148 blocks receive bids of the 77 million acres the federal government offered

The Bureau of Ocean Energy Management announced the successful sale of available blocks in the GOM, with final bids totaling almost $125 million. The area offered in this sale was the largest in history, with 14,431 blocks up for bidding. This is essentially the vast majority of the Gulf between Texas and Alabama, 77.3 million acres in total.

Activity was slightly up from the lease sale in August, when the agency offered up 75.9 million acres. That sale raised $121 million from bidding on 90 blocks.

Largest bid works out to $1,341/acre

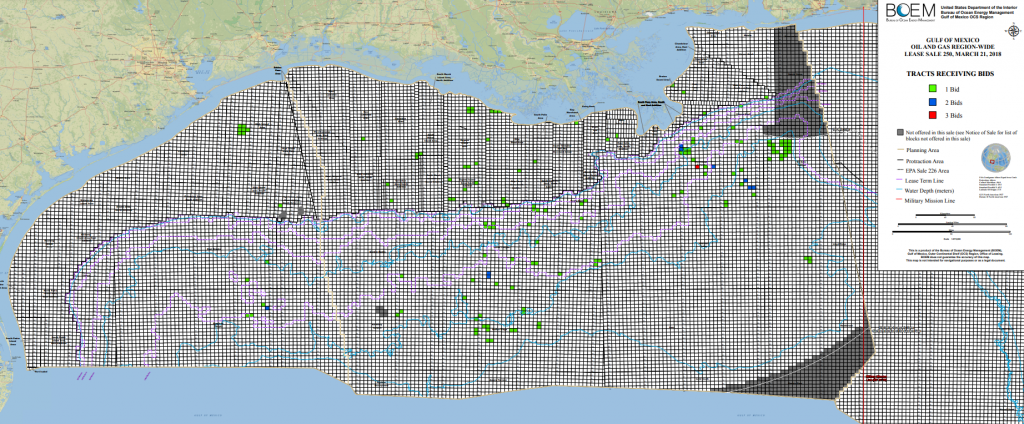

In this sale companies chose to bid on 148 blocks, with a total of 159 different bids. Bidding was generally spread out, with only nine blocks receiving two bids and one block receiving three. The largest single bid came from Total, which bid $7 million for the 5,220-acre Mississippi Canyon 697. This equates to $1,341 per acre, well above the overall sale average of $153 per acre. By comparison, the largest bid in the August sale was $12.1 million, or $2,100 per acre.

Bidding was dominated by supermajors, as BP, Chevron, Shell and Total received 76 blocks for a combined $87.6 million. BP secured the highest number of blocks, acquiring 27, while Chevron paid the most for its acquisitions, $29.4 million.

Shallow leases more popular than usual

Shallow leases were more popular this sale than in previous leases, as some of these leases saw lower royalty rates than usual. In this offering, blocks with depths below 200 meters received 43 bids, while in August such blocks received only 10. The deepest blocks were still the most popular overall, with 59 blocks with water depths below 1,600 meters receiving bids.

Shale activity distracts from offshore

While this sale raised more money than the August lease sale, which covered a comparable area, it was generally regarded as underwhelming. The overall average of $153/acre falls below August’s average of $238/acre.

Offshore activity is still struggling to come to grips with the current oil prices, and operations have only partially recovered from the oil price downturn. This has been exacerbated by competition from shale plays. The Permian and other shale locations have seen a major rebound in drilling and production, as operators are finding $60+ WTI more than adequate to ramp up activity. Barring a significant increase in oil prices, such that the massive capital expenditures generally seen in offshore projects are justified, this situation is likely to continue in the near future.