Production up 21% YOY, guidance raised

Laredo Petroleum (ticker: LPI) announced first quarter results today, showing net earnings of $86.5 million, or $0.36 per share.

Laredo produced a record 63.3 MBOEDP in Q1 2018, up 21% year-over-year. Laredo achieved this growth by completing 20 wells in the quarter, with an average completed lateral length of 9,700 feet. The company reports it has shortened its cycle times through modifying completion designs and contracting a second dedicated frac crew.

The shortened cycle times mean Laredo is more confident in its ability to grow production, and has raised total guidance slightly. The company is now predicting total growth of 12% year-over-year, with oil production growth of at least 10%. Production growth over individual quarters will be uneven, as like many Permian companies Laredo is currently focusing on multi-well development projects, which provide large increases to production when they come online.

Laredo plans to increase capital invested during 2018

Laredo increased its expected 2018 CapEx, as several developments indicate the company will need to spend more money in the year.

The company’s expected working interest and lateral length have both risen, meaning Laredo will spend more on the average well this year. In addition, implementing in-basin sand is delayed, so the company must import more expensive frac sand. To reflect this, Laredo has raised its expected spending by $30 million to a total of $585 million.

Contract dispute exposes Laredo to Midland pricing differential

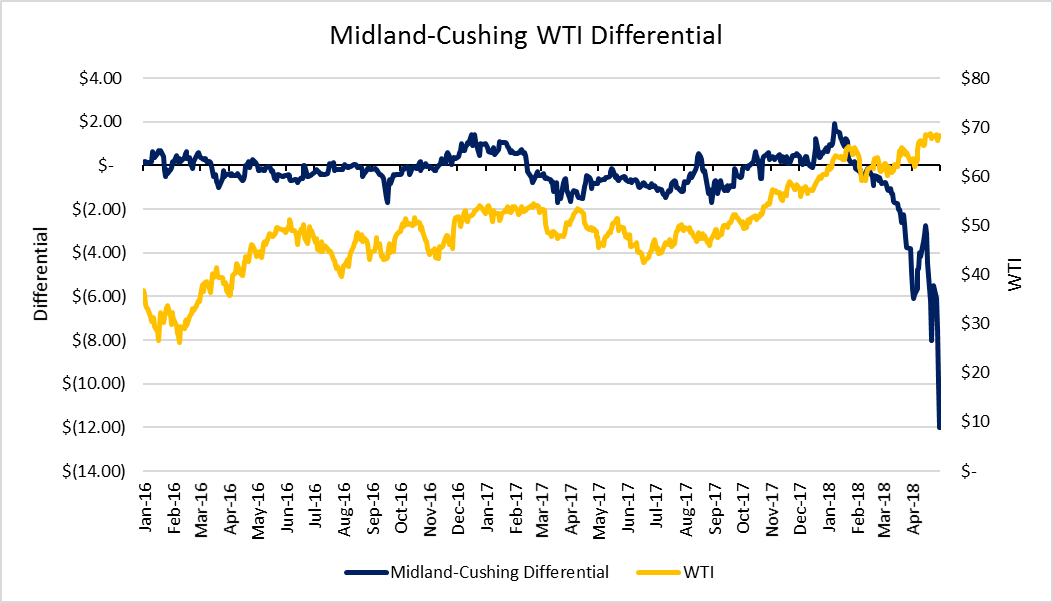

Like all other Permian companies, analysts are closely watching Laredo to determine the company’s exposure to Midland crude markets. Booming production has combined with pipeline constraints to create a significant differential between WTI at Midland and Cushing, currently $12/bbl, or nearly 18% of the Cushing WTI price.

Laredo’s most recent crude marketing developments will have an impact.

Laredo is in the midst of a contract dispute with its main marketing provider Shell Trading. Exactly one year ago Shell sued Laredo, alleging the marketing contract between the two had a drafting error related to prices, which Laredo disputes. While litigation is still in progress, Shell terminated the contract on May 1 and will no longer market oil for Laredo. While Laredo will no doubt seek damages, it is now more exposed to the harsh differentials seen in Midland.

