Statistics released from Libya’s National Oil Corporation show January’s production was 80% below output in 2011

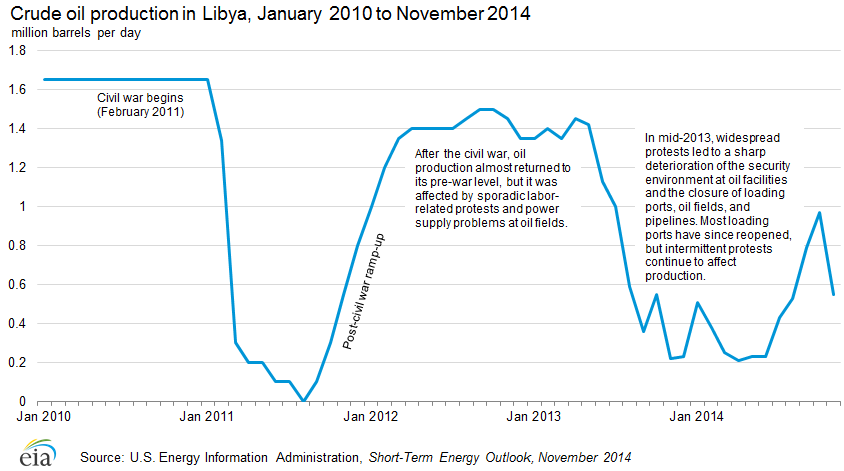

Ongoing conflict in Libya is preventing the country from maintaining output, a very serious problem considering the majority of the state’s revenues come from oil and gas revenue. During an interview with National Public Radio, Mustapha Sanallah, Chairman of Libya’s National Oil Corporation (NOC), said the outlook for his country is bleak.

“We cannot produce. We are losing 80% of our production,” Sanallah said. “Now we have two problems: low production and low prices.”

Low prices are being felt around the globe as a barrel of oil fetches less than half of what it did June of last year. Libya is far from alone in feeling the sting of $60 oil, even among OPEC members, but the country is in the midst of a conflict that has made it extremely difficult for its NOC to guarantee the safety of its employees and continued operations.

NOC has tried to remain neutral in the conflict, but with 90% to 95% of the country’s revenue coming directly from oil according to Sanallah, both sides desperately need the national oil assets in order to remain financially sound. Oil terminals have become a target in the conflict, and NOC has contacted the country’s Defense Ministry to provide additional protection. Sanallah also said that Libya is being forced to import diesel in order to meet domestic demand, putting even greater strain on the economy.

Libya only produced 330 MBOPD in January, almost 80% less than the 1,600 MBOPD the country produced before the start of armed conflict in 2011. If things continue the way they are, Sanallah predicts that Libya will not even earn 10% of the budget the country had in 2012.

Sanallah thinks that unless there is greater security at Libya’s oil terminals becomes a reality than the country may be in for more trouble. If negotiations don’t solve the civil unrest within the Libya, Sanallah says, the country will collapse.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.