the project.”

The Trans Mountain expansion will be built, Trudeau tweets

The governments of Alberta and Canada reiterated their support in response to Kinder Morgan’s announcement, with Prime Minster Trudeau tweeting, “The Trans Mountain expansion will be built.”

Alberta Premier Rachel Notley mentioned the possibility of the province becoming an investor in Trans Mountain, which could help alleviate Kinder Morgan’s reluctance to put capital at risk.

While analysts generally considered outright cancellation unlikely, the capital spending suspension is a significant signal. “This is not good. I think the key point is it shows a lack of confidence in our political and regulatory system,” said Tim Pickering, president of Auspice Capital in Calgary, Alberta.

Analysts at Tudor, Pickering, Holt & Co. view the spending halt as “a means of inducing more direct action in asserting relevant jurisdictions and clarifying future risks… We continue to expect the project to proceed and are watching for the upcoming Court of Appeal decision as the most direct indicator of go-no-go.”

A chilling effect on investment

Failing to reach a solution could have effects that ripple throughout the Canadian oil industry. Alex Pourbaix, CEO of Cenovus, which recently discussed its takeaway difficulties, explained the implications of giving up on the project. “The project is critical to Canada and the future of its oil and gas industry. If the rule of law is not upheld and this project is allowed to fail, it will have a chilling effect on investment not just in British Columbia, but across the entire country.”

Q&A from Kinder Morgan conference call

Q: I wanted to dive in a bit more if possible, if you could provide more details as far as what could constitute sufficient clarity for KML to move forward with TMEP out here? Is it something coming out of the national government or the BC Province or what could that look like?

Steven J. Kean: So it’s hard to know precisely. But, yeah, it could come either direction. And essentially what we need to see there is that we’re going to be able to construct and efficiently construct through British Columbia without the threat of additional or new requirements being imposed or being proposed or announced that would create further uncertainty. And, again, the threat that would be subject to additional requirements.

And I want to point something out. So just to put a little context on what we saw come out in February. So the topic of spill response and how to deal with it and how to mitigate it and all of those things have been the subject of the NEB conditions. We have 157 of those and many were directed at that. They were the subject of the BC EAO and we have conditions directed at that which we are fulfilling. It was also the subject of the BC5 agreement. And we’ve gone through step after step where the requirements and the principles have been laid out for us to fulfill and we’ve been fulfilling.

And so, to now come in and say, well, wait there’s more and especially important that the government that may propose, wait, there’s more, that that government is vocally in opposition to this project, which suggests that whatever jurisdiction there may be could be used in a way that undermines the project or ability to complete it or casts uncertainty to the point that our investors can’t go forward. That’s important.

It’s not a normal course of business regulatory process here. What we have is a government that is openly in opposition and has reaffirmed that opposition very recently. It’s outside of our control. It needs to come either at the federal level or at the provincial level.

Q: Can I just explore a little bit about the timing? You have a sort of a hard deadline on May 31. Presumably you’ve been sort of working towards the solutions that you’re talking about right along that that didn’t assume change from last night to today. But so why announce this today and sort of what kind of strategy I guess drives that? Because it would seem maybe that sort of putting a two-month window out there would perhaps only embolden the opposition to dig deeper?

Steven J. Kean: So, look, in a typical context, where a company is proceeding with a project and it becomes untenable to proceed that’s kind of the end of the matter. But this is not a typical project in so many ways. There are so many interests tied up in it that we didn’t think it appropriate to just say, well, we’re shutting this effort down but instead to openly and publicly invite the search for a solution and a way forward.

And so that’s why we’ve made it public to make sure that everybody knew what we were looking at and could focus on it. And to pursue that opportunity is why we simply didn’t just say, look, this is untenable for us to proceed and so we’re done, right?

I think, again, the two main things that we’re going to be focused on are:

- clarity through BC, and

- the ability to protect our shareholders.

What calls for that decision, that announcement at this time is we can’t move the seasons in Canada.

There are certain seasons during which you can do certain things. Mobilization for construction, the opening and closing of windows for clearing activities, materials to be ordered, et cetera—we’re on top of all of that, right now. And so we don’t have the ability to just kick the can down the road. We have to make a decision and we made it. Yeah, it’s difficult because of those other considerations, but it is an easy decision to make for investors.