Laredo is not totally at the mercy of Midland pricing, as it has 10 MBOPD of Midland-Cushing basis swaps and 10 MBOPD of firm capacity on the Bridgetex pipeline, hedged with Midland-Houston swaps. This accounts for 74% of the company’s current oil production, a share that will fall as Laredo grows output over the year. Overall, Laredo estimates 70% of its anticipated crude production is protected from the Midland differential, but this still leaves significant volumes unhedged. The company forecasts crude oil price realizations in Q2 will fall from 95% of WTI to 91%.

Differential here to stay for the year

According to Bloomberg, the Midland-Cushing differential is not likely to close any time soon, as Permian production continues to rise. While the Midland-to-Sealy line has now entered service, this is the only major pipeline project scheduled for the year. The EPIC pipeline starts operations in early 2019, and several other lines are scheduled for the end of the year. Until then, however, producers are faced with much more expensive methods for getting oil out of the basin. Bloomberg estimates rail transport would cost $6-$8 per barrel, while trucking would cost several times more. If the differential continues to widen however, these options may become more economic.

Q&A from LPI conference call

Q: Laredo will likely add a fifth rig later this year. Outside of commodity prices, are there any other checklist items that need to be addressed prior to adding the rig?

LPI: I think we look at a lot of things. We have inventory. We have infrastructure. We have a lot of data that would support that. So, Derrick, I think in our view, we’re financially secure enough that we could accelerate activity at that level and still do the share repurchase program or have a lot of optionality. So, I think we indicated some time ago that we were thinking about some methodical acceleration, and that’s how we view that. We’ll be careful on that, but we certainly have the structure, the inventory, the infrastructure to add rigs.

Q: So, my follow-up question is with regards to the Shell contract, and this one might be a tough one. But any sense on timing of resolution and appreciate how quickly you’ve tried to solve some of the issues with regards to the 2018. But at what point are you starting to kind of think about filling gaps on 2019?

LPI: Well, the way our infrastructure was built, the way we view this, I think, it somewhat addresses the robust nature of that by what we’ve been able to do so far. But I don’t have any anticipation or any schedule for when we’ll get resolution.

LPI: Our investment in infrastructure and our investment in Medallion and our ability to move crude oil around in the basin was demonstrated pretty dramatically with this termination. This happened after nominations for May. We’re already in place to move the barrels to Shell. And so, we had literally 48 hours to move our crude oil around, and we were able to do that without a single barrel being shut in. So, that kind of demonstrates our ability and our flexibility to move things around. But we have no indication of how long this litigation may take. We are taking additional steps. As we described in my remarks earlier, effective June 1, we think we’re going to be able to place 10,000 barrels a day of the 19,000 barrels into our BridgeTex transportation and move that crude oil to the Gulf Coast and enjoy the current spread between Midland and Houston. The other 9,000 barrels a day will take longer. We do have some things that we’re working on. And hopefully, we’ll have that optionality for all of those barrels back in our portfolio quickly.

Q: The increased lateral lengths are just taking some additional time to clean up and I guess the commentary on the lower decline on the PDP impacting the hydrocarbon mix in the near term, I guess, is there any need to adjust the type curves to account for either of those issues especially as you continue to expand your lateral lengths going forward?

LPI: At this point, we don’t think so. As you know, we’ve been slow to adjust the type curves even though we have substantial history of some doing most of our wells doing better than the type curve. We think we like the type curve. We look at it. And we’re careful to make sure we communicated to you what we’re actually seeing. But I think at this point, we’re pretty comfortable with the type curves.

Part of the issue is that we’re still doing some optimization work above with sand and lower fluid concentrations and stage, everything else, but I think the important thing for us is that we’ve been drilling packages of wells based on 24 wells per spacing unit and 32 wells per drilling spacing unit. And the early indications you heard me say how long we like to have that before we change things. But those wells are drilling – they are currently producing above type curves. So, that’s something we’re very interested in but no need to adjust today.