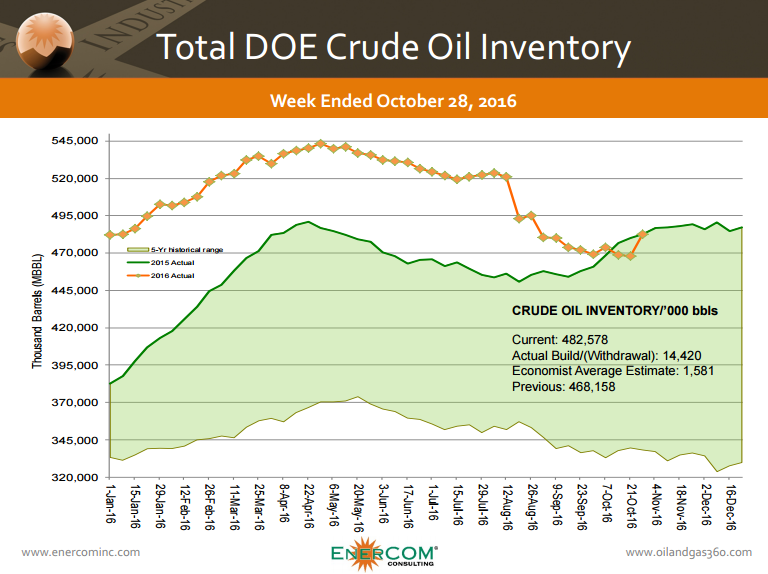

The EIA reported a 14.4 MMBO build to U.S. inventories in the week ended October 28

Just when the industry was feeling a little better about its prospects for the balance of 2016, the U.S. Energy Information Administration (EIA) reported the largest build in crude oil inventories ever recorded this week after surprise draws in eight of the last nine weeks. The draws going back to late August supported crude oil prices in recent weeks, and today’s massive build has quickly turned market sentiment negative. Both WTI and Brent crude are down over 3% today.

WTI traded as low as $44.96 during the day on Wednesday. Brent at one point was down to $46.48.

The size of the build today came as an unpleasant surprise to the oil and gas industry, with the average estimate pegging a build of just 1.6 MMBO for the week ended October 28. Things are likely to improve from here, however.

Refinery run rates fell 104 MBOPD as utilization rates fell 0.4% last week to 85.2% of total capacity. On top of seasonally low run rates, this week’s report showed higher imports also adding to reserves.

“I don’t think that imports will stay this high and runs will be increasing from here,” Scott Shelton, broker and commodities specialist with ICAP told Reuters. “This tells me that while this is an ugly report, it’s the worst we are going to see for the rest of the year.”

Stocks of finished products fell this week. Gasoline saw a 2.2 MMBO draw, twice what analysts anticipated. Distillate stockpiles, which include diesel and heating oil, fell 1.8 MMBO compared to an expected drop of 1.9 MMBO as well.